India Automotive Smart Antenna Market Size, Share, Trends and Forecast by Technology, Propulsion, Sales Channel, Frequency, and Region, 2025-2033

India Automotive Smart Antenna Market Overview:

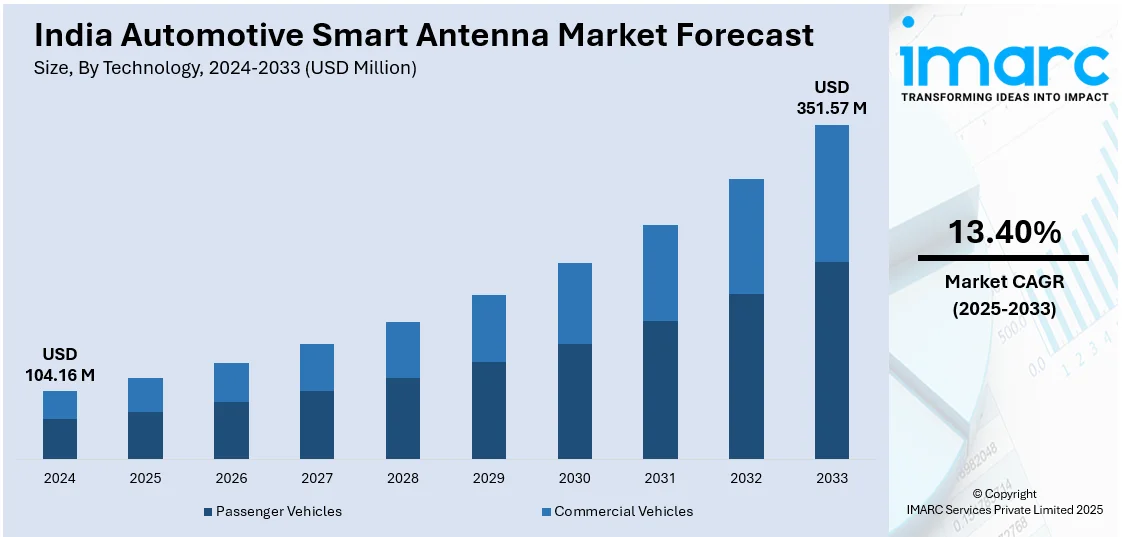

The India automotive smart antenna market size reached USD 104.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 351.57 Million by 2033, exhibiting a growth rate (CAGR) of 13.40% during 2025-2033. The market is driven by increasing vehicle connectivity, the rise of electric and autonomous vehicles, and the growing demand for advanced infotainment and telematics systems. Besides this, expanding 5G infrastructures, the implementation of stringent government regulations for vehicle safety, and the adoption of V2X (Vehicle-to-Everything) communication are also catalyzing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 104.16 Million |

| Market Forecast in 2033 | USD 351.57 Million |

| Market Growth Rate 2025-2033 | 13.40% |

India Automotive Smart Antenna Market Trends:

Expansion of Vehicle-to-Everything (V2X) Communication

The growing use of Vehicle-to-Everything (V2X) communication is a major driver of India's automotive smart antenna market, allowing for seamless connectivity between vehicles (V2V), infrastructure (V2I), pedestrians (V2P), and networks (V2N) to improve road safety and traffic efficiency. The Indian government's goal for linked mobility, notably through intelligent transportation systems (ITS) in smart cities, demands strong communication networks, which increases the demand for smart antennas. Furthermore, India's fast 5G rollout is expected to account for nearly 40% of mobile subscriptions in the country, reaching about 500 million users by 2027. This increase in connections will allow for high-speed, low-latency V2X applications in which smart antennas play an important role. Furthermore, as India moves towards Level 2 and Level 3 autonomous vehicles by 2025, V2X-enabled smart antennas will be essential for collision avoidance, real-time navigation, and automated traffic management, reinforcing their significance in the country’s evolving automotive ecosystem.

To get more information on this market, Request Sample

Rising Demand for Advanced Infotainment & Telematics Systems

The rising consumer demand for seamless connectivity, high-speed internet, and smart infotainment systems is significantly driving the adoption of automotive smart antennas in India. These antennas facilitate essential functions such as GPS, Wi-Fi, Bluetooth, and satellite radio, enhancing the overall in-car experience. By 2025, over 70% of new passenger vehicles in India are expected to feature embedded connectivity solutions, fueled by increasing demand for in-car entertainment, navigation, and over-the-air (OTA) updates. Leading automakers, such as Tata Motors and Mahindra, are actively investing in 4G/5G-enabled smart antennas to improve user experience. The Indian connected car market, valued at USD 4.3 billion in 2024, is projected to grow at a CAGR of 19.1% from 2025 to 2033, reaching USD 23.4 billion by 2033. Additionally, evolving consumer preferences, particularly the surge in smartphone integration and voice-controlled systems, are further accelerating the adoption of smart antennas, ensuring uninterrupted connectivity across urban and highway environments.

India Automotive Smart Antenna Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, propulsion, sales channel, and frequency.

Technology Insights:

- Passenger Vehicles

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the technology. This includes passenger vehicles and commercial vehicles.

Propulsion Insights:

- Electric

- Non-Electric

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes electric and non-electric.

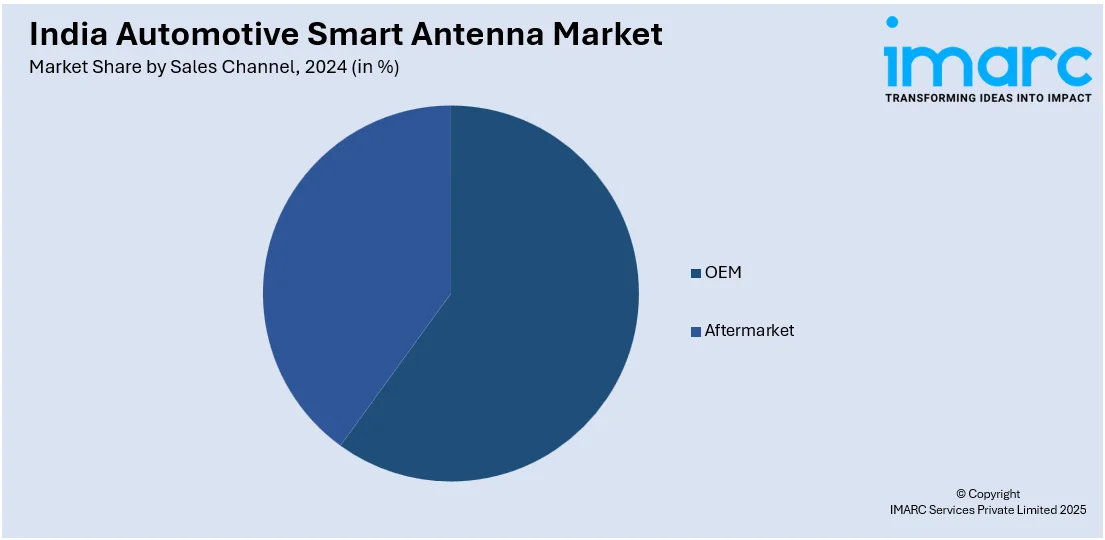

Sales Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and aftermarket.

Frequency Insights:

- High

- Very High

- Ultra High

A detailed breakup and analysis of the market based on the frequency have also been provided in the report. This includes high, very high, and ultra high.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Smart Antenna Market News:

- November 2024: Quectel Wireless Solutions unveiled its GNSS modules at Auto EV India 2024. The company showcased a range of advanced GNSS modules tailored for India's evolving landscape. Among them were the L89H(D) module, an AIS140-compliant solution featuring a dual-antenna design and an integrated Inertial Measurement Unit (IMU) for outstanding reliability, even in challenging environments.

- October 2024: Kia India unveiled its KIN 2.0 transformation strategy, introducing the EV9, which is equipped with Vehicle-to-Everything (V2X) technology. V2X enables the EV9 to interact with external systems, including powering devices via its Vehicle-to-Load (V2L) function, enhancing connectivity and utility. Currently exclusive to the EV9, Kia plans to expand V2X capabilities to additional models as the market evolves.

India Automotive Smart Antenna Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Passenger Vehicles, Commercial Vehicles |

| Propulsions Covered | Electric, Non-Electric |

| Sales Channels Covered | OEM, Aftermarket |

| Frequencies Covered | High, Very High, Ultra High |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive smart antenna market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive smart antenna market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive smart antenna industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 104.16 Million in 2024.

The India automotive smart antenna market is projected to exhibit a CAGR of 13.40% during 2025-2033, reaching a value of USD 351.57 Million by 2033.

The market's growth is driven by increasing vehicle connectivity, the rise of electric and autonomous vehicles, and growing demand for advanced infotainment and telematics systems. The expansion of 5G infrastructure and the adoption of V2X communication also play a crucial role in boosting market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)