India Biological Crop Protection Market Size, Share, Trends and Forecast by Type, Mode of Application, Crop Type, Form, Source, and Region, 2025-2033

India Biological Crop Protection Market Overview:

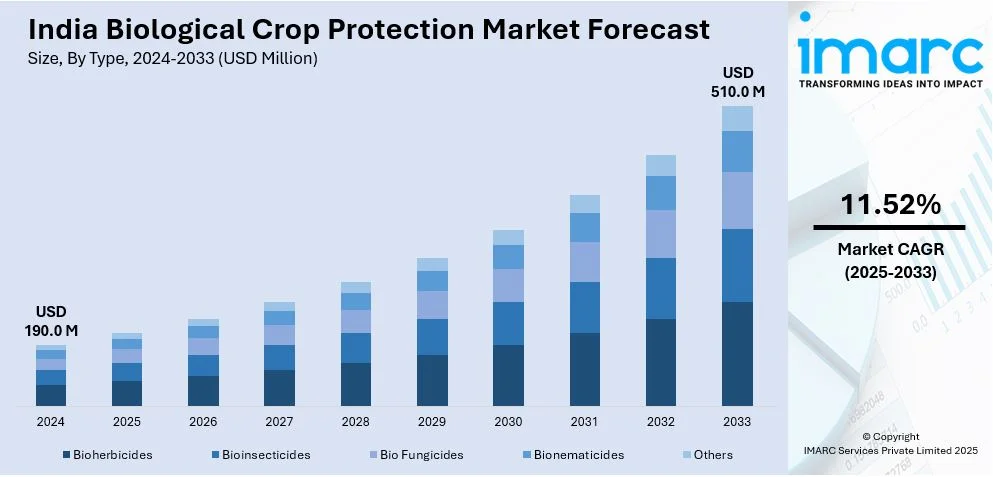

The India biological crop protection market size reached USD 190.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 510.0 Million by 2033, exhibiting a growth rate (CAGR) of 11.52% during 2025-2033. Growing demand for organic farming, increasing awareness of sustainable agriculture, government support through subsidies and regulations, rising consumer preference for chemical-free produce, advancements in biopesticide formulations, expansion of integrated pest management (IPM) practices, and the need to combat pesticide resistance are expanding India biological crop protection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 190.0 Million |

| Market Forecast in 2033 | USD 510.0 Million |

| Market Growth Rate (2025-2033) | 11.52% |

India Biological Crop Protection Market Trends:

Rising Adoption of Bio-Pesticides and Bio-Fungicides

India's agricultural sector is witnessing a significant shift towards biological crop protection, driven by the rising awareness of sustainable farming practices. Bio-pesticides and bio-fungicides, derived from natural organisms, are gaining popularity as safer alternatives to chemical-based solutions. Government initiatives promoting organic farming, along with increased consumer demand for pesticide-free produce, is acting as a key factor driving India biological crop protection market growth. For instance, the Ministry of Agriculture & Farmers Welfare announced on March 18, 2025, that since 2015–16, 59.74 lakh hectares have been converted to organic farming thanks to programs like the Mission Organic Value Chain Development for Northeastern Region (MOVCDNER) and the Paramparagat Krishi Vikas Yojana (PKVY). Under PKVY, farmers receive INR 15,000 directly for organic inputs, along with INR 31,500 in financial aid per hectare over three years. Similarly, MOVCDNER gives farmers INR 15,000 as a direct benefit transfer and offers INR 46,500 per acre over three years. Major players in the market are also investing in R&D to develop advanced microbial and botanical formulations. With stringent regulations on synthetic pesticides and a growing export market for organic products, the bio-pesticide industry is poised for rapid expansion in the coming years.

To get more information on this market, Request Sample

Integration of Biological Solutions with Precision Agriculture

The Indian agricultural landscape is changing with the integration of biological crop protection products and precision farming technologies. Farmers are adopting data-driven approaches such as soil health monitoring and AI-based pest detection to optimize the use of bio-based solutions. This trend improves efficiency while reducing reliance on chemical pesticides. Companies are launching biocontrol agents and microbial inoculants tailored for targeted applications. Additionally, government support for digital agriculture and sustainable practices is accelerating the adoption of precision-based biological protection. Notably, the Indian government launched the Digital Agriculture Mission on September 4, 2024, with an INR 2,817 Crore budget, of which INR 1,940 Crore was allocated centrally. Through the creation of Digital Public Infrastructure (DPI), the implementation of the Digital General Crop Estimation Survey (DGCES), and the support of several IT efforts throughout the federal, state, and academic and research sectors, this initiative seeks to revolutionize the agricultural industry. The development of AgriStack, a farmer-centric digital infrastructure that will provide digital identities for 11 crore farmers over three years, and the Krishi Decision Support System, which combines information on crops, soil, weather, and water resources to improve agricultural decision-making, are important elements. As the market matures, the synergy between technology and bio-based inputs is expected to improve crop yields and soil health, which in turn is positively impacting the India biological crop market outlook.

India Biological Crop Protection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, mode of application, crop type, form, and source.

Type Insights:

- Bioherbicides

- Bioinsecticides

- Bio Fungicides

- Bionematicides

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bioherbicides, bioinsecticides, bio fungicides, bionematicides, and others.

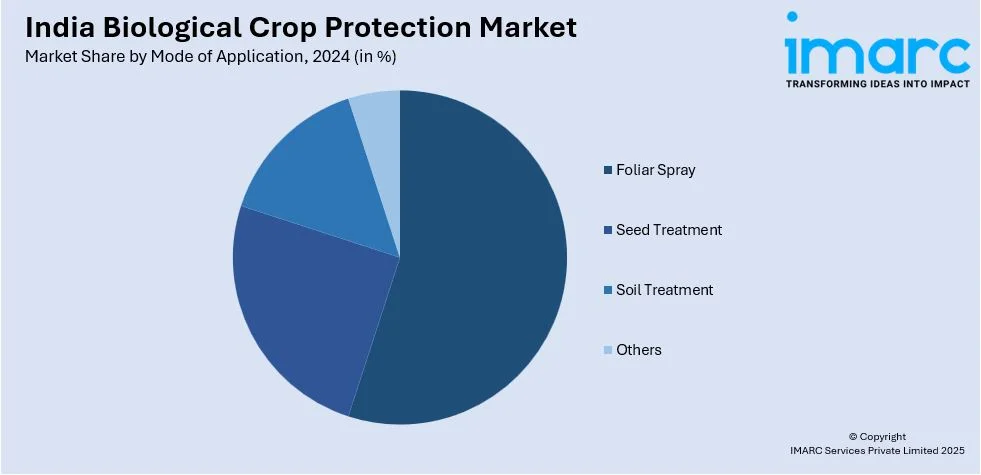

Mode of Application Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

A detailed breakup and analysis of the market based on the mode of application have also been provided in the report. This includes foliar spray, seed treatment, soil treatment, and others.

Crop Type Insights:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals and grains, oilseeds and pulses, fruits and vegetables, and others.

Form Insights:

- Liquid

- Dry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and dry.

Source Insights:

- Domestic

- Import

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes domestic and import.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biological Crop Protection Market News:

- On February 21, 2025, AphidControl and XanthoControl, two cutting-edge bioactive, non-chemical agricultural solutions, were delivered to PI Industries Ltd. by the Centre for Cellular and Molecular Platforms (C-CAMP). Aiming to solve the 10–35% yearly crop loss in India caused by pests and diseases, this project is a component of the 'Transforming Deep Science Discoveries into Impactful Innovations for India' program, which is funded by the Office of the Principal Scientific Adviser and Pratiksha Trust. In order to support sustainable agriculture, AphidControl, a botanical pesticide that targets aphids, and XanthoControl, a microbial metabolite-based product that fights Xanthomonas bacteria, will both go through extensive validation and commercialization.

- On September 4, 2024, Syngenta Biologicals and Provivi announced that they will work together to create and market pheromone-based biological treatments that target the pests known as Yellow Stem Borer (YSB) and Fall Armyworm (FAW) across Asia. The main food sources for 3.5 billion people worldwide are in danger due to the bugs' quick expansion throughout the main rice and corn-producing regions. The new products, YSB Eco-Dispenser for India and Indonesia, and FAW Eco-Granules for Thailand, are slated for delivery in 2026 with the goal of giving farmers environmentally friendly pest management choices.

India Biological Crop Protection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bioherbicides, Bioinsecticides, Bio Fungicides, Bionematicides, Others |

| Mode of Applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Forms Covered | Liquid, Dry |

| Sources Covered | Domestic, Import |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biological crop protection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biological crop protection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biological crop protection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biological crop protection market in India was valued at USD 190.0 Million in 2024.

The India biological crop protection market is projected to exhibit a CAGR of 11.52% during 2025-2033, reaching a value of USD 510.0 Million by 2033.

Key factors driving the India biological crop protection market include rising awareness about sustainable farming practices, growing demand for organic food, and concerns over chemical pesticide residues. Government support, improved farmer education, and the shift toward eco-friendly crop management solutions are also fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)