India Black Pepper Market Size, Share, Trends and Forecast by Product, Source, Form, Distribution Channel, Application, and Region, 2025-2033

India Black Pepper Market Overview:

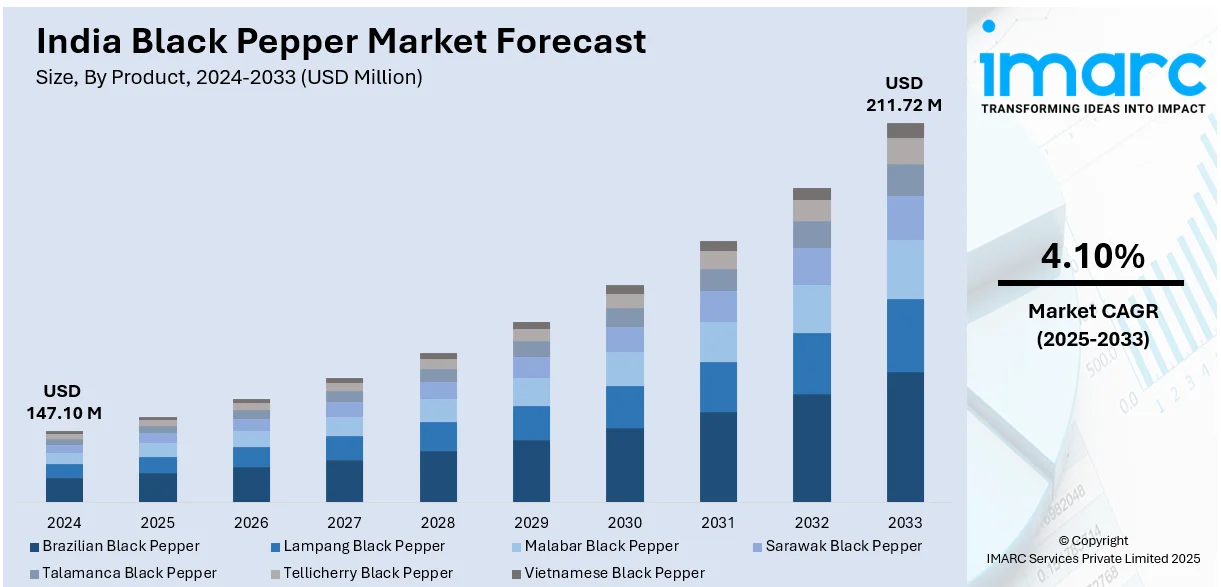

The India black pepper market size reached USD 147.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 211.72 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by rising demand from the food, pharmaceutical, and personal care industries, along with increasing exports to major markets. Favorable government policies, growing spice consumption in processed foods, and expanding organic farming practices further support the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 147.10 Million |

| Market Forecast in 2033 | USD 211.72 Million |

| Market Growth Rate 2025-2033 | 4.10% |

India Black Pepper Market Trends:

Growing Demand for Organic and Sustainably Sourced Black Pepper

The market demand for organic and sustainably cultivated black pepper in India is showing remarkable growth. Consumers are enthusiastically looking for pesticide-free, non-GMO, and chemical-free spices, triggering growth in organic certifications and sustainable agriculture practices. Farmers are employing agroforestry and regenerative agriculture practices to improve the health of soils and biodiversity with ethical sourcing guarantees. Moreover, international buyers and high-end spice companies are focusing on sustainability, compelling Indian pepper farmers to adopt fair trade and green initiatives. The government and other agricultural organizations are also promoting organic farming with subsidies and incentives, further compelling the shift. According to the sources, in March 2024, McCormick, GIZ, and AVT McCormick initiated a sustainable spice program in six Indian states that increased productivity, farmer earnings, and gender equality while encouraging environmentally friendly farming practices for long-term industry sustainability. Further, this trend is especially robust in export markets, where organic certification adds value and demand for Indian black pepper. As sustainability has become an important purchase driver, traceability, farm-to-table traceability, and reducing carbon footprints are priorities for farmers and spice processors to serve both domestic and global consumers.

To get more information on this market, Request Sample

Expansion of Value-Added Black Pepper Products

The India black pepper market is transforming from whole and powder forms to more value-added products. For instance, in April 2025, CAMPCO will roll out sterilized 30g black pepper sachets India-wide, promoting hygiene and purity. Manufacturing will ramp up depending on demand, firming up India's value-added spice market. Moreover, spice producers are creating new products like black pepper-flavored seasonings, ready-to-use spice mixes, pepper essential oils, and extracts for functional foods and nutraceuticals. The growing trend in consumer appetite for gourmet treatments and convenience food has been a main driver behind it, as black pepper finds integration into handcrafted snacks, dietary supplements, and even skincare due to its anti-inflammatory and antioxidant qualities. Other food and drink manufacturers also employ the ability of black pepper to bring extra depths of flavors into sauces, marinades, and drinks like spiced tea and health tonics. The increasing knowledge about the health benefits of black pepper, including its properties in digestion and metabolism boosting, further promotes its applications in wellness-oriented products. This trend towards premium and specialty products is generating new income streams for Indian black pepper growers, not only domestically but internationally as well.

Rising Integration of Black Pepper in Health and Wellness Products

The growing emphasis on natural wellness solutions has pushed the inclusion of black pepper into various wellness and nutraceutical products. Piperine, which is the bioactive ingredient found in black pepper, is proven to increase nutrient uptake, support digestion, and provide anti-inflammatory effects. For this reason, it is now being added into herbal supplements, Ayurvedic products, and functional foods intended to enhance immunity, metabolism, and mental processes. The compatibility of black pepper with other bioactive compounds, including turmeric (curcumin), is well known and hence its use in health drinks, protein supplements, and dietary supplements. Skincare and personal care companies are also using black pepper extracts for their antioxidant and detoxifying action in topical formulations. With the change in consumer attitudes towards natural therapies and preventive health, black pepper is emerging as a prime functional ingredient, which is opening new avenues in India's health and wellness space, as well as internationally.

India Black Pepper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, source, form, distribution channel, and application.

Product Insights:

- Brazilian Black Pepper

- Lampang Black Pepper

- Malabar Black Pepper

- Sarawak Black Pepper

- Talamanca Black Pepper

- Tellicherry Black Pepper

- Vietnamese Black Pepper

The report has provided a detailed breakup and analysis of the market based on the product. This includes Brazilian black pepper, Lampang black pepper, Malabar black pepper, Sarawak black pepper, Talamanca black pepper, Tellicherry black pepper, and Vietnamese black pepper.

Source Insights:

- Organic

- Inorganic

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes organic and inorganic.

Form Insights:

- Ground Black Pepper

- Rough Cracked Black Pepper

- Whole Black Pepper

The report has provided a detailed breakup and analysis of the market based on the form. This includes ground black pepper, rough cracked black pepper, and whole black pepper.

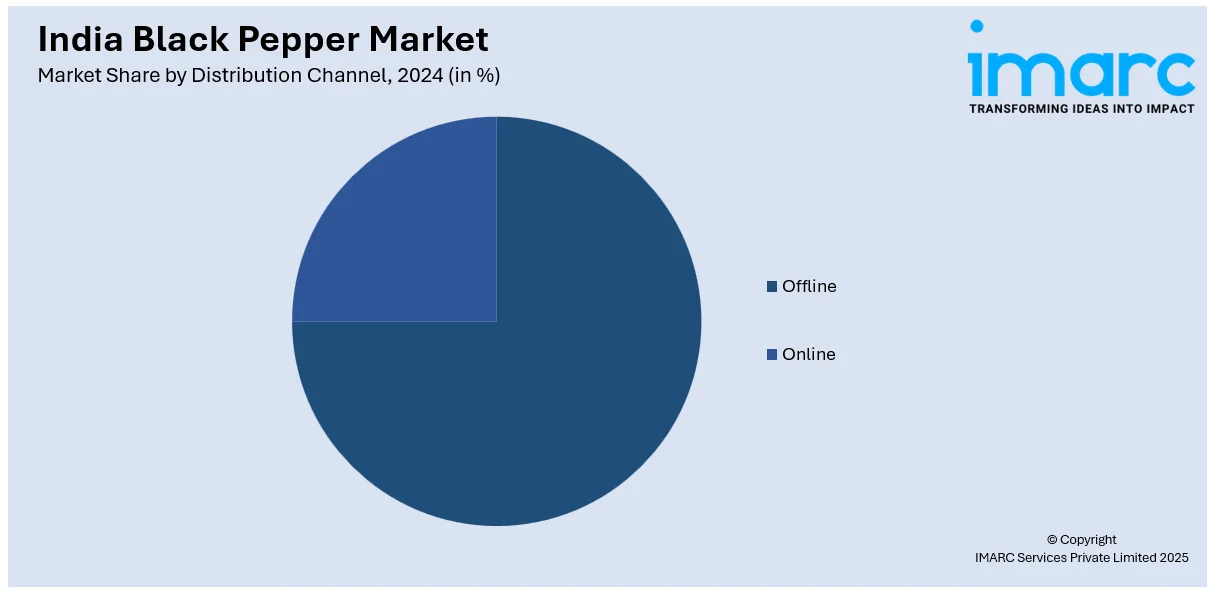

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Application Insights:

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, pharmaceuticals, personal care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Black Pepper Market News:

- In August 2024, the International Pepper Community (IPC) considered creating a black pepper trading application, modeled after India's IPSTA Pepper Trade application. The project is intended to boost international pepper trade, with possible interconnected platforms in member nations, pending government approvals and regulatory permits.

- In November 2023, India's Kozhikode-based Indian Institute of Spices Research (IISR) launched 'IISR Chandra,' a high-yielding variety of black pepper. Created using innovative hybridization techniques, it is endowed with better spike intensity and increased yield, making it a game-changer in India's black pepper market, with commercial production to be licensed.

India Black Pepper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Brazilian Black Pepper, Lampang Black Pepper, Malabar Black Pepper, Sarawak Black Pepper, Talamanca Black Pepper, Tellicherry Black Pepper, Vietnamese Black Pepper |

| Sources Covered | Organic, Inorganic |

| Forms Covered | Ground Black Pepper, Rough Cracked Black Pepper, Whole Black Pepper |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Food And Beverages, Pharmaceuticals, Personal Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India black pepper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India black pepper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India black pepper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The black pepper market in India was valued at USD 147.10 Million in 2024.

The India black pepper market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 211.72 Million by 2033.

The India black pepper market is primarily driven by growing consumption in culinary and medicinal applications. Rising health consciousness, improved cultivation methods, and demand from the food processing sector support growth. Additionally, export opportunities and increasing interest in high-quality, traceable spice varieties boost market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)