India Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Building Materials Market Overview:

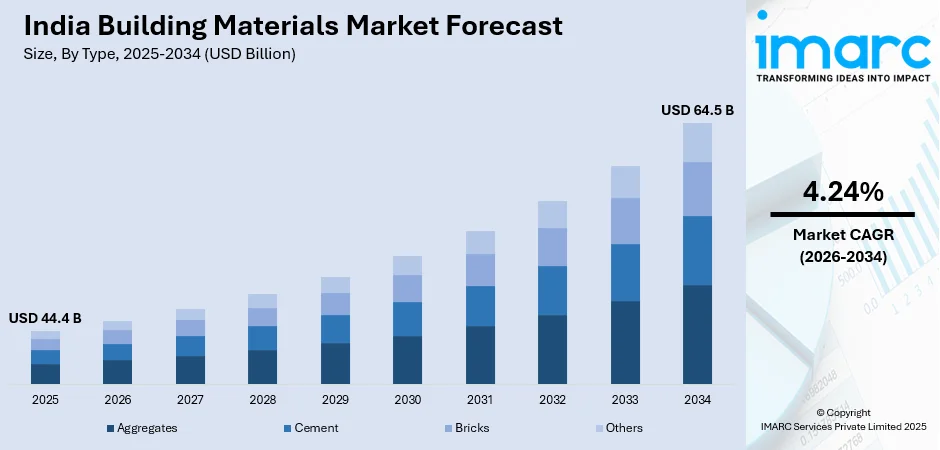

The India building materials market size reached USD 44.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 64.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.24% during 2026-2034. The market is driven by rapid urbanization, infrastructure development, and increasing construction activities. The rising demand for sustainable and energy-efficient materials, along with advancements in technology, is shaping market growth. Key segments include cement, steel, glass, and eco-friendly alternatives.

Key Takeaways:

- The India building materials market was valued at USD 44.4 billion in 2025.

- It is projected to reach USD 64.5 billion by 2034, representing a compound annual growth rate (CAGR) of about 4.24% between 2026–2034.

- Major growth drivers include rapid urbanization, increasing infrastructure development projects, rising investments in residential and commercial construction, government initiatives such as Smart Cities and Housing for All, and the growing adoption of sustainable and advanced building materials across India.

- Segmentation Highlights:

- Type: Cement, Bricks, Others.

- Application: Residential, Commercial, Industrial.

- Enclosure Type: Indoor, Outdoor.

- Regional Insights: The report covers major zones within India: North India, South India, East India and West India — signalling growth opportunities across geographies.

To get more information on this market, Request Sample

India Building Materials Market Trends:

Increasing Need for Eco-Friendly and Sustainable Materials

The India building materials industry is currently experiencing a notable inclination toward sustainability, typically propelled by environmental issues and regulatory policies. Green building materials, encompassing fly ash bricks, low-carbon cement, recycled concrete, and bamboo, are rapidly gaining momentum because of their minimized environmental influence. The government’s ventures, such as Energy Conservation Building Code (ECBC), and the widespread adoption of crucial certifications like Leadership in Energy and Environmental Design (LEED), are further incentivizing the utilization of environmentally safe materials. For instance, as per industry reports, India sustained its 3rd position worldwide for LEED certifications. 370 projects, involving both spaces and buildings, were approved through LEED in the nation, spanning around 8.5 Million square meters. In addition to this, both customers and developers are actively focusing on energy-saving materials, typically involving cool roofing solutions, insulated glass, and aerated concrete to significantly lower carbon footprints and improve long-term savings in expenditure. Enhancements in material science have also resulted in the formulation of self-healing as well as bio-based concrete, further expanding the market potential. As sustainability becomes a core focus in construction, the demand for green building materials is expected to surge, reshaping industry dynamics and driving innovation in product offerings.

Technological Advancements and Smart Building Materials Integration

Technological innovations are transforming the India building materials market, with a growing emphasis on smart and high-performance materials. The adoption of self-healing concrete, phase change materials (PCMs), and nano-engineered coatings is improving structural durability and energy efficiency. The incorporation of Internet of Things (IoT)-enabled materials, such as smart glass and intelligent insulation, is enhancing building automation and optimizing energy consumption. Prefabrication and 3D printing technologies are further streamlining construction processes, reducing material wastage, and improving overall efficiency. The rise of Building Information Modeling (BIM) is also facilitating precise material selection and resource management, minimizing costs and project delays. Additionally, high-strength, lightweight composites are replacing traditional materials to enhance seismic resilience and load-bearing capacities. As construction projects become more technologically advanced, the demand for innovative building materials is expected to grow, fostering greater efficiency and sustainability in India’s construction sector. For instance, in December 2024, NBCC Ltd. announced securing numerous significant construction ventures worth USD 1.084 Billion, across four states in India.

India Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Aggregates

- Cement

- Bricks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregates, cement, bricks, and others.

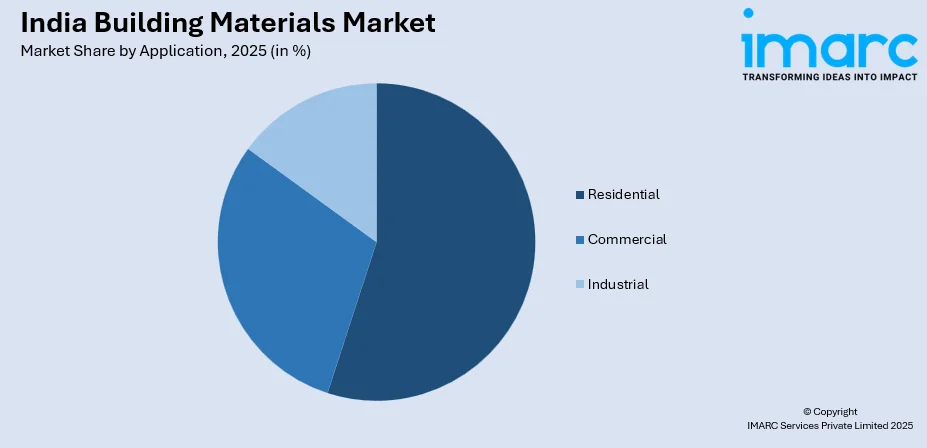

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Building Materials Market News:

- In February 2025, Titan Cement Group announced a joint venture with JAYCEE, an India-based cement materials provider, to expand its foothold across South Asia. The collaboration will produce, source, and distribute supplementary cementitious materials to aid consumers develop sustainable construction ventures by utilizing substitutes of clinker-based cement.

- In September 2024, Interarch Building Products unveiled its new manufacturing facility for pre-engineered steel structures, metal roofing and cladding in Andhra Pradesh. The Phase 1 of this facility is inaugurated that is constructed with a significant investment of USD 4.58 Million.

India Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aggregates, Cement, Bricks, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India building materials market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building materials market in India was valued at USD 44.4 Billion in 2025.

The building materials market in India is projected to reach USD 64.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.24% during 2026-2034.

Rapid urbanization, increasing construction activities, infrastructure development, as well as the augmenting demand for sustainable and energy-efficient materials are key drivers. Technological advancements in building materials are also playing a significant role in the expansion of the market across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)