India Building Integrated Photovoltaics Market Size, Share, Trends and Forecast by Product Type, Application, End Use, and Region, 2025-2033

India Building Integrated Photovoltaics Market Overview:

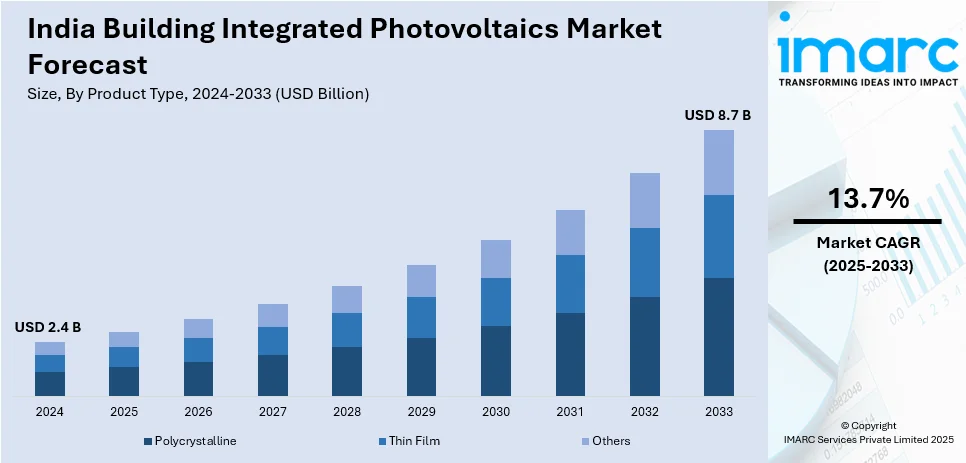

The India building integrated photovoltaics market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.7 Billion by 2033, exhibiting a growth rate (CAGR) of 13.7% during 2025-2033. The rising urbanization, increasing adoption of renewable energy, supportive government policies and incentives, growing sustainability awareness, declining photovoltaic costs, technological innovations, and regulatory mandates promoting energy-efficient construction, combined with expanding commercial and residential real estate development nationwide are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Market Growth Rate (2025-2033) | 13.7% |

India Building Integrated Photovoltaics Market Trends:

Solar Integration Driving Green Energy Expansion

India’s building sector is increasingly incorporating solar power solutions directly into architectural designs, driven by ambitious renewable energy targets and sustainability initiatives. The rapid adoption of building integrated photovoltaics (BIPV) is transforming urban infrastructure, making buildings both energy-efficient and visually appealing. As buildings become major energy consumers, these integrated solar solutions play a crucial role in achieving national renewable energy goals. The shift toward embedding photovoltaic technologies directly into building facades and rooftops significantly reduces carbon footprints and enhances energy self-sufficiency. This approach addresses India's rising electricity demand and environmental objectives simultaneously, supporting long-term sustainability. Government incentives, technological innovations, and increasing public awareness further accelerate this shift, strengthening India's path towards a low-carbon future. According to industry reports, India's building integrated photovoltaics (BIPV) market is set for substantial growth, driven by a national ambition of achieving 500 GW non-fossil capacity by 2030, with solar contributing nearly 365 GW by 2032. BIPV solutions, integrating solar technology into buildings, enhance aesthetics and sustainability, meeting rising energy demand as buildings will account for over 38% of India's electricity usage by 2047, crucial for achieving net-zero targets.

To get more information on this market, Request Sample

Railways Embracing Solar Innovations for Sustainable Infrastructure

India’s railway sector is increasingly adopting Building Integrated Photovoltaics (BIPV) solutions, strategically incorporating solar energy systems directly into station infrastructure. This shift toward embedding photovoltaic panels within building designs signifies a broader movement towards sustainable energy usage and environmental responsibility. By integrating solar technology directly into railway platforms and station structures, railways are maximizing energy efficiency, reducing dependency on traditional power sources, and contributing to carbon footprint reduction. This approach not only enhances the aesthetic appeal of railway facilities but also aligns with India's ambitious renewable energy objectives. As solar installations become integral components of railway infrastructure, India's transportation sector demonstrates leadership in sustainable innovation, setting a precedent for future infrastructure developments. This trend drives innovation in battery technology and promotes energy independence. For instance, Indian Railways, in collaboration with Central Electronics Limited, Sahibabad, inaugurated India’s first building integrated photovoltaics (BIPV) solar power facility at Sahibabad Railway Station's platform number 1. This innovative solar installation has a capacity of 729 kW, achieved through strategically embedding advanced solar panels directly into the station's structure, significantly enhancing energy efficiency using cutting-edge technology and promoting sustainable energy solutions.

India Building Integrated Photovoltaics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and end use.

Product Type Insights:

- Polycrystalline

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes polycrystalline, thin film, and others.

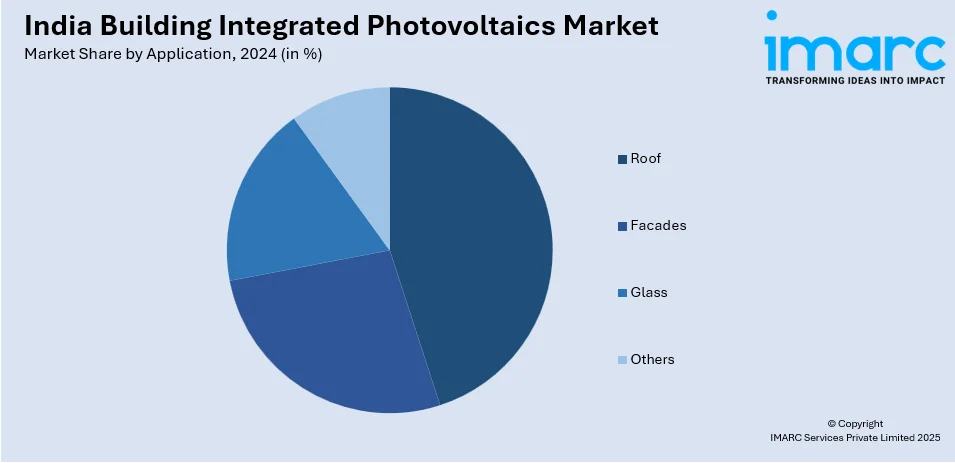

Application Insights:

- Roof

- Facades

- Glass

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes roof, facades, glass, and others.

End Use Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Building Integrated Photovoltaics Market News:

- In October 2024, Trinasolar Evergreen, a subsidiary of Trina Solar, introduced four new building-integrated photovoltaic (BIPV) products, including solar tiles, industrial wall solutions, photovoltaic noise barriers, and colored PV glass. These innovations incorporate advanced solar cell technology, achieving efficiencies up to 21.9%. This development offers Indian architects and builders enhanced options for integrating solar energy into diverse infrastructure projects, aligning with the nation's renewable energy goals.

India Building Integrated Photovoltaics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Polycrystalline, Thin Film, Others |

| Applications Covered | Roof, Facades, Glass, Others |

| End Uses Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India building integrated photovoltaics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India building integrated photovoltaics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India building integrated photovoltaics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building integrated photovoltaics market in India was valued at USD 2.4 Billion in 2024.

The India building integrated photovoltaics market is projected to exhibit a CAGR of 13.7% during 2025-2033, reaching a value of USD 8.7 Billion by 2033.

The India building integrated photovoltaics market is driven by rising demand for sustainable construction, supportive government policies, and advancements in solar technology. Growing awareness about renewable energy benefits, urbanization, and the push for energy-efficient buildings further fuel adoption, while falling installation costs make BIPV solutions more accessible across residential and commercial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)