India Biofuel Market Size, Share, Trends and Forecast by Type, Feedstock, and Region, 2025-2033

India Biofuel Market Overview:

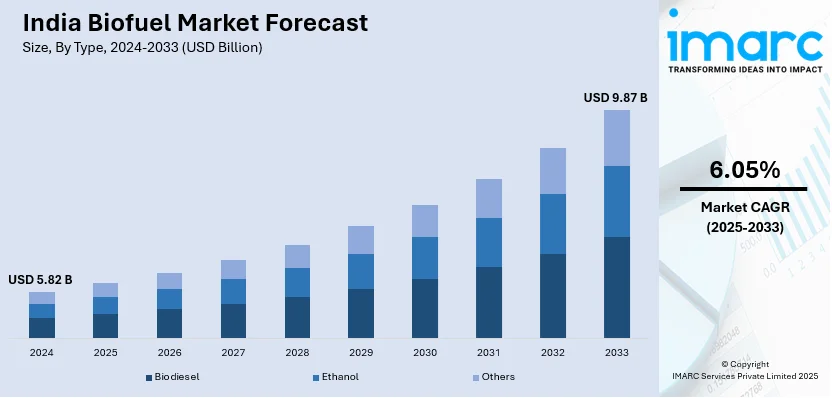

The India biofuel market size reached USD 5.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.87 Billion by 2033, exhibiting a growth rate (CAGR) of 6.05% during 2025-2033. The India biofuel market is driven by government policies promoting ethanol blending, rising crude oil import costs, and increasing demand for cleaner energy alternatives. Agricultural residue utilization, advancements in biofuel production technologies, and incentives for bioethanol and biodiesel production further support market growth, aligning with sustainability goals and energy security initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.82 Billion |

| Market Forecast in 2033 | USD 9.87 Billion |

| Market Growth Rate 2025-2033 | 6.05% |

India Biofuel Market Trends:

Government Policies and Ethanol Blending Program (EBP)

The Indian government’s Ethanol Blended Petrol (EBP) program is a major driver reshaping the biofuel market. Policies mandating ethanol blending targets, such as achieving 20% ethanol in petrol by 2025, have boosted domestic bioethanol production. Financial incentives, subsidies, and viability gap funding encourage sugar mills, grain-based distilleries, and agribusinesses to ramp up ethanol output. Additionally, the phased rollout of flex-fuel vehicles supports ethanol demand, while deregulation in feedstock procurement improves supply chain efficiency. The government's promotion of second-generation (2G) ethanol from non-food biomass further expands market opportunities. These initiatives not only reduce crude oil dependency but also create value for farmers by utilizing agricultural residues, making biofuels a key pillar of India's clean energy transition.

To get more information on this market, Request Sample

Expanding Feedstock Diversification for Biofuel Production

India’s biofuel sector is advancing through diversified feedstocks to boost production efficiency and sustainability. Beyond sugarcane-based ethanol, the government has approved surplus grains like maize and rice, ensuring a stable ethanol supply while addressing food security concerns. The shift towards non-food biomass, including crop stubble, bamboo, and municipal solid waste, is accelerating with increased investment in 2G bio-refineries. Oil Marketing Companies (OMCs) are establishing 12 such refineries with an investment of ₹14,000 crore ($1.68 billion) to utilize lignocellulosic biomass for ethanol production. Additionally, biodiesel production from used cooking oil (UCO) and non-edible oilseeds is expanding, supported by procurement initiatives. This strategy strengthens India’s biofuel supply chain, mitigates price volatility, and promotes a circular economy through waste repurposing.

Rising Private Sector Participation and Investment in Biofuels

Private sector involvement in India’s biofuel industry is accelerating, driven by favorable policy frameworks and increasing profitability. Major energy companies, sugar mills, and agribusinesses are expanding ethanol distilleries and biodiesel plants to meet growing demand. Foreign investments and joint ventures are also rising, with global firms partnering with Indian stakeholders to introduce advanced biofuel technologies. The Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum are strengthening their biofuel portfolios through production facility expansions and new blending infrastructure. Additionally, startups and technology firms are innovating in areas like enzymatic conversion, waste-to-biofuel processing, and synthetic biofuels. This growing investment landscape enhances production capacity, technological advancements, and market competitiveness, positioning India as a key player in the global biofuel industry.

India Biofuel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and feedstock.

Type Insights:

- Biodiesel

- Ethanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes biodiesel, ethanol, others.

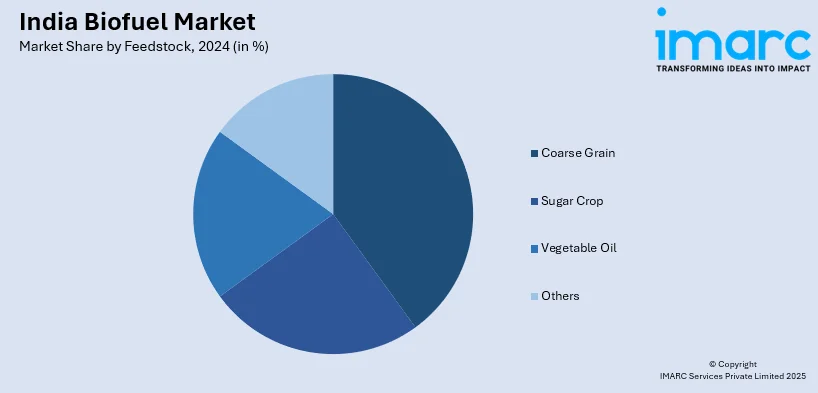

Feedstock Insights:

- Coarse Grain

- Sugar Crop

- Vegetable Oil

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes coarse grain, sugar crop, vegetable oil, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biofuel Market News:

- In November 2024, Union Minister Nitin Gadkari announced that Mahindra, Toyota, Hyundai, and Tata plan to introduce 100% ethanol-powered vehicles within the next six months, accelerating India's biofuel adoption. This move aims to cut emissions, enhance energy security, and support rural economies. The announcement was made at an event honoring biofuel pioneer Dr. Pramod Chaudhari, recognizing his contributions to India's ethanol industry.

- In August 2024, BPCL launched India’s first biofuel blend High Flash High-Speed Diesel (HFHSD) bunker at Mumbai Port, marking a milestone in green energy adoption. This initiative aligns with global efforts to decarbonize the shipping industry and reinforces BPCL’s commitment to sustainable fuel solutions, advancing India's transition toward cleaner maritime energy.

India Biofuel Market Repor Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biodiesel, Ethanol, Others |

| Feedstocks Covered | Coarse Grain, Sugar Crop, Vegetable Oil, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biofuel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biofuel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biofuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India biofuel market was valued at USD 5.82 Billion in 2024.

The India biofuel market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 9.87 Billion by 2033.

Rising energy demand, government mandates like blending targets, and fossil fuel price volatility drive India’s biofuel market. Abundant agricultural residues, ethanol production capacity, and investment in feedstock cultivation boost supply. Sustainability goals, rural farmer income support, and growing interest in renewable energy further accelerate biofuel adoption across transportation and industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)