India Automotive Camera Market Size, Share, Trends and Forecast by Vehicle Type, Technology, Application, and Region, 2025-2033

India Automotive Camera Market Overview:

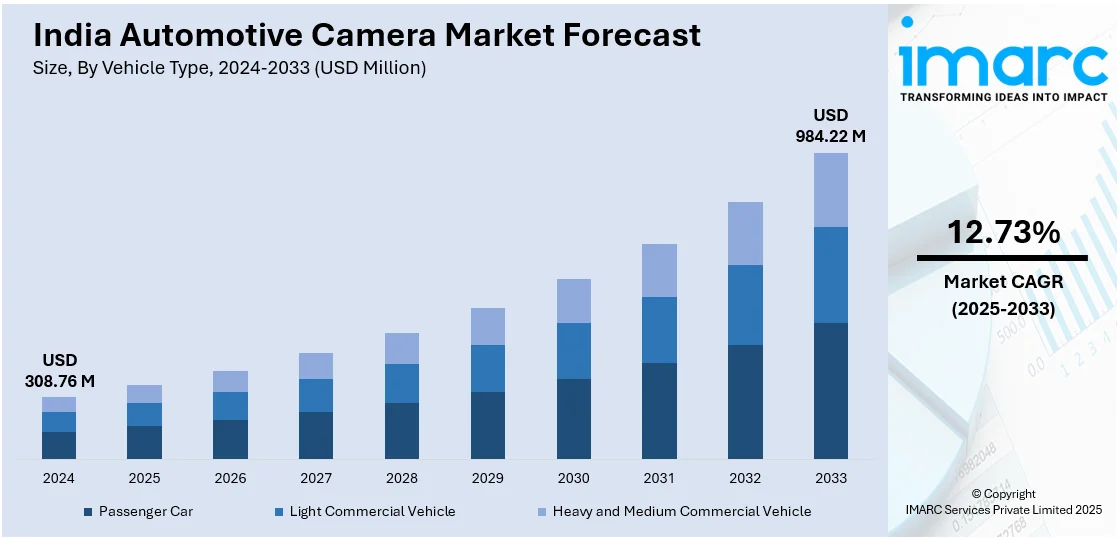

The India automotive camera market size reached USD 308.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 984.22 Million by 2033, exhibiting a growth rate (CAGR) of 12.73% during 2025-2033. The rising demand for advanced driver-assistance systems (ADAS), stricter safety regulations, increasing vehicle electrification, consumer preference for enhanced road safety, and the implementation of government mandates for rear-view cameras are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 308.76 Million |

| Market Forecast in 2033 | USD 984.22 Million |

| Market Growth Rate 2025-2033 | 12.73% |

India Automotive Camera Market Trends:

Growing Adoption of Advanced Driver-Assistance Systems (ADAS)

The growing emphasis on road safety and stringent government regulations are boosting ADAS adoption in India, consequently fueling the automotive camera market. As a vital element of ADAS, cameras support key safety functions like lane departure warning, blind-spot detection, and automatic emergency braking. In 2024, the Ministry of Road Transport and Highways (MoRTH) mandated rear-view cameras for all new passenger cars to enhance visibility and reduce accidents. While ADAS adoption has primarily been limited to premium and luxury vehicles, it is steadily expanding into mid-range cars. As of the 2023 model year, penetration rates for various ADAS features range between 22% and 94%. With India reporting over 150,000 road accident fatalities annually, both automakers and safety-conscious consumers are increasingly integrating camera-based ADAS to improve driving safety. This growing demand positions automotive cameras as a key technology in the country’s evolving vehicle safety landscape.

To get more information on this market, Request Sample

Expansion of Electric and Connected Vehicles

The rapid growth in sales of electric vehicles (EVs) and advancements in connected car technology are key drivers of automotive camera adoption in India. EVs, often equipped with advanced digital interfaces, depend on cameras for functions such as parking assistance, pedestrian detection, and driver monitoring. India is poised to become the largest EV market by 2030, with EVs accounting for over 50% of three-wheeler sales, approximately 5% of two-wheeler, and 2% of passenger cars purchased in 2024. As the market expands, major automakers are integrating high-tech safety features, including 360-degree cameras and night vision systems, to enhance driver and passenger safety. The rise of connected car technology, fueled by increased smartphone integration and 5G adoption, is also accelerating the deployment of AI-powered camera systems for real-time driver monitoring and adaptive cruise control. Additionally, declining costs driven by mass production and AI advancements are making automotive cameras more accessible, further boosting their adoption in India’s evolving automotive landscape.

India Automotive Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, technology, and application.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

- Heavy and Medium Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, light commercial vehicle, and heavy and medium commercial vehicle.

Technology Insights:

- Digital Camera

- Thermal Camera

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes digital camera and thermal camera.

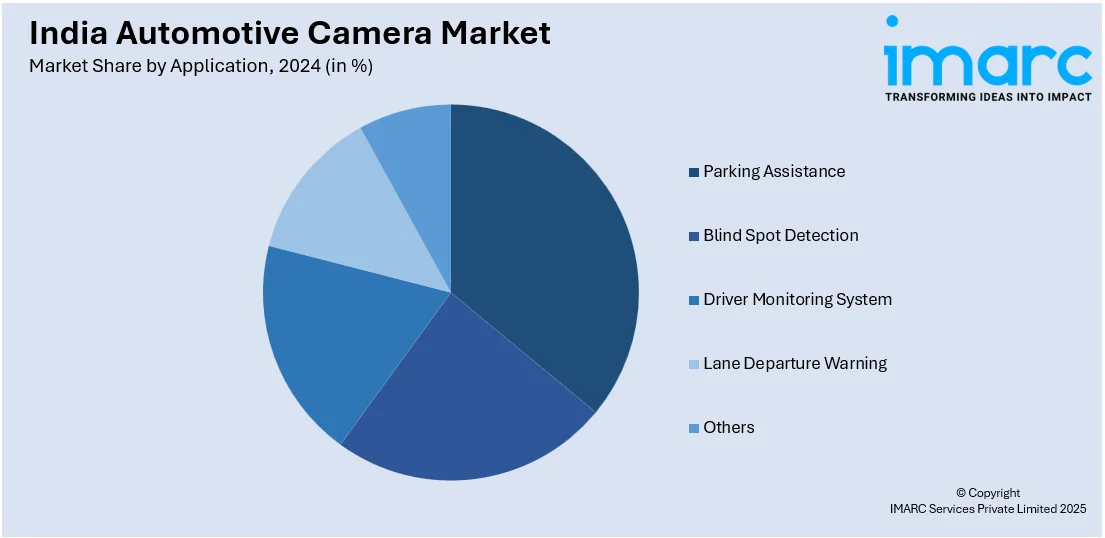

Application Insights:

- Parking Assistance

- Blind Spot Detection

- Driver Monitoring System

- Lane Departure Warning

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes parking assistance, blind spot detection, driver monitoring system, lane departure warning, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Camera Market News:

- August 2024: Pioneer India introduced a new range of AI-powered dashcams specifically designed for Indian driving conditions. The VREC Dash Camera series includes four models: VREC-H120SC, VREC-H320SC, VREC-H520DC, and VREC-Z820DC. These devices come equipped with advanced safety features such as AI Night Vision, ADAS Alerts, and Enhanced Parking Monitoring. They capture high-quality video footage, provide round-the-clock security, and give proof in the event of an accident or impact.

- August 2024: Boult introduced the CruiseCam X1 and X1 GPS dash cams for cars. These devices are engineered to provide high-quality video recording, enhanced safety features, and seamless connectivity for drivers.

India Automotive Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy and Medium Commercial Vehicle |

| Technologies Covered | Digital Camera, Thermal Camera |

| Applications Covered | Parking Assistance, Blind Spot Detection, Driver Monitoring System, Lane Departure Warning, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive camera market in India was valued at USD 308.76 Million in 2024.

The automotive camera market in India is projected to exhibit a CAGR of 12.73% during 2025-2033, reaching a value of USD 984.22 Million by 2033.

The market is driven by rising demand for enhanced vehicle safety, driver assistance features, and improved driving experiences. Increased adoption of technologies like parking assist, lane monitoring, and collision alerts, along with growing awareness, evolving regulations, and the shift toward connected and electric vehicles, are key growth factors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)