India Bread Market Size, Share, Trends and Forecast by Product Type, Ingredient, Sales Channel, and Region, 2025-2033

India Bread Market Overview:

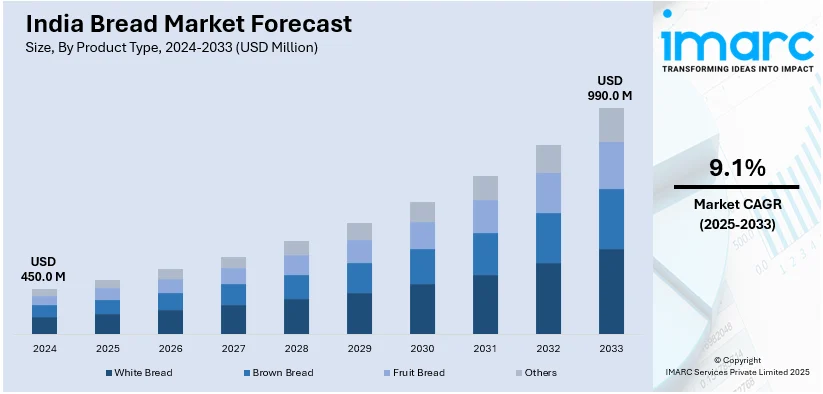

The India bread market size reached USD 450.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 990.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.1% during 2025-2033. The market is driven by increasing urbanization, rising demand for convenience foods, and growing health consciousness. Additionally, expanding retail and e-commerce channels, along with innovations in whole wheat, multigrain, and gluten-free bread, further fuel the India bread market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 450.0 Million |

| Market Forecast in 2033 | USD 990.0 Million |

| Market Growth Rate 2025-2033 | 9.1% |

India Bread Market Trends:

Growing Health Consciousness and Rising Demand for Healthier Alternatives

Rising awareness about health and nutrition has led to increased demand for whole wheat, multigrain, high-fiber, and gluten-free bread options in India. Consumers are shifting away from traditional white bread toward healthier alternatives that offer better nutritional value. This trend is also driving innovations in bread manufacturing, with brands introducing fortified bread enriched with vitamins, minerals, and seeds. The growing prevalence of lifestyle diseases such as obesity and diabetes are further encouraging consumers to opt for low-carb and protein-rich bread varieties supporting the shift toward functional foods and contributing to the growth of India bread market share. For instance, in May 2023, Bonn Group of Industries, a top manufacturer of FMCG food items in India, introduced Millet Bread along with other bakery products such as Millet Pizza and Millet Burgers. Bonn Millet bakery products are a nutritious superfood filled with the benefits of Jowar, Bajra, and Ragi, providing an excellent source of vital nutrients.

To get more information on this market, Request Sample

Expansion of Retail and E-Commerce Channels

The growth of supermarkets, hypermarkets, convenience stores, and online grocery platforms has significantly boosted the bread market in India. Organized retail makes fresh and packaged bread widely available, while e-commerce platforms provide convenience with home delivery options. The increasing penetration of quick commerce (10–30-minute delivery services) is also driving impulse purchases and making a variety of bread options more accessible. Additionally, bakeries and local brands are leveraging digital platforms to expand their reach, catering to a broader consumer base and creating a positive India bread market outlook. For instance, in January 2025, Baker’s Loaf launched in Delhi NCR offering artisanal handcrafted bread exclusively on quick-commerce platforms. The debut range features five premium products including Oatmeal Bread and Zero Maida Burger Buns. Designed for modern consumers Baker’s Loaf merges quality ingredients with artisanal techniques elevating everyday meals into memorable experiences.

India Bread Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, ingredient, and sales channel.

Product Type Insights:

- White Bread

- Brown Bread

- Fruit Bread

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes white bread, brown bread, fruit bread, and others.

Ingredient Insights:

- Inorganic

- Organic

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes inorganic and organic.

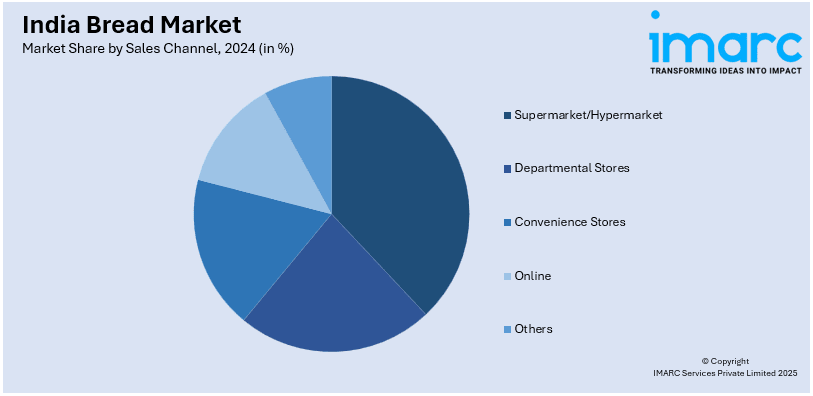

Sales Channel Insights:

- Supermarket/Hypermarket

- Departmental Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarket/hypermarket, departmental stores, convenience stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bread Market News:

- In February 2025, Bonn, a prominent brand in the FMCG industry known for its high-quality bakery items, launched its newest product, Bonn TRUE ZERO MAIDA Wholewheat Brown Bread. Created for today's health-aware consumer, this bread is made with top-quality ingredients to deliver an unmatched flavor experience, while remaining aligned with Bonn's dedication to providing healthy options in the bread market.

- In September 2023, Freshey's, the ready-to-cook (RTC) brand associated with BrandsNext, which is WayCool's quickest expanding FMCG division, made its debut in the Indian bread market by launching Malabar Parota and Whole Wheat Chapati. This tactical step taken by BrandsNext seeks to enhance its RTC portfolio, providing ease and variety for consumers.

India Bread Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Bread, Brown Bread, Fruit Bread, Others |

| Ingredients Covered | Inorganic, Organic |

| Sales Channels Covered | Supermarket/Hypermarket, Departmental Stores, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bread market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bread market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bread industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India bread market was valued at USD 450.0 Million in 2024.

The bread market in India is projected to exhibit a CAGR of 9.1% during 2025-2033, reaching a value of USD 990.0 Million by 2033.

The Indian bread market is driven by rapid urbanization, busy lifestyles, and rising disposable incomes demanding convenient, ready-to-eat options. Health consciousness boosts demand for whole wheat, multigrain, and gluten-free variants. Expansion of modern retail and ecommerce platforms further increases accessibility and encourages product innovation across brands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)