India Artisanal Dairy Products Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, End User, and Region, 2025-2033

India Artisanal Dairy Products Market Overview:

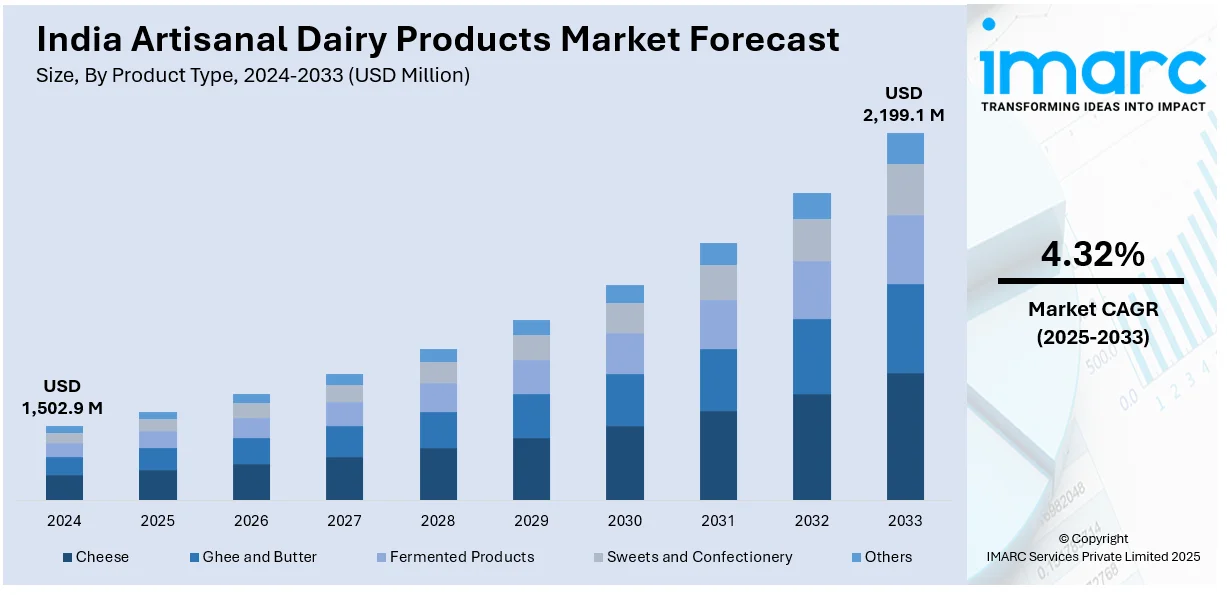

The India artisanal dairy products market size reached USD 1,502.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,199.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The growing health consciousness and demand for organic, chemical-free dairy products are key market drivers. Rising disposable incomes, premiumization trends, and innovative flavors attract urban consumers. Government support for organic farming and e-commerce expansion is further augmenting the India artisanal dairy products market share. Additionally, a shift toward traditional, sustainable, and functional dairy products fuels market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,502.9 Million |

| Market Forecast in 2033 | USD 2,199.1 Million |

| Market Growth Rate 2025-2033 | 4.32% |

India Artisanal Dairy Products Market Trends:

Rising Demand for Organic and Natural Artisanal Dairy Products

The rise in demand for organic and natural products, driven by increasing health consciousness among consumers is favoring the India artisanal dairy products market growth. According to the IMARC Group report, India's organic food market is expected to exhibit a CAGR of 25.25% during 2022-2027. This shift in preferences is significantly benefiting the artisanal dairy products market in India, where traditionally made, small-batch dairy items like organic ghee, handcrafted cheese, and A2 milk are gaining popularity. With increasing awareness of the side effects of processed foods and synthetic additives, consumers are turning to traditionally produced dairy products like ghee, organic paneer, and yogurt. Such products are viewed as healthy because they are free from chemicals and richer in nutrients. Local brands and small-scale dairy farmers are taking advantage of this trend by marketing heritage practices, like hand-churned butter and slow-fermented curd, which resonate with urban consumers' quest for authenticity. Also, the enforcement of government programs like the National Programme for Organic Production (NPOP) and private certifications are driving consumer confidence. Specialty stores and online platforms are further making these high-end products mainstream. Consequently, organic artisanal dairy is evolving from being a niche category to becoming a significant segment in India's dairy sector.

To get more information on this market, Request Sample

Premiumization and Innovation in Flavored Artisanal Dairy Products

The premiumization of flavored and fortified products, catering to changing consumer tastes, is creating a positive India artisanal dairy products market outlook. Artisans and boutique dairy brands are experimenting with unique flavors, such as saffron-infused milk, Himalayan honey yogurt, and spiced buttermilk, to differentiate their offerings. This innovation aligns with the rising preference for gourmet and functional dairy products among urban millennials and Gen Z consumers. Additionally, value-added items, including probiotic-rich artisanal cheese and lactose-free dairy alternatives, are gaining traction due to their digestive health benefits. Social media and food influencers play a crucial role in popularizing these niche products, creating a culture of experiential consumption. According to an industry report on April 21, 2024, the Indian cheesemakers are moving beyond traditional European varieties like Gouda and cheddar to create distinct regional cheeses using local ingredients and techniques. One of the many European-style cheeses that Indian cheesemakers have given a distinctively Indian personality is Konark, which was introduced in July 2023. Its name comes from the chariot wheel at the Konark temple in Odisha, which is reminiscent of the ring-shaped cheese wheel. Other cheesemakers across India are incorporating native spices and fermentation methods to craft unique cheeses that reflect the country's diverse food culture. Furthermore, sustainable and aesthetically appealing packaging enhances brand appeal, attracting eco-conscious buyers. As disposable incomes rise and culinary trends diversify flavored and premium artisanal dairy products are expected to witness sustained growth, reshaping India's traditional dairy landscape.

India Artisanal Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, raw material, distribution channel, and end user.

Product Type Insights:

- Cheese

- Ghee and Butter

- Fermented Products

- Sweets and Confectionery

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cheese, ghee and butter, fermented products, sweets and confectionery, and others.

Raw Material Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Mixed-Milk Products

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes cow milk, buffalo milk, goat milk, and mixed-milk products.

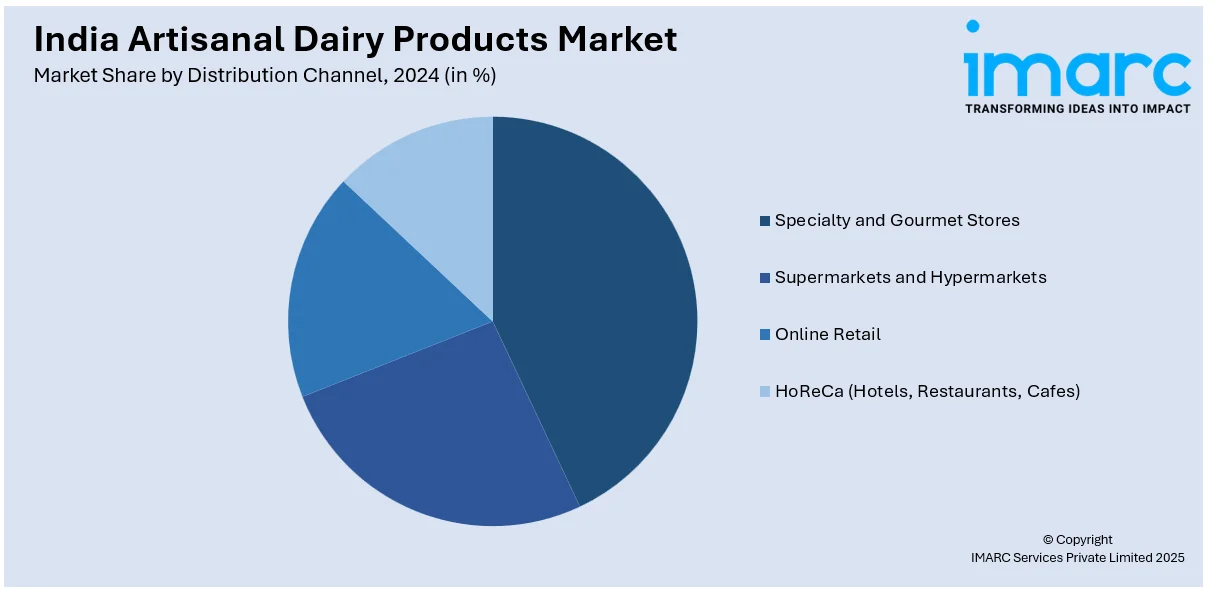

Distribution Channel Insights:

- Specialty and Gourmet Stores

- Supermarkets and Hypermarkets

- Online Retail

- HoReCa (Hotels, Restaurants, Cafes)

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and gourmet stores, supermarkets and hypermarkets, online retail, and HoReCa (hotels, restaurants, cafes).

End User Insights:

- Household Consumers

- Institutional Buyers

- Food Service Industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes household consumers, institutional buyers, and food service industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Artisanal Dairy Products Market News:

- On February 25, 2025, Panchal Dairy, founded in a small Gujarat village, impressed the Shark Tank India judges with its artisanal goat and sheep milk cheeses. The brand, which has gained international recognition at the World Cheese Conclave, sought an INR 20 Lakh (about USD 23,397) investment for 10% equity to expand operations. Anupam Mittal praised their efforts, highlighting the achievement of creating premium cheese in a rural setting.

India Artisanal Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cheese, Ghee and Butter, Fermented Products, Sweets and Confectionery, Others |

| Raw Materials Covered | Cow Milk, Buffalo Milk, Goat Milk, Mixed-Milk Products |

| Distribution Channels Covered | Specialty and Gourmet Stores, Supermarkets and Hypermarkets, Online Retail, HoReCa (Hotels, Restaurants, Cafes) |

| End Users Covered | Household Consumers, Institutional Buyers, Food Service Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India artisanal dairy products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India artisanal dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India artisanal dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The artisanal dairy products market in India was valued at USD 1,502.9 Million in 2024.

The India artisanal dairy products market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 2,199.1 Million by 2033.

The India artisanal dairy products market is fueled by rising consumer preference for natural, minimally processed foods, growing health and wellness awareness, and demand for premium, locally sourced products. Expanding urban incomes, evolving tastes for specialty cheeses and yogurts, and strong support for traditional, small-scale dairies further stimulate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)