India Antimalarial Drugs Market Size, Share, Trends and Forecast by Drug Class, Mechanism of Action, Distribution Channel, and Region, 2025-2033

India Antimalarial Drugs Market Overview:

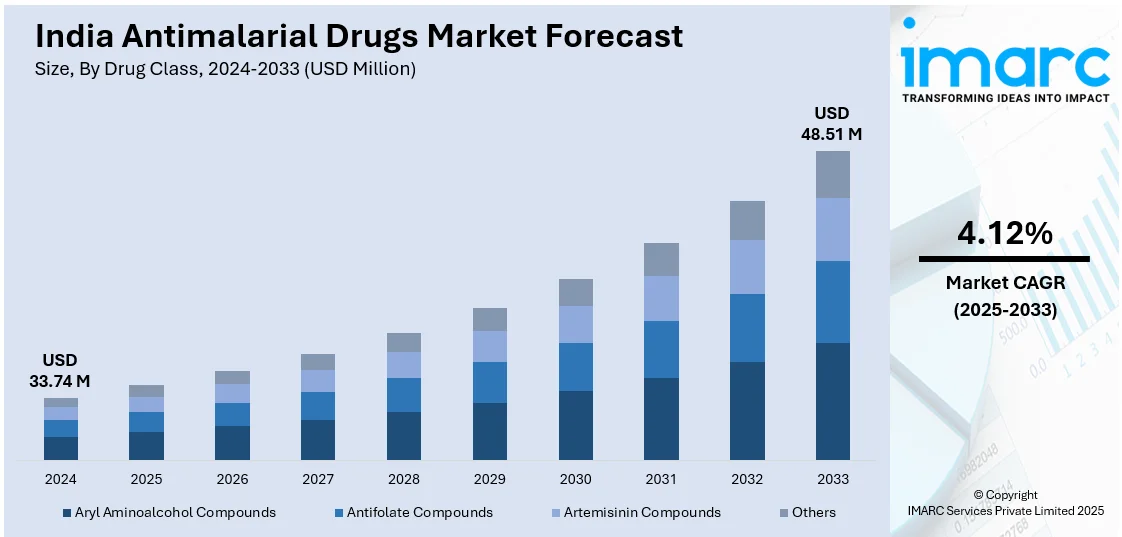

The India antimalarial drugs market size reached USD 33.74 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 48.51 Million by 2033, exhibiting a growth rate (CAGR) of 4.12% during 2025-2033. The India antimalarial drugs market share is expanding, driven by the increasing incidence of malaria, especially in states with tropical and humid climates, along with the expansion of healthcare infrastructure, leading to enhanced access to diagnosis and treatment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.74 Million |

| Market Forecast in 2033 | USD 48.51 Million |

| Market Growth Rate 2025-2033 | 4.12% |

India Antimalarial Drugs Market Trends:

Growing incidence of malaria

The rising incidence of malaria is impelling the India antimalarial drugs market growth. The country continues to report thousands of cases each year, especially in states with tropical and humid climates. According to the data released by the National Center for Vector Borne Diseases Control (NCVBDC), as of June 2024, there were more than 32,000 cases of malaria and 32 fatalities In India, illustrating a continuing public health issue. Even with regular attempts to manage the disease, malaria is still a significant public health issue, particularly in rural and semi-urban areas where mosquito breeding is high. The illness burden is driving the demand for antimalarial drugs, such as artemisinin-based combination treatments (ACTs), chloroquine, and primaquine. Seasonal outbreaks during monsoons create the need for effective treatments, prompting pharmaceutical companies to increase production and delivery. Furthermore, the emergence of drug-resistant malaria strains has encouraged the development of new and more advanced formulations. As awareness about early diagnosis is improving, private hospitals and pharmacies are seeing a rise in demand for antimalarial medications. With ongoing cases being reported and the need for both preventive and curative therapy, the market continues to broaden.

To get more information on this market, Request Sample

Expanding healthcare infrastructure

The expansion of healthcare infrastructure is offering a favorable India antimalarial drugs market outlook. With more hospitals, clinics, and healthcare centers being set up under government initiatives and private investments, malaria detection and treatment have become more efficient, leading to increased demand for antimalarial medications. The growing number of diagnostic labs and point-of-care (POC) testing facilities is aiding in faster identification of cases, ensuring timely treatment with effective drugs. Additionally, the rise of telemedicine and digital healthcare services is making it easier for patients in remote areas to consult doctors and get prescriptions for antimalarial treatments. Government agencies are wagering on advanced healthcare infrastructure development to improve access to reliable diagnosis. Government programs and state-level healthcare schemes are also increasing the distribution of essential medicines, including antimalarials, through public health centers. Under the Indian Union Budget 2024-25, the Indian Government designated approximately INR 90,958 Crore for the nation's healthcare sector, reflecting an increase of 2% from INR 89,155 Crore in FY2023-24. The emphasis of this budget was on enhancing healthcare infrastructure and supporting the execution of centrally sponsored schemes. With better hospital infrastructure, improved supply chains, and wider availability of medicines in pharmacies, more people are getting access to the right treatment at the right time. As healthcare facilities continue to grow, the demand for affordable antimalarial drugs is rising steadily in India.

India Antimalarial Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on drug class, mechanism of action, and distribution channel.

Drug Class Insights:

- Aryl Aminoalcohol Compounds

- Antifolate Compounds

- Artemisinin Compounds

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes aryl aminoalcohol compounds, antifolate compounds, artemisinin compounds, and others.

Mechanism of Action Insights:

- Treatment for Malaria

- Prevention from Malaria

A detailed breakup and analysis of the market based on the mechanism of action have also been provided in the report. This includes treatment for malaria and prevention from malaria.

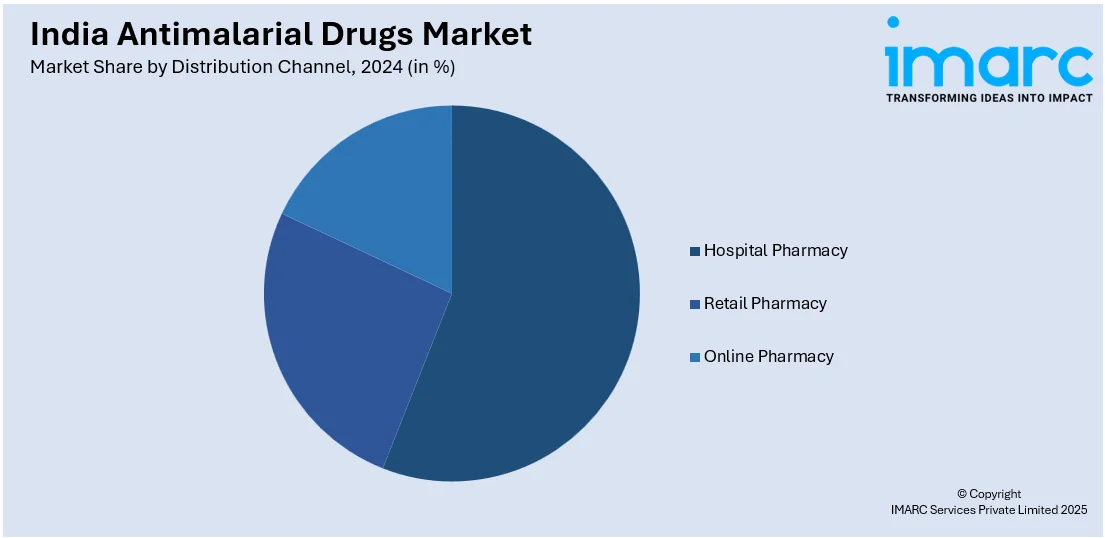

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacy, retail pharmacy, and online pharmacy.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Antimalarial Drugs Market News:

- In May 2024, a group of researchers from Jawaharlal Nehru University (JNU) discovered a possible vaccine candidate that could lead to improved prevention and treatment methods for malaria. The study, conducted by Prof. Shailja Singh and Prof. Anand Ranganathan at JNU's Special Centre for Molecular Medicine, discovered a unique host-parasite interaction complex that would be crucial for developing an effective vaccine approach.

India Antimalarial Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Aryl Aminoalcohol Compounds, Antifolate Compounds, Artemisinin Compounds, Others |

| Mechanisms of Actions Covered | Treatment for Malaria, Prevention from Malaria |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India antimalarial drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the India antimalarial drugs market on the basis of drug class?

- What is the breakup of the India antimalarial drugs market on the basis of mechanism of action?

- What is the breakup of the India antimalarial drugs market on the basis of distribution channel?

- What is the breakup of the India antimalarial drugs market on the basis of region?

- What are the various stages in the value chain of the India antimalarial drugs market?

- What are the key driving factors and challenges in the India antimalarial drugs market?

- What is the structure of the India antimalarial drugs market and who are the key players?

- What is the degree of competition in the India antimalarial drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India antimalarial drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India antimalarial drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India antimalarial drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)