India Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2026-2034

India Board Games Market Summary:

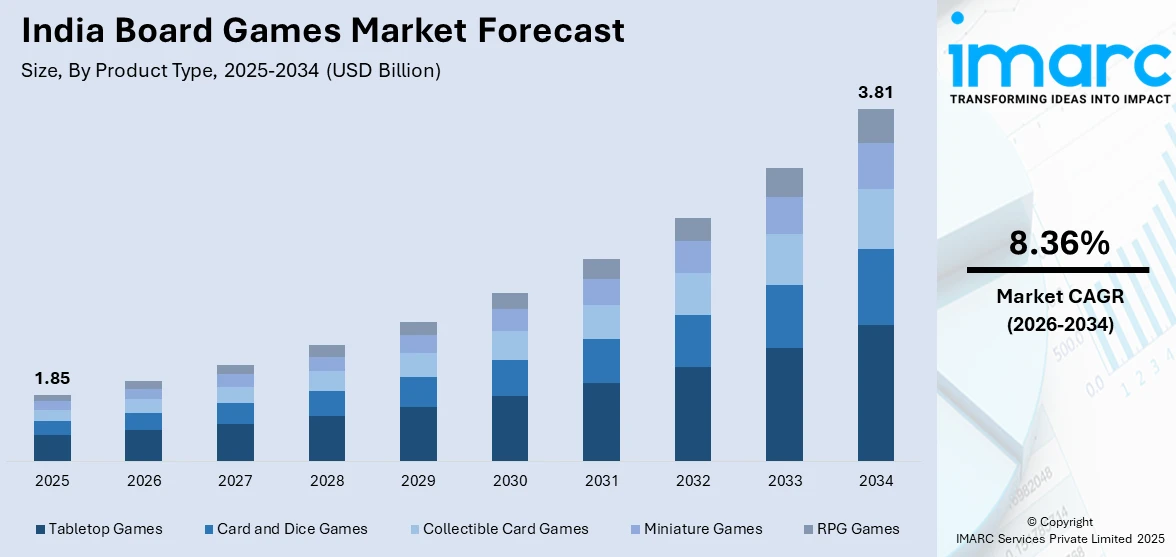

The India board games market size was valued at USD 1.85 Billion in 2025 and is projected to reach USD 3.81 Billion by 2034, growing at a compound annual growth rate of 8.36% from 2026-2034.

The India board games market is witnessing strong growth, fueled by rising disposable incomes, a shift toward family-focused entertainment, and increasing interest in indoor recreational activities. The market is further supported by the expansion of e-commerce, the nostalgic charm of traditional games, and a move toward engaging, interactive experiences that encourage social interaction, cognitive skills, and quality family time. These factors collectively contribute to the growing adoption of board games and a larger share in India’s recreational gaming segment.

Key Takeaways and Insights:

- By Product Type: Tabletop games dominated the market with 32% revenue share in 2025, driven by the enduring popularity of classic games like Ludo, Chess, and Carrom, which have deep cultural roots in Indian households and continue to be preferred choices for family gatherings and social entertainment.

- By Game Type: Strategy and war games led the market with a revenue share of 29% in 2025, owing to growing consumer interest in intellectually stimulating games that promote critical thinking, problem-solving abilities, and competitive engagement among players across different age groups.

- By Age Group: 5-12 years represent the largest revenue share of 40% in 2025, supported by parental emphasis on educational entertainment alternatives to screen time, along with schools integrating board games into curricula for cognitive skill development.

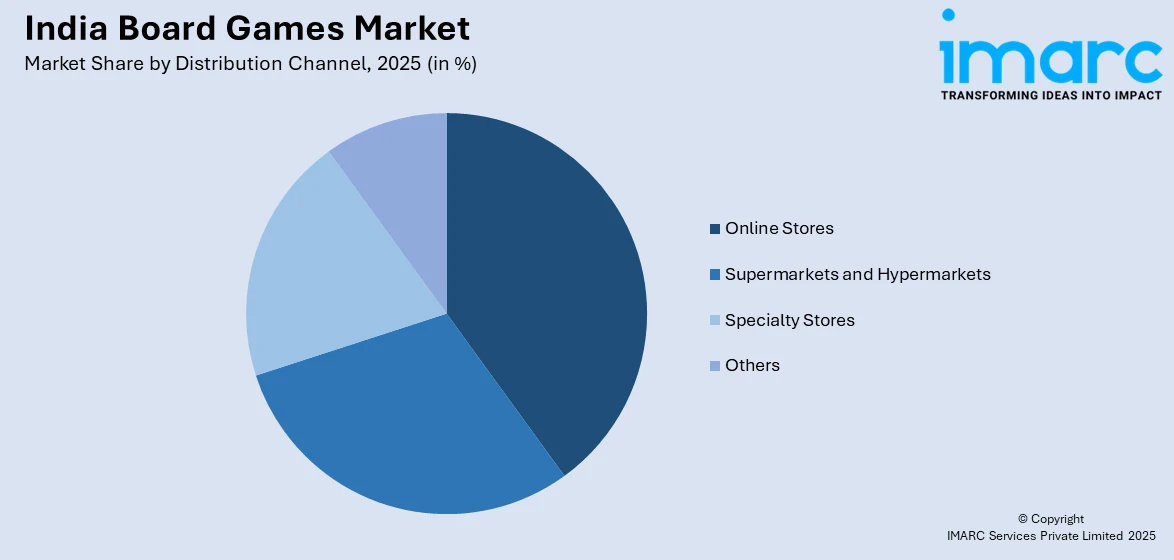

- By Distribution Channel: Online stores dominated with 36% market share in 2025, driven by expanding e-commerce penetration, competitive pricing, convenient doorstep delivery, and diverse product selection available through major platforms.

- By Region: North India represent the largest revenue share of 30% in 2025, driven by rising consumer interest in recreational and family entertainment, increasing awareness of educational and strategy-based games, growing urbanization, and the expansion of retail and e-commerce channels.

- Key Players: The India board games market exhibits moderate competitive intensity, with established multinational companies competing alongside domestic manufacturers. The market features a mix of international brands focusing on premium strategy games and local players offering affordable traditional games, creating diverse options across various price segments.

To get more information on this market Request Sample

The India board games market is witnessing a dynamic transformation driven by evolving consumer lifestyles, increasing urbanization, and the rising popularity of indoor entertainment. Families and young professionals are increasingly seeking board games as a medium for bonding, stress relief, and skill development. The digital shift has expanded availability through e-commerce platforms while popularizing hybrid models where traditional games integrate with online versions. For instance, Ludo King, developed by Gametion Technologies, became the first Indian mobile game to surpass one billion downloads globally in 2024, demonstrating the strong appetite for digitized traditional games. The market benefits from growing awareness about play-based learning and the cognitive benefits of board games, with publishers developing India-specific content incorporating local culture, history, and languages. Board game cafes and gaming communities are also promoting awareness and interest in contemporary board games, creating social venues that introduce consumers to diverse gaming experiences across major cities.

India Board Games Market Trends:

Growth of Online Board Game Platforms

The proliferation of digital board game platforms represents a transformative trend in the market, changing how consumers interact with classic games. With increasing smartphone and internet penetration, consumers are turning toward digital versions of well-known board games. Platforms offering Ludo, Carrom, and Chess have gained widespread popularity, providing convenient and immersive alternatives to physical games. These platforms enable multiplayer capabilities and social interaction across geographical boundaries, attracting new generations of players who may lack space or time for traditional board games.

Rising Demand for Educational and Skill-Based Games

Educational board games are gaining strong traction as parents and educators increasingly seek games that combine entertainment with intellectual engagement. These games enhance problem-solving, critical thinking, memory, and strategic planning skills. Titles focused on mathematics, language, science, and general knowledge are becoming popular among school-going children. Publishers are developing India-specific content incorporating local culture and history. For instance, in January 2025, a Kerala-based researcher announced the launch of an educational board game designed to demystify menstruation for children, demonstrating the expansion into socially conscious educational content.

Emergence of Culturally-Inspired Indian Board Games

A growing trend in the market is the increasing preference for games reflecting local heritage and cultural narratives. Consumers, especially younger generations, are showing renewed interest in titles inspired by Indian mythology, folklore, and historical themes. Startups and homegrown brands are innovating with games based on ancient Indian strategies alongside modernized versions of classic games. These culturally relevant products offer educational value while catering to rising demand for storytelling and cultural relevance, moving from homes to classrooms, cafes, and festivals.

Market Outlook 2026-2034:

The India board games market outlook remains positive, driven by sustained consumer interest in offline entertainment, expanding retail infrastructure, and continuous product innovation catering to diverse demographics. The market is expected to benefit from increasing disposable incomes, a growing middle-class population, and a rising preference for quality family time. Major international brands are expanding their presence through local manufacturing partnerships, making premium games more accessible. Board game cafes are proliferating across metropolitan areas, creating social venues that introduce consumers to diverse gaming experiences. The market generated a revenue of USD 1.85 Billion in 2025 and is projected to reach a revenue of USD 3.81 Billion by 2034, growing at a compound annual growth rate of 8.36% from 2026-2034.

India Board Games Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Tabletop Games |

32% |

|

Game Type |

Strategy and War Games |

29% |

|

Age Group |

5-12 Years |

40% |

|

Distribution Channel |

Online Stores |

36% |

|

Region |

North India |

30% |

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

Tabletop games dominate with a market share of 32% of the total India board games market in 2025.

Tabletop games represent the largest product category driven by deep cultural affinity for traditional Indian games and their role in family entertainment. Classic titles, including Ludo, Chess, Carrom, and Snakes & Ladders, continue to maintain strong consumer loyalty across generations. These games serve as essential components of family gatherings, festivals, and social occasions, reinforcing their position as household staples. The segment benefits from affordable pricing, easy accessibility, and a nostalgic appeal that resonates with consumers seeking screen-free entertainment options.

The board games segment is evolving with modernized versions that showcase improved designs, premium-quality materials, and diverse thematic variations. Alongside traditional games, international strategy titles are increasingly popular, with domestic manufacturers obtaining licensing agreements to produce these globally recognized games locally. This approach makes premium international games more accessible to consumers at competitive pricing while simultaneously fostering local production capabilities. By combining innovation in design with strategic manufacturing partnerships, the segment is enhancing its appeal, offering players high-quality gaming experiences that blend global standards with local availability.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

Strategy and war games leads the market with a share of 29% of the total India board games market in 2025.

Strategy and war games dominate the game type segment due to growing consumer appetite for intellectually challenging and competitive gaming experiences. These games promote critical thinking, tactical planning, and decision-making skills while providing engaging entertainment for both casual players and enthusiasts. The segment attracts a diverse demographic including young professionals and adults seeking mentally stimulating leisure activities that offer alternatives to digital entertainment.

International strategy titles are experiencing strong adoption among urban consumers, supported by expanding retail availability and growing board game communities. Publishers are localizing popular titles with Indian themes and cultural elements to enhance relevance. Sports-themed strategy games combining national passions with board game mechanics have emerged successfully, with manufacturers developing cricket-themed editions that resonate with consumers across age groups during major sporting events.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

5-12 years exhibits clear dominance with a 40% share of the total India board games market in 2025.

The 5-12 years age group represents the largest consumer segment, driven by parental focus on educational entertainment and cognitive development. Board games serve as effective tools for building problem-solving abilities, mathematical skills, vocabulary, and social interaction among children. Parents increasingly view board games as healthy alternatives to excessive screen time, promoting face-to-face interaction and family bonding. Schools and educational institutions are integrating board games into curricula as engaging learning tools.

The segment benefits from diverse product offerings spanning educational titles, creative games, and age-appropriate strategy games designed specifically for children. Government initiatives promoting play-based learning have further supported adoption, with state-level programs incorporating board games into early education curricula. Publishers are developing games that address various learning objectives including cognitive skills, motor development, and social-emotional learning, expanding the educational board games portfolio available to Indian consumers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Online stores represents the largest share with 36% of the total India board games market in 2025.

Online retail channels have emerged as the dominant distribution platform driven by expanding e-commerce penetration, digital payment adoption, and consumer preference for convenient shopping experiences. Major e-commerce platforms offer extensive product selection, competitive pricing, and doorstep delivery across urban and semi-urban areas. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. The channel particularly benefits younger demographics who prefer digital shopping journeys and rely on online reviews and recommendations for purchase decisions.

The online segment is experiencing accelerated growth supported by increasing smartphone penetration, expanding internet connectivity in smaller cities, and growing consumer confidence in digital transactions. E-commerce platforms facilitate access to both domestic and international titles, enabling consumers to discover niche products unavailable through traditional retail. The channel also supports independent game creators in reaching broader audiences, contributing to market diversification and innovation.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates the regional landscape with a 30% share of the total India board games market in 2025.

The India board games market in North India is being fueled by rising disposable incomes and a growing preference for family-oriented entertainment. Urban households are increasingly seeking indoor recreational activities that encourage social interaction and quality time, particularly among children and young adults. The popularity of strategy-based and educational games is also rising, as parents look for engaging ways to enhance cognitive skills and problem-solving abilities. E-commerce platforms and organized retail stores are making a wide variety of board games more accessible, further boosting adoption in the region.

Cultural trends and nostalgic appeal are significant drivers of the North India board games market. Traditional games, combined with modern, thematic, and immersive versions, resonate with consumers seeking both entertainment and meaningful engagement. Festivals, holidays, and school vacations create seasonal spikes in demand, while localized marketing campaigns increase awareness and visibility. Additionally, the growing acceptance of board games as gifts or social activity tools is encouraging frequent purchases, helping expand the market’s reach across urban, semi-urban, and emerging towns in North India.

Market Dynamics:

Growth Drivers:

Why is the India Board Games Market Growing?

Rising Disposable Incomes and Family Entertainment Preferences

The growth of disposable incomes in Indian households is allowing them to spend more on entertainment and leisure products such as board games. The increasing number of middle-class citizens is demanding good entertainment facilities as a family to bond and interact. Board games provide long-term value over replayability, unlike outdoor activities and online subscriptions, which are costly entertainment options. There is a growing trend of families setting up budgets to purchase recreational products that unite their members, especially on weekends, holidays, and during festivities. This reorientation of the family entertainment market has caused long-term competition in the provision of various board games at different price points.

Expanding E-Commerce Infrastructure and Digital Retail Growth

The fast development of e-commerce facilities is substantially increasing access to board games in India. The online platforms can help the consumers in lesser cities and towns to get access to the products that were only accessible in metropolitan regions. Online retailing platforms provide a wide product line, customer reviews, competitive prices, and convenient delivery services that the brick and mortar retailing cannot deliver. Online transactions have become easier with the growth of digital payment mechanisms, one of which is UPI, which is inviting consumers to adopt it. E-commerce platforms are also enabling international brands to enter the Indian market without extensive physical retail investment, expanding the product variety available to consumers.

Growing Awareness of Cognitive Benefits and Screen Time Concerns

Increasing parental awareness about the cognitive and developmental benefits of board games is driving market growth. Research highlighting the positive impact of board games on problem-solving abilities, strategic thinking, social skills, and emotional development has influenced purchasing decisions. Simultaneously, growing concerns about excessive screen time among children are prompting parents to seek engaging offline entertainment alternatives. Board games address both objectives by providing mentally stimulating activities that promote face-to-face interaction. Educational institutions are integrating board games into learning programs, further validating their developmental value and expanding the consumer base.

Market Restraints:

What Challenges the India Board Games Market is Facing?

Price Sensitivity and Affordability Concerns

Price sensitivity among Indian consumers presents a significant challenge for premium board game adoption. Many consumers exhibit psychological resistance to spending substantial amounts on board games, particularly when compared to low-cost traditional games. This pricing perception limits the addressable market for international strategy games and premium editions, constraining revenue growth potential in higher-margin segments.

Limited Distribution Networks in Smaller Cities

Distribution infrastructure limitations in Tier 2 and Tier 3 cities restrict market penetration beyond metropolitan areas. Specialty toy stores and premium retail outlets remain concentrated in major urban centers, limiting physical product availability in smaller markets. Independent game designers and smaller publishers face challenges in establishing distribution networks, hampering product diversity in underserved regions.

Intense Competition from Digital Gaming Alternatives

The proliferation of mobile gaming and digital entertainment platforms creates competitive pressure on physical board games. Free-to-play mobile games offer convenient, readily accessible entertainment that competes for consumer leisure time. Digital alternatives provide features including online multiplayer, progress tracking, and instant gratification that physical games cannot replicate, challenging traditional board game adoption among younger demographics.

Competitive Landscape:

The India board games market exhibits moderate competitive intensity characterized by a mix of multinational corporations, established domestic manufacturers, and emerging independent game creators. The market structure reflects segmentation across price tiers, with international brands competing in premium segments while local manufacturers dominate mass-market traditional games. Strategic licensing partnerships enable domestic companies to manufacture globally recognized titles locally, combining international intellectual property with cost-effective production. The competitive landscape is evolving with new entrants focusing on culturally-relevant content, educational games, and innovative designs that differentiate from established offerings. Distribution capabilities, pricing strategies, and brand recognition serve as key competitive factors influencing market positioning across segments.

Recent Developments:

- August 2024: Funskool India Ltd., backed by tyre giant MRF Group, has obtained the distribution rights for the Catan board game from prominent entertainment company Asmodee. By securing the manufacturing rights for Catan, Funskool India is expanding its portfolio of international board games, with plans to introduce the popular game to the Indian market soon.

- October 2023: Hasbro introduced Monopoly Cricket and launched an accompanying promotional campaign. The game is designed and produced in India, reflecting a focus on local manufacturing and sourcing. Monopoly Cricket is intended to bring people together for enjoyable and engaging experiences, with its release timed to align with the nationwide excitement surrounding the ICC World Cup 2023.

India Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India board games market size was valued at USD 1.85 Billion in 2025.

The India board games market is expected to grow at a compound annual growth rate of 8.36% from 2026-2034 to reach USD 3.81 Billion by 2034.

Tabletop games dominated the market with 32% revenue share in 2025, driven by cultural affinity for traditional games like Ludo, Chess, and Carrom that serve as household staples for family entertainment.

Key factors driving the India board games market include rising disposable incomes, expanding e-commerce infrastructure, growing awareness of cognitive benefits, increasing preference for screen-free family entertainment, and product innovation with culturally-relevant content.

Major challenges include price sensitivity among consumers limiting premium game adoption, limited distribution networks in Tier 2 and Tier 3 cities, intense competition from digital gaming alternatives, and psychological barriers to spending on board games compared to other entertainment options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)