India Aluminum Solar Panel Frame Market Size, Share, Trends and Forecast by Installation Type, Application, and Region, 2025-2033

India Aluminum Solar Panel Frame Market Overview:

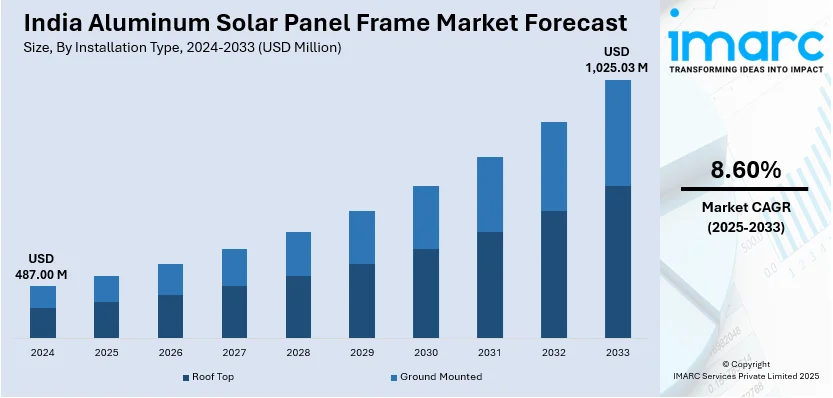

The India aluminum solar panel frame market size reached USD 487.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,025.03 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. India's solar panel frame market for aluminum is growing with the growth in domestic production and technology. Moreover, local manufacturing increases dependency on imports, while technological advances in high-efficiency solar panels create demand for light, robust frames. Additionally, The growth enhances cost efficiency, stability in supply chains, and sustained solar uptake.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 487.00 Million |

| Market Forecast in 2033 | USD 1,025.03 Million |

| Market Growth Rate (2025-2033) | 8.60% |

India Aluminum Solar Panel Frame Market Trends:

Rising Domestic Aluminum Frame Production

India's domestic aluminum solar panel frame market is experiencing high growth, fueled by the call for self-reliance and indigenous manufacturing growth. As solar energy takes hold, demand for aluminum frames is rising and needs to be produced on a large scale to address industry requirements. Concurrent with this, government policies favoring indigenous manufacturing, including the Production-Linked Incentive (PLI) scheme, also fuel this trend. Also, producers are concentrating on minimizing reliance on foreign frames by upgrading local production capabilities, thereby making them cost-effective and enhancing supply chain stability. For example, in September 2024, Insolation Energy began constructing a 12,000 metric tons per annum aluminum solar panel frame facility in Jaipur. This investment is a major step toward increasing domestic production, reducing reliance on imports, and enhancing India's self-sufficiency in solar panel components. The plant will assist in streamlining the supply chain, providing affordable solutions to manufacturers of solar panels while enhancing scalability in the aluminum solar frame industry. Increased domestic production is anticipated to reduce the costs of inputs and support price stability, further driving down the demand for solar panels. Moreover, higher local production will result in enhanced quality control, allowing high-durability frames appropriate for Indian climatic conditions. As businesses increase capacity, India's aluminum solar panel frame market has long-term expansion potential, backing the nation's solar energy facilities.

To get more information on this market, Request Sample

Advancements in High-Efficiency Solar Panels

India's solar industry is rapidly advancing with the introduction of high-efficiency solar panels that require durable and lightweight aluminum frames. The shift towards bifacial and high-output panels has intensified the need for superior frame materials that enhance structural integrity while ensuring long-term performance. Technological advancements in frame coatings, anodization, and alloy compositions are improving durability, corrosion resistance, and efficiency, making aluminum frames a critical component in modern solar modules. In June 2024, Pahal Solar introduced 595 Wp Topcon bifacial solar panels featuring silver anodized aluminum alloy frames. This development significantly enhances the durability and efficiency of solar panels, ensuring higher energy generation and extended lifespan. The use of anodized aluminum frames provides better resistance against environmental wear, reinforcing panel stability and performance in diverse climatic conditions. The push for high-efficiency panels is driving innovations in aluminum frame design, with manufacturers adopting lightweight yet robust materials to support next-generation solar technologies. As India aims to expand its solar capacity, the demand for advanced frames will continue to grow, ensuring reliability and efficiency in large-scale solar installations. These advancements not only improve energy output but also contribute to the long-term sustainability of the aluminum solar panel frame market in India.

India Aluminum Solar Panel Frame Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on installation type and application.

Installation Type Insights:

- Roof Top

- Ground Mounted

The report has provided a detailed breakup and analysis of the market based on the installation type. This includes roof top and ground mounted.

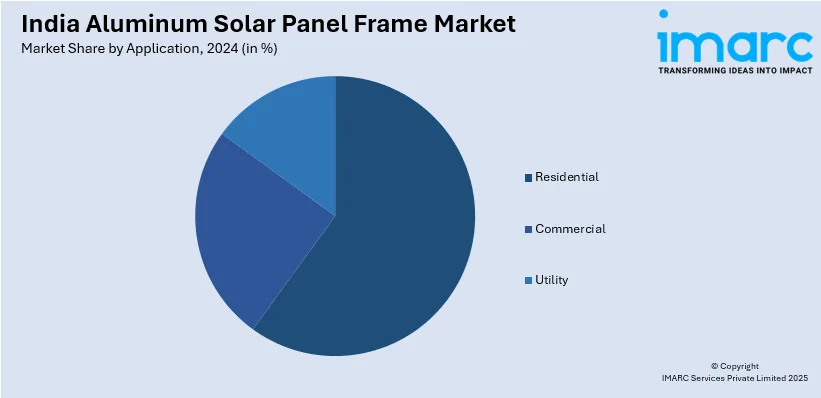

Application Insights:

- Residential

- Commercial

- Utility

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial and utility.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aluminum Solar Panel Frame Market News:

- November 2024: Premier Energies announced a 36,000 Metric Ton per annum aluminum solar panel frame manufacturing facility with an INR 230 Crore investment. This move strengthens domestic supply, reduces import reliance, and enhances cost efficiency, positively impacting India's aluminum solar panel frame industry.

- October 2024: GenY PV announced an 18,000 Metric Ton per annum aluminum solar panel frame manufacturing facility in Raipur. This investment strengthens India's domestic supply, reduces import dependency, and enhances production efficiency, positively impacting cost competitiveness and the overall growth of the aluminum solar panel frame sector.

India Aluminum Solar Panel Frame Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installation Type Covered | Roof Top, Ground Mounted |

| Application Covered | Residential, Commercial, Utility |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aluminum solar panel frame market performed so far and how will it perform in the coming years?

- What is the breakup of the India aluminum solar panel frame market on the basis of installation type?

- What is the breakup of the India aluminum solar panel frame market on the basis of application?

- What are the various stages in the value chain of the India aluminum solar panel frame market?

- What are the key driving factors and challenges in the India aluminum solar panel frame market?

- What is the structure of the India aluminum solar panel frame market and who are the key players?

- What is the degree of competition in the India aluminum solar panel frame market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aluminum solar panel frame market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aluminum solar panel frame market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aluminum solar panel frame industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)