India Automotive Paint Market Size, Share, Trends and Forecast by Application, Type, Vehicle Type, Finish Type, and Region, 2025-2033

India Automotive Paint Market Overview:

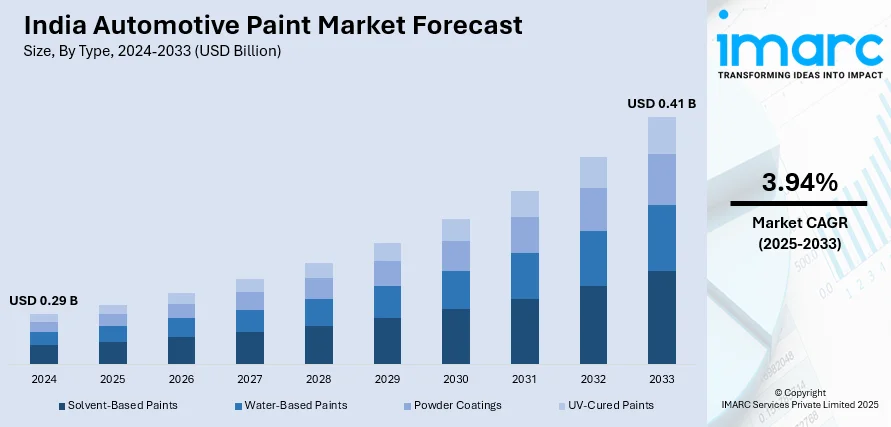

The India automotive paint market size reached USD 0.29 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.41 Billion by 2033, exhibiting a growth rate (CAGR) of 3.94% during 2025-2033. At present, with the increasing production of vehicles, catering to both local markets and export demands, the requirement for base coats, primers, topcoats, and clear coats is rising considerably. Besides this, the growing focus on vehicle maintenance and refurbishment is contributing to the expansion of the India automotive paint market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.29 Billion |

| Market Forecast in 2033 | USD 0.41 Billion |

| Market Growth Rate 2025-2033 | 3.94% |

India Automotive Paint Market Trends:

Increasing vehicle production and sales

Rising vehicle production and sales are fueling the market growth. As per the IBEF, in December 2024, the combined output of passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 19,21,268 units in India. As more vehicles are being manufactured each year, both for domestic use and export, the need for base coats, primers, topcoats, and clear coats is increasing significantly. Automotive paints not only enhance the visual appeal of vehicles but also provide essential protection against environmental damage, corrosion, and wear. With the growing competition among automakers, there is a higher focus on aesthetics and long-lasting finishes, which is encouraging innovations in the automotive paint segment. People are seeking cars with vibrant colors, customized finishes, and improved durability, motivating manufacturers to explore advanced paint technologies. Rapid urbanization activities are leading to higher vehicle ownership, especially in the two-wheeler and passenger car segments, further driving paint demand. Moreover, the expansion of retail channels is enhancing the accessibility of a wide assortment of automotive paint in the country. As India’s automotive sector is thriving with support from government initiatives and infrastructure development, the automotive paint market is experiencing steady expansion, driven by the need for performance and aesthetics in vehicle finishes.

To get more information on this market, Request Sample

Growing focus on vehicle maintenance and refurbishment

The increasing focus on vehicle maintenance and refurbishment is propelling the India automotive paint market growth. Regular maintenance helps preserve resale value and improves the visual appeal of both new and used cars, leading to a higher demand for repainting and touch-up solutions. Workshops and service centers are employing advanced paint technologies for catering to evolving customer expectations. Refurbishment activities are also expanding in the used vehicle market, where older vehicles are restored to like-new condition through repainting. According to the IMARC Group, the India used car market size was valued at USD 36.00 Billion in 2024. Fleet operators and commercial vehicle owners are investing in repainting to maintain brand image and vehicle condition. Paint manufacturers are responding by offering quick-drying, eco-friendly, and durable coatings that meet modern performance standards. Rising disposable income allows more vehicle owners to spend on cosmetic improvements, adding momentum to this market. As a result, the emphasis on maintenance and refurbishment is becoming a key growth driver for automotive paints in India.

India Automotive Paint Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application, type, vehicle type, and finish type.

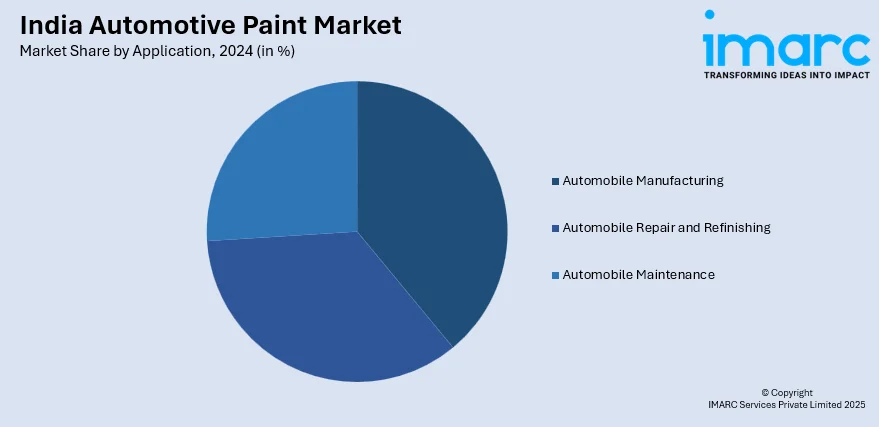

Application Insights:

- Automobile Manufacturing

- Automobile Repair and Refinishing

- Automobile Maintenance

The report has provided a detailed breakup and analysis of the market based on the application. This includes automobile manufacturing, automobile repair and refinishing, and automobile maintenance.

Type Insights:

- Solvent-Based Paints

- Water-Based Paints

- Powder Coatings

- UV-Cured Paints

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes solvent-based paints, water-based paints, powder coatings, and UV-cured paints.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Motorcycles

- Heavy-Duty Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, commercial vehicles, motorcycles, and heavy-duty vehicles.

Finish Type Insights:

- Matte Finish

- Gloss Finish

- Satin Finish

- Metallic Finish

A detailed breakup and analysis of the market based on the finish type have also been provided in the report. This includes matte finish, gloss finish, satin finish, and metallic finish.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Paint Market News:

- In April 2024, Nippon Paint, a prominent paint and coating firm, introduced a user-oriented automotive body and paint restoration service brand ‘Mastercraft’ in India. It was prepared to address the requirements of bringing vehicles back to their showroom splendor and creating tailored solutions. It provided a distinctive selection of paint and surface maintenance services.

- In April 2024, BASF's Coatings division revealed the enlargement of its e-coat production facility at the Mangalore location in India. E-coat, known as electrophoretic or cathodic dip coating, was designed to protect the surfaces, edges, and cavities of the car body from corrosion. Moreover, it eliminated the imperfections of pre-treated metal surfaces, establishing an excellent base for the application of the following paint layers.

India Automotive Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automobile Manufacturing, Automobile Repair and Refinishing, Automobile Maintenance |

| Types Covered | Solvent-Based Paints, Water-Based Paints, Powder Coatings, UV-Cured Paints |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Motorcycles, Heavy-Duty Vehicles |

| Finish Types Covered | Matte Finish, Gloss Finish, Satin Finish, Metallic Finish |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive paint market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive paint market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive paint industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive paint market in India was valued at USD 0.29 Billion in 2024.

The India automotive paint market is projected to exhibit a CAGR of 3.94% during 2025-2033, reaching a value of USD 0.41 Billion by 2033.

India automotive paint market is witnessing steady growth driven by expanding vehicle production and rising demand for aesthetic and protective coatings. Heightened focus on vehicle servicing, refurbishment, and customization is also fueling aftermarket paint consumption. Concurrently, technological innovations, such as eco-friendly waterborne and high-performance coatings, are further shaping industry evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)