India Bath Accessories Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2025-2033

India Bath Accessories Market Overview:

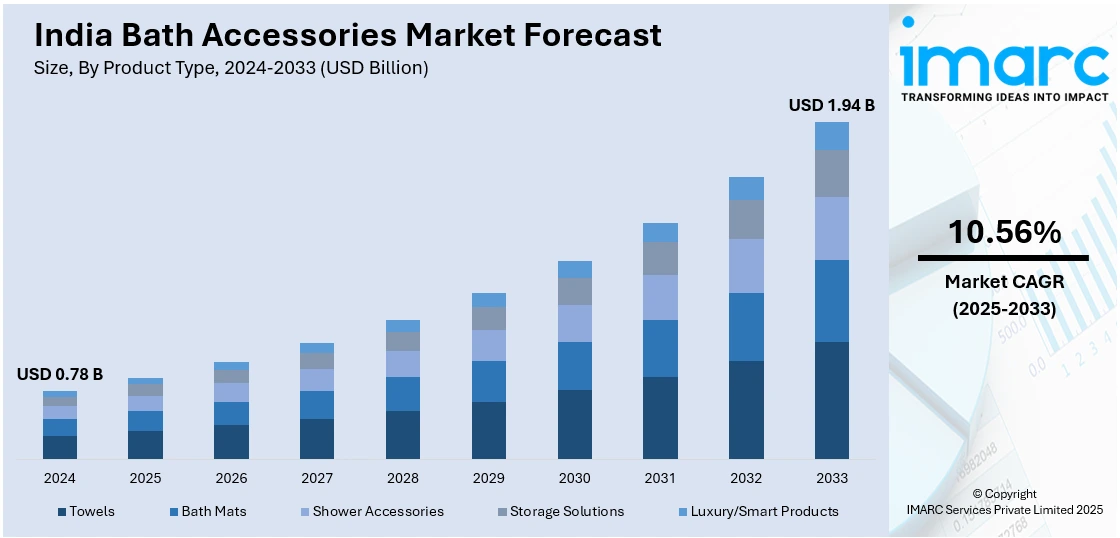

The India bath accessories market size reached USD 0.78 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.94 Billion by 2033, exhibiting a growth rate (CAGR) of 10.56% during 2025-2033. The market involves rising urbanization, increasing disposable incomes, greater awareness of hygiene, and the influence of modern interior design trends. Additionally, government initiatives for sanitation, expanding real estate and hospitality sectors, and the growing preference for premium, eco-friendly, and digitally accessible products impelling India bath accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.78 Billion |

| Market Forecast in 2033 | USD 1.94 Billion |

| Market Growth Rate 2025-2033 | 10.56% |

India Bath Accessories Market Trends:

Rising Demand for Premium and Aesthetic Products

India's expanding middle and upper-middle classes are investing more in luxury and beautiful bath accessories. Bathrooms are not only functional areas for consumers but also areas for relaxation and self-expression. Consequently, there is heightened demand for designer taps, rain showers, sensor taps, and sleek vanity units. Global interior design trends, social media, and home décor shows influence tastes for premium finishes such as brushed gold or matte black. This is particularly prevalent in urban centers where disposable incomes and aspirations are higher. Brands are also emphasizing product customization and modular designs to satisfy these changing tastes.

To get more information on this market, Request Sample

E-Commerce and Omni-Channel Expansion

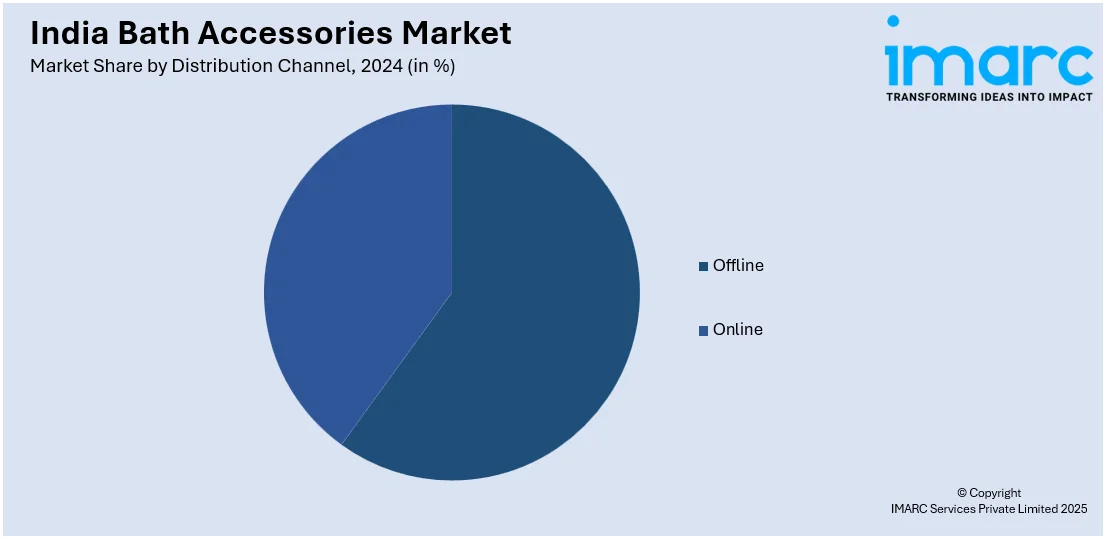

The Indian bath accessories market has been transformed by the digital revolution in India, with e-commerce driving sales through a leading channel. Sites such as Amazon, Flipkart, and niche decor websites enable customers to browse a large range of products, compare prices, and read reviews before making a buy. Most brick-and-mortar stores are also going omni-channel, marrying online catalogs with offline experience centers. The availability of augmented reality (AR) technologies and virtual showrooms has further increased the effectiveness of online shopping. The trend has developed large momentum following COVID, as consumers value convenience, safety, and greater variety. Notably, the growth of e-commerce in tier 2 and tier 3 cities, which now account for over 60% of sales, is expanding the reach of bath accessories beyond metropolitan areas, driving overall India bath accessories market growth.

Growing Popularity of Eco-Friendly and Sustainable Products

Sustainability is becoming an important factor for Indian consumers while buying bath accessories. There is a growing awareness regarding water conservation, material sustainability, and green living. Low-flow showerheads, dual-flush toilets, bamboo toothbrush holders, and recycled metal soap dispensers are some of the popular products. Green manufacturing processes and biodegradable packaging are now highlighted by many brands. Swachh Bharat campaigns and greater environmental education have helped to bring about this change. Urban millennials and Gen Z are specifically leading this shift through demanding ethics, transparent sourcing, and low-environmental-impact products, and the need for firms to rebrand and innovate sustainably.

India Bath Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, distribution channel, and end user.

Product Type Insights:

- Towels

- Bath Mats

- Shower Accessories

-

- Curtains

- Rods

- Caddies

-

- Storage Solutions

-

- Shelves

- Soap Dispensers

-

- Luxury/Smart Products

-

- Digital Mirrors

- Sensor Faucets

-

The report has provided a detailed breakup and analysis of the market based on the product type. This includes towels, bath mats, shower accessories (curtains, rods, and caddies), storage solutions (shelves and soap dispensers), and luxury/smart products (digital mirrors and sensor faucets).

Material Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes natural and synthetic.

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bath Accessories Market News:

- In April 2025, Gravity Bath Pvt. Ltd., one of India’s fastest-growing bathware brands, launched its first company-owned stores in New Delhi and Mumbai. This milestone marks its evolution into a ₹200+ crore enterprise with nationwide presence. The experiential retail stores showcase the brand’s full range of innovative, sustainable, and user-centric bathroom solutions, reinforcing its mission to deliver joy, quality, and design excellence in every bathroom space.

- In February 2025, TOTO India launched a new matte-finish washbasin range designed for modern, personalized bathrooms. Featuring an above-counter design and crafted with ultra-thin yet durable LINEARCERAM technology, the collection offers both elegance and strength. Managing Director Shiozawa Kazuyuki highlighted the growing demand for luxury and style in home spaces. TOTO plans to expand its offerings with a variety of toilets, faucets, showers, and accessories in diverse designs and colours.

India Bath Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Materials Covered | Natural, Synthetic |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bath accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bath accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bath accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bath accessories market in India was valued at USD 0.78 Billion in 2024.

The India bath accessories market is projected to exhibit a CAGR of 10.56% during 2025-2033, reaching a value of USD 1.94 Billion by 2033.

Major drivers of the India bath accessories market are urbanization, growing disposable incomes, and shifting consumer preferences for premium and aesthetic bathroom fittings. Demand is also driven by the growth of the real estate and hospitality industries. The trend of increasing awareness of hygiene, impact of home decoration trends, and presence of innovative, space-efficient accessories also boost demand across urban and semi-urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)