India Building Energy Efficiency Systems Market Size, Share, Trends and Forecast by System Type, Building Type, Deployment Mode, Technology Type, and Region, 2025-2033

India Building Energy Efficiency Systems Market Overview:

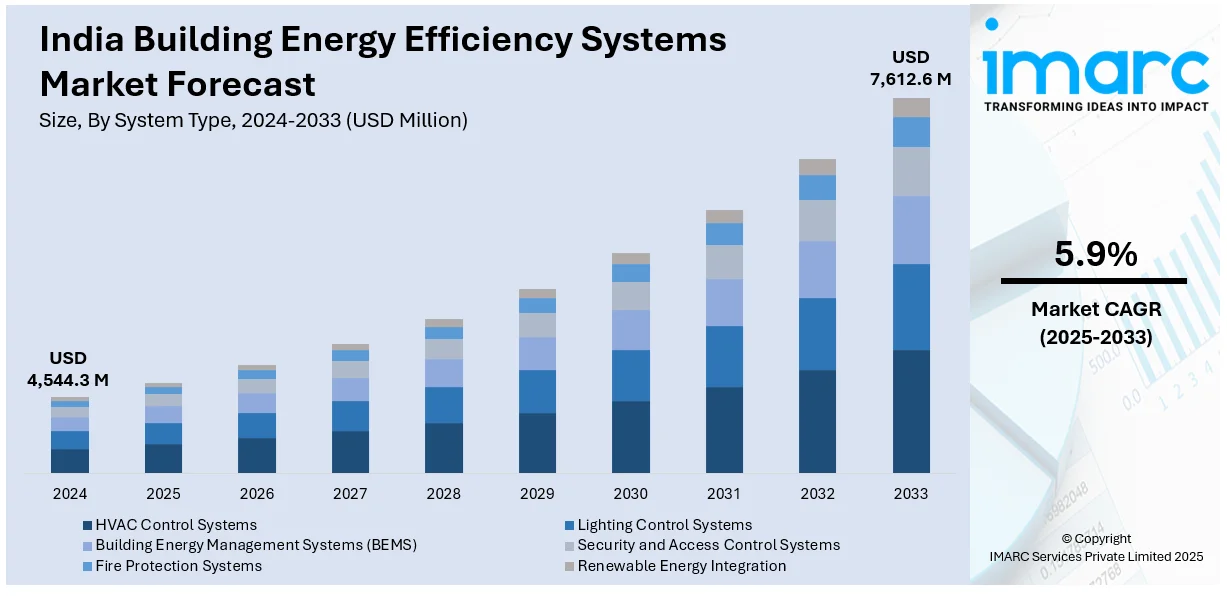

The India building energy efficiency systems market size reached USD 4,544.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,612.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The rising energy prices, increasing government energy conservation programs, growing smart building technology adoption, stricter environmental laws, rapid urbanization, the need for sustainable infrastructure, internet of things (IoT) and AI-driven energy management developments, and corporate sustainability pledges are expanding the India building energy efficiency systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,544.3 Million |

| Market Forecast in 2033 | USD 7,612.6 Million |

| Market Growth Rate 2025-2033 | 5.9% |

India Building Energy Efficiency Systems Market Trends:

Increasing Adoption of Smart Energy Solutions in Buildings

The rising focus on energy conservation and sustainability is driving the adoption of smart energy solutions in buildings across India. With increasing urbanization and the expansion of commercial and residential infrastructure, India building energy efficiency systems market growth is fueled by the growing demand for energy-efficient systems such as HVAC control, lighting management, and building energy management systems (BEMS). According to an industry report India's urban population is expected to grow to 600 million by 2036, potentially accounting for 75% of the country's GDP. This significant increase in urban population is projected to drive higher requirement for energy-efficient building systems, as cities will need to accommodate more residents and businesses in sustainable ways. The adoption of government policies, such as energy efficiency regulations and green building certification incentives, are further driving this transition. Moreover, the development of IoT, AI, and automation technologies is facilitating real-time monitoring and optimization of energy usage, resulting in substantial cost savings. Homeowners and businesses are increasingly investing in smart building technologies to improve energy performance and minimize carbon footprints. As companies and commercial establishments focus on sustainability, the market is also experiencing substantial growth, fueled by technological innovation and policy aid, placing energy efficiency systems as a key part of India's transforming infrastructure landscape.

To get more information on this market, Request Sample

Growing Investments in Renewable and AI-Driven Building Technologies

With a strong push toward sustainability and carbon neutrality, Indian businesses and government bodies are significantly investing in renewable energy integration and AI-driven energy management solutions. The article, published on April 26, 2024, examines the application of artificial intelligence (AI) techniques to enhance energy efficiency and indoor environmental quality (IEQ) in buildings. The study identifies five primary areas where AI is utilized, thermal comfort and indoor air quality control, energy management and consumption prediction, indoor temperature prediction, anomaly detection, and HVAC system controls. Additionally, the review highlights the need for policy development, real-life application scenarios, and further research into visual and acoustic comfort aspects. These results underscore the growing potential of AI-driven solutions in the building energy efficiency systems market, particularly as businesses and policymakers increasingly prioritize sustainability and cost-effective energy management. India building energy efficiency systems market outlook is influenced by smart buildings leveraging AI-powered automation to optimize energy usage, enhancing operational efficiency while lowering costs. The shift toward cloud-based deployment models is further improving the accessibility and scalability of building energy efficiency systems, enabling real-time energy monitoring. Additionally, the increasing adoption of wireless energy management solutions is streamlining system installation and reducing infrastructure costs. Companies are also prioritizing the integration of renewable energy sources such as solar and wind to reduce reliance on conventional power grids. With continued investments in AI, IoT, and clean energy technologies, the market is set for transformative growth in the coming years.

India Building Energy Efficiency Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on system type, building type, deployment mode, and technology type.

System Type Insights:

- HVAC Control Systems

- Lighting Control Systems

- Building Energy Management Systems (BEMS)

- Security and Access Control Systems

- Fire Protection Systems

- Renewable Energy Integration

The report has provided a detailed breakup and analysis of the market based on the system type. This includes HVAC control systems, lighting control systems, building energy management systems (BEMS), security and access control systems, fire protection systems, and renewable energy integration.

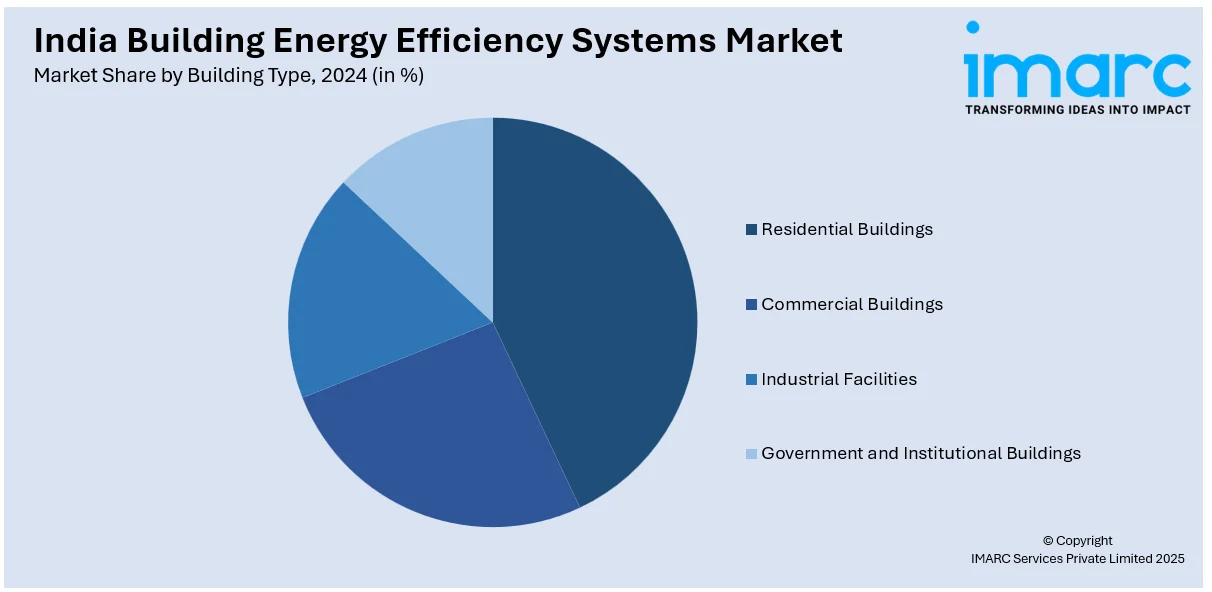

Building Type Insights:

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Government and Institutional Buildings

A detailed breakup and analysis of the market based on the building type have also been provided in the report. This includes residential buildings, commercial buildings, industrial facilities, and government and institutional buildings.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Type Insights:

- Wired Systems

- Wireless Systems

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes wired systems and wireless systems.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Building Energy Efficiency Systems Market News:

- On March 27, 2025, under the 'Bisleri's Greener Promise' initiative, Bisleri International Pvt. Ltd. announced a collaboration with Schneider Electric's Sustainability Business to strengthen energy efficiency and increase the use of renewable energy. As part of this partnership, six significant Bisleri plants in Maharashtra, Tamil Nadu, Karnataka, and Uttar Pradesh will receive up to 13.6 MW of solar power. The company's goal is to boost its green energy consumption to almost 33% and increase the energy efficiency of all of its manufacturing facilities by 2.5%.

India Building Energy Efficiency Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | HVAC Control Systems, Lighting Control Systems, Building Energy Management Systems (BEMS), Security and Access Control Systems, Fire Protection Systems, Renewable Energy Integration |

| Building Types Covered | Residential Buildings, Commercial Buildings, Industrial Facilities, Government and Institutional Buildings |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technology Types Covered | Wired Systems, Wireless Systems |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India building energy efficiency systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India building energy efficiency systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India building energy efficiency systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building energy efficiency systems market in India was valued at USD 4,544.3 Million in 2024.

The building energy efficiency systems market in India is projected to exhibit a CAGR of 5.9% during 2025-2033, reaching a value of USD 7,612.6 Million by 2033.

India’s building energy efficiency systems market is growing due to increasing urbanization and government policies like ECBC and PAT promoting sustainable construction. Rising awareness of climate change boosts demand for green buildings. Technological advances in smart building automation, IoT integration, and energy-efficient HVAC systems enhance performance. Additionally, financial incentives and stricter regulations support adoption. Growing infrastructure development and green certification trends further drive market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)