India Aquafeed Market Size, Share, Trends and Forecast by Species, Ingredients, Additives, Product Form, and Region, 2025-2033

Market Overview:

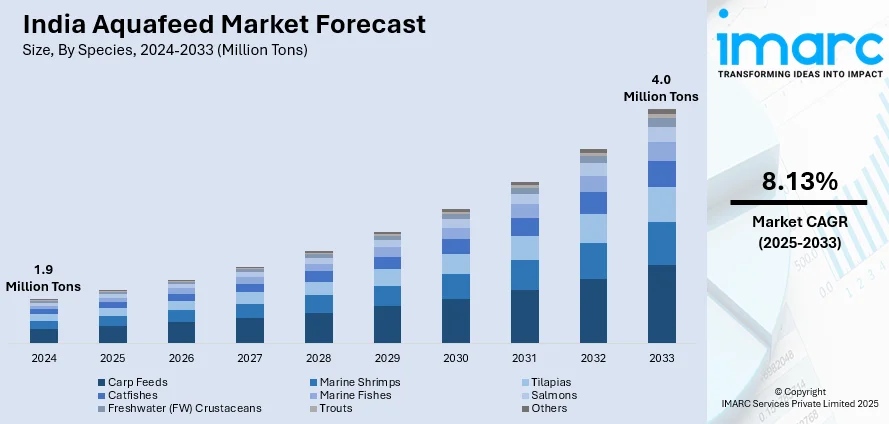

The India aquafeed market size reached 1.9 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 4.0 Million Tons by 2033, exhibiting a growth rate (CAGR) of 8.13% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1.9 Million Tons |

|

Market Forecast in 2033

|

4.0 Million Tons |

| Market Growth Rate 2025-2033 | 8.13% |

India represents one of the leading aquaculture markets across the globe on account of the rich biodiversity of aquatic species. Consequently, there is a high demand for aquafeed in the country to meet the growing need of aquaculture farmers and the expanding export businesses.

To get more information of this market, Request Sample

With increasing disposable incomes, growing health consciousness and improving cold chain facilities, seafood sales have expanded from local wet markets to organized retail channels, such as supermarkets. This represents one of the key factors fueling the growth of the aquafeed market in India. Moreover, the growing trend of natural and organic feeds has prompted manufacturers to incorporate high-quality raw materials that offer functional advantages and lower the usage of synthetic components. They are also enhancing the stability of feed pellets, reducing fine proportion, and improving pellets density and extension. Another major factor driving the industry growth is t significant shift from homemade feed to commercially available product variants. Along with enhancing the bioavailability of various nutrients, the commercial feed also helps in reducing environmental pollution and increasing profit margins. Furthermore, the Government of India is offering various subsidies for fish and shrimp farmers, which in turn is stimulating the growth of the aquafeed industry.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India aquafeed market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on species, ingredients, additives and product form.

Breakup by Species:

- Carp Feeds

- Marine Shrimps

- Tilapias

- Catfishes

- Marine Fishes

- Salmons

- Freshwater (FW) Crustaceans

- Trouts

- Others

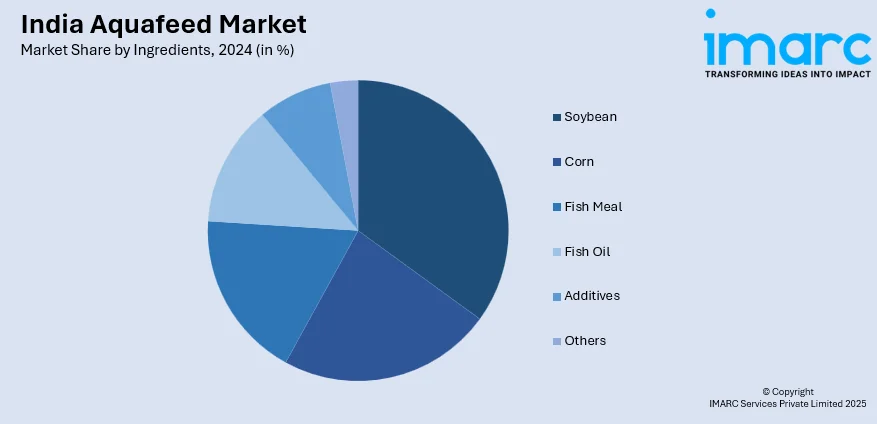

Breakup by Ingredients:

- Soybean

- Corn

- Fish Meal

- Fish Oil

- Additives

- Others

Breakup by Additives:

- Vitamins and Minerals

- Antioxidants

- Feed Enzymes

- Others

Breakup by Product Form:

- Pellets

- Extruded

- Powdered

- Liquid

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the India aquafeed market with detailed profiles of all major companies, including:

- Avanti Feeds Limited

- Godrej Agrovet Limited

- Growel Feeds Pvt. Ltd

- Happy Feeds

- IB Group

- IFB Agro Industries Limited

- Skretting India

- Sreema’s Feeds

- UNO Feeds

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | Species, Ingredients, Additives, Product Form, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Avanti Feeds Limited, Godrej Agrovet Limited, Growel Feeds Pvt. Ltd, Happy Feeds, IB Group, IFB Agro Industries Limited, Skretting India, Sreema’s Feeds, UNO Feeds, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India aquafeed market reached a volume of 1.9 Million Tons in 2024.

We expect the India aquafeed market to exhibit a CAGR of 8.13% during 2025-2033.

The growing consumer inclination towards incorporating seafood, such as tuna, crab, shrimp, etc., in their daily diet, along with the widespread adoption of natural resources and sustainable raw materials by leading manufacturers to produce aquafeed, is primarily driving the India aquafeed market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in various aquaculture activities and restrictions on the export and import of seafood.

Based on the species, the India aquafeed market can be segregated into carp feeds, marine shrimps, tilapias, catfishes, marine fishes, salmons, Freshwater (FW) crustaceans, trouts, and others. Currently, carp feeds hold the majority of the total market share.

Based on the ingredients, the India aquafeed market has been bifurcated into soybean, corn, fish meal, fish oil, additives, and others. Among these, soybean currently exhibits a clear dominance in the market.

Based on the product form, the India aquafeed market can be categorized into pellets, extruded, powdered, and liquid. Currently, pellets account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where South India currently dominates the India aquafeed market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)