India Automotive Fuel Tank Market Size, Share, Trends and Forecast by Material Type, Capacity, Vehicle Type, Distribution Channel, and Region, 2025-2033

India Automotive Fuel Tank Market Overview:

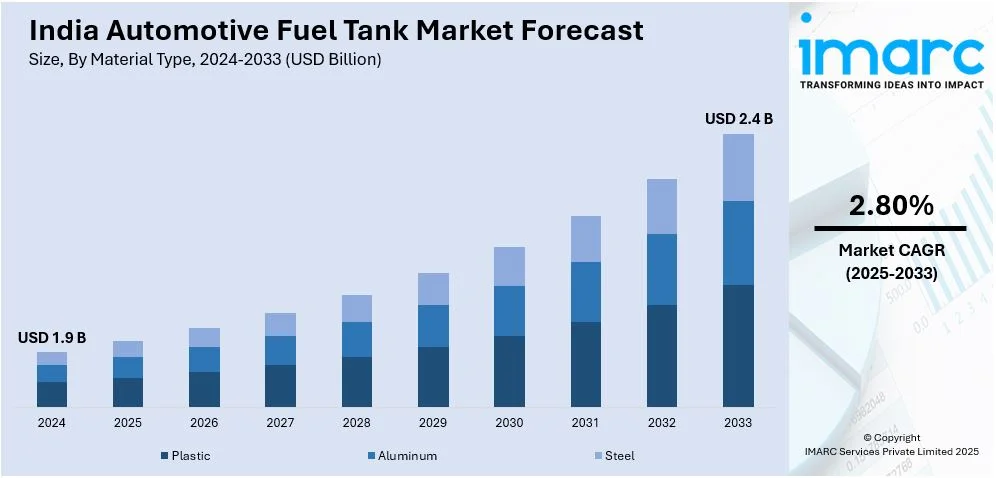

The India automotive fuel tank market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is driven by increasing vehicle production, stringent emission norms, and the demand for fuel-efficient vehicles. The adoption of lightweight materials, growth in electric and hybrid vehicles, and government policies promoting alternative fuels further expand the India automotive fuel tank market share. Rising consumer preference for durable and eco-friendly solutions also fuels expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 2.80% |

India Automotive Fuel Tank Market Trends:

Shift Towards Lightweight and Durable Materials

The significant shift towards the adoption of lightweight and durable materials, such as high-density polyethylene (HDPE) and advanced composites is majorly driving the India automotive fuel tank market growth. This trend is driven by the increasing demand for fuel-efficient vehicles and stringent government regulations aimed at reducing carbon emissions. Lightweight fuel tanks contribute to overall vehicle weight reduction, enhancing fuel efficiency and performance. Additionally, these materials offer superior resistance to corrosion, chemicals, and impact, ensuring longer product life and reduced maintenance costs. Automakers are increasingly partnering with material suppliers to develop innovative solutions that meet safety and environmental standards. As the automotive industry in India continues to change, the demand for advanced materials in fuel tank manufacturing is expected to grow, creating new opportunities for market players. The automotive industry in India produced 30.6 million vehicles in 2024, of which 4.27 million passenger cars, 0.95 million commercial vehicles, and 19.5 million two-wheelers were sold domestically. In December, it recorded production of 1.92 million units, reflecting strong market demand. The trend of expanding the automotive sector is seen as having a positive effect on the market, driven by increasing automotive production and the growth of electrification trends.

To get more information on this market, Request Sample

Rising Demand for Electric Vehicles and Alternative Fuel Systems

The growing focus on sustainability and environmental conservation is driving the demand for electric vehicles (EVs) and alternative fuel systems in India, creating a positive automotive fuel tank market outlook. As per a study, 40% of Indian consumers prefer hybrid vehicles over electric vehicles (EVs), while 85% are interested in premium models. This represents an important shift in consumer tastes when it comes to human locomotion. Currently, utility vehicles (UVs) and sport utility vehicles (SUVs) comprise 65% of total sales, potentially heralding the transition to sustainable alternatives, such as electric golf carts used in both urban and commercial settings. With electric vehicle infrastructure getting established, hybrid and alternative mobility solutions are gradually gaining traction in India. While traditional fuel tanks are essential for internal combustion engine (ICE) vehicles, the rise of EVs and hybrid vehicles is reshaping market dynamics. Manufacturers are now exploring dual-fuel systems and flexible fuel tanks that can accommodate alternative fuels including compressed natural gas (CNG) and liquefied petroleum gas (LPG). This trend is further supported by government incentives and policies promoting cleaner energy solutions. Although the transition to EVs may reduce the demand for conventional fuel tanks, the market is adapting by diversifying into hybrid and alternative fuel technologies. This shift highlights the industry's resilience and ability to innovate in response to changing consumer preferences and regulatory requirements.

India Automotive Fuel Tank Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material type, capacity, vehicle type, and distribution channel.

Material Type Insights:

- Plastic

- Aluminum

- Steel

The report has provided a detailed breakup and analysis of the market based on the material type. This includes plastic, aluminum, and steel.

Capacity Insights:

- Less Than 45 Liter

- 45 - 70 Liter

- Above 70 Liter

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes less than 45 liter, 45 - 70 liter, and above 70 liter.

Vehicle Type Insights:

- Passenger Vehicles

- LCVs

- HCVs

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, LCVs, and HCVs.

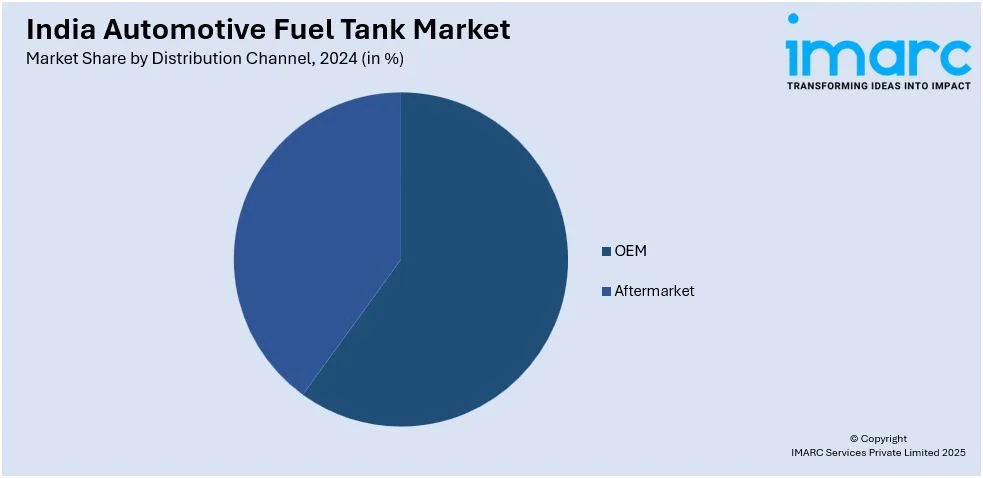

Distribution Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Fuel Tank Market News:

- February 24, 2025: INOX India's cryogenic fuel tanks became the first in the country to receive an IATF 16949 certification. It bolsters its already strong position in the Liquefied Natural Gas-powered automotive sector. Issued by Bureau Veritas, the certification recognizes INOX India's commitment to high-quality management standards and expertise in cryogenic technology. This will make it a key supplier for automotive OEMs in India and also widen its avenues in the global market.

- September 24, 2024: Tata Motors launched the Nexon iCNG in India with prices starting from INR 8.99 lakh (approximately USD 10,311.53). The SUV is the first of its kind; a turbocharged CNG SUV for the country featuring a 1.2L bi-fuel engine that delivers 100PS of power and 170Nm of torque. It features twin-cylinder technology, which accommodates a 60L CNG tank and provides 321L of boot space, making it a rival to the Maruti Suzuki Brezza S-CNG. The top-end variant of INR 14.59 lakh (approximately USD 16,744.10) also features leak detection and fire protection for safer operation.

India Automotive Fuel Tank Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Plastic, Aluminum, Steel |

| Capacities Covered | Less Than 45 Liter, 45 - 70 Liter, Above 70 Liter |

| Vehicle Types Covered | Passenger Vehicles, LCVs, HCVs |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive fuel tank market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive fuel tank market on the basis of material?

- What is the breakup of the India automotive fuel tank market on the basis of capacity?

- What is the breakup of the India automotive fuel tank market on the basis of vehicle type?

- What is the breakup of the India automotive fuel tank market on the basis of distribution channel?

- What is the breakup of the India automotive fuel tank market on the basis of region?

- What are the various stages in the value chain of the India automotive fuel tank market?

- What are the key driving factors and challenges in the India automotive fuel tank market?

- What is the structure of the India automotive fuel tank market and who are the key players?

- What is the degree of competition in the India automotive fuel tank market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive fuel tank market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive fuel tank market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive fuel tank industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)