India Aquaculture Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

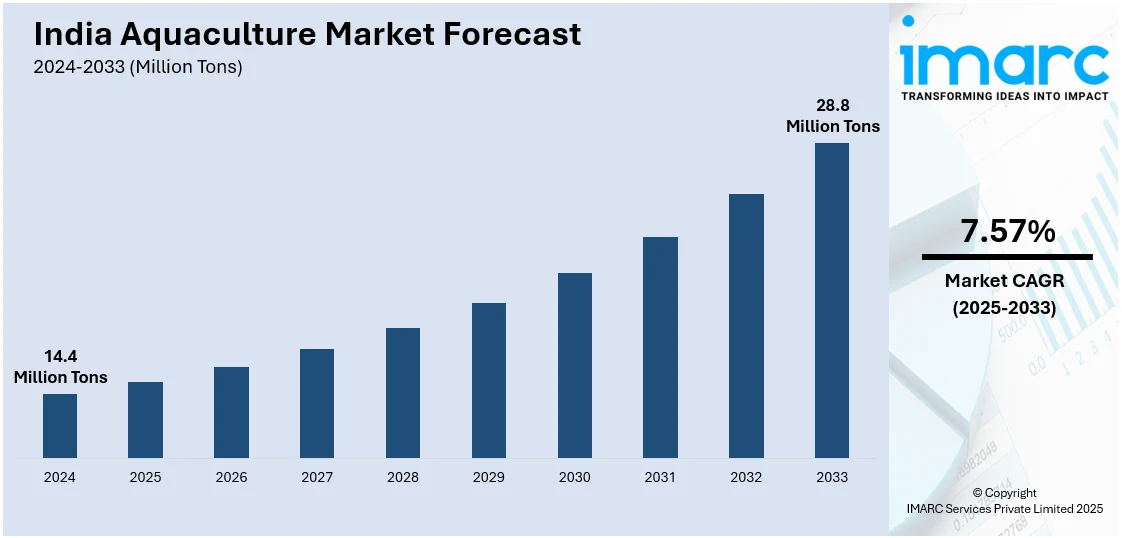

The India aquaculture market size reached 14.4 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 28.8 Million Tons by 2033, exhibiting a growth rate (CAGR) of 7.57% during 2025-2033. The growing sea temperatures and unpredictable climatic conditions, the growth in cold storage facilities, and modernized fishing harbors, and the introduction of training programs and workshops to educate farmers are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 14.4 Million Tons |

| Market Forecast in 2033 | 28.8 Million Tons |

| Market Growth Rate 2025-2033 | 7.57% |

Aquaculture, commonly referred to as fish farming, involves the breeding, rearing, and harvesting of aquatic organisms, including fish, crustaceans, mollusks, and aquatic plants. Unlike traditional fishing, which extracts fish from wild populations, aquaculture cultivates aquatic species under controlled conditions. This sector is essential for meeting the global demand for seafood, providing a crucial source of protein for millions of people worldwide. As wild fish stocks face pressures from overfishing and environmental changes, aquaculture has emerged as a sustainable alternative, offering the potential to boost seafood production without depleting natural resources. By controlling factors such as feed, water quality, and health management, aquaculture can produce high-quality, consistent yields. The continued development and improvement of sustainable aquaculture practices can contribute significantly to global food security and economic growth.

To get more information on this market, Request Sample

The rising sea temperatures and unpredictable climatic conditions have affected traditional marine fisheries. These changes have led to inconsistent yields from the seas, making aquaculture a more reliable alternative. As traditional fishing struggles with the impacts of climate change, aquaculture steps in to fill the supply-demand gap, ensuring a steady supply of seafood products. With globalization and exposure to international cuisines, Indian consumers are now more open to trying a diverse range of seafood products. This evolving palate has expanded the market for various species that were earlier not popular in the domestic market. This diversification of demand is pushing the industry to innovate and expand its product range. In addition, the growth in cold storage facilities, better transport connectivity, and modernized fishing harbors has streamlined the supply chain for aquaculture products. Efficient logistics ensures that the products maintain their freshness from the farm to the consumer, enhancing product quality and, consequently, market demand. Moreover, various organizations and government bodies are conducting training programs and workshops to educate farmers about sustainable and efficient farming practices. These efforts are aimed at enhancing yields, reducing disease outbreaks, and optimizing resource use. An informed and skilled farming community can significantly boost the industry's productivity and growth.

India Aquaculture Market Trends/Drivers:

Growing Demand for Protein-Rich Food Sources

The dietary habits of India's vast population have been undergoing a transformation in recent years. With the rise in disposable income, urbanization, and increased health awareness, there has been a prominent shift toward protein-rich food sources. Seafood, particularly fish, is a primary source of essential omega-3 fatty acids, vitamins, and minerals. As the population recognizes these nutritional benefits, the demand for seafood has risen. Furthermore, traditional Indian cuisines across various regions have always integrated fish as a staple, and this tradition is now merging with the newer health-driven demand. Therefore, this rising demand is driving the expansion of the aquaculture industry as it promises a consistent and sustainable supply of seafood products to meet the dietary requirements of the Indian populace.

Technological Advancements in Farming Practices

The aquaculture sector in India is benefitting from the adoption of modern and technologically advanced farming practices. Along with this, innovations in hatchery technology, feeding systems, and water quality management have optimized fish yields and reduced production cycles. In addition, the introduction of automated feeding systems, disease management solutions, and advanced pond liners has enhanced the efficiency of fish farms. Furthermore, the Indian government and private sectors are investing in research and development to further enhance aquaculture's yield and sustainability. These technological advancements increase productivity and make the sector more environmentally sustainable. Thus, it is also contributing to the market.

India Shrimp Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India shrimp market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on environment, species, shrimp size, end use and end form.

Breakup by Environment:

- Farmed Shrimp

- Wild Shrimp

Farmed shrimp dominates the market

The report has provided a detailed breakup and analysis of the market based on the environment. This includes farmed shrimp and wild shrimp. According to the report, farmed shrimp represented the largest segment.

The India aquaculture industry has witnessed significant growth in farmed shrimp market, driven by the rising demand for shrimp as a popular seafood delicacy among the masses across the country. Additionally, India's strategic geographic location, with an extensive coastline and suitable climate, provides ideal conditions for shrimp farming. Along with this, the government's supportive policies and initiatives to boost aquaculture activities further enhance the sector's growth prospects. Technological advancements and improved farming practices have increased shrimp production efficiency, making it economically viable for farmers. Moreover, the industry's ability to generate employment opportunities in rural areas contributes to its socio-economic impact. Environmental sustainability and certification programs have also played a pivotal role in strengthening India's position as a responsible and reliable supplier of farmed shrimp in the international market.

Breakup by Species:

- L. Vannamei

- Penaeus Monodon

- Scampi

L. vannamei dominate the market

A detailed breakup and analysis of the market based on the species have also been provided in the report. This includes L. Vannamei, Penaeus Monodon, and Scampi. According to the report, L. vannamei represented the largest segment.

The L. vannamei species has emerged as a significant market driver in the India aquaculture industry, experiencing notable growth and demand. This rise can be attributed to its desirable traits, including rapid growth, high survival rates, and resistance to diseases, making them a preferred choice for farmers. In addition, the species' versatility allows for successful cultivation in various regions across India, enhancing its widespread adoption. In addition, the escalating global demand for high-quality shrimp products, coupled with L. Vannamei's ability to cater to diverse market preferences, has further boosted its prominence. The Indian government's proactive support through policy frameworks and financial incentives has facilitated the expansion of L. Vannamei farming operations. Moreover, advancements in technology and innovative farming practices have enhanced production efficiency, making it a lucrative venture for aquaculture entrepreneurs.

Breakup by Shrimp Size:

- 31-40

- 41-50

- 51-60

- 61-70

- >70

- Others

31-40 dominates the market

The report has provided a detailed breakup and analysis of the market based on the shrimp size. This includes 31-40, 41-50, 51-60, 61-70, >70, and others. According to the report, 31-40 represented the largest segment.

The market drivers for the 31-40 shrimp size segment in the India aquaculture industry have played a pivotal role in driving its growth and prominence. One of the primary factors contributing to the demand for this particular size range is its widespread acceptance in various culinary markets, both domestically and internationally. The 31-40 size category strikes a balance between larger and smaller shrimp, making it versatile for a wide range of culinary preparations. Moreover, the segment's popularity is bolstered by the consistent supply and availability throughout the year, owing to effective farming practices and optimized production techniques. Additionally, the economic feasibility of cultivating this size range makes it an attractive choice for farmers, as it offers an optimal trade-off between input costs and market value. As consumer preferences evolve, the 31-40 shrimp size segment's ability to cater to diverse market demands ensures its continued growth and relevance in the India aquaculture industry.

Breakup by End Use:

- Hotels and Restaurants

- Retail Shops

- Hypermarkets and Supermarkets

- Online Sales

- Others

Hotels and restaurants dominate the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hotels and restaurants, retail shops, hypermarkets and supermarkets, online sales, and others. According to the report, hotels and restaurants represented the largest segment.

The hotels and restaurants end use segment has emerged as a significant market driver in the India aquaculture industry, exerting a notable impact on its growth and development. The thriving hospitality sector in the country, fueled by a burgeoning tourism industry and changing consumer preferences, has contributed to the increasing demand for seafood in hotels and restaurants. Seafood, including various fish and shrimp varieties, holds a prominent place in Indian cuisine, making it an essential component of menus in these establishments. In confluence with this, the growing awareness of the health benefits associated with seafood consumption has further bolstered its popularity among consumers, prompting hotels and restaurants to include diverse and sustainable seafood options on their menus. Additionally, the emphasis on sourcing locally produced, fresh, and high-quality seafood has provided a significant opportunity for the India aquaculture industry to cater to this demand. As hotels and restaurants continuously seek to enhance their culinary offerings, the partnership between the aquaculture sector and the hospitality industry remains a crucial driving force in fostering growth and promoting the consumption of Indian aquaculture products.

Breakup by End Form

- Frozen

- Fresh

- Canned

Frozen form dominates the market

The report has provided a detailed breakup and analysis of the market based on the end form. This includes frozen, fresh, and canned. According to the report, frozen form represented the largest segment.

The frozen form segment serves as a prominent market driver in the India aquaculture industry, exerting a substantial influence on its growth and market dynamics. The demand for frozen seafood has witnessed a significant increase in recent years due to several factors. Additionally, frozen seafood offers extended shelf life and convenience, making it a preferred choice for consumers seeking convenient and readily available options. As the busy urban lifestyle becomes more prevalent, the convenience of frozen seafood products aligns with evolving consumer preferences. In confluence with this, frozen seafood's ability to retain freshness, flavor, and nutritional value has garnered widespread acceptance among consumers. The accelerating popularity of international cuisines that incorporate seafood as a key ingredient has further stimulated the demand for frozen seafood in India. Moreover, the development of advanced freezing technologies and robust cold supply chains has facilitated the production and distribution of high-quality frozen seafood products. As a result, the frozen end use segment continues to be a driving force in the India aquaculture industry, catering to the evolving demands of consumers and the broader culinary landscape.

Breakup by States:

- Andhra Pradesh

- West Bengal

- Gujarat

- Tamil Nadu (Including Pondicherry)

- Orissa

- Maharashtra

- Karnataka

- Kerala

- Others

Andhra Pradesh exhibits a clear dominance, accounting for the largest India aquaculture market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Andhra Pradesh, West Bengal, Gujarat, Tamil Nadu (including Pondicherry), Orissa, Maharashtra, Karnataka, Kerala, and Others. According to the report, Andhra Pradesh was the largest market for India aquaculture market.

The aquaculture industry in Andhra Pradesh, India, is thriving, driven by the state's favorable geographical location with an extensive coastline and abundant freshwater resources that provide ideal conditions for aquaculture activities. This natural advantage enables the cultivation of diverse species such as shrimp, fish, and crab, catering to both domestic and international markets. Additionally, the proactive support and initiatives by the state government to promote aquaculture have played a crucial role in boosting the industry's growth. These efforts include providing financial incentives, technical assistance, and infrastructure development to encourage sustainable aquaculture practices. In confluence with this, the rising demand for seafood in the domestic market due to the changing dietary preferences and increased awareness of its health benefits. With a focus on innovation, sustainability, and quality, the aquaculture industry in Andhra Pradesh is poised for continued expansion and success in the years to come.

India Inland Fish Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India inland fish market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on environment and species.

Breakup by Environment:

- Fresh Water

- Brackish Water

The report has provided a detailed breakup and analysis of the market based on the environment. This includes fresh water and brackish water.

India's vast network of fresh water, including rivers, lakes, and ponds provides significant opportunities for freshwater aquaculture. The freshwater bodies are suitable for cultivating a wide variety of fish and other aquatic species. It supports the farming of species, including carp, catfish, and tilapia, which are popular in domestic and international markets. Freshwater systems often require less investment compared to brackish or marine systems. This accessibility attracts small and medium-scale farmers, contributing to the spread of aquaculture practices.

On the other hand, India's extensive coastline offers immense potential for brackish water aquaculture, particularly for shrimp farming. The growing focus on sustainable brackish water farming practices, including responsible sourcing and adherence to quality standards, adds value to the market. Brackish water species, such as shrimps have high demand in international markets. The export-driven growth significantly impacts India's trade balance and economic development.

Breakup by Species:

- Indian Major Carps

- Exotic Carps

- Pangasius

- Clarias

- Anabas

- Rupchanda

- Tilapia

- Seabass

- Others

A detailed breakup and analysis of the market based on the species have also been provided in the report. This includes indian major carps, exotic carps, pangasius, clarias, anabas, rupchanda, tilapia, seabass and others.

Indian major carps (IMC) includes prominent species, such as catla, rohu and mrigal, which are popular among consumers in India. These species are an integral part of the Indian culinary tradition and have widespread acceptance across different regions. IMC are well adapted to Indian climatic conditions, facilitating easier cultivation and management. Apart from this, IMC farming supports the livelihoods of numerous small and medium-scale farmers, contributing to rural employment and economic development, thereby gaining prominence across the country.

On the contrary, exotic carps, including common carp and grass carp have been introduced to Indian aquaculture, adding to the product range. The cultivation of exotic carps often involves advanced technologies and innovative practices, leading to improved efficiency and productivity. Also, it caters to diverse market segments, including niche and premium markets, both domestically and internationally, which is significantly supporting the overall market.

Breakup by States:

- Andhra Pradesh

- West Bengal

- Uttar Pradesh

- Maharashtra

- North East Region

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Andhra Pradesh, West Bengal, Uttar Pradesh, Maharashtra, North East Region and Others.

The North East Region of India, with its rich biodiversity, provides an ideal environment for various species of fish and shellfish, which promotes innovative aquaculture practices. Moreover, the government has introduced various schemes and programs to boost the aquaculture sector in this region. These initiatives have provided financial support, training, and technological advancements, encouraging more participation in the industry. Also, with abundant rivers and ponds, the North East Region is naturally suited for aquaculture, making it easier to undertake fish farming on different scales.

On the contrary, Uttar Pradesh has seen significant investment in modern aquaculture techniques. These include cage culture, biofloc technology, and integrated multi-trophic aquaculture, enhancing productivity. Also, its location provides good connectivity to major markets. This logistical advantage reduces transportation costs and makes market access easier.

Competitive Landscape:

The key players in the market are managing ponds and tanks, monitoring water quality, and employing sustainable farming practices to ensure optimal growth and health of aquatic organisms. Along with this, companies are investing in research and development to improve breeding techniques, develop disease-resistant strains, and enhance the overall productivity and sustainability of aquaculture operations. Therefore, this is positively influencing the market. In addition, several aquaculture companies in India are engaging in exporting seafood products to international markets. They comply with international quality standards, certifications, and regulations to ensure smooth trade and access to global markets, catalyzing market demand. Apart from this, several aquaculture companies in India are increasingly adopting sustainable practices to minimize environmental impacts, promote responsible aquaculture, and gain a competitive edge in the global market. Furthermore, technological advancements in aquaculture, such as automated feeding systems, IoT-based monitoring, and data analytics to optimize production efficiency and reduce operational costs are contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the India aquaculture market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Nekkanti Seafoods

- Avanti Frozen Foods Private Limited (AVANTI FEEDS LIMITED)

- Devi Sea Foods Limited

- Sandhya Marines

- Apex Frozen Foods Limited

- IFB Agro Industries Limited

- SSF Limited

- Kings Infra Ventures Limited

- The Waterbase Limited

- Kader Exports Private Limited

- Zeal Aqua Limited

- CP Aquaculture (India) Private Limited (Charoen Pokphand Foods Public Limited Company

- Coastal Corporation Limited

- Uniroyal Marine Exports Limited

- BKV Industries Limited

- Abad Fisheries Private Limited

- Ananda Aqua Exports Private Limited

- Anjaneya Sea Foods

- August Seafood

- Baby Marine Ventures

- BMR Group

- Devi Marine Foods Exports Private Limited

- Falcon Marine Exports Ltd

- Frontline Exports Private Limited

- Geo Seafoods

- Jayalakshmi Sea Foods Pvt. Ltd.

- JRJ Sea Foods India Private Limited

- Jude Foods India Private Limited

- K V Marine Exports

- Kadalkanny Frozen Foods

- Liberty Frozen Foods Private Limited

- Liberty Group of Seafood Companies

Key Questions Answered in This Report:

- How has the India aquaculture market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India aquaculture market?

- What is the impact of each driver, restraint, and opportunity on the India aquaculture market?

- What is the breakup of the India shrimp market based on the environment?

- Which is the most attractive environment in the India shrimp market?

- What is the breakup of the India shrimp market based on the species?

- Which is the most attractive species in the India shrimp market?

- What is the breakup of the India shrimp market based on the shrimp size?

- Which is the most attractive shrimp size in the India shrimp market?

- What is the breakup of the India shrimp market based on the end use?

- Which is the most attractive end use in the India shrimp market?

- What is the breakup of the India shrimp market based on the end form?

- Which is the most attractive end form in the India shrimp market?

- What is the breakup of the India inland fish market based on the environment?

- Which is the most attractive environment in the India inland fish market?

- What is the breakup of the India inland fish market based on the species?

- Which is the most attractive species in the India inland fish market?

- What is the breakup of the market based on imports and domestic manufacturing?

- What is the competitive structure of the India aquaculture market?

- Who are the key players/companies in the India aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aquaculture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)