India Battery Monitoring System Market Size, Share, Trends, and Forecast by Component, Type, Battery Type, End User, and Region, 2025-2033

India Battery Monitoring System Market Overview:

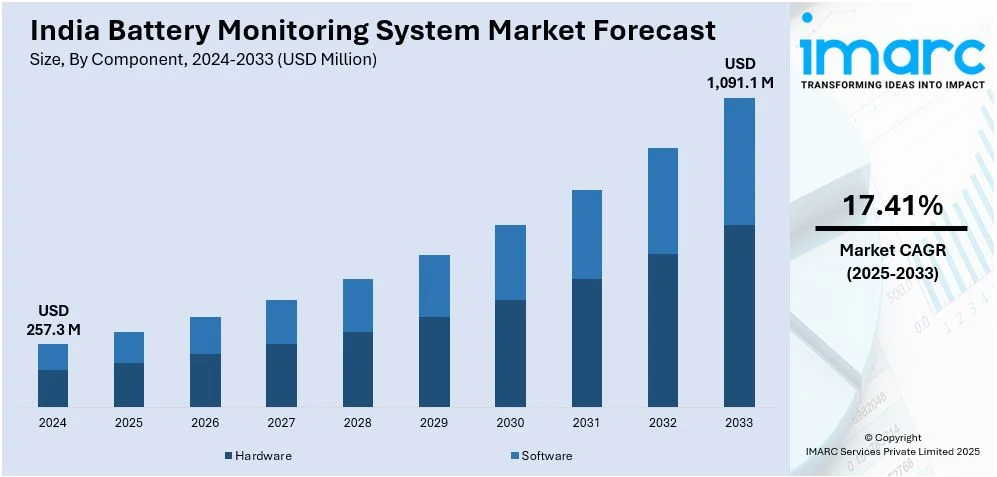

The India battery monitoring system market size reached USD 257.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,091.1 Million by 2033, exhibiting a growth rate (CAGR) of 17.41% during 2025-2033. The market is witnessing notable growth with the widespread implementation of battery monitoring systems in renewable energy storage and the increasing requirement for battery monitoring in electric vehicles. Extensive research and development operations further boost the market growth significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 257.3 Million |

| Market Forecast in 2033 | USD 1,091.1 Million |

| Market Growth Rate 2025-2033 | 17.41% |

India Battery Monitoring System Market Trends:

Increasing Adoption of Battery Monitoring Systems in Renewable Energy Storage

The increased deployment of renewable energies in India is driving the demand for battery monitoring systems. With approaches like the National Solar Mission and offshore wind energy initiatives, the Indian government is actively promoting the integration of renewable energy sources, thereby increasingly calling for efficient energy storage solutions. Battery Energy Storage Systems are playing a vital role in balancing power supply, especially in solar and wind power plants where energy generation is variable. For instance, in February 2024, SECI announced commissioning of India’s largest 40MW/120MWh solar-powered BESS in Rajnandgaon, Chhattisgarh, featuring a 152.325MWh PV plant with 100MW AC dispatchable capacity, enhancing renewable energy storage and grid stability. Battery monitoring systems play a crucial role in improving the performance and lifespan of energy storage units by providing real-time insights into battery health, charge levels, temperature, and potential failures. Advanced monitoring technologies with predictive analytics and remote monitoring capabilities are becoming standard to prevent costly downtime and enhance grid reliability. As India aims to achieve 500 GW of non-fossil fuel capacity by 2030, the deployment of smart battery management solutions will continue accelerating, particularly in utility-scale energy storage projects. The rise of grid modernization, alongside government policies supporting battery storage, is expected to further boost the adoption of battery monitoring systems, ensuring operational efficiency and cost-effectiveness in the country’s renewable energy infrastructure.

To get more information on this market, Request Sample

Growing Demand for Battery Monitoring in Electric Vehicles (EVs)

The rapid expansion of India’s electric vehicle (EV) industry is driving significant growth in the battery monitoring system market. With the Indian government’s push toward vehicle electrification through schemes such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) initiative, the demand for advanced battery management solutions is rising. For instance, in January 2025, Neuron Energy announced the launch of a 1.5 GWh lithium-ion battery plant in Chakan, India, producing high-performance batteries for EVs, energy storage, drones, and telecom solutions across a five-acre facility. EV batteries require continuous monitoring to optimize performance, prevent overheating, and extend battery life, making battery monitoring systems essential for both passenger and commercial EVs. Automakers and battery manufacturers are integrating smart battery monitoring technologies with cloud-based analytics, real-time diagnostics, and AI-driven predictive maintenance to enhance battery efficiency and safety. The increasing adoption of lithium-ion batteries in electric two-wheelers, three-wheelers, and fleet operations further strengthens the need for precise battery health tracking. Additionally, India’s expanding EV charging infrastructure, including ultra-fast charging stations, necessitates robust monitoring to prevent overcharging and ensure battery longevity. As battery costs remain a major factor in EV affordability, manufacturers are investing in advanced battery monitoring solutions to maximize energy utilization and reduce maintenance expenses. The EV sector’s growth, combined with technological advancements, will continue fueling the battery monitoring system market in India.

India Battery Monitoring System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, type, battery type, and end user.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Type Insights:

- Wired Battery Monitoring System

- Wireless Battery Monitoring System

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes Wired Battery Monitoring System and Wireless Battery Monitoring System.

Battery Type Insights:

- Lithium-Ion Based Battery

- Lead-Acid Battery

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes Lithium-Ion Based Battery, Lead-Acid Battery, and Others.

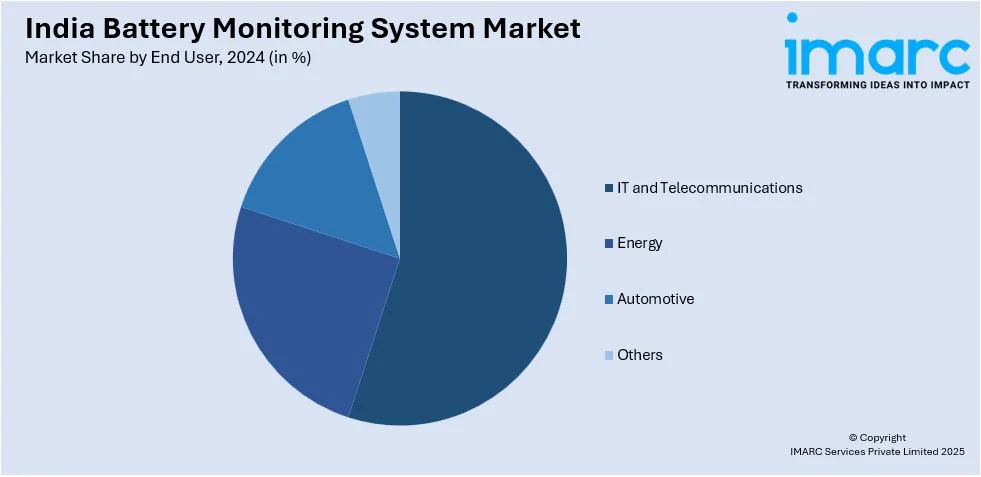

End User Insights:

- IT and Telecommunications

- Energy

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes IT and Telecommunications, Energy, Automotive, and Others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Battery Monitoring System Market News:

- In January 2025, The India Energy Storage Alliance (IESA) announced its plans for a $500 million investment in India's battery and mobility startup ecosystem within a year. This funding will drive innovation, R&D, and product advancements, benefiting companies in Battery Management Systems (BMS), safety, and components. IESA hosted Start-Up Connect with Hero MotoCorp at Bharat Battery Show 2025.

- In May 2024, The Delhi Electricity Regulatory Commission (DERC) approved India’s first commercial standalone Battery Energy Storage System (BESS) project. Supported by GEAPP’s concessional loan covering 70% of costs and partnered with IndiGrid and BRPL, this initiative positions India as a leader in global energy transition efforts.

India Battery Monitoring System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Types Covered | Wired Battery Monitoring System, Wireless Battery Monitoring System |

| Battery Types Covered | Lithium-Ion Based Battery, Lead-Acid Battery, Others |

| End Users Covered | IT and Telecommunications, Energy, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India battery monitoring system market performed so far and how will it perform in the coming years?

- What is the breakup of the India battery monitoring system market on the basis of component?

- What is the breakup of the India battery monitoring system market on the basis of type?

- What is the breakup of the India battery monitoring system market on the basis of battery type?

- What is the breakup of the India battery monitoring system market on the basis of end user?

- What is the breakup of the India battery monitoring system market on the basis of region?

- What are the various stages in the value chain of the India battery monitoring system market?

- What are the key driving factors and challenges in the India battery monitoring system?

- What is the structure of the India battery monitoring system market and who are the key players?

- What is the degree of competition in the India battery monitoring system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India battery monitoring system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India battery monitoring system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India battery monitoring system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)