India Building Insulation Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Building Insulation Market Overview:

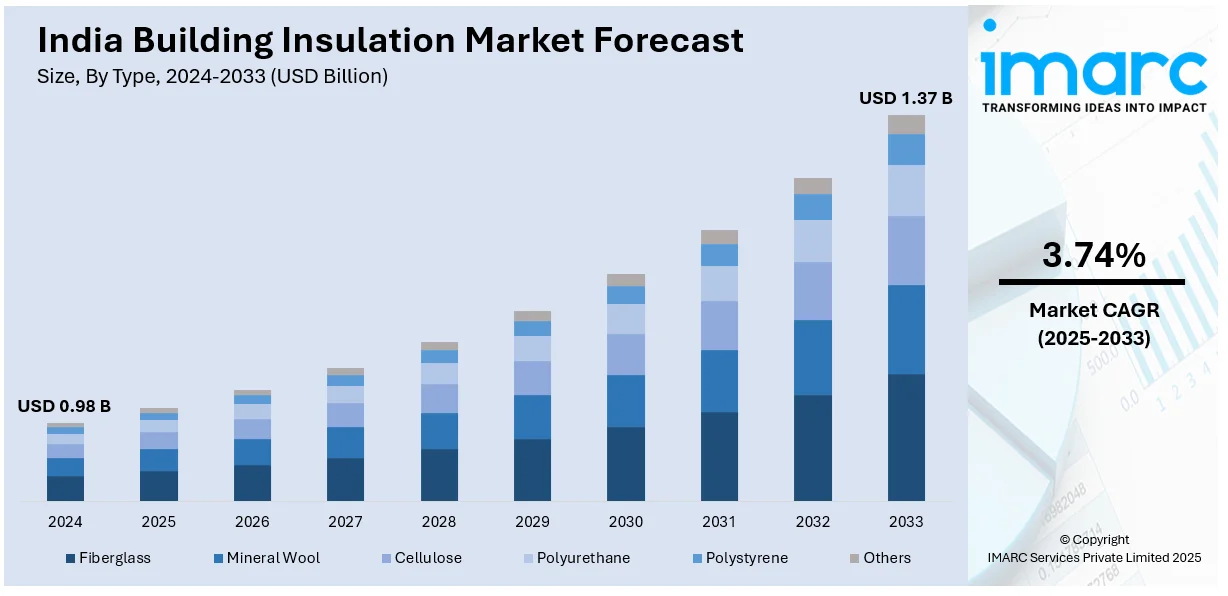

The India building insulation market size reached USD 0.98 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.37 Billion by 2033, exhibiting a growth rate (CAGR) of 3.74% during 2025-2033. Rising construction activities, energy efficiency regulations, and sustainability trends are driving the India building insulation market share. Besides this, government incentives, green building certifications, and technological advancements are catalyzing the demand for building insulation across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.98 Billion |

| Market Forecast in 2033 | USD 1.37 Billion |

| Market Growth Rate (2025-2033) | 3.74% |

India Building Insulation Market Trends:

Rising Number of Infrastructure Development Projects

The rising number of infrastructure development projects is significantly influencing the India building insulation market outlook. Growing investments in residential, commercial, and industrial projects are catalyzing the demand for efficient insulation solutions. Expanding urbanization and smart city initiatives are also encouraging the construction of energy-efficient buildings across India. In the Interim Budget 2024-25, the capital investment outlay for infrastructure increased by 11.1% to ₹11.11 lakh crore (US$ 133.86 billion), representing 3.4% of GDP, further driving the adoption of insulation. Large-scale metro rail, airport expansion, and highway projects are integrating insulation for thermal regulation and energy savings. The Government's focus on affordable housing and urban infrastructure is contributing to the adoption of advanced insulation materials. Increasing construction of IT parks, shopping malls, and hotels is creating opportunities for insulation manufacturers and suppliers. Rapid industrialization and the rise of manufacturing hubs are driving insulation demand for temperature-controlled environments. Strict energy efficiency regulations and building codes are mandating insulation usage in newly developed infrastructure. Developers are prioritizing sustainable construction practices, leading to higher adoption of eco-friendly insulation materials. Rising awareness about energy savings and indoor comfort is encouraging demand for insulation solutions. Apart from this, technological advancements are enabling the development of high-performance insulation materials for diverse infrastructure needs.

To get more information on this market, Request Sample

Rising Sustainability and Green Building Trends

Sustainability and green building trends are strengthening the India building insulation market growth, promoting energy-efficient materials. The rising adoption of Indian Green Building Council (IGBC), Green Rating for Integrated Habitat Assessment (GRIHA), and Leadership in Energy and Environmental Design (LEED) certifications is fueling the demand for eco-friendly insulation solutions. Developers are focusing on low-carbon footprint materials to align with global sustainability goals and regulations. The Energy Conservation Building Code (ECBC) is encouraging builders to incorporate insulation for improved energy efficiency. As India's renewable energy market is projected to reach USD 46.7 billion by 2032 as per IMARC Group, growing at a CAGR of 8.71% (2024-2032), sustainable construction is gaining momentum. Green buildings require high-performance insulation to reduce energy consumption and enhance indoor comfort levels. Government incentives and subsidies are encouraging the use of sustainable insulation materials in new construction projects. The growing corporate sustainability commitments are driving demand for recyclable and non-toxic insulation solutions. Increasing awareness about climate change and carbon emissions is advancing customers toward insulated, energy-efficient buildings. Businesses are prioritizing insulation to achieve net-zero energy buildings and lower long-term operational costs. Advanced insulation technologies such as aerogels and phase-change materials, are gaining traction in sustainable construction. Rising electricity costs are further motivating developers to integrate insulation for long-term energy savings.

India Building Insulation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Fiberglass

- Mineral Wool

- Cellulose

- Polyurethane

- Polystyrene

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fiberglass, mineral wool, cellulose, polyurethane, polystyrene, and others.

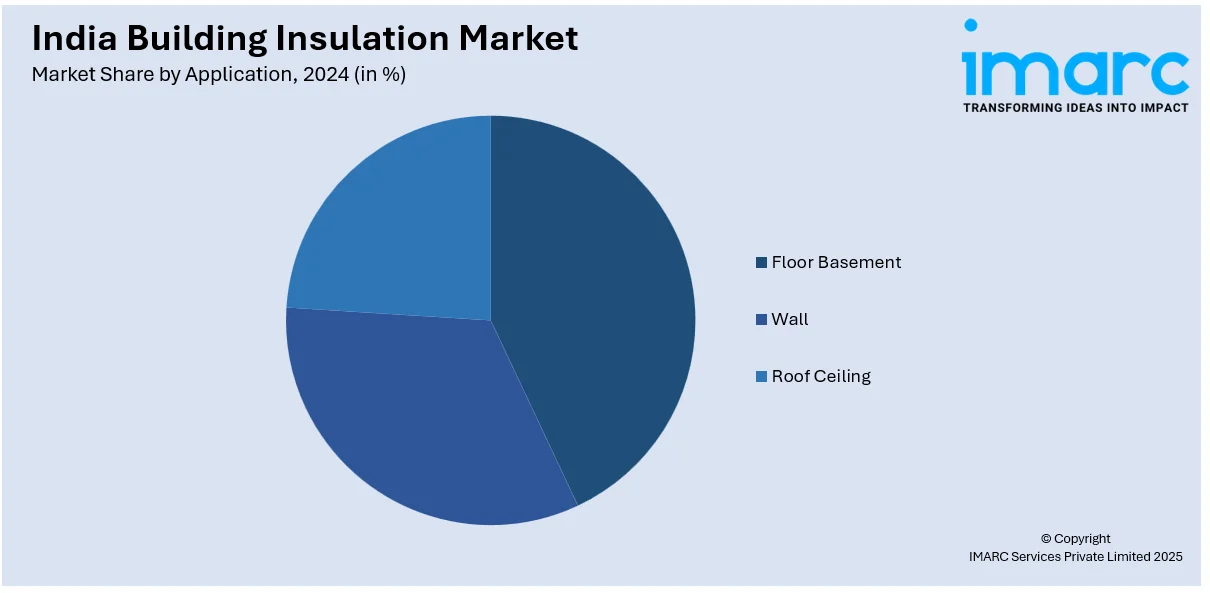

Application Insights:

- Floor Basement

- Wall

- Roof Ceiling

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes floor basement, wall, and roof ceiling.

End User Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and non-residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Building Insulation Market News:

- In January 2025, Indobell Insulations Limited, a leading manufacturer and contractor of specialized insulation products, announced its Initial Public Offering (IPO) to raise ₹1,014.30 lakhs. The IPO was open from January 6 to January 8, 2025, offering 22,05,000 equity shares at ₹46 each. Investors could participate with a minimum investment of ₹1,38,000, corresponding to a lot size of 3,000 shares.

- In September 2024, ROCKWOOL, a global leader in stone wool insulation, is strengthening its presence in India with a new factory in Cheyyar, Tamil Nadu. This ₹550 crore (approximately US$65.5 million) investment will be ROCKWOOL’s largest facility in India, producing 50,000 tons of non-combustible, recyclable stone wool insulation annually. The plant is set to begin operations in early 2026, generating around 150 local jobs.

India Building Insulation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fiberglass, Mineral Wool, Cellulose, Polyurethane, Polystyrene, Others |

| Applications Covered | Floor Basement, Wall, Roof Ceiling |

| End Users Covered | Residential, Non-Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India building insulation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India building insulation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India building insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India building insulation market size reached USD 0.98 Billion in 2024.

The India building insulation market is expected to reach USD 1.37 Billion by 2033, exhibiting a CAGR of 3.74% during 2025-2033.

Market growth is driven by increasing focus on energy efficiency in buildings, rising urbanization and construction activities, supportive government policies promoting green buildings, and growing awareness of thermal comfort and reduced energy costs among consumers and developers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)