India Automotive Temperature Sensor Market Size, Share, Trends and Forecast by Product, Technology, Vehicle Type, EV Application, and Region, 2025-2033

India Automotive Temperature Sensor Market Overview:

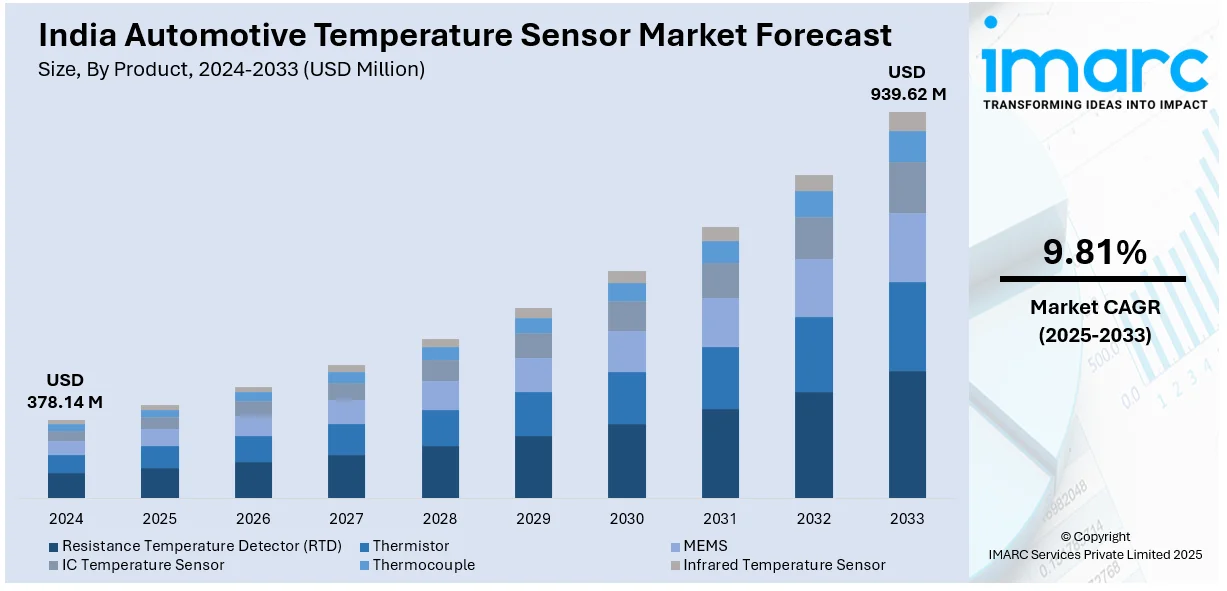

The India automotive temperature sensor market size reached USD 378.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 939.62 Million by 2033, exhibiting a growth rate (CAGR) of 9.81% during 2025-2033. Increasing vehicle production, rising demand for electric vehicles, stringent emission regulations, advancements in sensor technology, and growing consumer preference for fuel-efficient vehicles are some of the factors propelling the growth of the market. Additionally, government initiatives promoting electric mobility further boost market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 378.14 Million |

| Market Forecast in 2033 | USD 939.62 Million |

| Market Growth Rate 2025-2033 | 9.81% |

India Automotive Temperature Sensor Market Trends:

Enhanced Battery Safety Solutions in the EV Sector

With the increasing adoption of electric vehicles in India, advancements in thermal management technologies are gaining significant attention. Innovations designed to prevent battery overheating are becoming essential to ensure safety and extend battery life. As efficient temperature control becomes a key focus, the demand for advanced sensors that monitor and regulate heat is rising. Manufacturers are prioritizing the development of smart materials and integrated sensor systems that provide real-time temperature data, reducing the risk of thermal runaway. This focus on safety and performance optimization is driving the growth of specialized automotive sensors. Additionally, collaborations and investments in sensor technology are accelerating, fostering the introduction of more reliable and efficient battery management solutions across the EV landscape. For example, in December 2024, Hyundai Mobis developed new material technology to prevent electric vehicle (EV) battery overheating. This advancement enhances thermal management, ensuring battery safety and longevity. As India's EV adoption rises, the demand for reliable temperature sensors will grow, supporting the country's expanding automotive temperature sensor market with innovations in battery safety solutions.

To get more information on this market, Request Sample

Strategic Investments Driving Sensor Technology Advancements

The growing demand for advanced temperature sensing technologies in India’s automotive sector is fueling increased investment and collaboration. As electric vehicles gain traction, the need for efficient thermal management systems is accelerating. Companies are actively expanding their sensor portfolios to offer innovative solutions that ensure optimal battery performance and vehicle safety. Partnerships and acquisitions are enhancing technological capabilities, fostering the development of high-precision sensors designed to monitor and regulate temperatures in real time. This competitive focus on advanced sensing solutions is not only catering to electric mobility but also supporting the transition to connected and autonomous vehicles. Such strategic moves are driving the evolution of reliable thermal management systems across the automotive landscape. For instance, in February 2024, Remsons Industries Ltd. announced a majority investment in Uni-Automation’s automotive sensor division, enhancing its capabilities in temperature sensing technologies. This strategic move strengthens its presence in the India automotive temperature sensor market, driven by rising electric vehicle adoption and the need for advanced thermal management solutions in modern vehicles.

India Automotive Temperature Sensor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, technology, vehicle type, and EV application.

Product Insights:

- Resistance Temperature Detector (RTD)

- Thermistor

- MEMS

- IC Temperature Sensor

- Thermocouple

- Infrared Temperature Sensor

The report has provided a detailed breakup and analysis of the market based on the product. This includes resistance temperature detector (RTD), thermistor, MEMS, IC temperature sensor, thermocouple, and infrared temperature sensor.

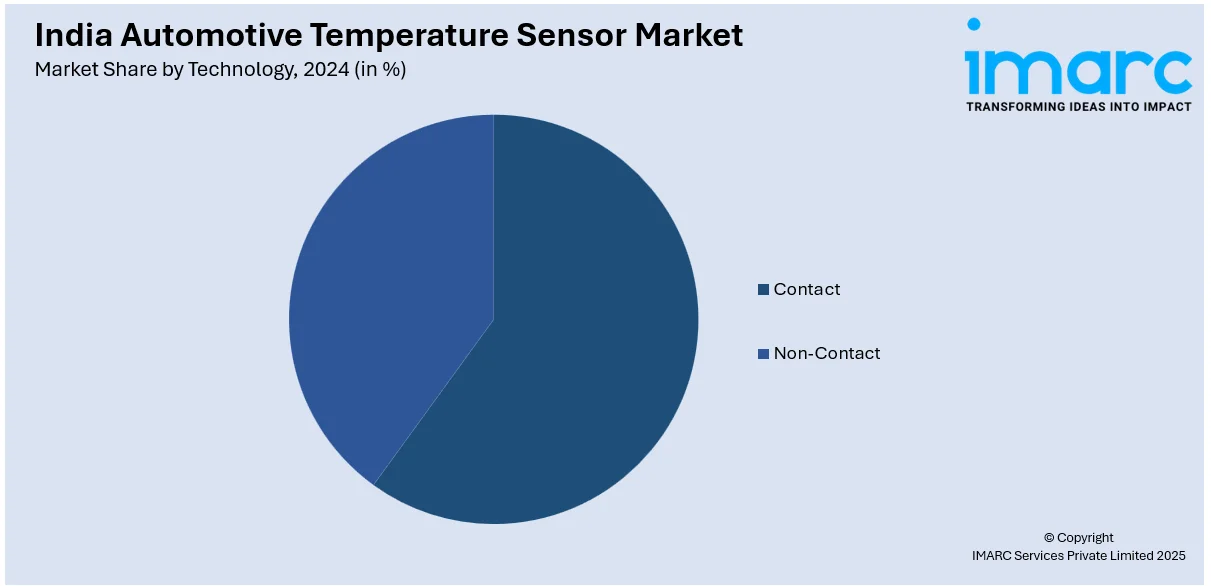

Technology Insights:

- Contact

- Non-Contact

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes contact and non-contact.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car and commercial vehicle.

EV Application Insights:

- HVAC

- Engine

- Battery

- Electric Motor

A detailed breakup and analysis of the market based on the EV application have also been provided in the report. This includes HVAC, engine, battery, and electric motor.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Temperature Sensor Market News:

- In March 2025, TDK Corporation introduced a new range of immersion temperature sensors designed for electric vehicle (EV) powertrain cooling applications. With India's growing EV adoption, these sensors can enhance thermal management, improving battery efficiency and vehicle safety. Their robust design and precise temperature monitoring support the expanding EV ecosystem, contributing to the growth of the India automotive temperature sensor market.

India Automotive Temperature Sensor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Resistance Temperature Detector (RTD), Thermistor, MEMS, IC Temperature Sensor, Thermocouple, Infrared Temperature Sensor |

| Technologies Covered | Contact, Non-Contact |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| EV Applications Covered | HVAC, Engine, Battery, Electric Motor |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive temperature sensor market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive temperature sensor market on the basis of product?

- What is the breakup of the India automotive temperature sensor market on the basis of technology?

- What is the breakup of the India automotive temperature sensor market on the basis of vehicle type?

- What is the breakup of the India automotive temperature sensor market on the basis of EV application?

- What are the various stages in the value chain of the India automotive temperature sensor market?

- What are the key driving factors and challenges in the India automotive temperature sensor market?

- What is the structure of the India automotive temperature sensor market and who are the key players?

- What is the degree of competition in the India automotive temperature sensor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive temperature sensor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive temperature sensor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive temperature sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)