India BFSI BPO Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, End User, and Region, 2025-2033

India BFSI BPO Services Market Overview:

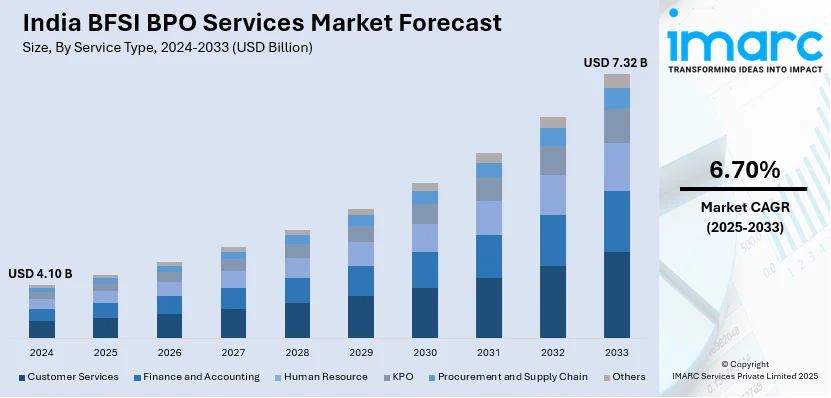

The India BFSI BPO services market size reached USD 4.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.32 Billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is growing because of cost-effectiveness, regulatory compliance requirements, digitalization, increasing fintech usage, improved risk management, automation, data security issues, and customer experience enhancement. Moreover, AI-based analytics, cloud solutions, and increased outsourcing of non-core activities are propelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.10 Billion |

| Market Forecast in 2033 | USD 7.32 Billion |

| Market Growth Rate 2025-2033 | 6.70% |

India BFSI BPO Services Market Trends:

Increased Adoption of AI and Automation in BFSI BPO Services

The convergence of artificial intelligence (AI), robotic process automation (RPA), and machine learning (ML) is revolutionizing the India BFSI BPO industry by enhancing operational efficiency, fraud detection, and customer experience. AI-driven chatbots and virtual assistants are processing mundane banking queries, cutting response time and improving customer experience. RPA is automating back-office operations like data entry, compliance reporting, and claims processing, reducing operational expenses and minimizing errors. Banks and other financial institutions are using predictive analytics to evaluate credit risks and tailor financial products, thereby improving risk management. This is fueling the demand for sophisticated automation solutions in the outsourcing sector, enabling BFSI firms to concentrate on core financial services while repetitive processes are outsourced to specialized BPO companies. For instance, in February 2025, Hinduja Global Solutions (HGS) leveraged AI to improve customer satisfaction. AI is being integrated into contact centers for quality assurance and personalized coaching, enhancing customer interactions. The shift involves balancing AI capabilities with human oversight, addressing concerns about full automation. HGS’s AI-driven approach boosts efficiency and customer experience, reflecting the growing role of AI in BPO and customer service operations.

To get more information on this market, Request Sample

Demand for Enhanced Customer Experience and Omnichannel Solutions

Customer experience is a critical focus in the India BFSI BPO services market, leading to the adoption of omnichannel communication platforms. Banks and financial institutions are investing in multi-channel support, including voice, email, chatbots, and social media, to provide seamless service. With customers demanding personalized financial solutions, BFSI BPOs are implementing data-driven customer insights, CRM integration, and AI-powered service models to enhance engagement. The shift toward self-service options, mobile banking support, and digital advisory solutions is also gaining momentum. Additionally, BFSI companies are outsourcing KYC verification, fraud detection, and grievance redressal processes to specialized BPO providers to improve response times. The emphasis on a customer-centric approach is reshaping service delivery models, driving higher retention rates and increased trust in outsourced financial services. For instance, in October 2024, Cynergy BPO announced a major push in fintech customer support outsourcing by leveraging AI, automation, and machine learning through partnerships with India’s top BPO providers. The initiative aims to provide real-time, scalable, and personalized support for global fintech firms. Indian BPOs are integrating AI-driven chatbots, predictive analytics, and omnichannel solutions, improving customer experience and operational efficiency. With a strong focus on security, compliance, and cost-effective outsourcing, Cynergy BPO is helping fintech companies optimize support services while ensuring data protection and regulatory adherence.

India BFSI BPO Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, enterprise size, and end user.

Service Type Insights:

- Customer Services

- Finance and Accounting

- Human Resource

- KPO

- Procurement and Supply Chain

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes customer services, finance and accounting, human resource, KPO, procurement and supply chain, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

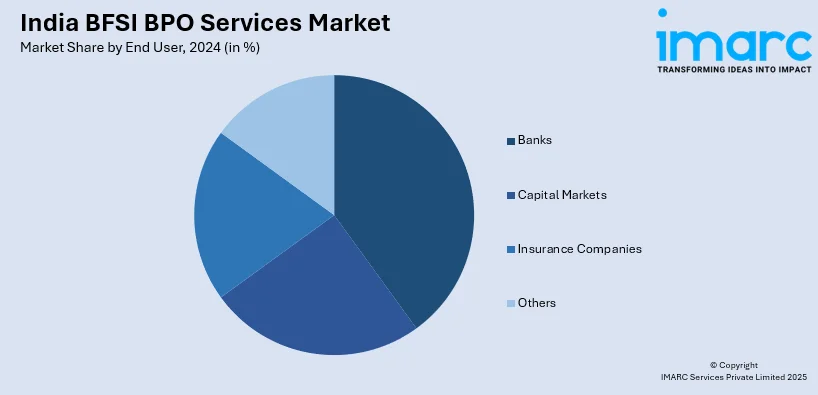

End User Insights:

- Banks

- Commercial Banking

- Retail Banking

- Cards

- Lending

- Capital Markets

- Investment Banking

- Brokerage

- Asset Management

- Others

- Insurance Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks (commercial banking, retail banking, cards, and lending), capital markets (investment banking, brokerage, asset management, and others), insurance companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India BFSI BPO Services Market News:

- In February 2024, Fusion CX, a business process management (BPM) company, opened a 500-seat BPO facility in Navi Mumbai to expand its operations in India. The facility will provide multi-lingual customer experience management, technical support, and back-office operations across sectors like BFSI, healthcare, technology, retail, and utilities, strengthening Fusion CX’s presence nationwide.

India BFSI BPO Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Customer Services, Finance and Accounting, Human Resource, KPO, Procurement and Supply Chain, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| End Users Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India BFSI BPO services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India BFSI BPO services market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India BFSI BPO services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The BFSI BPO services market in India was valued at USD 4.10 Billion in 2024.

The India BFSI BPO services market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 7.32 Billion by 2033.

The key factors driving the India BFSI BPO services market include the rising need for cost-effective operations, increasing digital transformation in banking and insurance sectors, growing focus on customer experience management, and the availability of a skilled English-speaking workforce supporting global service delivery and compliance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)