India Beer Market Size, Share, Trends and Forecast by Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel, and Region, 2026-2034

India Beer Market Summary:

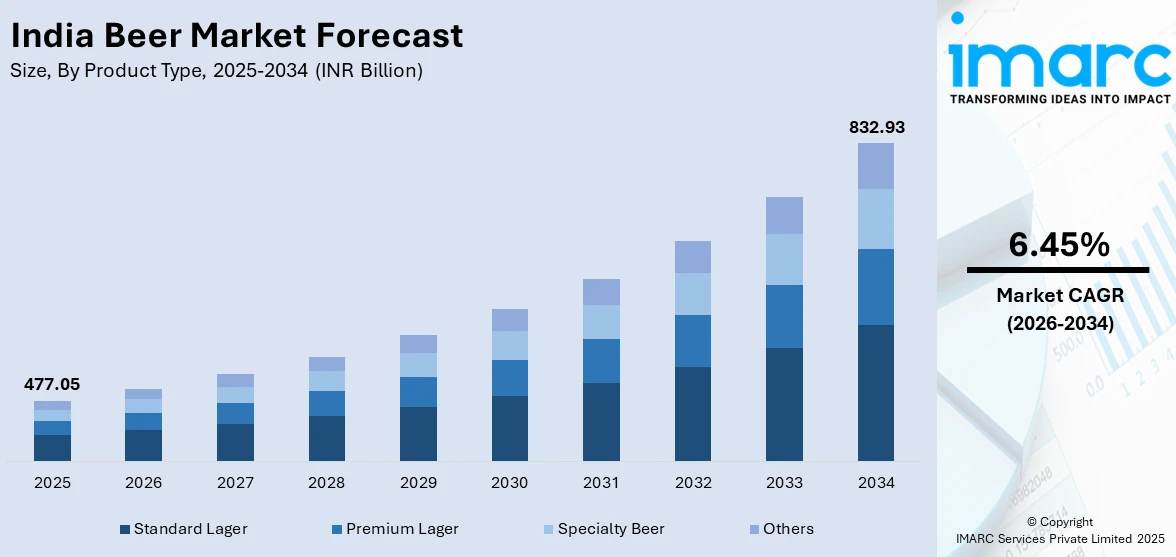

The India beer market size was valued at INR 477.05 Billion in 2025 and is projected to reach INR 832.93 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

The market is driven by rising urbanization, evolving consumer preferences toward premium beverages, and increasing social acceptance of beer consumption among young adults. Growing disposable incomes among the middle-class population, expanding hospitality and tourism sectors, and the proliferation of modern retail formats are further contributing to market expansion. Additionally, favorable demographic trends, shifting lifestyle patterns, and the growing influence of Western drinking culture are accelerating demand, strengthening India beer market share.

Key Takeaways and Insights:

- By Product Type: Standard lager dominates the market with a share of 52% in 2025, driven by widespread consumer acceptance, affordability, and extensive availability across diverse retail and on-trade channels throughout the country.

- By Packaging: Glass leads the market with a share of 40% in 2025, owing to consumer perception of superior taste preservation, premium positioning, and traditional brand associations with quality.

- By Production: Macro-brewery represents the largest segment with a market share of 69% in 2025, driven by stablished distribution networks, production economies of scale, and extensive brand portfolios catering to mass consumer segments.

- By Alcohol Content: Low dominates the market with a share of 44% in 2025, owing to health-conscious consumption patterns, favorable regulatory preferences, and suitability for tropical climate conditions prevalent nationwide.

- By Flavor: Unflavored leads the market with a share of 73% in 2025, driven by strong traditional consumer preferences, mainstream appeal, and consistent demand across all diverse demographic segments nationwide.

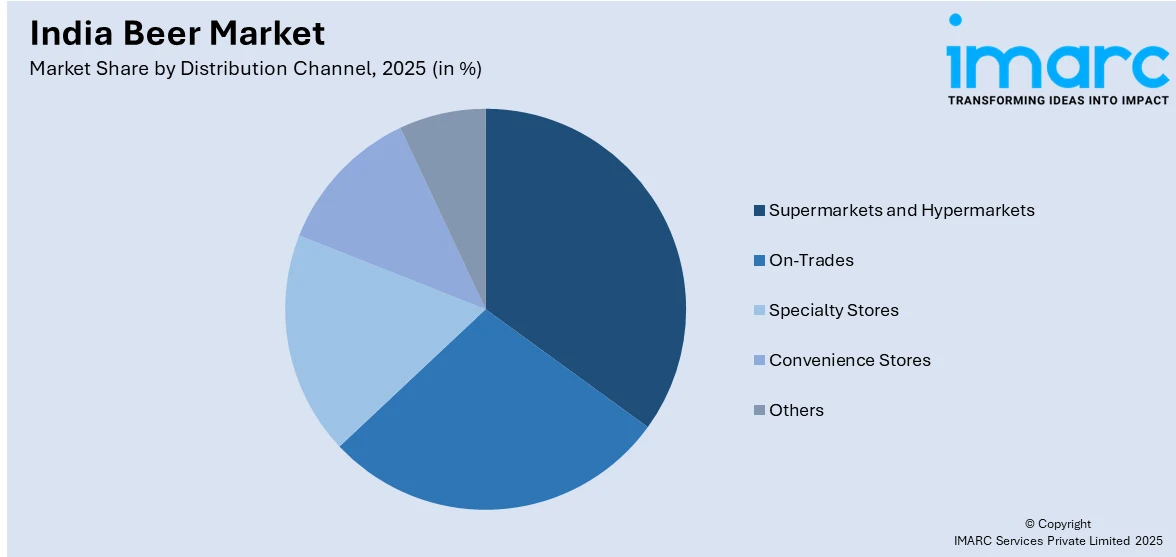

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 34% in 2025, owing to organized retail expansion, convenient one-stop shopping experiences, and attractive promotional pricing strategies offered nationwide.

- By Region: North India leads the market with a share of 29% in 2025, driven by favorable regulatory environments in certain states, high population density, and strong presence of hospitality establishments nationwide.

- Key Players: The India beer market exhibits a consolidated competitive landscape, with established multinational brewing corporations competing alongside regional manufacturers across premium and economy price segments. Companies focus on distribution expansion, brand building, and product innovation initiatives to capture market share nationwide. Some of the key players operating in the market include Anheuser-Bush InBev SA NV, Arbor Brewing Company India, B9 Beverages Private Limited, Carlsberg India Private Limited, Devans Modern Breweries Ltd., Gateway Brewing Company, SOM Distilleries And Breweries Limited, Sona Beverages Private Limited, United Breweries Limited (Heineken N.V.), and White Rhino Brewing Co.

To get more information on this market Request Sample

The India beer market is experiencing robust growth fueled by a confluence of socioeconomic and demographic factors that are reshaping consumer behavior patterns. Rising urbanization and the expansion of metropolitan areas are creating new consumption hubs where beer is increasingly viewed as a preferred social beverage. In January 2026, Carlsberg India invested ₹100 Crore to install a new canning line at its Mysuru brewery, boosting production capacity to 22,000 Cans per hour and reinforcing its commitment to meeting rising demand in the Indian market. Moreover, the growing working-age population, coupled with increasing exposure to global lifestyle trends through digital media, is driving demand for diverse beer offerings. Furthermore, the hospitality industry's expansion, including restaurants, bars, and hotels, is creating additional consumption occasions. The retail landscape is also evolving with modern trade formats offering improved accessibility and product visibility, thereby facilitating market penetration across previously underserved regions and consumer segments, supporting sustained industry expansion.

India Beer Market Trends:

Premiumization and Craft Beer Movement

The Indian beer market is witnessing a significant shift toward premium and craft offerings as consumers increasingly seek differentiated drinking experiences. As per sources, in April 2025, Red Rhino opened a commercial brewery in Malur, Karnataka, expanding distribution of Signature Lager and Hefeweizen across Bengaluru and Hyderabad, enhancing accessibility of premium craft beers. Furthermore, urban millennials and young professionals are demonstrating willingness to explore artisanal brews that offer unique flavor profiles and authentic brewing heritage. This trend is fostering innovation in product development, with breweries focusing on small-batch production, local ingredient sourcing, and distinctive branding strategies.

Health-Conscious Consumption Patterns

Consumer awareness regarding health and wellness is fundamentally transforming beer consumption patterns across India. In September 2025, Ironhill India launched “Zero Gravity AF,” its first non‑alcoholic wheat beer with under 0.5% ABV, catering to health‑conscious drinkers seeking beer experiences without alcohol and reflecting brands’ responses to rising demand for low‑alcohol options. There is growing demand for low-alcohol, light, and calorie-reduced variants that align with fitness-oriented lifestyles without entirely sacrificing social drinking occasions. This trend is encouraging product innovation focused on developing beverages that balance taste preferences with nutritional considerations.

On-Premises Experience Enhancement

The expansion and premiumization of on-trade channels are significantly influencing beer consumption culture in India. Brewpubs, microbrewery restaurants, and themed drinking establishments are proliferating in urban areas, offering consumers immersive experiences that combine quality beer with food pairings and social entertainment. According to sources, in January 2026, Beerlin opened its neighbourhood brewpub at South Point Mall, Gurugram, offering freshly brewed in-house beers and casual dining, enhancing the city’s craft beer and experiential hospitality scene.

Market Outlook 2026-2034:

The India beer market is projected to demonstrate sustained revenue growth during the forecast period, driven by favorable demographic dynamics and evolving consumption patterns. Rising disposable incomes among the expanding middle class are expected to support increased per capita consumption, while premiumization trends will enhance overall market value. Ongoing modernization of retail infrastructure and hospitality sectors will improve product accessibility. Regulatory liberalization and growing social acceptance are anticipated to create favorable conditions for market expansion. The market generated a revenue of INR 477.05 Billion in 2025 and is projected to reach a revenue of INR 832.93 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

India Beer Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Standard Lager |

52% |

|

Packaging |

Glass |

40% |

|

Production |

Macro-Brewery |

69% |

|

Alcohol Content |

Low |

44% |

|

Flavor |

Unflavored |

73% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

34% |

|

Region |

North India |

29% |

Product Type Insights:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Standard lager dominates with a market share of 52% of the total India beer market in 2025.

Standard lager maintains its dominant position in the India beer market, representing the largest revenue share among all product categories available nationwide. This segment benefits from widespread consumer familiarity, consistent taste profiles, and competitive pricing structures that appeal to mass-market consumers across diverse socioeconomic segments. In August 2025, United Breweries launched a ₹90 Crore canned beer facility at Nizam Brewery, Telangana, expanding production of Kingfisher, Kingfisher Ultra, and Heineken to meet growing consumer demand.

Standard lager market leadership is further reinforced by extensive distribution coverage spanning urban, semi-urban, and emerging rural markets across the country. Established brand recognition and strong consumer loyalty ensure repeat purchases and sustained demand, while the segment's price accessibility positions it as the primary entry point for new beer consumers exploring alcoholic beverages. Continuous marketing investments, promotional activities, and strategic brand campaigns maintain strong recall, supporting sustained demand across both retail and on-trade channels throughout India.

Packaging Insights:

- Glass

- PET Bottle

- Metal Can

- Others

Glass leads with a share of 40% of the total India beer market in 2025.

Glass commands the leading position in India's beer market, driven by consumer perception of superior quality preservation and strong premium product associations among discerning buyers. Traditional glass bottles maintain robust appeal among consumers who associate this packaging format with authenticity, heritage, and enhanced taste experience compared to alternative materials. In July 2025, Kerala’s Bevco introduced a bottle deposit scheme for glass beer bottles, refunding ₹20 on returns to boost recycling and sustainable glass packaging use.

The dominance of glass reflects established infrastructure investments and deeply ingrained consumer drinking rituals that favor bottle service in both off-trade and on-trade settings across India. Returnable bottle systems offer significant economic advantages for manufacturers and retailers alike, while the premium visual appeal strongly supports brand differentiation strategies. Glass packaging remains integral to the overall beer consumption experience, particularly in hospitality venues where sophisticated presentation and serving aesthetics contribute meaningfully to enhanced consumer satisfaction and enjoyment.

Production Insights:

- Macro-Brewery

- Micro-Brewery

- Others

Macro-brewery exhibits a clear dominance with a 69% share of the total India beer market in 2025.

Macro-brewery dominates India's beer production landscape through extensive manufacturing capabilities, nationwide distribution networks, and substantial operational scale advantages. These large-scale production operations benefit significantly from economies of scale that enable highly competitive pricing while maintaining consistent product quality across high-volume production batches. As per sources, in February 2025, India’s top brewers (United Breweries, AB InBev, Carlsberg) pledged over ₹3,500 Crore in capex to expand brewery facilities nationwide, reinforcing large‑scale production and distribution leadership.

The segment's sustained market leadership is maintained through substantial marketing investments, diverse brand portfolios spanning multiple price segments, and deep retail penetration across organized and traditional trade channels. Macro-breweries leverage sophisticated logistics infrastructure and cold chain networks to ensure product freshness and widespread availability across diverse geographic regions throughout India. Their considerable financial resources support continuous capacity expansion, technological upgrades, and innovation initiatives, maintaining significant competitive advantages over smaller production operations and emerging craft brewing establishments nationwide.

Alcohol Content Insights:

- High

- Low

- Alcohol Free

Low leads with a market share of 44% of the total India beer market in 2025.

Low holds the largest revenue share within India's market, reflecting consumer preferences significantly influenced by regulatory frameworks, health considerations, and lifestyle choices. In January 2025, Gen Z and millennials significantly boosted demand for low‑alcohol and no‑alcohol beers like Budweiser 0.0 and Heineken 0.0, reflecting rising health‑focused drinking trends across urban India. Moreover, this segment appeals strongly to consumers seeking moderate consumption options that facilitate extended social occasions and gatherings without excessive intoxication or next-day aftereffects.

The segment's dominance is substantially reinforced by taxation structures in several states that favor lower alcohol content products, creating notable price advantages over stronger alternatives for cost-conscious consumers. Health-conscious individuals increasingly gravitate toward low-alcohol options as part of balanced lifestyle choices emphasizing wellness and moderation in consumption habits. Additionally, this segment serves as an accessible and approachable entry point for new consumers developing beer preferences, supporting ongoing market expansion and broadening the overall consumer base across demographic groups.

Flavor Insights:

- Unflavored

- Flavored

Unflavored leads with a share of 73% of the total India beer market in 2025.

Unflavored maintains overwhelming dominance in India's market, reflecting strong traditional consumer preferences for classic, authentic beer taste profiles without additional flavor modifications. This segment appeals broadly to mainstream consumers who value consistent, familiar flavors and straightforward taste experiences without experimental additions or unconventional ingredients. As per sources, in January 2025, Telangana briefly rationed Kingfisher beer supplies after United Breweries halted shipments amid pricing disputes, underscoring overwhelming demand for classic unflavored lagers like Kingfisher nationwide.

The segment's market leadership reflects the relatively nascent stage of flavor experimentation in India's evolving beer culture, where consumers predominantly prefer recognizable and traditional taste experiences over novel alternatives. Unflavored varieties benefit substantially from established brand portfolios, extensive distribution networks, and sustained marketing campaigns that reinforce traditional beer attributes and heritage. However, growing curiosity among younger urban consumers suggests gradual openness to flavored alternatives in future years, though unflavored options will likely maintain substantial majority preference throughout the forecast period.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 34% share of the total India beer market in 2025.

Supermarkets and hypermarkets lead India's beer distribution landscape through accelerating organized retail expansion and significantly enhanced shopping convenience for modern consumers. These retail formats offer consumers comprehensive one-stop shopping experiences with diverse brand selections, competitive pricing structures, and comfortable air-conditioned environments conducive to browsing. In October 2025, Delhi’s draft excise policy proposed mall-ready, spacious liquor stores operated by government corporations, enhancing consumer experience and modernizing beer and liquor retail outlets across the city.

The segment's leadership reflects ongoing retail modernization fundamentally transforming India's consumer landscape and shopping behavior patterns across urban and semi-urban markets. Modern trade formats provide manufacturers with premium shelf visibility, dedicated display sections, and valuable opportunities for brand activation through impactful in-store promotions and sampling activities. Temperature-controlled storage facilities ensure optimal product quality and freshness, effectively addressing concerns prevalent in traditional retail channels. Growing consumer preference for organized retail shopping experiences strongly supports continued channel expansion and market share consolidation.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 29% of the total India beer market in 2025.

North India commands the largest regional share in the beer market, driven by favorable regulatory conditions in key states and substantial population concentrations across major urban centers. The region's demographic profile, characterized by a young, rapidly urbanizing population with rising disposable incomes and evolving lifestyle preferences, creates highly supportive demand fundamentals for beer consumption. Strong presence of hospitality establishments, entertainment venues, restaurants, and nightlife destinations provide diverse consumption occasions that drive consistent regional demand throughout the year.

The region's market leadership is strongly supported by established distribution infrastructure efficiently connecting major consumption centers across multiple states and territories. Climatic conditions, particularly during extended hot summer months, drive significant seasonal demand peaks that contribute substantially to annual sales volumes and revenue generation. Ongoing urbanization trends, infrastructure development, and tourism expansion in key destinations continue expanding consumption opportunities and market penetration, reinforcing North India's position as the leading and most significant regional market for beer products.

Market Dynamics:

Growth Drivers:

Why is the India Beer Market Growing?

Demographic Dividend and Urbanization Acceleration

India's favorable demographic profile represents a fundamental driver of beer market expansion, with a substantial proportion of the population entering prime consumption age groups. In February 2026, Heineken’s India chief highlighted that India’s shift toward nuclear families and a growing young, urban middle‑class consumer base is accelerating beer adoption and reshaping drinking culture nationwide. Further, the ongoing urbanization wave is creating new metropolitan and tier-two city markets where beer consumption is gaining cultural acceptance. Young professionals relocating to urban centers for employment opportunities are adopting lifestyle patterns that include social drinking occasions.

Rising Disposable Incomes and Aspiration-Driven Consumption

Economic growth and expanding employment opportunities are driving disposable income increases across India's middle-class population, enabling discretionary spending on premium beverages including beer. Consumer aspirations are evolving toward lifestyle products that signal social status and personal success among peer groups. Beer consumption is increasingly associated with modern, cosmopolitan lifestyles portrayed through media and entertainment, encouraging adoption among upwardly mobile consumers. This income-driven demand supports premiumization trends where consumers trade up to higher-quality offerings, contributing to both volume and value market growth.

Hospitality Sector Expansion and Tourism Development

India's hospitality industry is experiencing significant expansion driven by domestic tourism growth, business travel, and increasing international visitor arrivals annually. In January 2026, Dakshina Kannada Coast received a Rs 500 Crore investment for four new five‑star hotels, aiming to expand premium hospitality options and attract more tourists to the region. Moreover, hotels, restaurants, bars, and entertainment venues are proliferating across major cities and tourist destinations, creating additional beer consumption occasions. The sector's investment in experiential dining and drinking concepts is elevating beer from a commodity to an integral component of premium hospitality offerings.

Market Restraints:

What Challenges the India Beer Market is Facing?

Stringent Regulatory and Taxation Framework

India's alcoholic beverage sector operates under complex regulatory frameworks that vary significantly across states, creating market fragmentation and operational challenges. High taxation levels increase consumer prices, potentially limiting consumption among price-sensitive segments and encouraging informal market alternatives. Licensing requirements for manufacturing, distribution, and retail create barriers that restrict market accessibility and operational efficiency.

Limited Distribution Infrastructure in Rural Areas

Despite India's large rural population, beer distribution remains concentrated in the urban and semi-urban markets due to infrastructure limitations. Inadequate cold chain facilities, fragmented retail networks, and transportation challenges restrict product freshness and availability in remote regions. This geographic concentration limits market penetration potential and constrains overall volume growth opportunities.

Cultural and Social Acceptance Barriers

The traditional social attitudes toward alcohol consumption in certain demographics and regions create demand constraints that limit market expansion. Family and community influences discourage beer consumption among specific population segments, particularly women and older generations. These cultural factors restrict overall addressable market size and limit consumption frequency among existing consumers.

Competitive Landscape:

The India beer market features a competitive structure characterized by established players maintaining significant market presence through brand portfolios spanning economy to premium segments. Competition manifests through pricing strategies, distribution expansion, marketing investments, and product innovation initiatives targeting evolving consumer preferences. Manufacturers focus on strengthening distribution networks to enhance market coverage while investing in brand building to develop consumer loyalty. The premiumization trend is intensifying competition in specialty and craft segments where differentiation opportunities exist. Strategic investments in production capacity and supply chain efficiency support competitive positioning.

Some of the key players include:

- Anheuser-Bush InBev SA NV

- Arbor Brewing Company India

- B9 Beverages Private Limited

- Carlsberg India Private Limited

- Devans Modern Breweries Ltd.

- Gateway Brewing Company

- SOM Distilleries And Breweries Limited

- Sona Beverages Private Limited

- United Breweries Limited (Heineken N.V.)

- White Rhino Brewing Co.

Recent Developments:

- In October 2025, Conan, a new 8 % ABV strong lager, was launched in Delhi by entrepreneur Arvind Bajaj. Crafted with German malt and American hops, it targets premium strong‑beer consumers seeking smoother, sophisticated flavors, with phased expansion into Uttar Pradesh and other Indian states planned throughout 2026.

India Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packagings Covered | Glass, PET Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Contents Covered | High, Low, Alcohol Free |

| Flavors Covered | Unflavored ,Flavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Anheuser-Bush InBev SA NV, Arbor Brewing Company India, B9 Beverages Private Limited, Carlsberg India Private Limited, Devans Modern Breweries Ltd., Gateway Brewing Company, SOM Distilleries And Breweries Limited, Sona Beverages Private Limited, United Breweries Limited (Heineken N.V.), and White Rhino Brewing Co. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India beer market size was valued at INR 477.05 Billion in 2025.

The India beer market is expected to grow at a compound annual growth rate of 6.45% from 2026-2034 to reach INR 832.93 Billion by 2034.

Standard lager held the largest market share, driven by widespread consumer acceptance, affordability, familiar taste profiles, and extensive availability across diverse retail and on-trade channels throughout the country, making it the preferred choice among mainstream consumers.

Key factors driving the India beer market include rising urbanization, favorable demographic dynamics, increasing disposable incomes among the middle-class population, expanding hospitality and tourism sectors, growing social acceptance among young adults, and modernization of retail distribution infrastructure across urban and semi-urban regions.

Major challenges include stringent regulatory frameworks and high taxation across states, limited distribution infrastructure in rural areas, cultural barriers to alcohol consumption, seasonal demand fluctuations, and competition from alternative alcoholic beverages.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)