India Biodegradable Packaging Market Size, Share, Trends and Forecast by Material Type, Application, and Region, 2025-2033

India Biodegradable Packaging Market Overview:

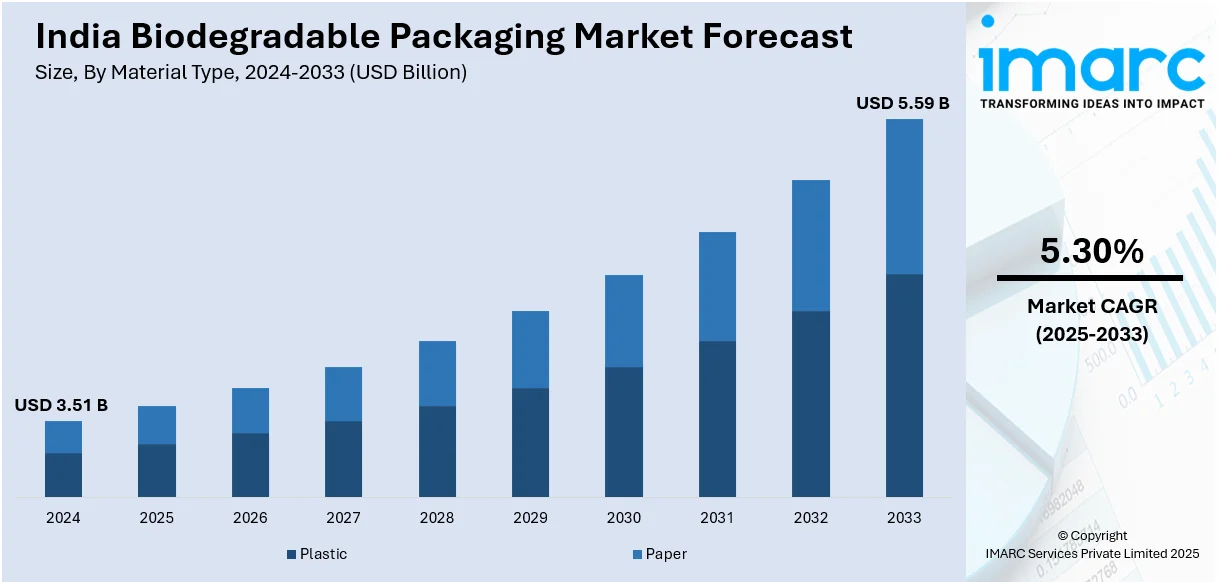

The India biodegradable packaging market size reached USD 3.51 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.59 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is driven by rising environmental awareness, government bans on single-use plastics, and consumer preference for sustainable products. Technological advancements in eco-friendly materials and cost-effective production methods are favoring the India biodegradable packaging market growth. Industries including food, e-commerce, and personal care are adopting biodegradable solutions to meet regulatory and consumer demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.51 Billion |

| Market Forecast in 2033 | USD 5.59 Billion |

| Market Growth Rate 2025-2033 | 5.30% |

India Biodegradable Packaging Market Trends:

Increasing Demand for Eco-Friendly Packaging Solutions

The India biodegradable packaging market share is witnessing a significant rise in demand due to growing environmental awareness and stringent government regulations. Consumers and businesses are increasingly shifting toward sustainable alternatives to reduce plastic waste and carbon footprints. Millennials and Generation Z, whose lifestyles tend to be more eco-friendly, are playing a huge role in the rise of green packaging, as these groups prefer brands that match their eco-conscious values. In addition, the Indian government's ban on single-use plastics and campaigns such as the Swachh Bharat Mission, have accelerated this transition toward biodegradable packaging materials, including cornstarch, bagasse, and polylactic acid (PLA). Industries such as food and beverage, e-commerce, and personal care are leading the charge in this movement, adopting compostable and biodegradable packaging solutions to meet consumer expectations while also aligning with regulatory standards. On 11th November 2024, researchers at IISc-Bengaluru created a biodegradable foam utilizing non-edible oils and tea leaf extracts, presenting a sustainable substitute for plastic packaging that can decompose within hours. This innovation, which greatly diminishes greenhouse gas emissions, seeks to revolutionize the USD 7.9 Billion foam market by providing environmentally friendly options for fast-moving consumer goods packaging. This trend is expected to drive innovation and investment in the sector, making India a key player in the global biodegradable packaging market.

To get more information on this market, Request Sample

Technological Advancements and Cost-Effective Solutions

Technological advancements are playing a pivotal role in shaping the India biodegradable packaging market outlook. Material science developments have led to the production of cost-effective and high-quality biodegradable materials for small to medium enterprises. Concurrently, they are investing money for research and development (R&D) in packaging that is environmentally friendly, durable, lightweight, and can be customized. For instance, biopolymer manufacturing advancements have both reduced costs and increased the scalability of biodegradable packaging. Additionally, the integration of smart packaging technologies such as QR codes and RFID tags is enhancing the functionality of biodegradable packaging and making it more appealing to companies. On 1st July 2024, Myprotein introduced the 'Authentication QR Code,' which helps users access information about the Origin and expiry of its impact on whey protein In India. This move is consistent with India's push to increase transparency in consumer products and the momentum behind the growing demand for biodegradable packaging. The QR code adds a touch of trust and sustainability, which can truly drive the health and nutrition sector more in the direction of eco-friendly packaging practices. As production costs decrease and technology improves, the adoption of biodegradable packaging is expected to grow across various sectors, further solidifying its position as a sustainable alternative to traditional plastic packaging.

India Biodegradable Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material type and application.

Material Type Insights:

- Plastic

- Starch-based Plastics

- Cellulose-based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Others

- Paper

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

The report has provided a detailed breakup and analysis of the market based on the material type. This includes plastic (starch-based plastics, cellulose-based plastics, polylactic acid (PLA), poly-3-hydroxybutyrate (PHB), polyhydroxyalkanoates (PHA), and others), and paper (kraft paper, flexible paper, corrugated fiberboard, and boxboard).

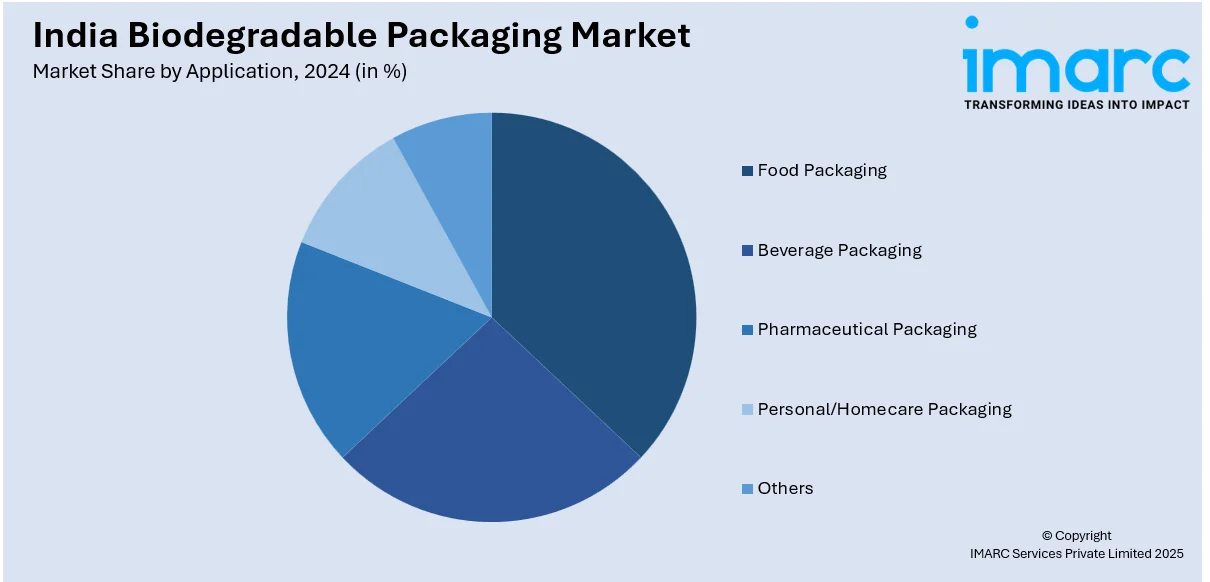

Application Insights:

- Food Packaging

- Beverage Packaging

- Pharmaceutical Packaging

- Personal/Homecare Packaging

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food packaging, beverage packaging, pharmaceutical packaging, personal/homecare packaging, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biodegradable Packaging Market News:

- February 28, 2025: Tetra Pak unveiled eco-friendly carton packaging, which uses up to 5% of certified recycled polymers, in India. This initiative strengthens the biodegradable packaging market in India through reduced dependence on fossil-based solutions and promotes circularity. This ISCC PLUS-certified packaging reflects the solution through Tetra Pak's long-standing commitment to sustainability, taking steps towards pioneering green solutions within the food and beverage sector.

- September 24, 2024: Pakka launched M1, M3, and NM1 (three new compostable flexible packaging solutions) for chocolates, confectioneries, and food items in FMCG. In addition, these biodegradable materials offer high barrier properties, heat and cold sealability and are suitable for various printing technologies addressing the growing demand for sustainable packaging in India.

India Biodegradable Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Food Packaging, Beverage Packaging, Pharmaceutical Packaging, Personal/Homecare Packaging, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biodegradable packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biodegradable packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biodegradable packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biodegradable packaging market in India was valued at USD 3.51 Billion in 2024.

The India biodegradable packaging market is projected to exhibit a (CAGR) of 5.30% during 2025-2033, reaching a value of USD 5.59 Billion by 2033.

India's biodegradable packaging sector is picking up pace with increasing environmental consciousness, bans on single-use plastics, and encouraging government regulations. Consumer attitudes towards eco-friendly options in food, FMCG, and online shopping drive adoption. Advances in materials, such as PLA, bagasse, and starch-based polymers also enhance scalability, cost, and adherence to green packaging standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)