India Boiler Market Size, Share, Trends and Forecast by Boiler Type, End User, and Region, 2025-2033

India Boiler Market Size and Share:

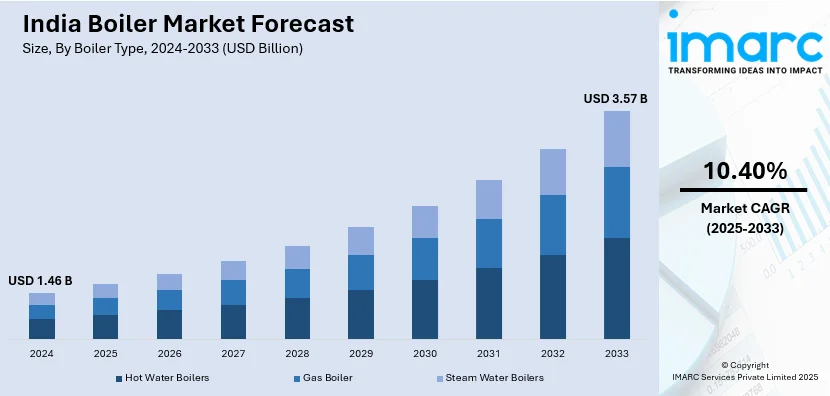

The India boiler market size reached USD 1.46 Billion in 2024. The market is expected to reach USD 3.57 Billion by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. The market growth is attributed to rapid industrial expansion driven by 'Make in India' initiatives and growing manufacturing sectors including textiles, pharmaceuticals, and food processing industries, rising electricity demand from increasing urbanization and industrialization requiring advanced thermal power generation infrastructure, and comprehensive government policies promoting energy efficiency and environmental compliance in industrial operations.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of boiler type, the market has been divided into hot water boilers, gas boiler, and steam water boilers.

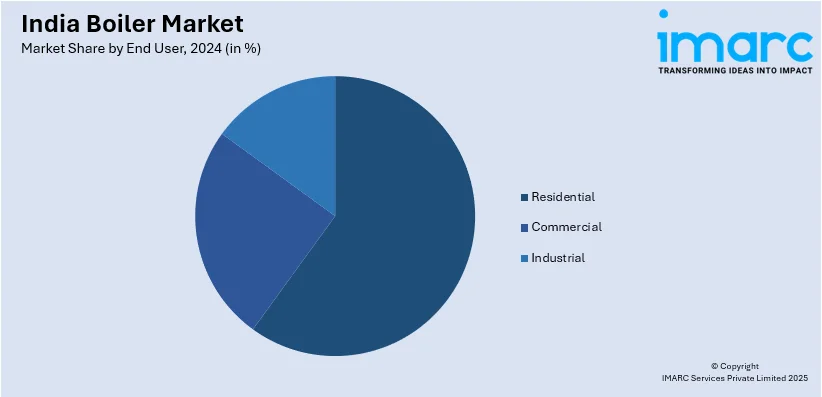

- On the basis of end user, the market has been divided into residential, commercial, and industrial.

Market Size and Forecast:

- 2024 Market Size: USD 1.46 Billion

- 2033 Projected Market Size: USD 3.57 Billion

- CAGR (2025-2033): 10.40%

India Boiler Market Trends:

Growing Industrial Expansion

Industrial expansion is catalyzing the India boiler market outlook by increasing demand across multiple sectors. Manufacturing, chemical, and power industries require efficient boilers for steam generation and heating applications. Growing industrialization under initiatives like ‘Make in India’ is encouraging investments in large-scale production facilities. These industries need high-capacity boilers to support continuous operations and enhance productivity. The rapid growth of sectors such as textiles, pharmaceuticals, and food processing are further accelerating boiler adoption. The Ministry of Food Processing Industries approved 41 Mega Food Parks, 399 Cold Chain projects, 76 Agro-Processing Clusters, 588 Food Processing Units, 61 projects for Backward & Forward Linkages, and 52 Operation Green projects under PMKSY, catalyzing the demand for industrial boilers. Expanding industrial hubs and special economic zones (SEZs) are creating a strong market for advanced boiler systems. Rising foreign direct investments (FDI) in manufacturing and process industries are fueling demand for energy-efficient boilers. Industrial plants are upgrading to modern boilers to comply with energy efficiency and environmental regulations. Increasing construction of industrial parks and factories is necessitating reliable steam and power generation solutions. Adoption of automation and Industry 4.0 technologies is driving the need for high-performance industrial boilers.

To get more information on this market, Request Sample

Rising Power Demand

The growing electricity consumption from industries, households, and commercial sectors is advancing investments in power generation. Thermal power plants, which dominate India’s energy mix, require high-capacity boilers for steam and electricity production. Expanding urbanization and industrialization are contributing to higher energy needs, necessitating advanced and efficient boiler systems. Government initiatives to enhance power infrastructure are also strengthening the installation of new thermal power plants. In February 2025, THDC India Limited (THDCIL) officially began commercial operations of a 660-megawatt (MW) unit at the Khurja Super Thermal Power Plant (STPP) in Bulandshahr (Uttar Pradesh), signifying its foray into the thermal energy sector and increasing demand for high-performance boilers. Moreover, the escalating demand for uninterrupted electricity supply is encouraging investments in supercritical and ultra-supercritical boilers, which further propels the India boiler market growth. Renewable energy integration requires stable backup power, supporting the use of efficient steam boilers. Rising coal-based and gas-based power projects are creating a steady demand for industrial boiler systems. Upgradation of existing thermal plants is driving the replacement of outdated boilers with energy-efficient models. Expansion of data centers and IT hubs is increasing electricity consumption, leading to higher boiler installations. Growing electrification in rural areas is further amplifying the need for consistent power generation capacity.

Sustainability and Technological Innovation

As per the India boiler market analysis, the industry is experiencing a transformative shift toward sustainable and technologically advanced solutions, driven by environmental consciousness and operational efficiency requirements. The industry is witnessing a significant transition toward low-emission boiler systems, with manufacturers increasingly developing biomass boilers that utilize agricultural waste, wood pellets, and other organic materials as fuel sources, reducing carbon footprint and supporting India's renewable energy targets. Waste-heat recovery boilers are gaining prominence across industrial applications, enabling companies to capture and utilize waste heat from manufacturing processes, thereby improving overall energy efficiency and reducing operational costs and augmenting the India boiler market share. Simultaneously, the digitalization revolution is reshaping boiler operations through the integration of Internet of Things (IoT) sensors, artificial intelligence algorithms, and advanced automation systems that enable real-time monitoring, predictive maintenance, and remote operation capabilities. Smart boilers equipped with AI-powered analytics can predict potential equipment failures, optimize fuel consumption, and automatically adjust operational parameters to maintain peak efficiency. Leading manufacturers like Thermax are introducing products such as the Greenpac biograte boiler and Thermeon 2.0 systems that incorporate these advanced technologies.

Regulatory Compliance and Energy Transition

Government regulations and energy efficiency mandates are fundamentally reshaping the India boiler market demand, compelling industries to adopt high-efficiency, low-emission boiler systems to meet increasingly stringent environmental standards. The Central Pollution Control Board (CPCB) and various state pollution control boards have implemented stringent emission norms for industrial boilers, particularly targeting sulfur dioxide, nitrogen oxides, and particulate matter limits that require advanced combustion technologies and pollution control equipment. The Ministry of Power's Perform, Achieve and Trade (PAT) scheme mandates energy efficiency improvements for energy-intensive industries, driving demand for supercritical and ultra-supercritical boiler technologies that offer significantly higher thermal efficiency compared to conventional systems, contributing to the India boiler market growth. The Bureau of Energy Efficiency (BEE) has established mandatory energy efficiency standards for industrial boilers, requiring regular energy audits and compliance reporting that incentivize investments in modern, efficient boiler systems. Renewable energy integration policies are creating new opportunities for boiler manufacturers as intermittent solar and wind energy sources require reliable backup power systems to ensure grid stability and continuous industrial operations. Hybrid energy systems combining renewable sources with efficient steam boilers are becoming increasingly popular, particularly in industries with high process steam requirements such as textiles, chemicals, and food processing.

Industry 4.0 and Advanced Manufacturing Integration

The widespread adoption of Industry 4.0 technologies across India's manufacturing sector is driving unprecedented demand for high-performance, intelligent boiler systems that can seamlessly integrate with automated production environments and smart manufacturing ecosystems and impact the India boiler market price trends. Advanced manufacturing facilities implementing digital twin technologies, real-time data analytics, and automated quality control systems require boiler infrastructure that can provide precise, consistent steam parameters while adapting to dynamic production requirements and varying load conditions. The pharmaceutical and biotechnology industries, which have experienced significant growth in India, demand ultra-clean steam generation systems with precise temperature and pressure control capabilities to support critical manufacturing processes including fermentation, sterilization, and chemical synthesis operations. Food processing plants implementing advanced packaging, preservation, and quality control technologies require specialized boiler systems that can provide multiple steam grades, from high-pressure process steam to low-pressure heating applications, while maintaining strict hygiene and safety standards. The automotive manufacturing sector, particularly with the growth of electric vehicle production facilities, requires sophisticated boiler systems that can support advanced manufacturing processes including metal forming, coating applications, and battery component production. Textile manufacturers adopting automated dyeing, finishing, and quality control systems demand boiler infrastructure that can provide consistent steam supply while minimizing water consumption and chemical usage through advanced water treatment integration. The integration of boiler systems with Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) platforms enables real-time production optimization, energy cost management, and predictive maintenance scheduling.

Growth, Opportunities, and Challenges in the India Boiler Market:

- Growth Drivers of the India Boiler Market: The rapid industrial expansion under 'Make in India' initiative and growing manufacturing sectors including pharmaceuticals, textiles, and food processing are creating substantial demand for advanced boiler systems. Increasing electricity consumption from urbanization and digitalization is driving investments in thermal power generation infrastructure requiring high-capacity boiler installations. Government policies promoting energy efficiency and environmental compliance are compelling industries to upgrade to supercritical and ultra-supercritical boiler technologies.

- Opportunities in the India Boiler Market: The transition toward sustainable manufacturing and green energy solutions presents significant opportunities for biomass boiler manufacturers and waste-heat recovery system providers. Integration of IoT, AI, and automation technologies offers substantial growth potential for smart boiler solutions enabling predictive maintenance and remote monitoring capabilities. Expansion of renewable energy infrastructure creates demand for flexible backup boiler systems supporting grid stability and industrial process continuity.

- Challenges in the India Boiler Market: High initial capital investments for advanced supercritical boiler technologies and associated infrastructure upgrades create financial barriers for small and medium enterprises. Stringent environmental regulations and compliance requirements increase operational complexity and ongoing monitoring costs for boiler operators. Limited availability of skilled technicians and engineers with expertise in advanced boiler technologies constrains effective operation and maintenance of sophisticated systems.

India Boiler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on boiler type and end user.

Boiler Type Insights:

- Hot Water Boilers

- Gas Boiler

- Steam Water Boilers

The report has provided a detailed breakup and analysis of the market based on the boiler type. This includes hot water boilers, gas boiler, and steam water boilers.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Boiler Market News:

- In May 2025, iFOREST hosted the first National Conclave on Greening Industrial Boilers in Lucknow, releasing reports on India’s boiler landscape. The conclave emphasized the need for a Green Boiler Mission to reduce emissions, promote clean technologies like solar thermal, hydrogen, and biomass, and address the growing environmental impact of process boilers in India.

- In March 2025, the Boilers Bill, 2024 was introduced in the Lok Sabha, aimed at replacing the Boilers Act, 1923. The Bill introduces key reforms to enhance safety, ease of doing business, and the efficiency of boiler operations in India. Notably, it decriminalizes certain offences, reduces penalties for non-criminal offences, and emphasizes worker safety and the competence of personnel involved in boiler operations. The Bill also omits obsolete provisions and clarifies regulations to meet modern industry needs, benefiting sectors like MSMEs.

- In September 2024, Thermax, a leading provider of energy and environmental solutions, presented a diverse range of innovative technologies at Boiler India 2024, held from September 25 to 27, 2024, at the CIDCO Exhibition Centre in Navi Mumbai.

- In September 2024, Boiler India 2024, held from September 25-27 at CIDCO Exhibition Centre, Navi Mumbai, showcased advanced boiler technologies, pressure vessels, and energy solutions. With 258 exhibitors and 24,000+ visitors, the event featured seminars, panel discussions, and awards, fostering innovation and networking in India's boiler industry, highlighting sustainability, efficiency, and regulatory advancements.

- In May 2024, Valmet announced it will upgrade a recovery boiler for Kuantum Papers Limited in Punjab, India. This project, which involves enhancing an older boiler originally commissioned in 2007, aims to boost efficiency and performance. The upgrade includes key pressure parts, a new economizer, and advanced boiler-related systems. The installation is set for February 2025.

- In March 2024, the 1st Bharat Steam Boiler Expo was inaugurated in Guwahati. The event, aimed at promoting innovation and sustainability in the boiler industry, hosted industry leaders and experts, focusing on energy-efficient solutions and skill development, while also unveiling the Bharat Institute of Modern Manufacturing Applied Sciences for the youth’s future industrial readiness.

India Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Boiler Types Covered | Hot Water Boilers, Gas Boiler, Steam Water Boilers |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India boiler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India boiler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The boiler market in India was valued at USD 1.46 Billion in 2024.

The India boiler market is projected to exhibit a CAGR of 10.40% during 2025-2033, reaching a value of USD 3.57 Billion by 2033.

The India boiler market is driven by rising industrialization, increasing demand for power generation, and growing adoption of energy-efficient systems. Expanding manufacturing sectors, infrastructure projects, and emphasis on cleaner fuel technologies are further boosting demand, supported by government initiatives promoting sustainable energy solutions across various industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)