India Aniline Market Size, Share, Trends and Forecast by Derivative, Application, End User, and Region, 2025-2033

India Aniline Market Overview:

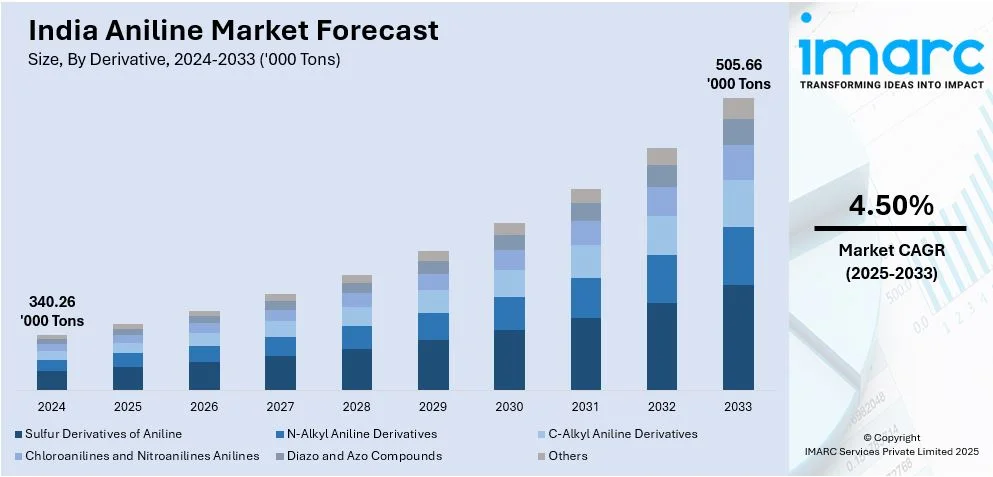

The India aniline market size reached 340.26 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 505.66 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is driven by rising demand in dyes and pigments, expanding rubber and polymer industries, growth in pharmaceuticals, increasing agrochemical applications, ongoing advancements in specialty fibers, government support for domestic chemical production, and shifting trends toward sustainable and high-performance materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 340.26 Thousand Tons |

| Market Forecast in 2033 | 505.66 Thousand Tons |

| Market Growth Rate (2025-2033) | 4.50% |

India Aniline Market Trends:

Growing Demand for Aniline in the Dyes and Pigments Industry

The Indian market for aniline is experiencing rapid expansion because the dyes and pigments sector requires more products due to the rapid growth of both the textile and leather industries. As India stands as one of the largest textile producers worldwide the demand for synthetic dyes requiring aniline as their primary component continues to expand. For instance, in September 2024, Maniram Organics Private Limited announced a brownfield expansion to increase the production of dyes and dye intermediates, including copper phthalocyanine blue and pigment blues, aiming for a total capacity of 700 tons per month. Moreover, industries are increasingly using pigments derived from aniline in paint and coating applications and printing ink production. Besides this, manufacturers now direct investments toward developing sustainable dye solutions because of the market preference for high-performance environmentally friendly products. Furthermore, government programs support domestic manufacturing through the Production-Linked Incentive scheme and intermediary import restrictions. Additionally, the India aniline market growth is driven by the global sustainability trends which lead businesses to source locally produced high-quality dyes and pigments across industries, thereby boosting the India aniline market share.

To get more information on this market, Request Sample

Increasing Utilization of Aniline in the Rubber and Polymer Industry

The India market for aniline is expanding because aniline functions as a fundamental component for creating methylene diphenyl diisocyanate (MDI) used to produce polyurethane foams. In line with this, aniline market trends follow industrial growth and urban changes because industries such as automotive, construction, and footwear need more polyurethane-based products. Concurrently, the increasing demand for synthetic rubber tires and automotive components within the rising automotive sector drives up aniline consumption levels across the market. In confluence with this, polyurethane foams serve a critical role in infrastructure development through insulation materials for smart cities and modern housing projects because of their increased demand. Additionally, domestic aniline manufacturing in India is primarily driven by the "Make in India" government program and local chemical production incentives which make India a leading force in international aniline markets while reducing import dependence, thus enhancing the India aniline market outlook. Supporting this growth, BASF India announced an expansion of PA and PBT production in May 2024 and launched a Polyurethane Technical Development Center in Mumbai to enhance local manufacturing and technical capabilities, further boosting aniline demand for polyurethane applications.

India Aniline Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on derivative, application and end user.

Derivative Insights:

- Sulfur Derivatives of Aniline

- N-Alkyl Aniline Derivatives

- C-Alkyl Aniline Derivatives

- Chloroanilines and Nitroanilines Anilines

- Diazo and Azo Compounds

- Others

The report has provided a detailed breakup and analysis of the market based on the derivative. This includes sulfur derivatives of aniline, N-alkyl aniline derivatives, C-alkyl aniline derivatives, chloroanilines and nitroanilines anilines, diazo and azo compounds, and others.

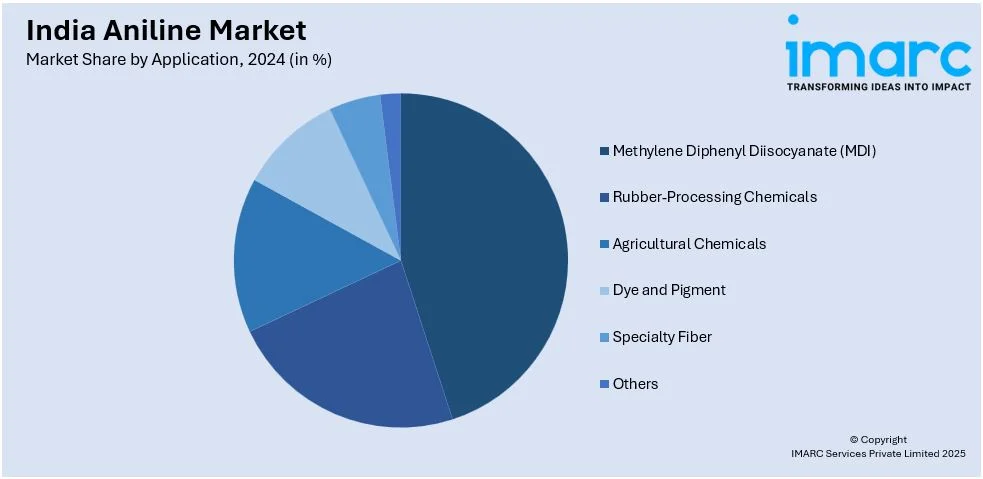

Application Insights:

- Methylene Diphenyl Diisocyanate (MDI)

- Rubber-Processing Chemicals

- Agricultural Chemicals

- Dye and Pigment

- Specialty Fiber

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes methylene diphenyl diisocyanate (MDI), rubber-processing chemicals, agricultural chemicals, dye and pigment, specialty fiber, and others.

End User Insights:

- Chemical

- Petrochemical

- Oil and Gas

- Energy Power

- Healthcare

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes chemical, petrochemical, oil and gas, energy power, healthcare, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aniline Market News:

- In September 2024, Pidilite Industries Limited partnered with the Architectural Digest Design Show 2024 as an Associate Sponsor. They showcased innovative installations demonstrating their diverse chemical solutions, highlighting their commitment to integrating aesthetics with advanced chemical applications, potentially influencing demand for products like aniline derivatives

- In August 2024, Boehringer Ingelheim India announced a strategic distribution partnership with Vvaan Lifesciences Pvt Ltd to expand the reach of their pet parasiticide portfolio. This collaboration aims to enhance veterinary care standards across India, potentially increasing the demand for chemical intermediates like aniline used in pharmaceutical applications.

India Aniline Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Sulfur Derivatives of Aniline, N-Alkyl Aniline Derivatives, C-Alkyl Aniline Derivatives, Chloroanilines and Nitroanilines Anilines, Diazo and Azo Compounds, Others |

| Applications Covered | Methylene Diphenyl Diisocyanate (MDI), Rubber-Processing Chemicals, Agricultural Chemicals, Dye and Pigment, Specialty Fiber, Others |

| End Users Covered | Chemical, Petrochemical, Oil and Gas, Energy Power, Healthcare, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aniline market performed so far and how will it perform in the coming years?

- What is the breakup of the India aniline market on the basis of derivative?

- What is the breakup of the India aniline market on the basis of application?

- What is the breakup of the India aniline market on the basis of end user?

- What is the breakup of the India aniline market on the basis of region?

- What are the various stages in the value chain of the India aniline market?

- What are the key driving factors and challenges in the India aniline?

- What is the structure of the India aniline market and who are the key players?

- What is the degree of competition in the India aniline market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aniline market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aniline market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aniline industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)