India Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2026-2034

India Bancassurance Market Summary:

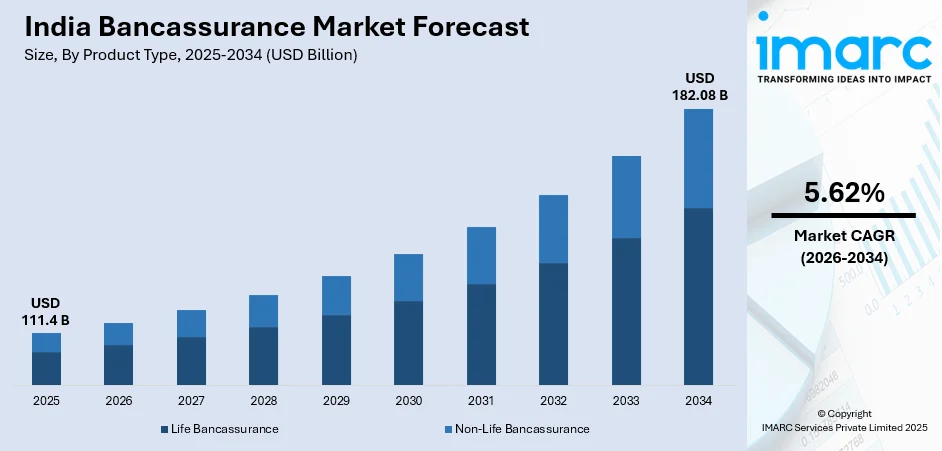

The India bancassurance market size was valued at USD 111.4 Billion in 2025 and is projected to reach USD 182.08 Billion by 2034, growing at a compound annual growth rate of 5.62% from 2026-2034.

The India bancassurance market is experiencing robust momentum as banks and insurers deepen their strategic collaborations to deliver integrated financial solutions through established distribution networks. Rising demand for convenient one-stop financial services, coupled with expanding digital infrastructure and mobile banking penetration, is accelerating adoption across urban and semi-urban centers. Progressive regulatory frameworks introduced by the Insurance Regulatory and Development Authority of India are creating a more transparent and customer-centric environment, while technological innovations in artificial intelligence (AI) and data analytics are expanding the India bancassurance market share.

Key Takeaways and Insights:

-

By Product Type: Life bancassurance dominates the market with a share of 60% in 2025, establishing itself as the cornerstone of India's bancassurance ecosystem by offering comprehensive protection, retirement planning, and wealth-building solutions through trusted banking channels.

-

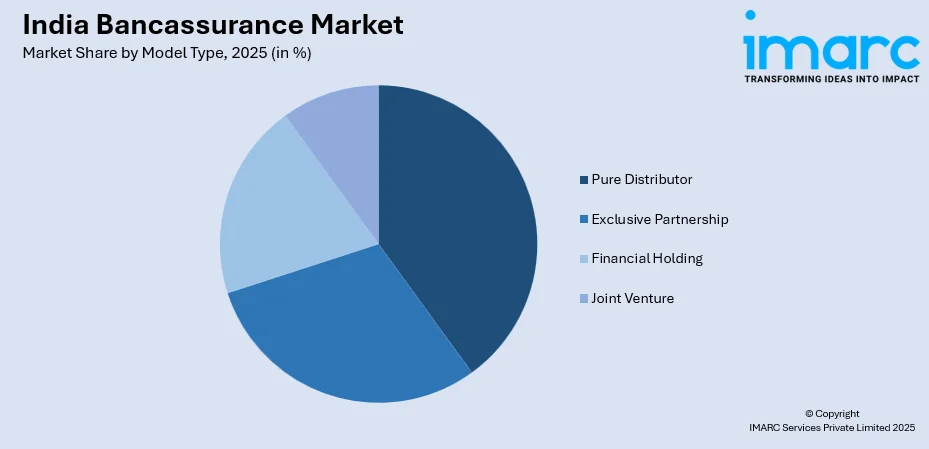

By Model Type: Pure distributor leads the market with a share of 39% in 2025, enabling banks to generate additional revenue streams through commission-based arrangements while insurance companies leverage extensive branch networks to reach broader customer segments efficiently.

-

By Region: West and Central India represents the largest segment with a market share of 32% in 2025, driven by the concentration of financial institutions in Mumbai and Maharashtra, higher urban population density, greater financial literacy, and strong demand for sophisticated insurance products.

-

Key Players: The India bancassurance market exhibits dynamic competition as public and private sector banks expand partnerships with leading life and non-life insurers, focusing on product diversification, digital channel enhancement, customer experience optimization, and geographical penetration to capture growing demand.

To get more information on this market Request Sample

The India bancassurance market is advancing rapidly as financial institutions recognize the strategic value of integrated insurance distribution through banking channels. Banks leverage their established customer relationships, extensive branch networks, and digital platforms to offer insurance products seamlessly, creating convenient touchpoints for policy purchases without requiring customers to approach separate insurance providers. This model generates additional revenue streams for banks through commissions while enabling insurers to access vast customer bases cost-effectively. The convenience factor resonates strongly with Indian consumers who prefer consolidated financial services under trusted banking brands. Recent strategic partnerships demonstrate this momentum, exemplified when ICICI Lombard General Insurance entered a bancassurance agreement with Karnataka Bank Limited in July 2024, encompassing approximately 915 branches and over 13 million customers to deliver comprehensive non-life insurance products through both physical and digital channels. This collaboration drives insurance penetration nationwide. As regulatory frameworks evolve to support innovation and digital banks integrate sophisticated data analytics for personalized offerings, the bancassurance model is positioned to accelerate financial inclusion and reshape how Indians access insurance protection throughout their lifecycle stages.

India Bancassurance Market Trends:

Digital Transformation Revolutionizing Bancassurance Distribution

Banks and insurers are rapidly digitizing their bancassurance operations by embedding insurance offerings directly into mobile banking applications, online banking portals, and digital payment platforms. This digital-first approach enables customers to explore product features, compare options, and complete purchases entirely through self-service digital interfaces without visiting physical branches. Artificial intelligence (AI) and machine learning (ML) algorithms are being deployed to analyze customer transaction patterns, financial behaviors, and life stage indicators to deliver personalized insurance recommendations at optimal moments in the customer journey. In July 2024, ICICI Lombard General Insurance launched Elevate, an AI-equipped health insurance plan offering tailored solutions for medical emergencies, diverse healthcare needs, and rising medical costs. The integration of video know-your-customer procedures, electronic policy issuance, and automated claims processing is further streamlining the end-to-end experience, reducing turnaround times from days to minutes and significantly improving customer satisfaction while lowering operational costs for both banks and insurers.

Embedded Insurance Gaining Traction Through Fintech Integration

The embedded insurance model is emerging as a transformative distribution channel where coverage is seamlessly integrated into non-insurance digital platforms and transactions. Payment applications, e-commerce marketplaces, ride-sharing platforms, and digital wallets are embedding insurance options directly into checkout flows and transaction journeys, making protection products instantly accessible at the point of need. This approach eliminates traditional friction points in insurance purchasing by contextualizing coverage around specific activities such as travel bookings, vehicle rentals, or high-value purchases. In March 2025, PhonePe rolled out comprehensive vehicle insurance for two-wheelers and four-wheelers, enabling users to compare policies from multiple insurers and complete purchases directly through the PhonePe application. The embedded model particularly appeals to younger, tech-savvy demographics who prefer seamless digital experiences and micro-insurance products tailored to specific needs rather than comprehensive traditional policies, creating new growth avenues beyond conventional bancassurance channels.

Geographic Expansion Accelerating into Tier 2 and Tier 3 Cities

Banks and insurers are strategically expanding bancassurance operations beyond metropolitan centers into tier 2 and tier 3 cities where rising income levels, increasing financial literacy, and improving digital infrastructure are creating untapped market potential. Regional and cooperative banks with strong local presence are forming bancassurance partnerships to serve communities historically underserved by traditional insurance distribution channels. This geographic diversification strategy involves training branch staff in smaller cities on insurance product features, establishing vernacular language support, and adapting product offerings to address local needs and affordability constraints. In November 2024, Bandhan Life announced the expansion of its bancassurance partnership with Bandhan Bank into Northern India, making flagship products including iGuarantee Vishwas, iInvest II, and Shubh Samriddhi available at 142 Bandhan Bank branches across Delhi to customers through both branch and digital channels. The combination of physical branch accessibility in emerging cities with digital enablement is proving effective in building trust and driving adoption among first-time insurance buyers who value personal guidance alongside digital convenience.

Market Outlook 2026-2034:

The India bancassurance market is positioned for sustained growth as banks deepen insurance product integration into their core offerings and digital channels become primary distribution vehicles. The market generated a revenue of USD 111.4 Billion in 2025 and is projected to reach a revenue of USD 182.08 Billion by 2034, growing at a compound annual growth rate of 5.62% from 2026-2034. Regulatory modernization initiatives by IRDAI, including streamlined product approval processes and enhanced policyholder protection frameworks, are creating a more conducive environment for innovation and market expansion. The ongoing shift toward digital-first banking experiences, accelerated smartphone adoption, and increasing financial literacy among younger demographics are expanding the addressable customer base.

India Bancassurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Life Bancassurance | 60% |

| Model Type | Pure Distributor | 39% |

| Region | West and Central India | 32% |

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance dominates with a market share of 60% of the total India bancassurance market in 2025.

Life bancassurance represents the dominant product category as banks leverage their trusted relationships with customers to distribute protection and savings-oriented insurance solutions addressing critical lifecycle needs. Life insurance products align naturally with banking services as they involve long-term financial commitments, wealth accumulation objectives, and retirement planning goals that resonate with customers already engaged in financial planning through their banks. Banks benefit from attractive commission structures on life insurance premiums while customers appreciate the convenience of purchasing comprehensive coverage without engaging separate insurance agents.

The product category encompasses term insurance for pure protection, endowment plans combining protection with guaranteed returns, unit-linked insurance plans offering market-linked growth, and pension products for retirement income. In 2024, the Life Insurance Corporation of India (LIC) has partnered with IDFC First Bank Ltd. through a corporate agency agreement. As per the agreement, over one crore clients of IDFC First Bank will have the opportunity to purchase LIC policies via the bank. The arrangement is aimed at enhancing the role of bancassurance and striving to offer life insurance coverage for everyone by 2047. The growing awareness of family financial security, coupled with tax benefits on life insurance premiums, continues to drive demand through bancassurance channels.

Model Type Insights:

Access the comprehensive market breakdown Request Sample

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Pure distributor leads with a share of 39% of the total India bancassurance market in 2025.

The pure distributor model dominates India's bancassurance landscape as it offers operational flexibility and simplicity for banks entering insurance distribution without significant capital commitments or complex ownership structures. Under this arrangement, banks act as corporate agents or brokers for insurance companies, earning commissions or fees for policies sold through their distribution network without holding equity stakes in the insurer. This model allows banks to partner with multiple insurance providers across different product categories, offering customers diverse options from various insurers rather than being restricted to a single partner's portfolio.

The arrangement requires relatively lower regulatory compliance burdens compared to other models and enables banks to generate ancillary income from their existing customer base and branch infrastructure without diverting capital from core banking operations. In 2024, Federal Bank announced a bancassurance partnership with Tata AIA Life Insurance Company Limited, enabling Federal Bank customers to access Tata AIA Life's extensive range of insurance products through the bank's distribution network. Insurance companies favor the pure distributor model as it provides access to extensive distribution networks and large customer bases without requiring them to establish parallel infrastructure or share ownership, allowing them to focus resources on product development and underwriting excellence while leveraging banks' retail presence and customer trust.

Regional Insights:

- North India

- West and Central India

- East India

- South India

West and Central India exhibits a clear dominance with a 32% share of the total India bancassurance market in 2025.

West and Central India dominates the bancassurance market due to the concentration of major banks and insurance companies headquartered in Mumbai, India's financial capital, creating a mature ecosystem for financial services innovation and distribution. The region encompasses Maharashtra and Gujarat, states with high per capita incomes, strong industrial bases, and significant urban populations that demonstrate greater financial sophistication and insurance awareness. Mumbai serves as the nerve center for both banking and insurance operations, housing head offices of leading public and private sector banks alongside major insurance providers, facilitating easier collaboration and partnership formation.

The region's cosmopolitan population exhibits higher receptivity to financial products, greater trust in institutional channels, and willingness to allocate household budgets toward insurance protection and investment-linked policies. Moreover, people residing in this region are well aware about the importance of investing in insurance policies. The extensive presence of corporate employees with stable incomes, the proliferation of organized retail banking, and well-developed digital infrastructure collectively contribute to West and Central India's leadership position in bancassurance adoption and premium generation.

Market Dynamics:

Growth Drivers:

Why is the India Bancassurance Market Growing?

Rising Financial Literacy and Insurance Awareness Across Population Segments

India is witnessing a fundamental shift in financial awareness as government initiatives, media campaigns, and digital platforms educate citizens about the importance of insurance protection for family security, healthcare coverage, and retirement planning. Improved education levels, particularly among younger demographics, are translating into greater understanding of risk management concepts and the role of insurance in comprehensive financial planning. Financial literacy programs conducted by banks, insurance companies, and regulatory bodies are demystifying insurance products and addressing misconceptions that historically limited adoption. The proliferation of personal finance content across digital media, television, and social platforms has made insurance concepts more accessible and relatable to mass audiences. According to the India Brand Equity Foundation, India's life insurance industry's new business premium rose 12.06% year-over-year in October 2025 to USD 3.83 billion, driven by robust growth in both individual and group segments, reflecting increasing consumer awareness of financial protection needs. As awareness deepens, customers are increasingly recognizing insurance not merely as a compliance requirement but as an essential component of responsible financial management, creating sustained demand through banking distribution networks that offer trusted advice and multiple product options under one roof.

Progressive Regulatory Support and IRDAI-Led Market Reforms

The Insurance Regulatory and Development Authority of India has emerged as a proactive enabler of bancassurance growth through regulatory frameworks that balance consumer protection with industry innovation and distribution expansion. IRDAI's strategic initiatives include simplifying product approval processes, standardizing disclosure requirements, enhancing grievance redressal mechanisms, and expanding the range of permissible bancassurance arrangements. Additionally, IRDAI introduced comprehensive regulations in April 2024 aimed at enhancing policyholder protection and streamlining insurer operations. IRDAI's push for digital adoption, including mandates for electronic policy issuance and encouragement of video-based customer identification, has accelerated the digital transformation of bancassurance channels.

Strategic Bank-Insurer Partnerships Expanding Distribution Reach and Product Innovation

Banks and insurance companies are forging increasingly sophisticated partnerships that go beyond simple distribution arrangements to create integrated value propositions combining banking convenience with insurance protection. These strategic alliances enable insurers to access banks' extensive customer bases, established branch networks, and digital platforms without investing in parallel distribution infrastructure, significantly reducing customer acquisition costs compared to traditional agency channels. Banks benefit from additional revenue streams through commissions, enhanced customer lifetime value through cross-selling opportunities, and improved customer stickiness as insurance relationships create additional touchpoints and switching barriers. In 2025, Generali revealed Central Bank of India (CBI) as its latest joint venture (JV) partner in the nation. CBI is one of the oldest public sector banks in India, founded in 1911, with a market capitalization of ₹461 billion (€5.1 billion) and a network of over 4,500 branches catering to more than 80 million customers. The collaboration with CBI intended to boost Generali’s market visibility, reinforcing its brand positioning and distribution strengths in both Life and P&C.

Market Restraints:

What Challenges the India Bancassurance Market is Facing?

Limited Penetration in Rural and Semi-Urban Markets

Despite expanding branch networks and digital initiatives, bancassurance penetration remains significantly constrained in rural and semi-urban regions where lower income levels, limited financial literacy, and cultural perceptions about insurance create adoption barriers. Rural populations often prioritize immediate consumption needs over future-oriented financial protection, viewing insurance premiums as discretionary expenses rather than essential commitments. The lack of consistent income streams among agricultural and informal sector workers makes regular premium payments challenging, limiting viable customer segments for traditional insurance products. Additionally, trust deficits stemming from past experiences with other financial products or mis-selling incidents create skepticism that banks must overcome through patient education and relationship-building rather than transactional sales approaches.

Complex Regulatory Compliance and Operational Integration Challenges

Maintaining compliance with evolving IRDAI regulations while simultaneously integrating banking and insurance systems presents substantial operational complexities requiring significant technology investments and process standardization. Banks operating bancassurance channels must navigate detailed compliance requirements covering licensing, training certifications, disclosure standards, claims processing, and grievance redressal mechanisms that differ fundamentally from traditional banking regulations. The need to maintain separate systems for tracking insurance transactions, managing commission reconciliations, and ensuring policy servicing creates operational overhead and integration challenges with core banking platforms. Training bank staff to understand insurance products sufficiently to provide appropriate guidance while maintaining regulatory compliance on suitability and disclosure requires ongoing investment and quality assurance monitoring that strains operational resources.

Digital Literacy Gap and Customer Adoption Barriers

Although smartphone penetration and internet connectivity are expanding rapidly, significant portions of India's population lack the digital literacy and comfort level needed to navigate insurance purchase journeys through digital banking channels. Older demographics, rural populations, and less educated segments often prefer in-person interactions with trusted bank relationship managers rather than self-service digital interfaces for financial decisions of long-term consequence. The complexity of insurance products, involving technical terminology, exclusions, and conditions, makes digital-only journeys challenging even for digitally savvy customers who may require clarification and reassurance before committing to policies. Language barriers persist as most digital insurance content remains primarily in English, limiting accessibility for vernacular language speakers who constitute the majority of potential customers in many regions.

Competitive Landscape:

The India bancassurance market is characterized by intensifying competition as both public sector and private sector banks expand their insurance distribution capabilities through diverse partnership models with leading life and non-life insurance providers. Public sector banks leverage their extensive branch networks, particularly in rural and semi-urban areas, to offer insurance products alongside traditional banking services, benefiting from high customer trust and established relationships. Private sector banks compete through superior digital capabilities, customer experience innovation, and more flexible product offerings tailored to urban and affluent customer segments. Competition extends beyond banks to encompass new-age fintech companies and digital platforms integrating embedded insurance offerings directly into payment and e-commerce journeys, creating alternative distribution channels that bypass traditional bancassurance arrangements. Insurers compete for preferential partnerships with high-distribution banks by offering attractive commission structures, dedicated support resources, and co-branded product development. The market is witnessing consolidation of strategic partnerships as banks move from multiple-insurer arrangements toward exclusive or preferred partnerships enabling deeper integration and better customer experiences.

Recent Developments:

-

In December 2025, IndiaFirst Life Insurance has formed a bancassurance alliance with Dombivli Nagari Sahakari Bank (DNS Bank), providing the bank’s clients access to IndiaFirst Life’s selection of term, savings, and retirement insurance offerings. This marks DNS Bank's third significant partnership in the life insurance sector.

-

In October 2025, Ageas Federal Life Insurance revealed a strategic partnership in SME Bancassurance with CSB Bank to broaden life insurance reach for small and medium enterprises (SMEs) and individual entrepreneurs. The partnership intends to incorporate protection-oriented financial offerings into CSB Bank’s vast network, delivering comprehensive financial solutions to entrepreneurs throughout India.

-

In October 2025, RBL Bank has partnered with Life Insurance Corporation of India (LIC), the nation’s biggest life insurer, for bancassurance operations, as per a stock market announcement on September 30. This strategic partnership will allow RBL Bank customers to utilize LIC’s wide array of life insurance offerings via the Bank’s vast branch network and digital platforms, according to the bank.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered |

Life Bancassurance, Non-Life Bancassurance |

| Model Type Covered |

Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bancassurance market size was valued at USD 111.4 Billion in 2025.

The India bancassurance market is expected to grow at a compound annual growth rate of 5.62% from 2026-2034 to reach USD 182.08 Billion by 2034.

Life bancassurance, holding the largest revenue share of 60%, dominates the market as banks leverage their trusted customer relationships to distribute protection, savings, and retirement planning products. The category benefits from attractive commission structures, tax advantages for customers, and alignment with banks' long-term financial planning advisory roles, making it the cornerstone of India's bancassurance ecosystem.

Key factors driving the India bancassurance market include rising financial literacy and insurance awareness among the population, progressive regulatory support and IRDAI-led market reforms enhancing distribution frameworks, strategic bank-insurer partnerships expanding distribution reach, digital transformation enabling seamless customer experiences, and growing demand for integrated financial services through convenient banking channels.

Major challenges include limited penetration in rural and semi-urban markets where income levels and financial literacy remain low, complex regulatory compliance requirements requiring substantial technology investments, digital literacy gaps preventing adoption of digital-first insurance journeys, operational integration challenges between banking and insurance systems, and commission structure pressures affecting partnership economics for both banks and insurers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)