India Asphalt Pavers Market Size, Share, Trends and Forecast by Type, Paving Range, and Region, 2026-2034

India Asphalt Pavers Market Overview:

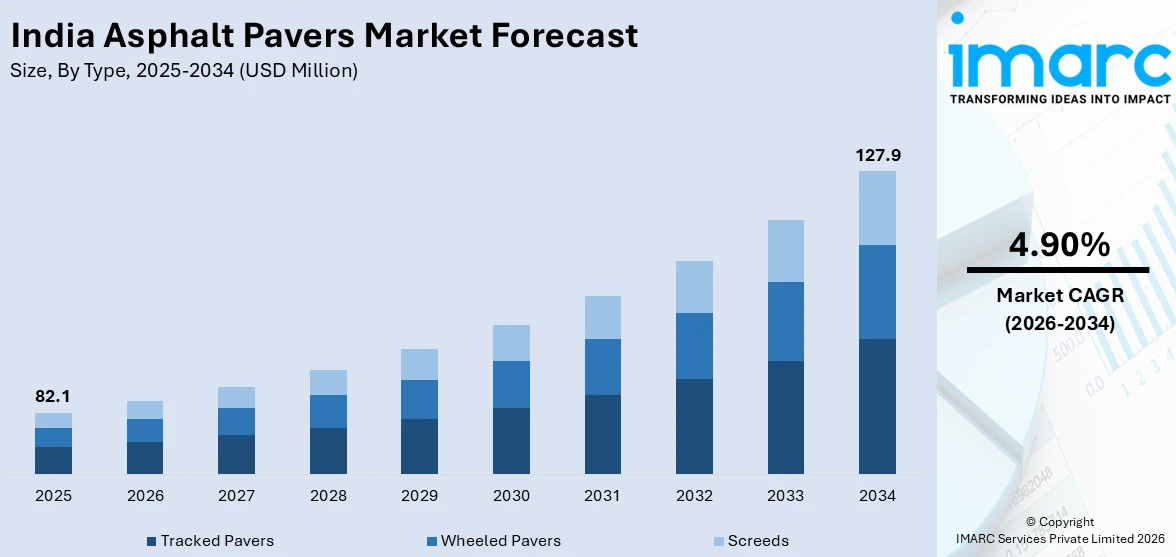

The India asphalt pavers market size reached USD 82.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 127.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.90% during 2026-2034. The increasing infrastructure development, government investments in road construction projects, rising demand for efficient paving equipment, expansion of smart cities, advancements in paving technology, the need for durable, high-performance roads to support urbanization, and improved transportation networks are some of the key factors positively impacting India asphalt pavers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 82.1 Million |

| Market Forecast in 2034 | USD 127.9 Million |

| Market Growth Rate (2026-2034) | 4.90% |

India Asphalt Pavers Market Trends:

Growing Applications of Automated and Sensor-Based Asphalt Pavers

The increased adoption of sensor-based and automated pavers due to their efficiency, accuracy, and cost-effectiveness in road construction is propelling India asphalt pavers market growth. Companies are integrating smart paving systems with sensors to monitor mat thickness, temperature, and paving speed for consistent quality output and reducing material wastage. Also, stringent government regulations on-road performance and ride quality are pushing builders to invest in high-tech equipment with grade control systems and automated screed leveling. The advancements in technologies minimize human involvement, increasing precision in asphalt laying and reducing fatigue levels of operators. On June 9, 2024, KDI Technology launched the HSP-2545 Hydrostatic Sensor Paver Finisher, utilized for effective paving of asphalt up to 4.5 meters in width. The advanced technology device comes with a 133 HP motor, hydrostatic transmission, and MOBA (Germany) sensors, providing highly accurate automatic operation based on the slope and level of the road. The HSP-2545 focuses on easy-to-operate controls, heavy-duty technology, and increased productivity, achieving up to standards for superior quality road construction output. These advancements align with India’s infrastructure modernization goals, boosting demand for technologically advanced asphalt pavers.

To get more information on this market Request Sample

Enhanced Road Infrastructure and Smart City Plans

Increasing investments in road infrastructure and smart city projects driven by urbanization and government initiatives are positively impacting the India asphalt pavers market outlook. According to India Brand Equity Foundation, In India, there were 826 public-private partnership (PPP) road projects out of 1,883 total projects as of July 2024. Eight national high-speed corridor projects, totaling 936 kilometers of highway development at a cost of INR 50,655 Crore (USD 6.09 Billion), were approved by the Union government in a major attempt to improve infrastructure. Large-scale infrastructure projects, such as expressways, highways, and urban roads, are leading to a higher requirement for advanced paving equipment to ensure high-quality and durable output. The National Infrastructure Pipeline (NIP) and the Gati Shakti initiatives speed up road construction and provide massive budget allocations, triggering global equipment manufacturers to launch high-performance asphalt pavers. Smart city projects are also propelling the demand for machines capable of providing high-precision paving for roads with smart transport integration, thereby facilitating the market growth.

India Asphalt Pavers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and paving range.

Type Insights:

- Tracked Pavers

- Wheeled Pavers

- Screeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes tracked pavers, wheeled pavers, and screeds.

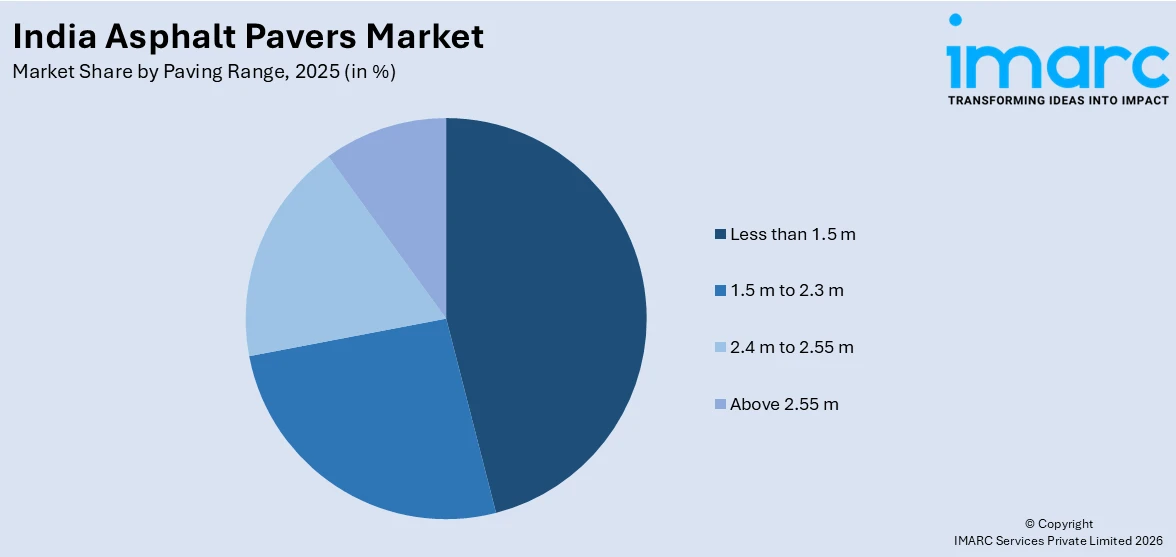

Paving Range Insights:

Access the comprehensive market breakdown Request Sample

- Less than 1.5 m

- 1.5 m to 2.3 m

- 2.4 m to 2.55 m

- Above 2.55 m

A detailed breakup and analysis of the market based on the paving range have also been provided in the report. This includes less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, and above 2.55 m.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Asphalt Pavers Market News:

- On June 26, 2024, Joseph Vögele AG introduced two new Universal Class pavers to the Indian market: the SUPER 1900-3 G-Tier and the advanced SUPER 1900-3 P-Tier. Both models are equipped with powerful, low-emission engines compliant with CEV Stage V standards and are designed for versatile applications. They feature a laydown rate of up to 1,000 t/h, with rugged material handling components that enable efficient and high-quality paving of asphalt mixes and abrasive materials such as cement-treated base (CTB).

- On February 7, 2025, Ammann introduced the ABG 5420 Paver, a midsize machine designed for both the Indian and export markets, offering the sophistication of larger highway-class pavers. Equipped with a 101-kW Eicher CEV Stage V engine for India and a 96-kW Stage T3 Deutz engine for exports, the paver delivers high efficiency, traction, and stability, with a theoretical output of 600 tonnes per hour. Key features include a 12-tonne hopper, Eco Mode for up to 30% fuel savings, ultrasonic auger control, and an operator-centric design that enhances comfort, productivity, and safety.

India Asphalt Pavers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tracked Pavers, Wheeled Pavers, Screeds |

| Paving Ranges Covered | Less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, Above 2.55 m |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India asphalt pavers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India asphalt pavers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India asphalt pavers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The asphalt pavers market in India was valued at USD 82.1 Million in 2025.

The India asphalt pavers market is projected to exhibit a CAGR of 4.90% during 2026-2034, reaching a value of USD 127.9 Million by 2034.

Key factors driving the India asphalt pavers market include rapid infrastructure development, increased demand for road construction, government initiatives such as the Bharatmala Pariyojana, and the expansion of national highways. Additionally, technological advancements in paver machines and increased private sector investments in infrastructure contribute significantly to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)