India Assistive Technology Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India Assistive Technology Market Size and Share:

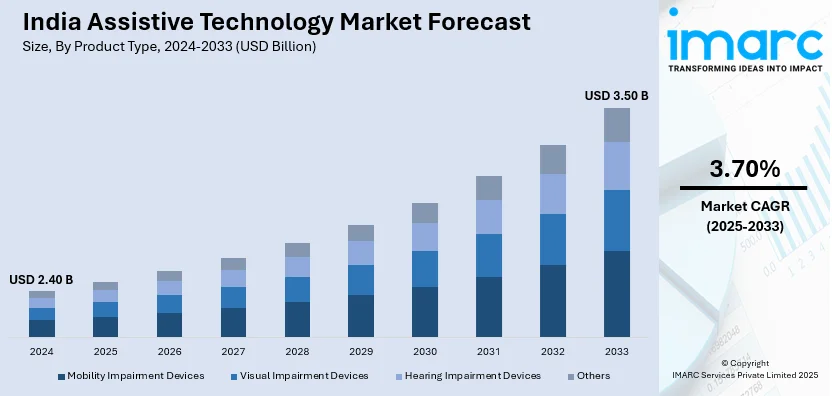

The India assistive technology market size reached USD 2.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.50 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. Government initiatives, demographic shifts, increased healthcare access, technological advancements, rising disability awareness, supportive policies, growing startup ecosystems, foreign investments, demand for elderly care solutions, and affordability improvements are key factors propelling India's assistive technology market, fostering innovation, accessibility, and widespread adoption across urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.40 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

India Assistive Technology Market Trends:

Government Initiatives and Policy Support

The Indian government has been at the forefront in promoting the development of the assistive technology industry through a set of initiatives and policy interventions. Realizing the potential of assistive tools and technologies in bringing healthcare facilities to the mainstream and making them inclusive and accessible, the Department of Science and Technology (DST) has facilitated the creation of cost-effective assistive tools that can be suited to the Indian context. These initiatives seek to enhance the convenience of living for disabled and elderly groups, especially in countering the effects of issues such as COVID-19. Besides, the Department of Pharmaceuticals has played a crucial role in developing the medical devices sector, including assistive technologies. The "Boosting the Indian Medical Devices Industry" report identifies measures to improve manufacturing capabilities, simplify regulatory procedures, and encourage research and development in the medical devices industry. In addition, the National Institution for Transforming India (NITI Aayog) has held discussions with the intention of opening up opportunities in the assistive devices sector. The areas under discussion include regulatory governance, building capacity, encouraging private investment, and creating collaborations between government institutions, private enterprises, innovation centers, and non-governmental organizations. All this collaboration is aimed at revolutionizing the existing state of affairs of assistive technology in India.

To get more information on this market, Request Sample

Demographic Trends and Healthcare Needs

India's population is changing significantly, and there is a greater need for assistive technologies. According to the World Bank, in 2023, approximately 6.92% of India's population was aged 65 and above. This reflects the greater need for healthcare services and medical devices geared toward the elderly. Moreover, the total population growth of the country also fuels this demand. The population of India was approximately 1.46 billion as of March 2025 according to Worldometer’s. With an escalating population, more healthcare facilities are needed, thus creating the demand for medical equipment, including assistive devices. In addition, as life expectancy enhances with improved healthcare and living conditions, more of the population will need assistive solutions to ensure mobility, communication, and independence. Urbanization and the surge in number of nuclear families have also raised the demand for assistive devices, as older people tend to use technology for everyday tasks. Also, government initiatives like the Assistance to Disabled Persons for Purchase/Fitting of Aids and Appliances (ADIP) scheme contribute to the embracement of assistive technologies. These currents, combined with expanding disposable incomes and awareness, are fueling remarkable development and availability in India's assistive technology space.

India Assistive Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type,and end user.

Product Type Insights:

- Mobility Impairment Devices

- Visual Impairment Devices

- Hearing Impairment Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mobility impairment devices, visual impairment devices, hearing impairment devices, and others.

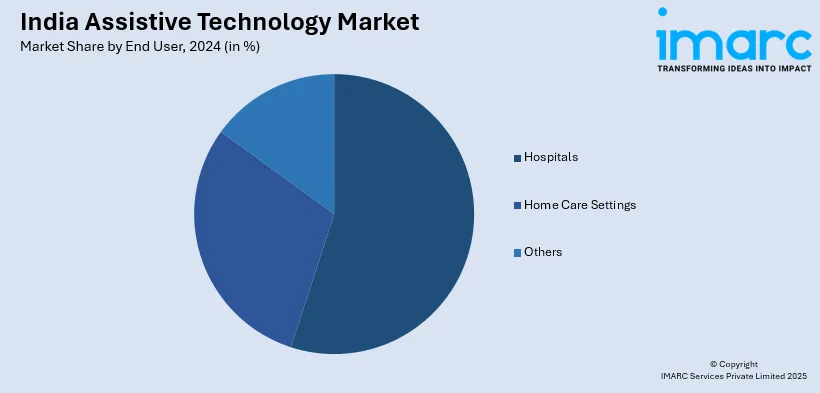

End User Insights:

- Hospitals

- Home Care Settings

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, home care settings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Assistive Technology Market News:

- March 2025: AssisTech Foundation was awarded the Indian Innovation Icons Award by Marico Innovation Foundation in 2025 for incubating innovative disability technology startups. The award reflects the increasing relevance of assistive technologies in India and propels more innovation and investment in the sector. Such awards expand the recognizability of assistive tech initiatives, which drives the market further.

- July 2024: Attvaran, an Indian accelerator program, was established to fund startups building assistive technologies by providing mentorship, networking, and market connections. By building innovation and bridging entrepreneurs with industry players and investors, it is enhancing the assistive technology ecosystem.

India Assistive Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobility Impairment Devices, Visual Impairment Devices, Hearing Impairment Devices, Others |

| End Users Covered | Hospitals, Home Care Settings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India assistive technology market performed so far and how will it perform in the coming years?

- What is the breakup of the India assistive technology market on the basis of product type?

- What is the breakup of the India assistive technology market on the basis of end user?

- What are the various stages in the value chain of the India assistive technology market?

- What are the key driving factors and challenges in the India assistive technology market?

- What is the structure of the India assistive technology market and who are the key players?

- What is the degree of competition in the India assistive technology market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India assistive technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India assistive technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India assistive technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)