India Artisanal Bread Market Size, Share, Trends and Forecast by Type, Ingredients, Distribution Channel, and Region, 2026-2034

India Artisanal Bread Market Size and Share:

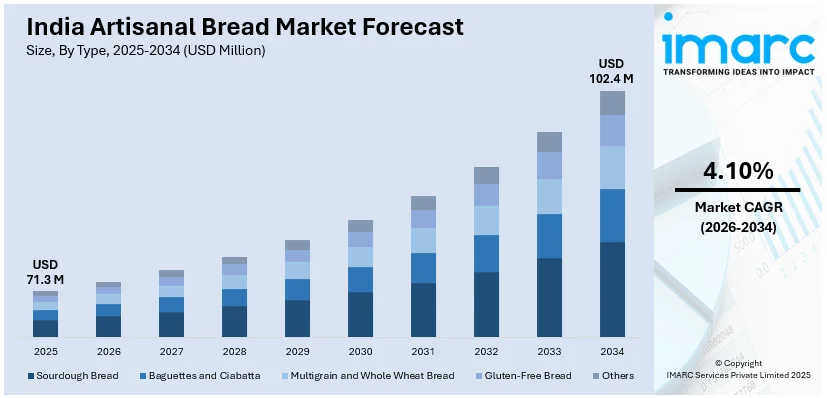

The India artisanal bread market size reached USD 71.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 102.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.10% during 2026-2034. The growing health consciousness is fueling demand for organic, multigrain, and sourdough breads. Urbanization, rising disposable incomes, and exposure to global food trends are enhancing premium artisanal purchases. The expansion of specialty bakeries and online delivery platforms enhances accessibility. Additionally, clean-label preferences and sustainable practices are further expanding the India artisanal bread market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 71.3 Million |

| Market Forecast in 2034 | USD 102.4 Million |

| Market Growth Rate 2026-2034 | 4.10% |

India Artisanal Bread Market Trends:

Rising Demand for Health-Conscious and Organic Artisanal Breads

The increasing health awareness among consumers is significantly supporting the India artisanal bread market growth. According to an industry report, organic exports from India are expected to reach INR 20,000 Crore (approximately USD 2,500 Million) by 2028 as against the current levels of INR 5,000-6,000 Crore (approximately USD 625 Million 750 Million), a 3 to 3.5 fold jump. The country is a global leader in organic farming, with over 1.7 Million Hectares of organic-certified land and 1.4 Million organic farmers. Among the major export items are organic cereals, pulses, oilseed, spices, tree species, tea, and coffee, and they are in demand in these markets, including the USA, EU, and Japan. Urban populations, especially millennials and Gen Z, are shifting away from mass-produced white bread due to concerns over preservatives, refined flour, and artificial additives. Instead, they are opting for artisanal bread made with whole grains, multi-grains, sourdough, and organic ingredients. Bakeries and specialty stores are responding by introducing gluten-free, high-fiber, and protein-enriched variants to cater to dietary preferences, including keto, vegan, and diabetic-friendly diets. Additionally, the influence of global food trends and exposure to international cuisines is popularizing sourdough, rye, and sprouted grain breads. Social media and food blogs are further amplifying this trend, encouraging consumers to explore premium, nutrient-dense artisanal breads. As a result, bakeries are emphasizing clean-label products, transparency in sourcing, and sustainable practices to attract health-conscious buyers.

To get more information on this market Request Sample

Growth of Specialty Bakeries and Online Artisanal Bread Sales

The expansion of specialty bakeries and online delivery platforms is creating a positive India artisanal bread market outlook. According to industry reports, India's online food delivery industry is set to surpass USD 15 Billion (over Rs 1.24 lakh crore) by March 2029, with the demand for 10-minute delivery options, especially those offered by Zomato, Swiggy, and Zepto. As Zepto Cafe alone manages an impressive 30,000 orders daily, the quick-commerce sector is expanding rapidly. However, concerns about food quality continue to emerge, creating space for premium products to gain traction. This swift expansion offers a significant opportunity for artisanal bread producers to cater to the increasing demand for fresh, high-quality items within the quick-commerce market. Independent bakeries, café chains, and gourmet stores are gaining popularity by offering handcrafted, fresh, and unique bread varieties such as focaccia, ciabatta, and brioche. These establishments focus on quality, authenticity, and artisanal techniques, appealing to consumers seeking premium and exotic flavors. Simultaneously, e-commerce and direct-to-consumer (D2C) models are improving accessibility, allowing artisanal bakeries to reach a wider audience through online marketplaces, subscription services, and Instagram-based sales. The convenience of doorstep delivery, coupled with the rising trend of home baking during and post-pandemic, has further fueled demand. Cloud kitchens and hybrid bakery models are also emerging, combining offline experiences with digital ordering. As disposable incomes rise and consumers prioritize gourmet experiences, the artisanal bread segment is set to grow, supported by innovation in flavors, packaging, and distribution channels.

India Artisanal Bread Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, ingredients, and distribution channel.

Type Insights:

- Sourdough Bread

- Baguettes and Ciabatta

- Multigrain and Whole Wheat Bread

- Gluten-Free Bread

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sourdough bread, baguettes and ciabatta, multigrain and whole wheat bread, gluten-free bread, and others.

Ingredients Insights:

- Organic Flour-Based Breads

- Grain and Seed Mix Breads

- Dairy-Free and Vegan Options

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes organic flour-based breads, grain and seed mix breads, and dairy-free and vegan options.

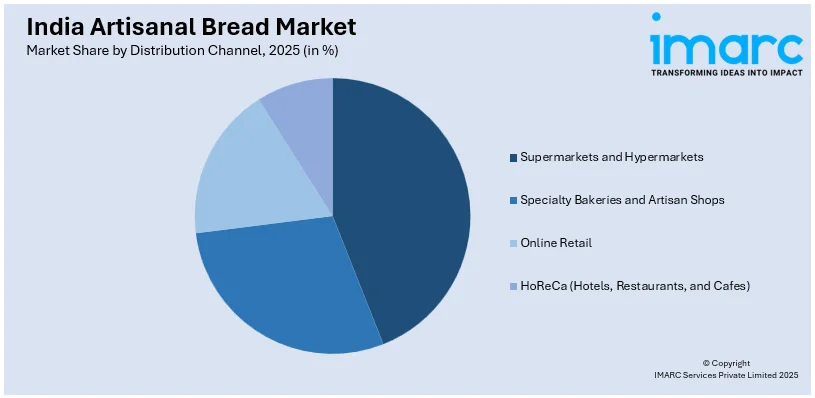

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Bakeries and Artisan Shops

- Online Retail

- HoReCa (Hotels, Restaurants, and Cafes)

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty bakeries and artisan shops, online retail, and HoReCa (hotels, restaurants, and cafes).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Artisanal Bread Market News:

- January 07, 2025: Baker's Loaf launched its premium range of artisanal bread in the Delhi NCR region, setting a benchmark for craftsmanship in the Indian bakery space. Highlighting the use of quality ingredients and traditional baking methods, the brand aims to redefine the country’s bread-making landscape. Baker's Loaf is forging new ground in the dynamic Indian bakery sector with the crunch, crackle, and pop of artisanal bread.

India Artisanal Bread Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sourdough Bread, Baguettes and Ciabatta, Multigrain and Whole Wheat Bread, Gluten-Free Bread, Others |

| Ingredients Covered | Organic Flour-Based Breads, Grain and Seed Mix Breads, Dairy-Free and Vegan Options |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Bakeries and Artisan Shops, Online Retail, HoReCa (Hotels, Restaurants, and Cafes) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India artisanal bread market performed so far and how will it perform in the coming years?

- What is the breakup of the India artisanal bread market on the basis of type?

- What is the breakup of the India artisanal bread market on the basis of ingredients?

- What is the breakup of the India artisanal bread market on the basis of distribution channel?

- What is the breakup of the India artisanal bread market on the basis of region?

- What are the various stages in the value chain of the India artisanal bread market?

- What are the key driving factors and challenges in the India artisanal bread market?

- What is the structure of the India artisanal bread market and who are the key players?

- What is the degree of competition in the India artisanal bread market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India artisanal bread market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India artisanal bread market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India artisanal bread industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)