India Ayurvedic Health Drinks Market Size, Share, Trends and Forecast by Product Type, Ingredient, Functionality, Packaging Type, Distribution Channel, End User, and Region, 2025-2033

India Ayurvedic Health Drinks Market Overview:

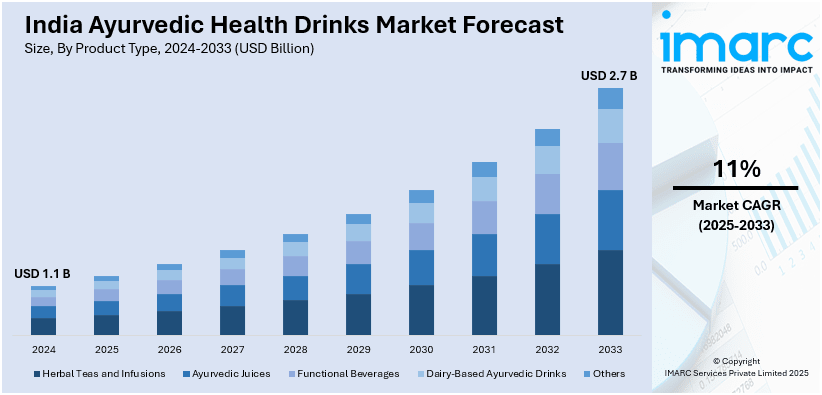

The India ayurvedic health drinks market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 11% during 2025-2033. The rising consumer awareness regarding health and wellness, increasing preference for natural and organic products, growing disposable income, rapid urbanization, implementation of supportive government initiatives, heightened focus on preventive healthcare, and the popularity of traditional Ayurvedic formulations are expanding the India Ayurvedic health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 11% |

India Ayurvedic Health Drinks Market Trends:

Product Innovation and Premiumization

Manufacturers in the Ayurvedic health drinks market are focusing heavily on product innovation to cater to the evolving preferences of consumers, which is positively impacting the India Ayurvedic health drinks market outlook. Major companies in the market are introducing a variety of functional beverages that address specific health concerns and diverse age groups. Formulations combining traditional Ayurvedic herbs like Ashwagandha, Tulsi, Turmeric, and Amla with modern ingredients such as adaptogens, vitamins, and probiotics are gaining traction. For instance, on July 30, 2024, Zydus Wellness expanded its Complan product line by introducing Complan Immuno-Gro in Tamil Nadu, an Ayurvedic health drink. This formulation incorporates over 20 Ayurvedic herbs, including Amla, Ashwagandha, and Brahmi, aimed at enhancing immunity and overall health among children. Premiumization is another major trend in the market, with manufacturers introducing high-end products aimed at urban and high-income consumers. Apart from this, ready-to-drink Ayurvedic drinks, herbal teas, and fortified juices are becoming increasingly popular in urban areas. Further, brands are also focusing on green packaging and sustainable sourcing of ingredients to appeal to environmentally aware purchasers. In addition to this, the growing off-take of individually prescribed health drinks based on one's dietary and wellness requirements is further broadening the market. In line with this, strategic collaborations with nutritionists, Ayurveda experts, and fitness gurus to formulate scientifically recommended products are further building credibility and customer trust.

To get more information on this market, Request Sample

Rising Consumer Awareness and Health Consciousness

The growing emphasis on health and wellness among Indian consumers is significantly contributing to the increased demand for Ayurvedic health drinks. With heightened awareness regarding the benefits of natural and herbal products, more people are seeking functional beverages that offer holistic health advantages. In addition to this, the prevalence of lifestyle diseases, including diabetes, obesity, and hypertension, is encouraging consumers to explore preventive healthcare options. According to an industry report, about 45% of the population is on the verge of being categorized as unhealthy in India. Additionally, data from more than six million users showed that there is a worrying gender health disparity, with 59% of women and 40% of males classified as unhealthy. This growing health consciousness is leading to a surge in demand for Ayurvedic health drinks, which are perceived as natural and effective wellness solutions. Additionally, the proliferation of health campaigns by government bodies, non-profits, and health organizations is reinforcing the appeal of Ayurveda-based products. Health-conscious millennials and Gen Z consumers are showing a strong preference for plant-based, chemical-free options, which is facilitating the India Ayurvedic health drinks market growth. Social media platforms and digital influencers are playing a key role in promoting Ayurvedic health drinks, fostering greater brand visibility and trust. This trend is further amplified by the COVID-19 pandemic, which heightened the demand for immunity-enhancing products.

India Ayurvedic Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, ingredient, functionality, packaging type, distribution channel, and end user.

Product Type Insights:

- Herbal Teas and Infusions

- Ayurvedic Juices

- Functional Beverages

- Dairy-Based Ayurvedic Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes herbal teas and infusions, ayurvedic juices, functional beverages, dairy-based ayurvedic drinks, and others.

Ingredient Insights:

- Turmeric-Based Drinks

- Ashwagandha and Adaptogen-Based Drinks

- Amla and Herbal Extracts

- Tulsi and Ginger-Based Beverages

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes turmeric-based drinks, ashwagandha and adaptogen-based drinks, amla and herbal extracts, Tulsi and ginger-based beverages, and others.

Functionality Insights:

- Immunity Boosting

- Detox and Digestion

- Energy and Rejuvenation

- Stress Relief and Relaxation

- Others

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes immunity boosting, detox and digestion, energy and rejuvenation, stress relief and relaxation, and others.

Packaging Type Insights:

- Bottled Drinks

- Ready-to-Drink (RTD) Pouches

- Powdered Mixes

- Tea Bags and Sachets

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes bottled drinks, ready-to-drink (RTD) pouches, powdered mixes, and tea bags and sachets.

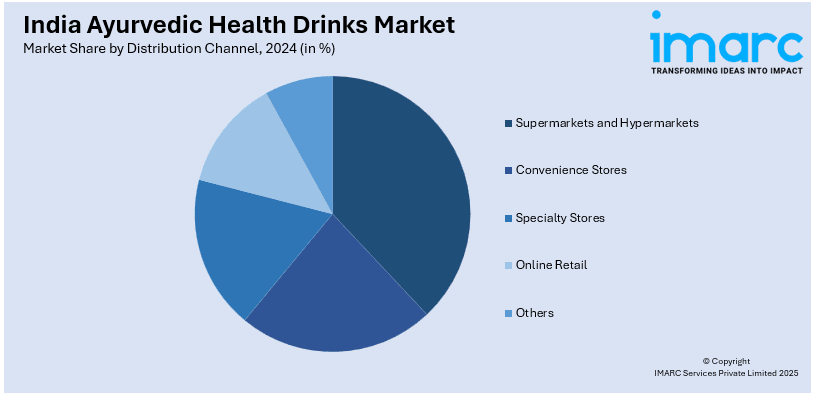

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online retail, and others.

End User Insights:

- Adults

- Elderly Population

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes adults, elderly population, and kids.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ayurvedic Health Drinks Market News:

- On March 19, 2025, Fytika, a prominent nutraceutical company, expanded into the health beverage sector by launching two Ayurvedic health juices: Glycobalance Juice and Kolest Care Juice. Glycobalance Juice combines traditional Ayurvedic ingredients such as Gurmar, Neem, Karela, Vijaysar, Amla, and Methi to support blood sugar regulation and metabolic health. Kolest Care Juice features a blend of Shankpushpi, Arjun Chhal, Jatamansi, Vach, Dhaniya, Pudina, Mulethi, and Lahsun, aiming to promote cardiovascular wellness by managing cholesterol levels and blood pressure.

India Ayurvedic Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbal Teas and Infusions, Ayurvedic Juices, Functional Beverages, Dairy-Based Ayurvedic Drinks, Others |

| Ingredients Covered | Turmeric-Based Drinks, Ashwagandha and Adaptogen-Based Drinks, Amla and Herbal Extracts, Tulsi and Ginger-Based Beverages, Others |

| Functionalities Covered | Immunity Boosting, Detox and Digestion, Energy and Rejuvenation, Stress Relief and Relaxation, Others |

| Packaging Types Covered | Bottled Drinks, Ready-to-Drink (RTD) Pouches, Powdered Mixes, Tea Bags and Sachets |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others |

| End Users Covered | Adults, Elderly Population, Kids |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ayurvedic health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the India ayurvedic health drinks market on the basis of product type?

- What is the breakup of the India ayurvedic health drinks market on the basis of ingredient?

- What is the breakup of the India ayurvedic health drinks market on the basis of functionality?

- What is the breakup of the India ayurvedic health drinks market on the basis of packaging type?

- What is the breakup of the India ayurvedic health drinks market on the basis of distribution channel?

- What is the breakup of the India ayurvedic health drinks market on the basis of end user?

- What is the breakup of the India ayurvedic health drinks market on the basis of region?

- What are the various stages in the value chain of the India ayurvedic health drinks market?

- What are the key driving factors and challenges in the India ayurvedic health drinks?

- What is the structure of the India ayurvedic health drinks market and who are the key players?

- What is the degree of competition in the India ayurvedic health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ayurvedic health drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ayurvedic health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ayurvedic health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)