India Biopsy Devices Market Size, Share, Trends and Forecast by Procedure Type, Product, Application, Guidance Technique, End User, and Region, 2025-2033

Market Overview:

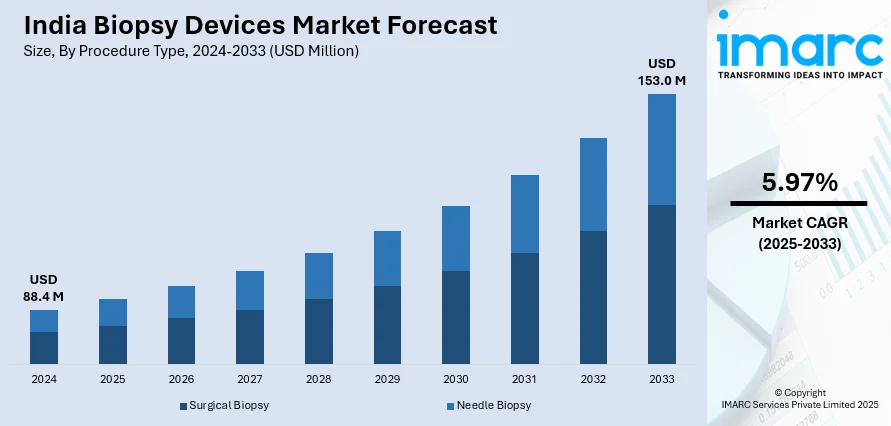

The India biopsy devices market size reached USD 88.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 153.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.97% during 2025-2033. The increasing prevalence of cancer and other chronic diseases, advancements in medical technology and growing awareness among healthcare professionals are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.4 Million |

| Market Forecast in 2033 | USD 153.0 Million |

| Market Growth Rate (2025-2033) | 5.97% |

Biopsy devices are medical instruments used by healthcare professionals to obtain tissue samples from a patient's body for diagnostic purposes. These devices play a crucial role in the early detection, diagnosis, and treatment of various medical conditions, particularly cancer. Biopsies help to identify abnormal cells or tissues, determine the presence and extent of diseases, and guide treatment decisions. Common types of biopsy devices include needles, forceps, brushes, and probes, which are used to collect tissue samples from organs or areas of concern. The collected tissue samples are then examined under a microscope by pathologists to provide essential insights into the patient's condition, aiding in accurate diagnosis and personalized treatment plans.

To get more information of this market, Request Sample

The rising demand for biopsy procedures to facilitate early and accurate diagnosis due to the increasing prevalence of cancer and other chronic diseases in the country, has contributed to their uptake in India. Moreover, the escalating need for efficient biopsy devices to support timely and effective treatment planning owing to rapid expansion in the healthcare sector and the increasing number of people seeking medical attention for potential health issues is positively influencing the market growth. Apart from this, numerous in medical technology and diagnostic procedures has accelerated the adoption of innovative biopsy devices in India. Additionally, the introduction of minimally invasive techniques and imaging-guided biopsies has enhanced diagnostic accuracy, reduced patient discomfort, and accelerated recovery times, thereby propelling the market growth. Besides this, the heightening focus on early detection and disease management has augmented the demand for biopsy devices in India. Furthermore, numerous favorable government initiatives and ongoing healthcare infrastructure development are contributing to the market growth in India.

India Biopsy Devices Market Trends/Drivers:

Advancements in Medical Technology

Ongoing advancements in medical technology have significantly impacted the biopsy devices landscape in India. The introduction of innovative techniques, such as image-guided biopsies and liquid biopsies, has transformed the field by improving diagnostic accuracy and patient outcomes. Image-guided biopsies use advanced imaging modalities, such as ultrasound, CT scans, or MRI, to precisely target the biopsy site, reducing the need for more invasive procedures. Similarly, liquid biopsies analyze circulating tumor DNA in the blood, enabling non-invasive cancer detection and monitoring. These cutting-edge technologies have gained popularity among healthcare professionals and patients alike, accelerating the adoption of advanced biopsy devices in the country.

Government Initiatives and Healthcare Infrastructure Development

The Indian government's commitment to enhancing healthcare accessibility and infrastructure has been a critical catalyst for the biopsy devices market. Various initiatives and policies have been implemented to improve healthcare services and reduce the burden of diseases, including cancer. Investments in healthcare infrastructure and the establishment of medical facilities in rural and remote areas have expanded the reach of biopsy services, enabling more patients to access timely and accurate diagnostic procedures. As the government focuses on early detection and disease management, there is an increasing emphasis on biopsy as a fundamental tool for diagnosing and treating various medical conditions, further fueling the demand for biopsy devices in India.

The rising cases of cancer represent one of the significant factors driving the growth of the biopsy devices market in India. Moreover, the escalating demand for minimally-invasive (MI) surgeries is positively influencing demand for these devices in the country. Another key factor contributing to the market growth is the increasing willingness among individuals to spend on healthcare. Furthermore, the rising demand for biopsy devices from medical clinics, hospitals, and diagnostic centers is fueling the market growth.

India Biopsy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India biopsy devices market report, along with forecasts at the regional and country level for 2025-2033. Our report has categorized the market based on procedure type, product, application, guidance technique and end user.

Breakup by Procedure Type:

- Surgical Biopsy

- Needle Biopsy

Needle biopsy represents the most popular procedure type

The report has provided a detailed breakup and analysis of the market based on the procedure type. This includes surgical and needle biopsy. According to the report, needle biopsy represented the largest segment.

Needle biopsy plays a pivotal role in driving the India biopsy devices market due to its widespread adoption, efficiency, and minimally invasive nature. As a key diagnostic procedure, needle biopsy allows healthcare professionals to obtain tissue samples from various organs, such as the breast, lung, liver, and prostate, with minimal discomfort to the patient. The procedure is commonly used for cancer diagnosis and staging, aiding in treatment planning and patient management. With the increasing incidence of cancer and other chronic diseases in India, the demand for accurate and timely diagnoses has grown significantly.

Needle biopsy's ability to provide precise and reliable tissue samples for histological examination has made it a preferred choice for healthcare professionals and patients alike. Moreover, advancements in imaging technologies, such as ultrasound and CT guidance, have further enhanced the accuracy and safety of needle biopsy procedures, driving its prominence and contributing to the overall growth of the India biopsy devices market.

Breakup by Product:

- Biopsy Guidance Systems

- Needle Based Biopsy Guns

- Biopsy Needles

- Biopsy Forceps

- Others

Needle based biopsy guns account for the majority of the market share

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes biopsy guidance systems, needle based biopsy guns, biopsy needles, biopsy forceps, and others. According to the report, needle based biopsy guns accounted for the largest market share.

Needle based biopsy guns play a crucial role in driving the India biopsy devices market, owing to their efficiency, accuracy, and minimally invasive approach. These devices have revolutionized biopsy procedures, enabling healthcare professionals to obtain tissue samples from targeted areas with enhanced precision and reduced patient discomfort. The use of biopsy guns has significantly improved the diagnostic yield of tissue samples, facilitating more accurate and timely cancer diagnoses, which are particularly critical in India's rising cancer burden.

Additionally, needle based biopsy guns offer advantages such as faster procedure times, shorter recovery periods, and lower risk of complications, making them a preferred choice for both patients and healthcare providers. As the demand for effective and reliable biopsy devices continues to grow with the increasing incidence of cancer and other diseases in India, the adoption of needle based biopsy guns is expected to drive substantial growth in the country's biopsy devices market, revolutionizing diagnostic practices and improving patient care.

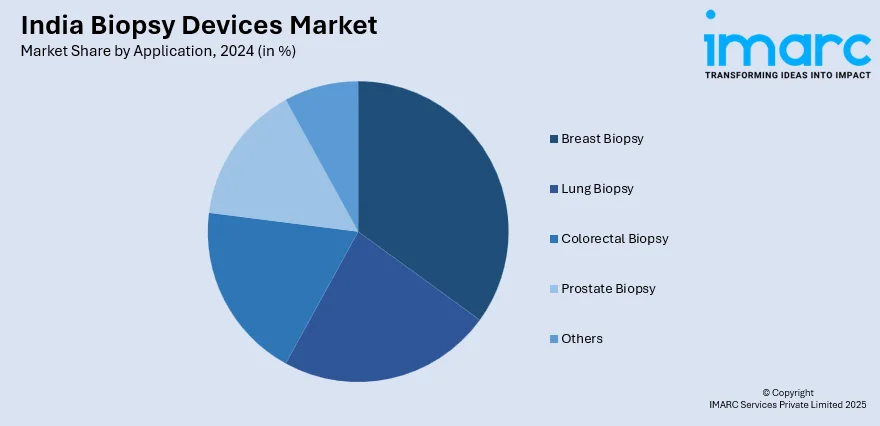

Breakup by Application:

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

Breast biopsy holds the largest market share

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes breast, lung, colorectal, prostate, and other biopsies. According to the report, breast biopsy accounted for the largest market share.

Breast biopsy plays a significant role in driving the India biopsy devices industry, primarily due to its critical importance in breast cancer diagnosis and management. As breast cancer remains the most prevalent cancer among Indian women, the demand for accurate and early detection has become paramount. Breast biopsy procedures, such as core needle biopsy and vacuum-assisted biopsy, are essential in obtaining tissue samples from breast abnormalities for histological examination. These procedures aid in determining the presence of cancer, identifying the tumor type, and assessing its characteristics, which are crucial for treatment planning and patient care.

As breast cancer awareness continues to rise across the country, there is a growing emphasis on regular screenings and timely diagnoses, fueling the demand for breast biopsy devices. Moreover, advancements in imaging technologies, such as mammography and ultrasound, have further improved the accuracy and efficiency of breast biopsy procedures, contributing to the segment growth.

Breakup by Guidance Technique:

- Ultrasound-guided Biopsy

- Stereotactic-guided Biopsy

- MRI-guided Biopsy

- Others

Ultrasound-guided biopsy represents the most widely used guidance technique

A detailed breakup and analysis of the market has been provided based on guidance technique. This includes ultrasound-guided biopsy, stereotactic-guided biopsy, MRI-guided biopsy, and others. According to the report, ultrasound-guided biopsy accounted for the largest market share.

Ultrasound-guided biopsy plays a significant role in propelling the India biopsy devices market forward due to its non-invasive, accurate, and real-time imaging capabilities. As a widely utilized technique, ultrasound-guided biopsy enables healthcare professionals to precisely target and obtain tissue samples from various organs and tissues with enhanced accuracy and safety.

In the context of breast cancer diagnosis, this method has become particularly vital, as it facilitates the visualization of breast abnormalities, guiding the needle to the precise location for sampling. The non-invasive nature of ultrasound-guided biopsy reduces patient discomfort and recovery time, making it a preferred choice for both healthcare providers and patients. As breast cancer and other medical conditions continue to pose significant healthcare challenges in India, the demand for reliable and effective biopsy devices equipped with ultrasound guidance has surged, contributing to the overall growth and advancement of the biopsy devices market.

Breakup by End User:

- Hospitals and Clinics

- Academic and Research Institutes

- Others

Hospitals and clinics are the leading end user in the market

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes hospitals and clinics, academic and research institutes, and others. According to the report, the hospitals and clinics accounted for the largest market share.

Hospitals and clinics play a crucial role in driving the India biopsy devices market due to their role as key healthcare providers and diagnostic centers. As the demand for accurate and timely medical diagnoses increases, hospitals and clinics rely heavily on biopsy devices to facilitate essential diagnostic procedures. These healthcare facilities require reliable and advanced biopsy devices to obtain tissue samples for various medical conditions, including cancer and other chronic diseases. Additionally, with the rising awareness of the importance of early detection and disease management, there is a growing emphasis on providing comprehensive and specialized diagnostic services. As a result, hospitals and clinics continuously invest in modern biopsy technologies and devices that offer enhanced accuracy, efficiency, and patient comfort. Their commitment to delivering high-quality healthcare services catalyzes the demand for state-of-the-art biopsy devices in the India market, propelling the growth and advancement of biopsy technologies and contributing to improved patient outcomes.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

West and Central India exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the region has also been provided in the report. This includes North India, West and Central India, South India, and East India. According to the report, the West and Central India accounted for the largest market share.

West and Central India play a significant role in driving the India biopsy devices market due to their robust healthcare infrastructure, increasing prevalence of chronic diseases, and growing healthcare awareness. These regions are also home to several major cities with well-established medical facilities, hospitals, and diagnostic centers that cater to a large population. With a rising burden of cancer and other diseases, there is an escalating demand for accurate and timely diagnostic procedures, leading to an increased adoption of biopsy devices in the region. Moreover, many healthcare providers and institutions in West and Central India continuously invest in modern medical technologies, including advanced biopsy devices, to offer state-of-the-art diagnostic services to patients. The presence of specialized medical professionals and centers of excellence further contributes to the demand for reliable and efficient biopsy devices, driving the growth and expansion of the biopsy devices market in these regions.

Competitive Landscape:

The key players in the market have made several innovations and advancements to meet the evolving demands of consumers and businesses. Thes players have integrated artificial intelligence and machine learning algorithms in biopsy devices with enhanced data analysis and interpretation, leading to faster and more accurate diagnoses. Moreover, the development of robotic-assisted biopsy systems has introduced greater precision and control during procedures, minimizing invasiveness and reducing patient discomfort. Manufacturers are developing advanced imaging technologies, such as MRI-guided and ultrasound-guided biopsies that enable precise and targeted sampling of tissues. Liquid biopsies, a non-invasive technique, have emerged as a groundbreaking innovation for cancer detection and monitoring, using circulating tumor DNA in the blood.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

India Biopsy Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Procedure Types Covered | Surgical Biopsy, Needle Biopsy |

| Products Covered | Biopsy Guidance Systems, Needle Based Biopsy Guns, Biopsy Needles, Biopsy Forceps, Others |

| Applications Covered | Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others |

| Guidance Techniques Covered | Ultrasound-guided Biopsy, Stereotactic-guided Biopsy, MRI-guided Biopsy, Others |

| End Users Covered | Hospitals and Clinics, Academic and Research Institutes, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biopsy devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biopsy devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biopsy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India biopsy devices market was valued at USD 88.4 Million in 2024.

We expect the India biopsy devices market to exhibit a CAGR of 5.97% during 2025-2033.

The growing adoption of biopsy devices by radiologists, surgeons, cardiologists, and other medical practitioners to diagnose the presence or extent of diseases that are cancerous or inflammatory in nature is primarily driving the India biopsy devices market.

The sudden outbreak of the COVID-19 pandemic had led to the postponement of various elective minimally-invasive surgeries to reduce the risk of the coronavirus infection upon hospital visits and interaction with medical equipment, thereby negatively impacting the Indian market for biopsy devices.

Based on the procedure type, the India biopsy devices market can be segmented into surgical biopsy and needle biopsy, where needle biopsy holds the majority of the total market share.

Based on the product, the India biopsy devices market has been divided into biopsy guidance systems, needle based biopsy guns, biopsy needles, biopsy forceps, and others. Among these, needle based biopsy guns currently exhibit a clear dominance in the market.

Based on the application, the India biopsy devices market can be categorized into breast biopsy, lung biopsy, colorectal biopsy, prostate biopsy, and others. Currently, breast biopsy accounts for the majority of the total market share.

Based on the guidance technique, the India biopsy devices market has been segregated into ultrasound-guided biopsy, stereotactic-guided biopsy, MRI-guided biopsy, and others. Among these, ultrasound-guided biopsy currently exhibits a clear dominance in the market.

Based on the end user, the India biopsy devices market can be bifurcated into hospitals and clinics, academic and research institutes, and others. Currently, hospitals and clinics hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the Indian biopsy devices market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)