India Analytical Instrument Market Size, Share, Trends and Forecast by Application Type, Product Type, Instrument Type, and Region, 2025-2033

India Analytical Instrument Market Size and Share:

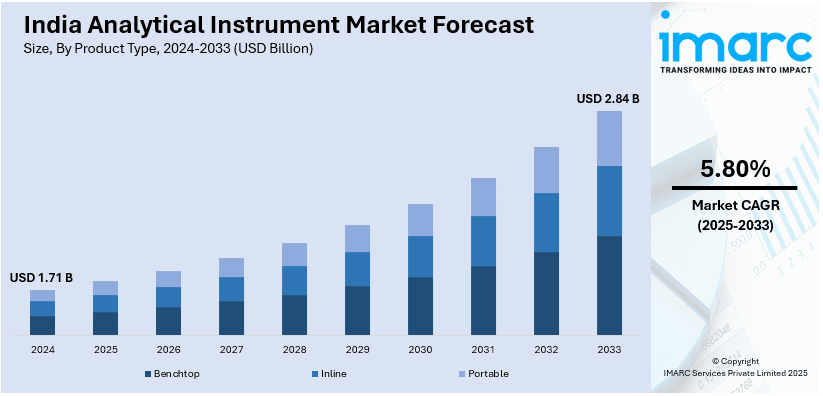

The India analytical instrument market size reached USD 1.71 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.84 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is expanding due to rising pharmaceutical R&D, stringent regulatory norms, and growing environmental testing needs. Increased demand for food safety compliance, government initiatives such as "Make in India," and advancements in portable and automated technologies further propel growth. Rising pollution levels and quality control requirements are also expanding the India analytical instrument market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 2.84 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

India Analytical Instrument Market Trends:

Increasing Demand for Advanced Analytical Instruments in Pharmaceuticals

The expanding pharmaceutical and biotechnology sectors are significantly supporting the India analytical instrument market growth. A research report released by IMARC Group indicates that the pharmaceutical market in India was valued at USD 61.36 Billion in 2024. It is projected to grow to USD 174.31 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.32% from 2025 to 2033. Drug development and quality assurance are also driven by stringent regulation requirements put forth by regulatory bodies such as the FDA and CDSCO and thus through high-performance liquid chromatography (HPLC), mass spectrometry (MS), and spectroscopy instruments. The demand is propelled in part by an increase in generic drug production and the growth of contract research organizations (CROs). Moreover, an increase in government initiatives such as "Make in India," and an increase in investments in research and development (R&D) activities are further fueling the adoption of advanced analytical technologies. Along with this, firms are focusing on the development of portable and automated instruments that require less effort and also reduce the total operational cost. With its ambitions to be a major global pharmaceutical hub, the demand for reliable, fast, and precise analytical instruments is growing in India.

To get more information on this market, Request Sample

Growth of Environmental Testing and Food Safety Applications

The rising need for environmental monitoring and food safety testing is creating a positive India analytical instrument market outlook. With increasing pollution levels and stricter environmental regulations, industries and government bodies are deploying advanced instruments such as gas chromatographs, atomic absorption spectrometers, and pH meters for air, water, and soil analysis. Similarly, the food and agriculture sectors are adopting technologies such as PCR-based systems and near-infrared (NIR) spectroscopy to ensure food quality and compliance with FSSAI standards. Food Safety and Standards Authority of India (FSSAI) has significantly improved food safety testing throughout the country, having analyzed over 4,51,000 food samples from 2023–2024, compared to 1,07,829 samples in 2020-21. In the last three years, it has seized 105,907 samples that did not comply with regulations. India has 239 primary laboratories, 261 mobile units, and 22 referral laboratories in which it operates. With the expansion in testing capabilities, India's analytical instrument market is experiencing an uprise in demand. The growing awareness of food adulteration and contamination has further propelled investments in analytical testing infrastructure. Additionally, smart city projects and wastewater management initiatives are creating new opportunities for analytical instrument manufacturers. This trend is expected to continue as sustainability and public health concerns drive demand for accurate and efficient testing solutions.

India Analytical Instrument Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application type, product type, and instrument type.

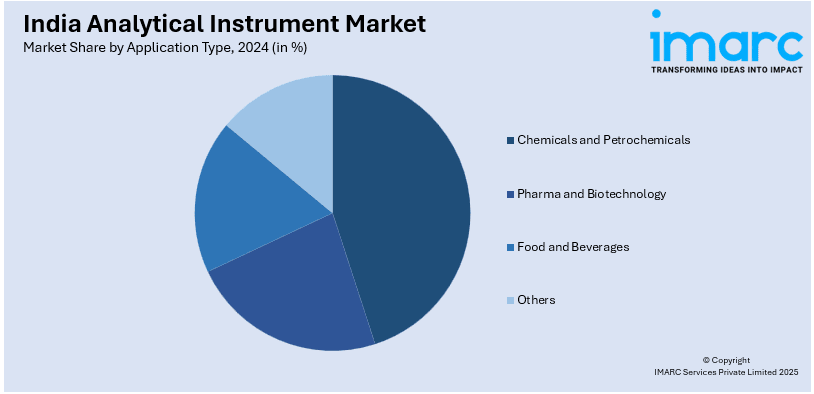

Application Type Insights:

- Chemicals and Petrochemicals

- Pharma and Biotechnology

- Food and Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application type. This includes chemicals and petrochemicals, pharma and biotechnology, food and beverages, and others.

Product Type Insights:

- Benchtop

- Inline

- Portable

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes benchtop, inline, and portable.

Instrument Type Insights:

- Chromatography

- BOD/COD Analyzer

- pH Meter

- Others

The report has provided a detailed breakup and analysis of the market based on the instrument type. This includes chromatography, BOD/COD analyzer, pH meter, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Analytical Instrument Market News:

- September 23, 2024: Metal Power Analytical launched its Optical Emission Spectrometer (OES), the Metavision-8i, which can provide 99.98% purity analysis for ferrous and non-ferrous metals. It is designed specifically for India's micro, small, and medium enterprises (MSMEs). It integrates dual-optics and CMOS detectors to facilitate accurate elemental analysis and thus bolster the analytical instrument sector in the country and enhance export potential.

India Analytical Instrument Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Types Covered | Chemicals and Petrochemicals, Pharma and Biotechnology, Food and Beverages, Others |

| Product Types Covered | Benchtop, Inline, Portable |

| Instrument Types Covered | Chromatography, BOD/COD Analyzer, pH Meter, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India analytical instrument market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India analytical instrument market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India analytical instrument industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The analytical instrument market in India was valued at USD 1.71 Billion in 2024.

The India analytical instrument market is projected to exhibit a (CAGR) of 5.80% during 2025-2033, reaching a value of USD 2.84 Billion by 2033.

The market is driven by expanding pharmaceutical and biotechnology research, food safety regulations, and environmental regulations. Greater investment in healthcare diagnosis and research at academia level enhances demand. Technological developments with precision and automation capture laboratory and industrial use. Government initiatives in digital labs and quality control also boost penetration of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)