India Anti-Jamming Market Size, Share, Trends and Forecast by Receiver Type, Application, Anti-Jamming Technique, End User, and Region, 2025-2033

India Anti-Jamming Market Overview:

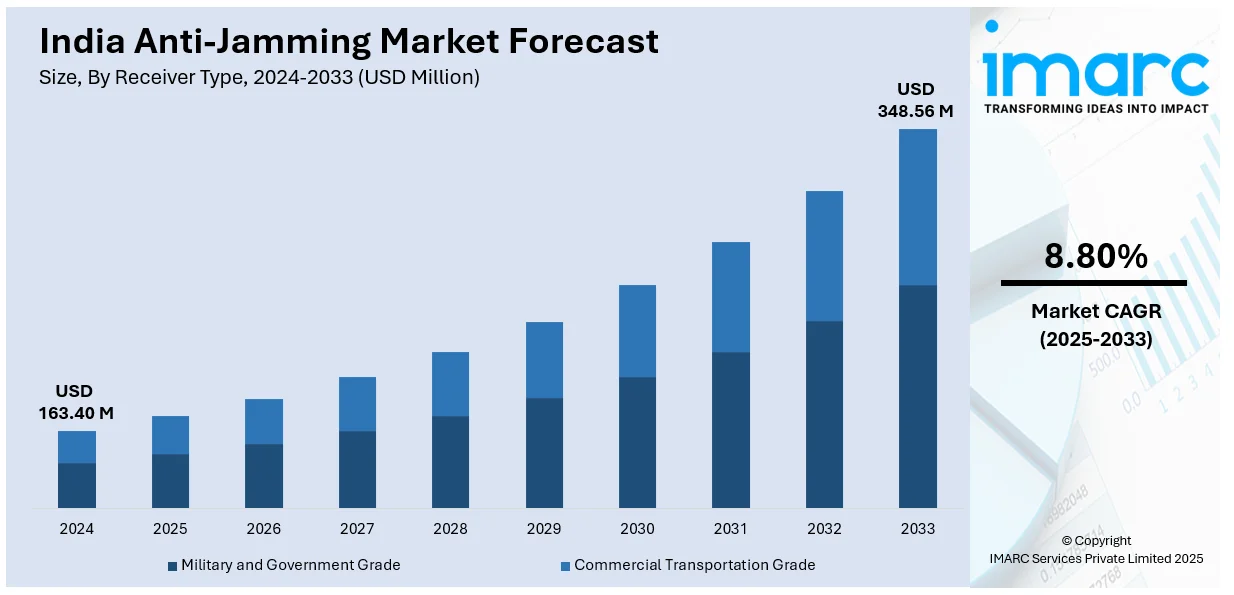

The India anti-jamming market size reached USD 163.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 348.56 Million by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. The market is growing due to increasing defense modernization, rising threats of electronic warfare, and expanding satellite-based navigation systems. Government initiatives in indigenous defense manufacturing, rising adoption of unmanned aerial vehicles (UAVs), and increased investments in GNSS security further drive demand for anti-jamming solutions in military and commercial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 163.40 Million |

| Market Forecast in 2033 | USD 348.56 Million |

| Market Growth Rate (2025-2033) | 8.80% |

India Anti-Jamming Market Trends:

Growing Demand for GNSS Anti-Jamming Solutions

India's increasing reliance on satellite-based navigation for defense, aviation, and maritime applications has escalated concerns over GNSS signal interference. The rising threats from intentional jamming and spoofing have driven defense agencies and commercial sectors to adopt advanced anti-jamming technologies. For instance, as per industry reports, GPS spoofing incidents have surged, affecting aviation and national security. India-Pakistan and India-Myanmar borders rank among the top five global hotspots, impacting over 10% of aircraft. Delhi’s airspace recorded 316 cases in May 2024 alone. India's DGCA mandates SOPs for airlines, while ICAO calls for global coordination to mitigate risks and safeguard navigation systems. Besides this, with initiatives like NavIC (Navigation with Indian Constellation), India is strengthening its positioning, navigation, and timing (PNT) capabilities. The government is also pushing for indigenous anti-jamming solutions, ensuring critical sectors remain resilient to signal disruptions. Automotive and telecom industries are integrating anti-jamming receivers to protect GPS-based services from malicious attacks, further contributing to market expansion.

To get more information on this market, Request Sample

Rising Adoption of Anti-Jamming in UAVs and Military Applications

The Indian defense sector is increasingly deploying unmanned aerial vehicles (UAVs) and drones for surveillance, reconnaissance, and combat operations. With growing threats of GPS jamming by adversaries, there is a heightened demand for anti-jamming systems to maintain uninterrupted navigation and communication. The Make in India initiative has encouraged domestic defense manufacturers to develop advanced anti-jamming technologies for UAVs, fighter jets, and military ground vehicles. Additionally, satellite communication-based jamming solutions are being integrated into border surveillance and missile guidance systems, ensuring operational continuity in electronic warfare scenarios. For instance, as per industry reports, in March 2023, the Indian Army successfully tested anti-drone jammers and spoofers along the Indo-Pak border in Jammu and Punjab. These systems effectively prevented Pakistan-based terror groups from using drones to smuggle weapons and drugs into India. The army deployed 30 jammers and spoofers, which either disrupt drone signals or hijack their communication links. Given the rising threat of UAVs, India plans to expand its anti-drone capabilities and acquire more advanced systems to enhance border security and counterterrorism efforts.

India Anti-Jamming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on receiver type, application, anti-jamming technique, end user.

Receiver Type Insights:

- Military and Government Grade

- Commercial Transportation Grade

The report has provided a detailed breakup and analysis of the market based on the receiver type. This includes military and government grade and commercial transportation grade.

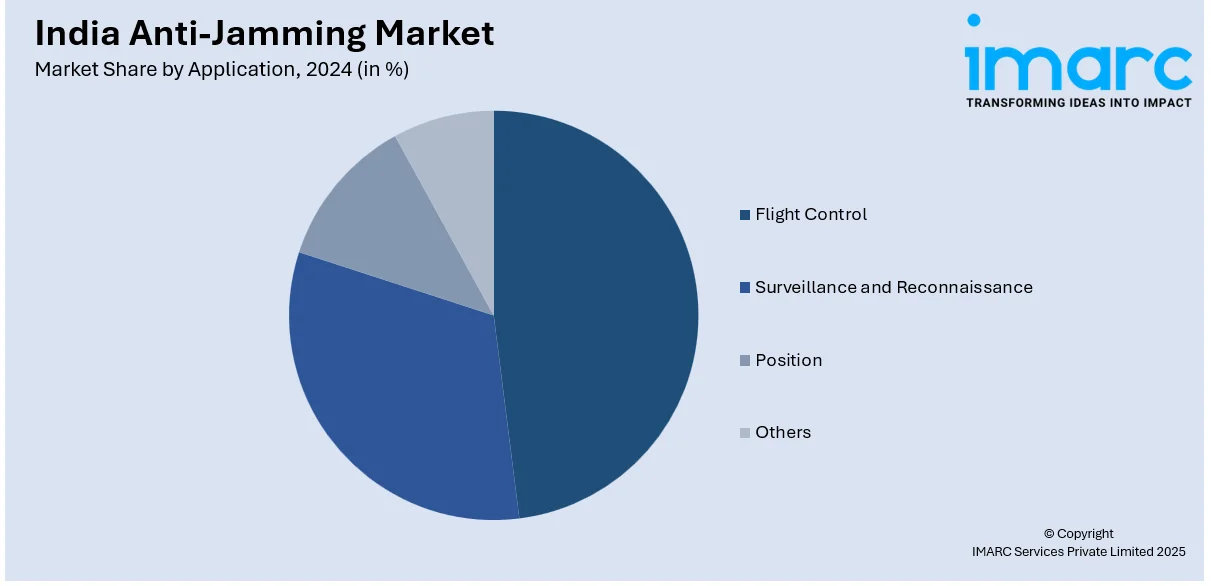

Application Insights:

- Flight Control

- Surveillance and Reconnaissance

- Position

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes flight control, surveillance and reconnaissance, position, and others.

Anti-Jamming Technique Insights:

- Nulling Technique

- Beam Steering Technique

- Civilian Techniques

A detailed breakup and analysis of the market based on the anti-jamming technique have also been provided in the report. This includes nulling technique, beam steering technique, and civilian techniques.

End User Insights:

- Military

- Civilian

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes military and civilian.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Anti-Jamming Market News:

- In September 2023, IIT Jammu, in collaboration with CST Advanced Systems, is nearing completion of two critical defense projects: an anti-GPS jamming device and an Identification Friend or Foe (IFF) system. The anti-jamming device will protect GPS-enabled assets, while the IFF system will help security forces identify friendly troops during counter-terrorism operations. These technologies are designed for diverse battlefield conditions, ensuring operational effectiveness. The projects align with India's defense modernization efforts and will enhance military capabilities along the Line of Control and hinterlands.

India Anti-Jamming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Receiver Types Covered | Military and Government Grade, Commercial Transportation Grade |

| Applications Covered | Flight Control, Surveillance and Reconnaissance, Position, Others |

| Anti-Jamming Techniques Covered | Nulling Technique, Beam Steering Technique, Civilian Techniques |

| End Users Covered | Military, Civilian |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India anti-jamming market performed so far and how will it perform in the coming years?

- What is the breakup of the India anti-jamming market on the basis of receiver type?

- What is the breakup of the India anti-jamming market on the basis of application?

- What is the breakup of the India anti-jamming market on the basis of anti-jamming technique?

- What is the breakup of the India anti-jamming market on the basis of end user?

- What are the various stages in the value chain of the India anti-jamming market?

- What are the key driving factors and challenges in the India anti-jamming market?

- What is the structure of the India anti-jamming market and who are the key players?

- What is the degree of competition in the India anti-jamming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India anti-jamming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India anti-jamming market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India anti-jamming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)