India Bath Mats and Rugs Market Size, Share, Trends and Forecast by Product Type, End-User, and Region, 2026-2034

India Bath Mats and Rugs Market Summary:

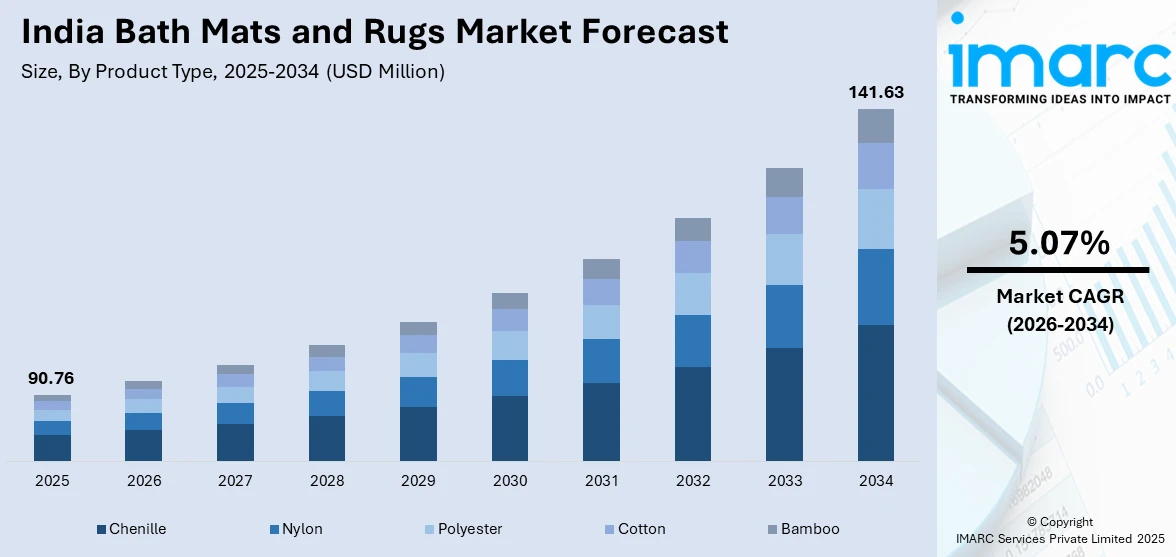

The India bath mats and rugs market size was valued at USD 90.76 Million in 2025 and is projected to reach USD 141.63 Million by 2034, growing at a compound annual growth rate of 5.07% from 2026-2034.

The India bath mats and rugs market is experiencing robust growth driven by rapid urbanization, increasing disposable incomes, and the expanding real estate and hospitality sectors. Consumer preferences are shifting toward premium, sustainable, and aesthetically designed home textiles, while e-commerce platforms are enhancing product accessibility. Growing awareness of bathroom hygiene and interior aesthetics, combined with the rising middle-class population, is further propelling India bath mats and rugs market share.

Key Takeaways and Insights:

- By Product Type: Chenille dominated the market with 28% revenue share in 2025, driven by its superior softness, plush texture, high absorbency, and quick-drying properties that appeal to comfort-seeking consumers in both residential and commercial applications.

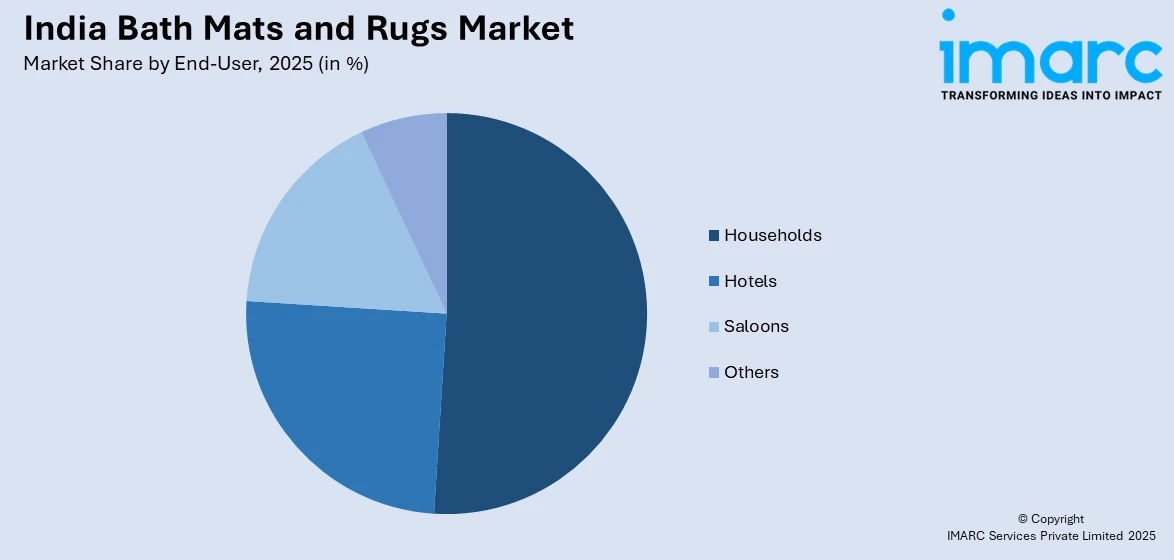

- By End-User: Households represent the largest revenue share of 51% in 2025. This dominance is driven by increasing homeownership rates, rising disposable incomes among middle-class families, and growing emphasis on bathroom aesthetics and personal hygiene in urban residences.

- By Region: North India dominated the market share of 30% in 2025, attributed to high urbanization rates in Delhi NCR, robust real estate development, concentration of hospitality establishments, and higher purchasing power among consumers in metropolitan areas.

- Key Players: The India bath mats and rugs market exhibits a fragmented competitive landscape, with domestic manufacturers competing alongside international home textile brands. Companies are focusing on product innovation, sustainable materials, and expanding distribution networks through both offline retail stores and e-commerce platforms to capture market share.

To get more information on this market Request Sample

The India bath mats and rugs market is experiencing transformative growth as the country witnesses unprecedented residential construction and hospitality sector expansion. Rapid urbanization is reshaping consumer preferences, with modern households increasingly treating bathrooms as personal wellness spaces rather than mere functional areas. According to the World Bank Group, by 2036, approximately 600 million people will reside in Indian cities, representing 40% of the total population compared to 31% in 2011, with metropolitan areas contributing over 70% of GDP. This urban expansion is driving demand for coordinated bathroom accessories including premium bath mats featuring anti-slip properties, quick-drying capabilities, and aesthetic designs. The India luxury hotel market size reached USD 2.7 Billion in 2024. The market is expected to reach USD 6.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8.83% during 2025-2033, and is particularly influencing consumer expectations as homeowners seek to replicate hotel-style bathroom experiences in their residences.

India Bath Mats and Rugs Market Trends:

Rising Demand for Antimicrobial and Premium Bath Textiles

Rising consumer focus on bathroom hygiene is boosting demand for bath mats and rugs with antimicrobial properties that help control bacteria and minimize odors. Urban households are increasingly favoring premium materials that offer better absorbency, quick-drying performance, and long-lasting durability. The hospitality sector is also shaping this trend, with hotels investing in high-quality bathroom textiles featuring antimicrobial treatments and personalized designs. This shift highlights a broader emphasis on combining hygiene, functionality, and premium aesthetics in modern bathroom solutions.

E-commerce Expansion Transforming Distribution Channels

Digital retail platforms are transforming the way consumers explore and purchase bath mats and rugs, providing a wide range of products, competitive pricing, and convenient home delivery. These platforms allow shoppers to compare designs, materials, and styles while accessing a mix of domestic and international offerings. The growing adoption of online home decor channels is expanding opportunities for the bath textile segment, as e-commerce platforms increasingly enhance their home furnishing categories to meet rising consumer demand and preferences for convenience and variety. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034.

Growing Preference for Sustainable and Eco-Friendly Materials

Environmental consciousness is increasingly influencing purchasing decisions, with consumers seeking bath mats and rugs made from sustainable materials such as organic cotton, bamboo, and recycled fibers. Manufacturers are responding by incorporating eco-friendly production processes and obtaining GOTS (Global Organic Textile Standard) certifications. Bamboo bath mats are gaining particular traction due to their natural antimicrobial properties, moisture resistance, and sustainability credentials. For instance, in May 2025, Sharadha Terry Products Private Limited (STPPL), renowned globally for its premium MicroCotton bath textiles, expanded into the sustainable rug segment with a $1.75 million investment from the Good Fashion Fund (GFF). The funding supported the establishment of a state-of-the-art rug manufacturing facility, Sri Gugan Mills, in Metupalayam, Tamil Nadu. This reflects the premiumization and sustainability trends shaping consumer preferences.

Market Outlook 2026-2034:

The outlook for the India bath mats and rugs market remains positive, driven by supportive demographic trends, growing infrastructure development, and changing consumer lifestyles. Expansion in the residential construction sector continues to fuel demand for home textiles, including bath accessories, as households seek functional and aesthetically appealing solutions for modern living spaces. Government initiatives like PM Awas Yojana, targeting housing needs for one crore urban families with Rs. 10 lakh crore investment, will expand the addressable market. The market generated a revenue of USD 90.76 Million in 2025 and is projected to reach a revenue of USD 141.63 Million by 2034, growing at a compound annual growth rate of 5.07% from 2026-2034.

India Bath Mats and Rugs Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Chenille |

28% |

|

End-User |

Households |

51% |

|

Region |

North India |

30% |

Product Type Insights:

- Chenille

- Nylon

- Polyester

- Cotton

- Bamboo

Chenille dominates with a market share of 28% of the total India bath mats and rugs market in 2025.

Chenille bath mats have established market leadership owing to their exceptional softness, plush texture, and superior comfort that creates a luxurious bathroom experience. The thick, shaggy chenille fibers provide excellent moisture absorption while drying quickly, making them ideal for high-traffic residential and commercial bathrooms. Consumer preference for spa-like comfort in home settings has accelerated demand for chenille products, with manufacturers offering diverse color options and anti-slip backings to enhance safety and aesthetic appeal.

The segment has been driven by ongoing product innovation, with brands integrating advanced materials and sustainable treatments to improve performance and environmental friendliness. Premium bath mats with features like memory foam layers and antimicrobial properties are increasingly favored by urban consumers looking for enhanced bathroom comfort and hygiene. Manufacturers are also emphasizing quality certifications to assure safety and durability, reinforcing the appeal and market positioning of high-end bath textiles.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Hotels

- Saloons

- Households

- Others

The households segment leads with a share of 51% of the total India bath mats and rugs market in 2025.

The residential segment commands market leadership driven by increasing homeownership rates, rising middle-class incomes, and growing consumer emphasis on bathroom aesthetics and personal hygiene. Urban households are increasingly investing in quality bath mats and rugs as functional necessities and decorative elements that enhance overall bathroom design. Social media platforms and home improvement content have heightened awareness about contemporary bathroom styling, encouraging consumers to invest in coordinated bathroom accessories that reflect personal taste and modern living standards.

The residential segment is further boosted by the expanding real estate sector, with new construction activity and home renovation projects driving replacement and upgrade purchases. Nuclear family formation, particularly in metropolitan areas, is creating demand for smaller, stylish, and space-efficient bath mats suitable for compact urban bathrooms. Research indicates that 33% of millennials and 23% of Gen Z consumers plan to purchase rugs and home textiles, highlighting significant market potential among younger demographics seeking customized and aesthetically appealing bathroom solutions.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits clear dominance with a 30% share of the total India bath mats and rugs market in 2025.

North India maintains market leadership driven by the concentration of urban population in Delhi NCR, high real estate development activity, and robust hospitality sector presence. The region benefits from higher disposable incomes, well-established retail infrastructure, and strong e-commerce penetration that facilitates access to diverse bath textile products. Major metropolitan areas, including Delhi, Noida, and Gurugram, house numerous luxury hotels, modern residential complexes, and commercial establishments that drive consistent demand for quality bath mats and rugs.

The region benefits from its proximity to major textile manufacturing clusters and distribution centers, enabling efficient supply chain operations and competitive product pricing. Retail expansion in North India continues to strengthen market presence, with stores offering a mix of contemporary and culturally inspired home decor, including bathroom accessories. Ongoing government infrastructure development and smart city initiatives are supporting urbanization, creating favorable conditions for growth in the home textiles and bath accessory market. These factors collectively reinforce the region’s strategic importance for distribution and consumer accessibility.

Market Dynamics:

Growth Drivers:

Why is the India Bath Mats and Rugs Market Growing?

Rapid Urbanization and Expanding Residential Construction

India’s rapid urbanization is reshaping demand for bathroom accessories, as growing numbers of consumers move into modern living spaces that prioritize coordinated interiors and personal comfort. Expansion in residential construction is driving a larger market for bath mats and rugs, with contemporary homes increasingly featuring designer bathrooms where bath textiles serve both practical and decorative roles, blending functionality with aesthetic appeal. The Union Budget 2025-26 allocated Rs. 78,126 crore for PM Awas Yojana, representing a 64% increase, targeting housing for millions of urban families and subsequently driving demand for home furnishing products, including bath accessories.

Booming Hospitality Industry Elevating Product Standards

The expanding hospitality sector is creating substantial demand for premium bath mats and rugs while simultaneously influencing residential consumer expectations. Luxury hotels, resorts, and boutique accommodations prioritize bathroom experiences as key differentiators, investing in high-quality, antimicrobial-treated bath textiles featuring custom branding and coordinated designs. This emphasis on premium bathroom accessories cascades to residential markets as consumers seek to replicate hotel-style comfort in their homes. The hospitality industry's focus on hygiene, durability, and aesthetic appeal is raising product standards across the market, encouraging manufacturers to innovate with advanced materials and treatments.

Rising Consumer Awareness of Hygiene and Home Aesthetics

Growing consumer consciousness regarding bathroom hygiene and interior design is accelerating demand for quality bath mats and rugs. Urban consumers increasingly view bathrooms as personal wellness spaces deserving thoughtful accessorization rather than merely functional areas. Government initiatives emphasizing sanitation have heightened awareness about maintaining clean bathroom environments. The proliferation of social media platforms and home improvement content has exposed consumers to global interior design trends, inspiring investments in stylish bath textiles that complement overall home aesthetics. This behavioral shift toward viewing bath accessories as both functional necessities and design elements is driving market premiumization.

Market Restraints:

What Challenges the India Bath Mats and Rugs Market is Facing?

Intense Competition from Low-Cost Imports

There is immense competition of the market with cheap imported bath mats and rugs, especially through the Asian manufacturing centers that offer competitive prices. The imports compete with local manufacturers on pricing, which may reduce profit margins and market share expansion of quality-oriented manufacturers. Price-sensitive consumer segment tends to focus more on price rather than quality, thus fragmenting the market.

Limited Product Differentiation in the Mass Market

The market of bath mats and rugs is facing commoditization of its products in the mass-market segment, where very minimal product differentiation limits pricing power and brand building. Because of the perception of a basic bath mat by many consumers as a commodity that can be substituted by others, it is difficult to charge high prices unless the manufacturer is adding premium features to it. It is a pressure of commoditization that applies to smaller manufacturers who are not well-endowed in terms of innovation.

Raw Material Price Volatility

The unpredictable changes in prices of cotton, synthetic fibers and any other raw materials pose a threat to manufacturers regarding production costs and profit margins. Pricing strategies and inventory management are complicated because of supply chain disruptions and fluctuating prices of commodities. Such pressure on costs may constrain the capacity of manufacturers to invest in product innovation and product expansion projects.

Competitive Landscape:

The India bath mats and rugs market exhibits a fragmented competitive structure characterized by the presence of numerous domestic manufacturers, regional players, and international home textile brands. Companies compete across multiple dimensions including product quality, design innovation, pricing strategies, and distribution network strength. Leading players are investing in sustainable manufacturing practices, premium product development, and e-commerce capabilities to differentiate their offerings. Brand building remains challenging in the mass-market segment, while premium and luxury segments offer greater opportunities for differentiation through quality, design exclusivity, and antimicrobial features. Strategic partnerships, retail expansion, and product portfolio diversification are key competitive strategies employed by market participants.

Recent Developments:

- January 2025: Jaipur Rugs, India's largest handmade carpet manufacturer, acquired the iconic Shyam Ahuja luxury rug and fabric brand, obtaining the entire design archive and personal collection. The acquisition strengthens Jaipur Rugs' position in the premium home textile segment and expands its portfolio of heritage craftsmanship products.

- January 2025: Jaipur Rugs expanded its retail presence with the opening of its first store in Raipur, Chhattisgarh, increasing the company's total store count to 19, including international flagship locations in Milan, Dubai, London, and Singapore.

- December 2024: Jaipur Rugs announced the 'Jardins du Monde' collection in collaboration with Paris-based designer Tatiana de Nicolay. The series comprises seven distinct designs inspired by renowned gardens worldwide including the Albert Kahn gardens in Paris, handcrafted by artisans in Rajasthan.

India Bath Mats and Rugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chenille, Nylon, Polyester, Cotton, Bamboo |

| End-Users Covered | Hotels, Saloons, Households, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bath mats and rugs market size was valued at USD 90.76 Million in 2025.

The India bath mats and rugs market is expected to grow at a compound annual growth rate of 5.07% from 2026-2034 to reach USD 141.63 Million by 2034.

Chenille dominated the product type segment with 28% market share in 2025, driven by its superior softness, plush texture, high absorbency, and quick-drying properties appealing to comfort-seeking consumers.

Key factors driving the India bath mats and rugs market include rapid urbanization and residential construction growth, expanding hospitality sector driving premium product demand, rising consumer awareness of bathroom hygiene and aesthetics, and e-commerce expansion enabling wider product accessibility.

Major challenges include intense competition from low-cost imports, limited product differentiation in the mass-market segment, raw material price volatility affecting manufacturing costs, and fragmented market structure limiting brand building opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)