India Biopharmaceutical Packaging Market Size, Share, Trends and Forecast by Material, Packaging Type, Application, and Region, 2025-2033

India Biopharmaceutical Packaging Market Overview:

The India biopharmaceutical packaging market size reached USD 0.69 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.51 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. Growing demand for biologics, increasing pharmaceutical exports, advancements in packaging technologies, stringent regulatory standards, rising focus on sustainability, and the need for enhanced drug safety and stability are expanding the India biopharmaceutical packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.69 Billion |

| Market Forecast in 2033 | USD 1.51 Billion |

| Market Growth Rate 2025-2033 | 9.10% |

India Biopharmaceutical Packaging Market Trends:

Increasing Adoption of Sustainable and Eco-Friendly Packaging

The India biopharmaceutical packaging market growth is driven by a rapid shift toward sustainable materials due to growing environmental concerns and stringent regulatory policies. Companies are focusing on biodegradable, recyclable, and reusable packaging solutions to reduce plastic waste and carbon footprint. For instance, the Indian Institute of Technology Madras (IIT-M) has created a Center of Excellence devoted to the development of zero-waste bioplastics as of March 2, 2025. In order to reduce the ecological impact of plastic use and promote a circular economy, the center will concentrate on research and development to create novel biodegradable materials. Glass vials, biopolymers, and plant-based plastics are gaining traction as viable alternatives to traditional materials. Additionally, advancements in lightweight packaging help reduce transportation costs while maintaining product integrity. The push for sustainability is further supported by government initiatives promoting eco-friendly practices in pharmaceutical manufacturing. As a result, biopharmaceutical companies are investing in greener solutions to meet both consumer demand and compliance requirements.

.webp)

To get more information on this market, Request Sample

Rising Demand for Smart and Tamper-Evident Packaging Solutions

With increasing concerns over drug safety and counterfeiting, the India biopharmaceutical packaging market is experiencing an increase in demand for smart and tamper-evident packaging. Technologies such as RFID tags, QR codes, and NFC-enabled packaging are being integrated to improve traceability and ensure product authenticity. For instance, 'Dristi,' an Internet of Things (IoT)-based RFID reader that is set to transform the supply chain sector, was introduced by Bar Code India (BCI) on August 30, 2024. In demanding environments, Dristi's robust processor, large memory, and 4G-LTE/Wi-Fi connectivity provide durability and real-time data access. With this 'Made in India' invention, inventory management, process control, industrial automation, and asset tracking will all be more accurate and efficient. Serialization and unique identification codes help in tracking pharmaceuticals throughout the supply chain, minimizing the risk of counterfeit products entering the market. Additionally, tamper-evident features, including breakable seals and visible damage indicators, are becoming standard across high-value biologics and vaccines. These innovations not only improve patient safety but also align with global regulatory standards, ensuring compliance and quality assurance, which in turn is positively impacting India biopharmaceutical packaging market outlook.

India Biopharmaceutical Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material, packaging type, and application.

Material Insights:

- Plastic

- Paper

- Glass

- Aluminium

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, paper, glass, and aluminium.

Packaging Type Insights:

- Vials

- Bottles

- Ampoules

- Syringes

- Cartridges

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes vials, bottles, ampoules, syringes, and cartridges.

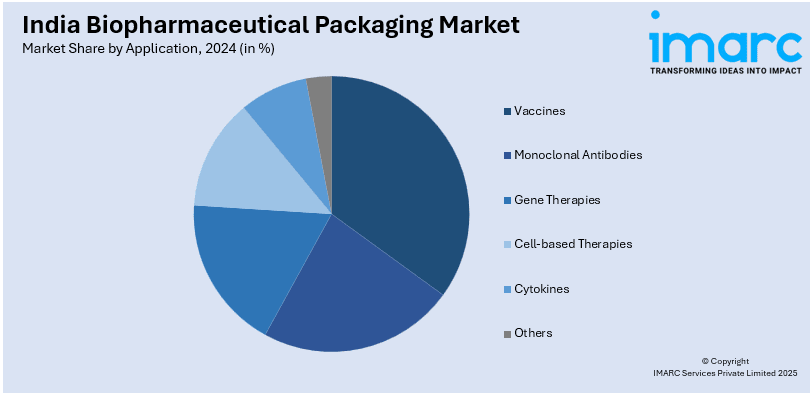

Application Insights:

- Vaccines

- Monoclonal Antibodies

- Gene Therapies

- Cell-based Therapies

- Cytokines

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes vaccines, monoclonal antibodies, gene therapies, cell-based therapies, cytokines, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biopharmaceutical Packaging Market News:

- July 4, 2024: AstraZeneca India Private Limited (AZIPL), a research-based biopharmaceutical company, has announced an investment of 250 Crore Rupees (USD 30 Million) to expand its Global Innovation and Technology Centre (GITC) in Chennai, Tamil Nadu. This expansion will create close to 1,300 new roles focused on driving innovation and improving efficiency across the company's global operations.

India Biopharmaceutical Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Paper, Glass, Aluminium |

| Packaging Types Covered | Vials, Bottles, Ampoules, Syringes, Cartridges |

| Applications Covered | Vaccines, Monoclonal Antibodies, Gene Therapies, Cell-based Therapies, Cytokines, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India biopharmaceutical packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India biopharmaceutical packaging market on the basis of material?

- What is the breakup of the India biopharmaceutical packaging market on the basis of packaging type?

- What is the breakup of the India biopharmaceutical packaging market on the basis of application?

- What is the breakup of the India biopharmaceutical packaging market on the basis of region?

- What are the various stages in the value chain of the India biopharmaceutical packaging market?

- What are the key driving factors and challenges in the India biopharmaceutical packaging market?

- What is the structure of the India biopharmaceutical packaging market and who are the key players?

- What is the degree of competition in the India biopharmaceutical packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biopharmaceutical packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biopharmaceutical packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biopharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)