India Anti Microbial Fabrics Market Size, Share, Trends and Forecast by Active Agent, Application, and Region, 2025-2033

India Anti Microbial Fabrics Market Size and Share:

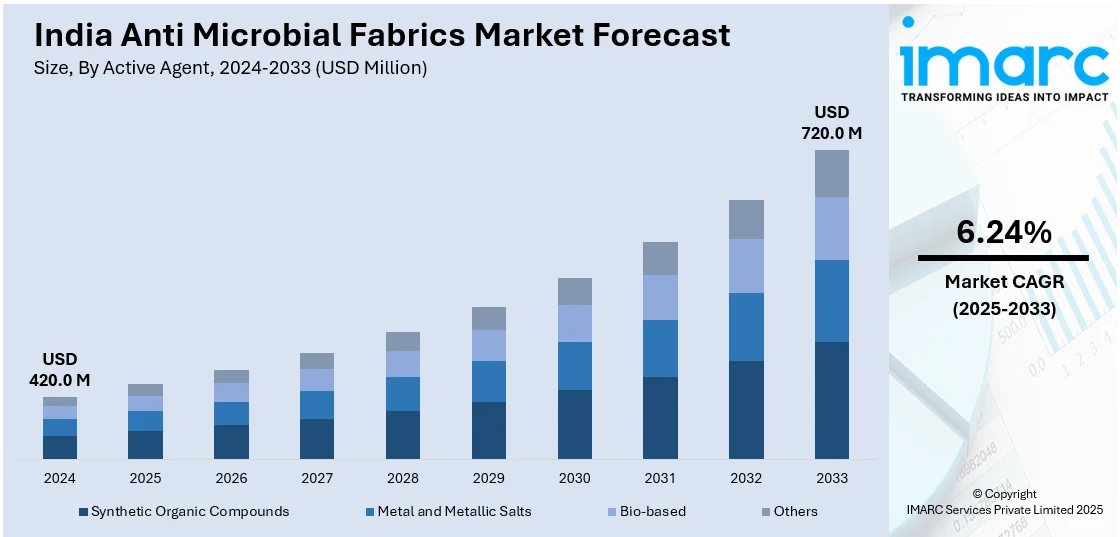

The India anti microbial fabrics market size reached USD 420.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 720.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The growing health awareness, rising demand for infection-control textiles in healthcare, and increasing hygiene concerns among consumers are augmenting the India anti microbial market share. The implementation of government initiatives promoting sanitary standards, advancements in eco-friendly antimicrobial treatments, and the expansion of the healthcare and apparel sectors further propel market growth. Sustainable innovations also attract environmentally conscious buyers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 420.0 Million |

| Market Forecast in 2033 | USD 720.0 Million |

| Market Growth Rate 2025-2033 | 6.24% |

India Anti Microbial Fabrics Market Trends:

Expansion of Antimicrobial Fabrics in Activewear and Sportswear

The rise in demand for antimicrobial fabrics in activewear and sportswear, driven by the growing fitness culture and rising health consciousness, is favoring the India antimicrobial fabrics market growth. A research report from the IMARC Group indicates that the sportswear market in India was valued at USD 10.2 Million in 2024. It is projected to grow to USD 16.6 Million by 2033, reflecting a compound annual growth rate (CAGR) of 5.1% from 2025 to 2033. This growth is driven by athletes and fitness enthusiasts who favor apparel that resists odor-causing bacteria, offering better comfort during long training sessions. In line with this trend, the anti-microbial fabrics market in India is gaining traction as sportswear brands increasingly incorporate these fabrics to meet consumer expectations for hygiene, performance, and durability. Brands are integrating silver-ion, copper-infused, and plant-based antimicrobial treatments into performance wear to improve moisture-wicking and durability. The increasing popularity of yoga, gym wear, and outdoor sports further fuels this trend. Additionally, e-commerce platforms are making these advanced fabrics more accessible to consumers. With the athleisure market expanding rapidly, manufacturers are investing in R&D to develop lightweight, breathable, and long-lasting antimicrobial textiles. This trend aligns with the broader shift toward functional and hygienic apparel, positioning antimicrobial sportswear as a key growth segment in India’s textile industry.

To get more information on this market, Request Sample

Sustainable and Eco-Friendly Antimicrobial Textiles Gaining Traction

The shift toward sustainable and eco-friendly solutions is creating a positive India antimicrobial fabrics market outlook. Consumers and manufacturers are increasingly prioritizing environmentally safe antimicrobial treatments, moving away from traditional chemical finishes that may cause skin irritation or environmental harm. Natural antimicrobial agents, such as neem extract, chitosan, and aloe vera, are being incorporated into textiles to meet this demand. The rise of organic and biodegradable fabrics aligns with global sustainability trends and stricter environmental regulations. Organic exports from India are expected to reach INR 20,000 Crore (approximately USD 2,500 Million) by 2028 as against the current levels of INR 5,000-6,000 Crore (approximately USD 625 Million-USD 750 Million), a 3 to 3.5 fold jump. This rapid growth signals a strong shift toward environmentally responsible production, which is also influencing the market. As sustainability becomes a priority, manufacturers are turning to natural anti-microbial agents and eco-certified treatments. Brands are also leveraging this shift as a marketing strategy to attract eco-conscious buyers. Furthermore, advancements in bio-based antimicrobial coatings are improving fabric performance without compromising sustainability. As India’s textile industry embraces greener practices, the demand for eco-friendly antimicrobial fabrics is expected to rise, particularly in apparel, sportswear, and home furnishing segments.

India Anti Microbial Fabrics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on active agent and application.

Active Agent Insights:

- Synthetic Organic Compounds

- Metal and Metallic Salts

- Bio-based

- Others

The report has provided a detailed breakup and analysis of the market based on the active agent. This includes synthetic organic compounds, metal and metallic salts, bio-based, and others.

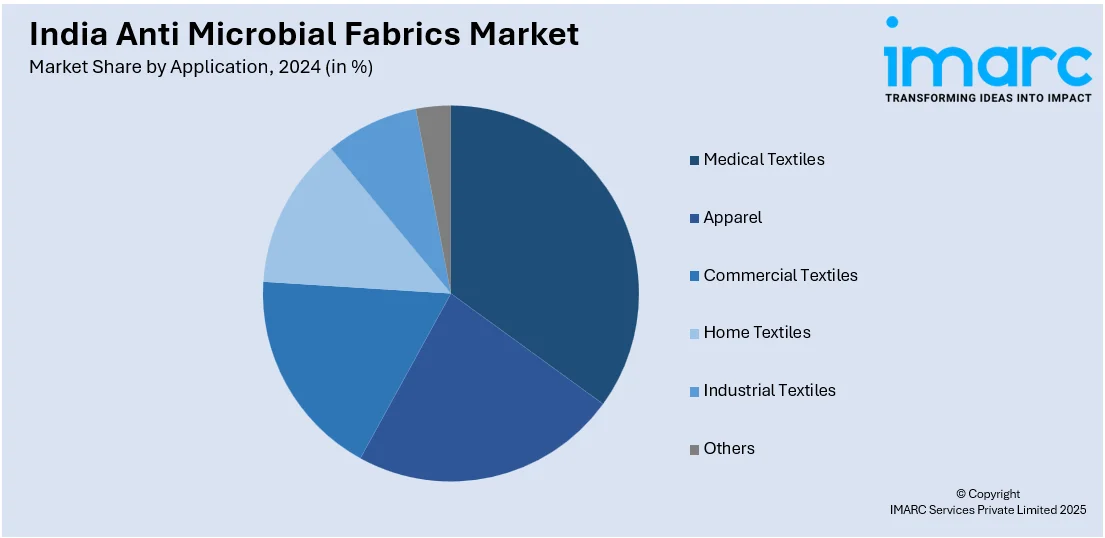

Application Insights:

- Medical Textiles

- Apparel

- Commercial Textiles

- Home Textiles

- Industrial Textiles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes medical textiles, apparel, commercial textiles, home textiles, industrial textiles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Anti Microbial Fabrics Market News:

- February 18, 2025: RSWM Limited unveiled its most recent Panchtatva initiative, showcasing innovative antimicrobial textiles at BharatTex 2025. This initiative was praised by Shri Giriraj Singh, Hon'ble Union Minister of Textiles & launched by Smt. Roop Rashi Mahapatra. The aim is to overhaul India's textile industry. This move positions RSWM as a key player in the growing antimicrobial fabrics market as demand rises.

- February 12, 2025: Polyspin launched its Nano 5 textile treatment with antimicrobial features in India at the second edition of the DyeChem World Expo during Bharat Tex 2025 to meet the growing need for antimicrobial fabrics in the country. This silver-based, eco-friendly, safe solution kills bacteria, viruses, and fungi and keeps killing them long after use or laundering. With its innovative nanoparticle technology, Nano 5 is poised for widespread distribution across India via Polyspin’s network, ensuring exceptional performance at competitive rates.

India Anti Microbial Fabrics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Active Agent Covered | Synthetic Organic Compounds, Metal and Metallic Salts, Bio-based, Others |

| Applications Covered | Medical Textiles, Apparel, Commercial Textiles, Home Textiles, Industrial Textiles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India anti microbial fabrics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India anti microbial fabrics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India anti microbial fabrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti microbial fabrics market in India was valued at USD 420.0 Million in 2024.

The India anti microbial fabrics market is projected to exhibit a CAGR of 6.24% during 2025-2033, reaching a value of USD 720.0 Million by 2033.

Growing health awareness, demand for hygiene products, and rising infections are bolstering the anti microbial fabrics market growth in India. Hospitals, sportswear, and home textiles increasingly use these fabrics to prevent germs and odors. Furthermore, innovations in textile treatments and supportive government policies for medical textiles further encourage the adoption across sectors like healthcare and hospitality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)