India Barley Market Size, Share, Trends and Forecast by Type, Grade, Distribution Channel, Industry Vertical, and Region, 2026-2034

India Barley Market Size and Share:

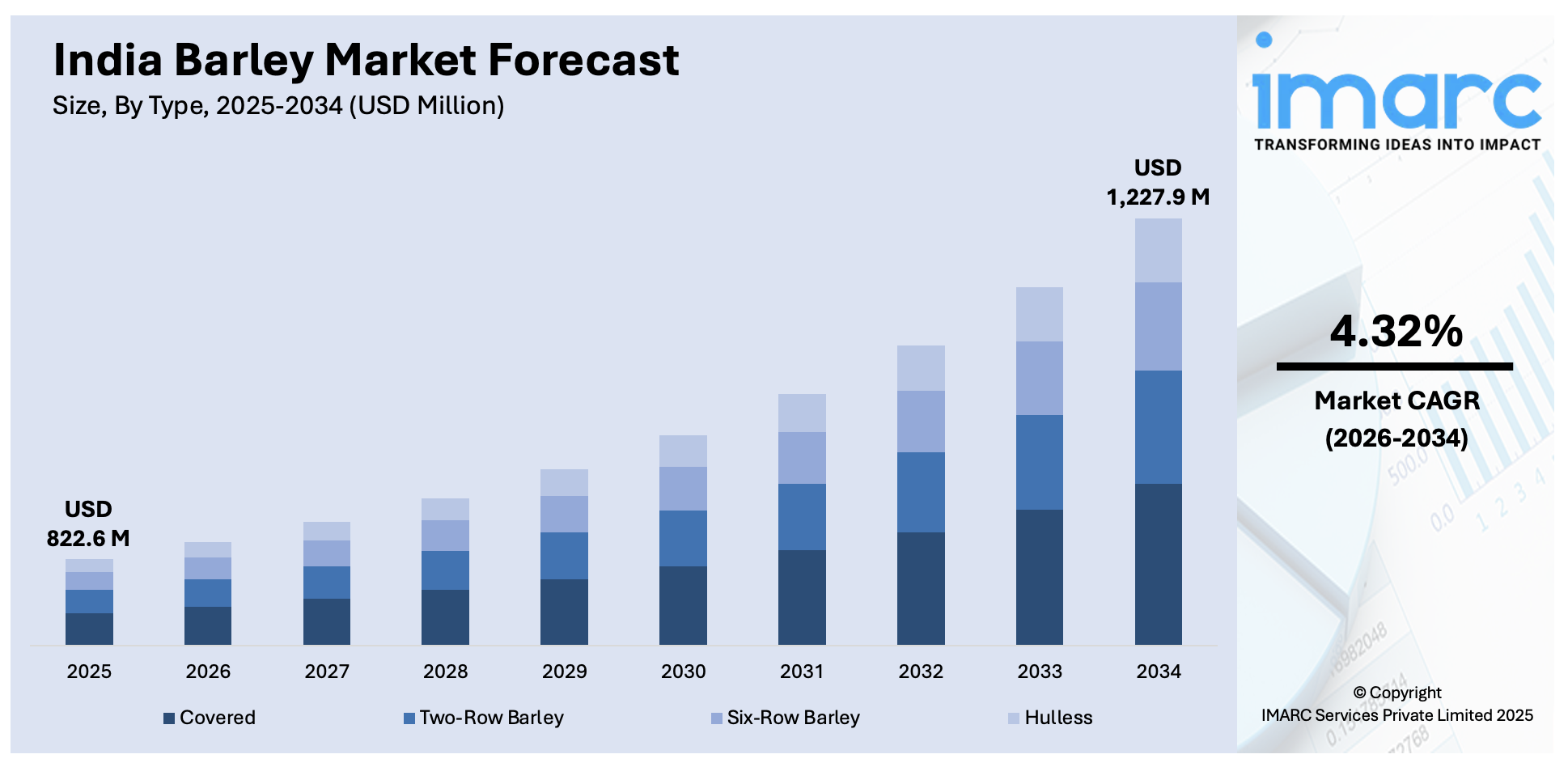

The India barley market size was valued at USD 822.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,227.9 Million by 2034, exhibiting a CAGR of 4.32% from 2026-2034. The market share is growing as a result of the increased use of barley in brewing, animal feed, and health food items. Additionally, support from the government in the form of minimum support price (MSP), improved crop management practices, and growing high-yielding, and investing in drought-resistant varieties are strengthening the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 822.6 Million |

| Market Forecast in 2034 | USD 1,227.9 Million |

| Market Growth Rate (2026-2034) | 4.32% |

Barley is gaining attention for its health advantages, such as high dietary fiber, antioxidants, and low glycemic index, which are turning it into a sought-after crop among health-aware consumers. The demand can be seen in products like breakfast cereals, snacks, beverages, and functional foods that are used to manage cholesterol levels and aid the digestive system. The governmental body also plays an instrumental part by supporting barley cultivation through subsidies and financial support. Programs like MSP for barley, crop insurance, and effective irrigation and superior quality seed type programs are great aids to farmers. These not only stabilize production but also help in making a consistent supply available, thereby promoting the development of the Indian market for barley and fulfilling domestic as well as overseas demand.

To get more information on this market Request Sample

Besides this, increased utilization of barley as a leading input in animal feed, led by poultry, cattle, and pigs, as a result of its energy value and nutritional composition, is yielding a positive market outlook. Additionally, improvement in farm technology, including higher seed varieties, pest control, and precision farm methods, is facilitating the yield and quality of barley. They raise the efficiency and sustainability of barley production, making it possible to have a guaranteed supply. Apart from this, innovation like controlled-environment agriculture and vertical farming facilitate easier production of barley in urban cities and regions of limited resources. Such technologies offer an environmentally sustainable way of producing barley year-round, increasing consistency of supply as well as driving local production.

India Barley Market Trends:

Utilization in Brewing Industry

With the rise in demand for craft beer and other alcoholic drinks, breweries are dependent on barley as a key ingredient. The growing demand is due to changing consumer tastes for flavored, premium, and locally produced beverages, led by craft beer in the Indian alcohol market. Barley is crucial in the brewing process as it offers starches that aid in fermentation, which is responsible for the production of alcohol. It also gives the unique malt flavors that are characteristic of most beers. The increasing demand for local craft beer brands, which are usually produced using quality barley, is also catalyzing the demand for this crop. Furthermore, barley is seen as an important ingredient for producing specialty beers with special flavors, targeting a broader and more discerning market. In 2024, Bad Monkey Beer, a product from the Indian brewery Sinq Beverages, was launched in Uttar Pradesh. The beer, made with barley and hops, has two types, including Strong and Tamed. The brand, which has already achieved success in Delhi and Jharkhand, aimed to attract local beer enthusiasts.

Consumer Preferences and Dietary Shifts

In India, shifting food habits and consumer preferences are driving the demand for barley. With the middle class growing and healthier consumers on an increase, barley is not only being recognized as an animal feed grain but also as a nutritious food ingredient for human use. Barley contains a high level of fiber and provides numerous health benefits, due to which it is a well-liked ingredient in health foods and functional foods. The rise in barley-based products such as soups, cereals, and flour is also propelling its increased usage. Barley is being increasingly used in conventional cooking and even as a substitute for rice and wheat in other regions of India. The emerging food trends and a shift towards healthier, diversified foods are fueling demand for barley. Sunpure brought out its 12 cereals, pulses, and millets-based Multigrain Atta in 2023, which has barley among the key ingredients.

Advancements in Agricultural Technology and Farming Practices

The application of innovative agricultural practices and farming technologies highly influences the growth of the Indian barley market. Precision farming, which entails the application of high-yielding seed varieties and advanced irrigation strategies, is vital for increasing the yield of barley crops. For example, drip irrigation systems coupled with soil moisture monitoring equipment improve the efficiency of water use, a crucial factor for barley production. Furthermore, the availability of genetically modified (GM) barley that is developed to resist pests, diseases, and unfavorable weather ensures more stable yields and reduces crop loss. As these technologies become popular with farmers, overall efficiency increases, satisfying both local consumption requirements and export needs. In 2024, researchers at the Indian Institute of Wheat and Barley Research (IIWBR) in Karnal introduced a new barley variety called DWRB-219, developed following nine years of study. The variety yielded more (54.49 quintals/hectare) and showed resistance to diseases.

India Barley Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India barley market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, grade, distribution channel, and industry vertical.

Analysis by Type:

- Covered

- Two-Row Barley

- Six-Row Barley

- Hulless

Covered is defined by its outer shell that stays whole after being harvested. This variety of barley is frequently favored for its greater nutritional content since the husk preserves vital nutrients like fiber, vitamins, and minerals. It is frequently utilized in food manufacturing, especially for producing barley flour, dietary supplements, and a range of traditional dishes such as soups and porridge. The high demand stems from its health advantages and its importance in functional foods, along with its popularity in areas that emphasize whole grain consumption.

Two-row barley is a type characterized by grains that arrange in two rows on the spike, making harvesting and processing easier. This variety is primarily used for malting, particularly for brewing beer and other spirits, due to its high extract yield and low protein content. Two-row barley is favored for malting because it produces malt of superior quality with enhanced enzymatic activity. This sector is also employed in the production of animal feed, especially in livestock farming in regions abundant in barley cultivation.

Six-row barley is defined by the manner in which its grains develop in six rows along the spike, providing higher protein content compared to two-row barley. The type is utilized more often as animal feed due to the high quality of protein, thus being inappropriate for malting but good for use in livestock. Six-row barley is employed in economical malt varieties production and also in cereals and food products manufacturing. Its high protein content can be beneficial where it's essential to supply livestock with cost-effective feed or make cost-effective grain-derived products.

Hulless barley lacks the outer husk, which simplifies processing and consumption. Hulless barley is gaining popularity due to its convenience and its rich levels of soluble fiber and beta-glucan, which appeal to health-conscious individuals. Hulless barley is employed in the making of nutritious foods like energy bars, soups, and snacks.

Analysis by Grade:

- Food Grade

- Feed Grade

- Malt Grade

Food grade barley is mostly used in the food and beverage (F&B) sector for its quality and human consumption suitability. The grade is marked by purity, nutritional content, and low contamination, which makes it suitable for use in products such as cereals, snacks, malt drinks, and health foods. It is also applied in functional foods and nutraceuticals because of its high fiber, vitamins, and antioxidant content.

Feed grade barley is mainly utilized in animal feed because of its nutritional value, which encompasses fiber, protein, and vital minerals. This type of barley is appropriate for livestock, poultry, and various animals, offering an affordable and nutritious feed choice. Feed grade barley is generally not as processed as food grade and might contain somewhat higher impurity levels since it is not meant for human use.

Malt grade barley is sown and treated for use in the production of malt, an essential product for the brewing and distilling industries. Malt grade is special in that it can be induced to germinate under controlled conditions, thus yielding enzymes required for the fermentation process. Malt grade barley is sown under specific conditions to achieve optimal malting quality, such as moisture level and kernel size. The increasing demand for beer, whisky, and other spirits is driving the demand for quality malt grade barley, which is utilized by breweries and distilleries to produce their output.

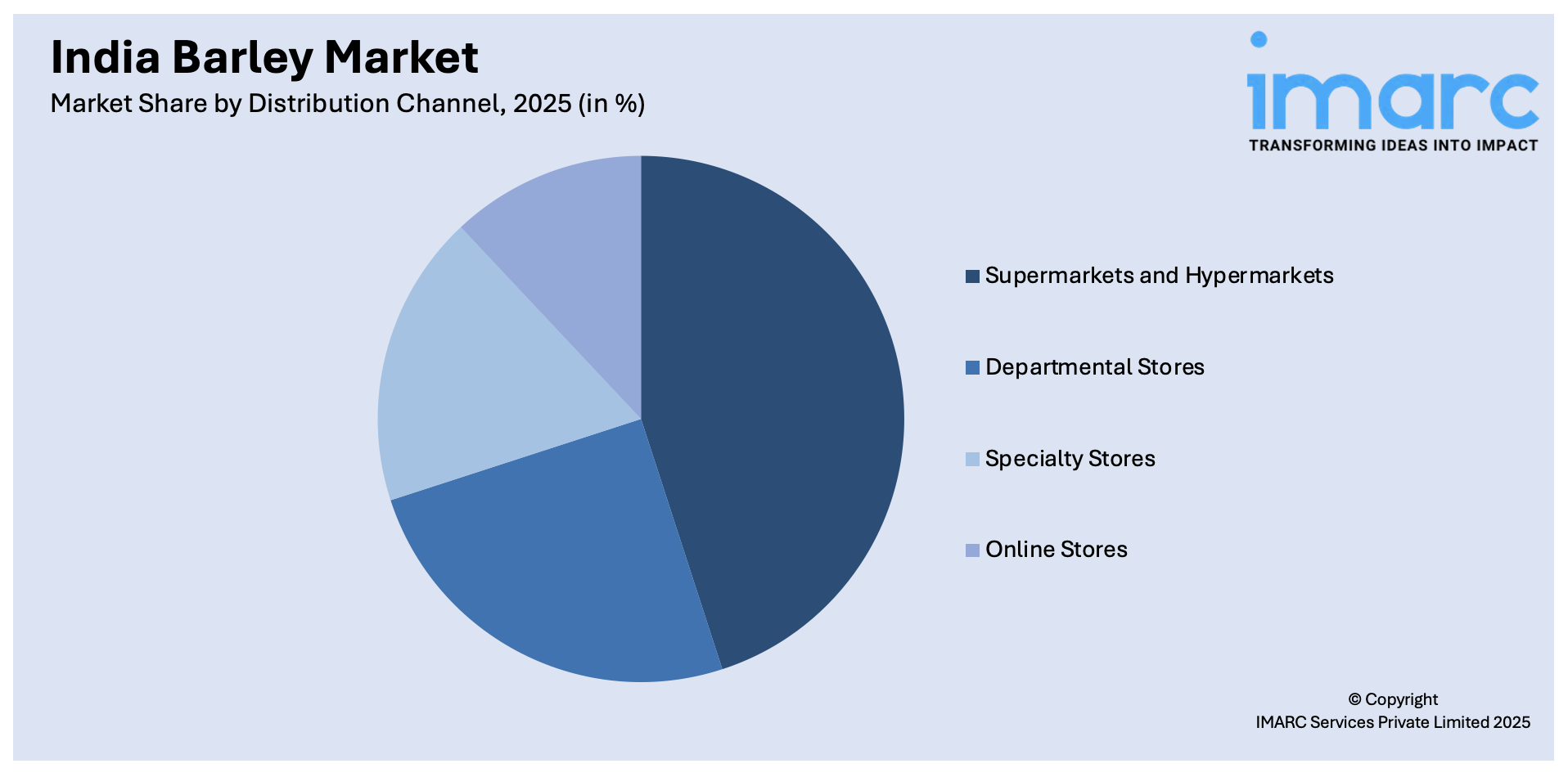

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets are key distribution channels of barley products, particularly within the food and beverage market. These retail giants offer a wide kind of barley products like cereals, snacks, and malt beverages in easily accessible locations. The prominence of supermarkets and hypermarkets in the distribution of barley is driven by convenience and variety. In addition, such stores often stock barley-based health food products that appeal to health-conscious consumers, further solidifying their role as a primary outlet for barley sales.

Department stores cater to a diverse user base and often provide barley-based items in their food and health sections. These stores offer a range of barley products such as whole grains, flours, and nutritional supplements, attracting buyers who value both convenience and quality. Department stores are typically located in downtown areas and attract a diverse range of customers, including those looking for specialty foods or health-related products. Their wide variety of products allows barley to be displayed alongside other premium or organic goods, increasing its visibility.

Specialty stores are growing in significance as outlets for barley products, especially within the health and wellness industry. Retailers that emphasize organic, natural, or health-oriented foods commonly offer barley in multiple varieties, such as barley flour, malt, and drinks made from barley. These shops serve specialized markets of health-aware buyers seeking premium, eco-friendly, or unique ingredients.

Online stores are becoming an important distribution channel for barley-based products, offering consumers a convenient shopping experience and a wider variety of barley products. Internet retailers have a wide variety of barley products, including grains, flour, malt extracts, and dietary supplements, allowing consumers to easily compare prices and find new products. The increased trend of shopping online, along with the increased demand for organic and specialty barley, has significantly boosted the role of e-commerce in expanding the market base of barley.

Analysis by Industry Vertical:

- Food and Beverages

- Pharmaceuticals

- Seed Industry

- Personal Care

- Animal Feed

- Nutraceuticals

- Others

The food and beverages sector is among the biggest users of barley, especially for malting in beer production. Barley is being used more and more in making snacks, cereals, and health foods because of its nutritional advantages. Its adaptability as a crucial component in beer, whisky, and various alcoholic drinks consistently fuels demand. Furthermore, barley flour and various barley-derived products are becoming increasingly popular in the food processing industry as healthier options compared to refined grains. This sector continues to be a major player in the barley market, experiencing significant growth in both conventional and novel food uses.

Barley is used in the pharmaceutical sector primarily for its health benefits. It has rich soluble fibers, vitamins, and antioxidants, making it an important ingredient in various medicinal products aimed at improving digestive health, cholesterol levels, and overall well-being. Barley extracts are also incorporated into functional supplements and herbal preparations, extending its use in the pharmaceutical sector. Increased interest in natural and plant-based ingredients in medicine increases the increased use of barley in the development of more holistic health products.

Barley is critical to agricultural production in the seed industry, with many quality barley seed varieties developed for varied climatic conditions and farming practices. Both smallholder and large-scale farmers drive demand for certified barley seeds through high-yield and disease-resistant barley varieties. Barley seed production is a critical segment of the broader barley market, enabling the development of barley farming in varied regions. This portion is essential to ensure constant supply of high-quality seeds capable of meeting the rising needs from diverse sectors, including food and beverages and animal feed.

Barley is becoming more popular in the personal care sector for its moisturizing, anti-inflammatory, and antioxidant qualities. Barley extract is frequently included in skin care items like creams, lotions, and face masks to improve skin hydration and provide protection. The grain's rich antioxidant profile also renders it a crucial component in anti-aging products. Moreover, barley oil is utilized in hair care items to promote scalp wellness and boost hair resilience. The growing emphasis on natural and organic components in the personal care industry enhances position of barley in the market.

The animal feed sector holds a notable India barley market share, especially in areas where barley serves as a beneficial component for livestock. Barley is a favored feed grain for cattle, poultry, and pigs because of its rich fiber content, digestibility, and nutritional balance. It is additionally utilized in creating animal supplements and feed additives. The requirement for barley in animal feed is closely linked to the increasing demand for protein-enriched diets in livestock, further enhancing barley's significance in agriculture and feed industries.

Barley is commonly applied in the nutraceutical market because of its health advantages, such as aiding digestion, reducing cholesterol, and offering antioxidants. Barley grass, especially, is rich in minerals and vitamins and is applied in dietary supplements, powders, and juices. The increasing trend of preventive care and natural wellness products is catalyzing the demand for barley in the nutraceutical market. The rising consumer choice for natural and functional ingredients used in health items guarantees a continuous increase in market share for barley in this segment.

Others include barley-using industries like biofuels, textiles, and paper making. In biofuel manufacturing, barley is used as a feedstock to produce ethanol, which adds to the renewable energy segment. Barley fibers find use in textiles and paper production because they are strong and sustainable. While these segments are lesser compared to the large-scale sectors such as food and beverages, they contribute significantly to the overall market scenario. Technological advances in these specialized uses further fragment the market for barley, creating additional opportunities for growth.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

The barley market in South India is influenced by the brewing sector's demand, especially in states such as Karnataka, Tamil Nadu, and Andhra Pradesh. The areas advantageous weather for barley farming, combined with robust agricultural infrastructure, facilitates top-notch production. The existence of well-known breweries and distilleries boosts the region's consumption, as South India remains a major producer of barley for malting and various industrial applications.

North India, particularly areas such as Uttar Pradesh, Punjab, and Haryana, holds a significant role in barley cultivation. The region's cold and dry climate is ideal for growing barley, and it is still among the primary regions for barley cultivation. The north market also benefits from an abundance of large breweries and distilleries, which require high-quality malted barley. Agricultural practices in North India are highly evolved and have constant demand from food and beverage, as well as the animal feed industries, to serve as an integral part of the entire market.

West and Central India, encompassing significant barley-producing states like Rajasthan, Madhya Pradesh, and Maharashtra, is vital to the national supply. These regions are acknowledged for their widespread agricultural practices and favorable weather for growing barley. Rajasthan, in particular, ranks among the leading barley producers in the country. The demand in this area is driven by the brewing industry, alongside the increasing use of barley in the food and beverage sector for products such as barley flour and dietary supplements. The export potential from these regions also supports the growth of the market.

East India, including states like West Bengal, Odisha, and Bihar, has moderate levels of consumption and production of barley. In East India, the food and beverage industry is the major user, with barley included in a variety of traditional and health-oriented foods. The growing awareness about the benefits of barley products, combined with the region's growing agricultural potential, is expected to support the continued expansion of the barley market.

Competitive Landscape:

Market leaders are focusing on simplifying production by bringing in new farm technology, like precision farming and better irrigation systems, to manage the crop efficiently. They are also establishing research operations to develop drought-resistant and high-yielding barley that would be suited to various climates all over the nation. Collaborations with local farmers and agricultural institutions are increasing to mechanize supply chains and ensure consistency in quality. Furthermore, major players are strengthening their presence in the malting and brewing industries for local consumption as well as exports. They are also launching new varieties with unique flavors to suit the varying taste pallets. In 2023, the South Seas Distilleries introduced its inaugural retail whisky label, "Crazy Cock," with two expressions: Double Oak and Dhua. Made from 6-row Indian barley and aged in ex-bourbon and ex-sherry casks, Crazy Cock has a rich, full-bodied taste with a peaty depth in Dhua.

The report provides a comprehensive analysis of the competitive landscape in the India barley market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: United Breweries Limited (UBL) launched its premium beer, Amstel Grande, in India, crafted with the finest barley, unique Dutch yeast, and carefully selected hops. The gradual brewing method guarantees a deep, velvety flavor. Currently offered in Maharashtra, the beer plans to extend to additional states, addressing India's increasing desire for premium beers.

- December 2024: Himmaleh Spirits commenced whisky making at its newly established distillery in Uttarakhand, utilizing Indian barley sourced locally and employing Scottish Forsyths pot stills. The distillery aimed to redefine Indian single malts with a Himalayan influence.

- September 2024: The foundation for Pernod Ricard's largest malt distillery in India was laid on October 7 in Nagpur. The facility boosted local barley farming and created significant opportunities for Vidarbha's farmers. The distillery, with a daily capacity of 60,000 liters, is considered the biggest in India and possibly Asia.

- August 2024: Paul John Single Malt and SMAC launched the limited-edition whisky "Ego" in India. This was released solely as part of the Alter-Ego cask series, limited to 120 bottles and available exclusively to SMAC members. It highlighted the brand's dedication to outstanding single malt whisky, produced from regional barley and matured in Goa's warm climate.

India Barley Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Covered, Two-Row Barley, Six-Row Barley, Hulless |

| Grades Covered | Food Grade, Feed Grade, Malt Grade |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores |

| Industry Verticals Covered | Food And Beverages, Pharmaceuticals, Seed Industry, Personal Care, Animal Feed, Nutraceuticals, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India barley market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India barley market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India barley industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The barley market in the India was valued at USD 822.6 Million in 2025.

The growth of the India barley market is driven by the increasing demand for barley in food, beverages, and livestock feed, rising health awareness promoting its nutritional benefits, government initiatives supporting agriculture, and the expanding craft beer industry, boosting production and usage.

The India barley market is projected to exhibit a CAGR of 4.32% during 2026-2034, reaching a value of USD 1,227.9 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)