India Burglar Alarm Market Size, Share, Trends and Forecast by Systems and Hardware, End User, and Region, 2025-2033

India Burglar Alarm Market Overview:

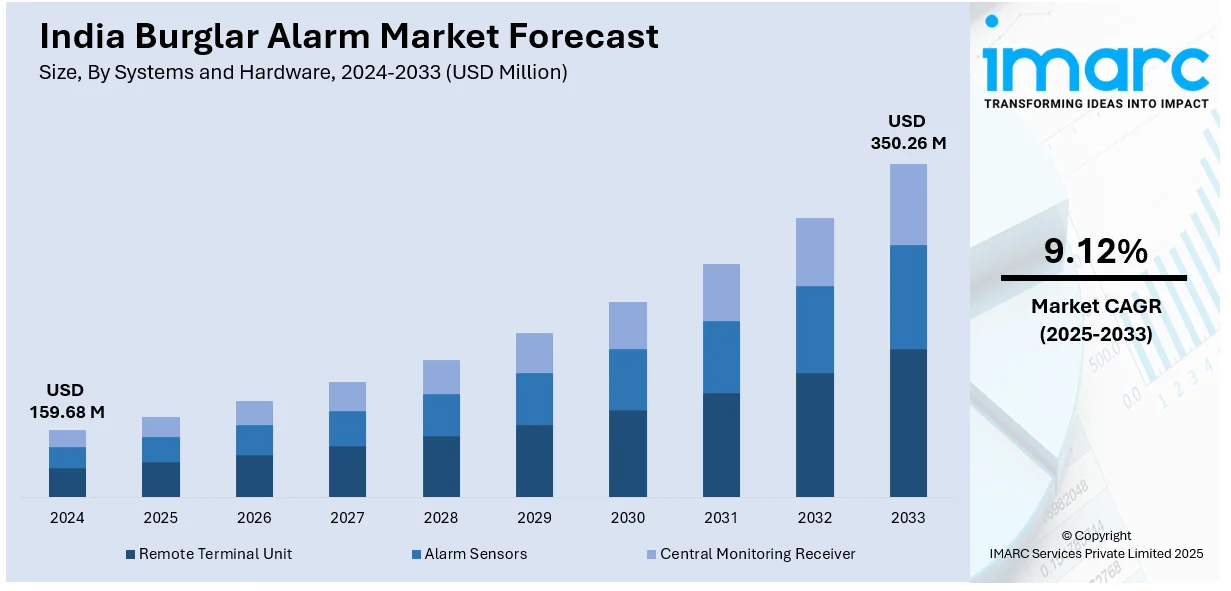

The India burglar alarm market size reached USD 159.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 350.26 Million by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. The market is driven by rising urbanization, increasing crime rates, and growing awareness of home security. Technological advancements, such as IoT-enabled smart alarms, and the proliferation of affordable, user-friendly systems are key factors. Government initiatives for smart cities and higher disposable incomes in tier 2 and 3 cities further enhance the India burglar alarm market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 159.68 Million |

| Market Forecast in 2033 | USD 350.26 Million |

| Market Growth Rate (2025-2033) | 9.12% |

India Burglar Alarm Market Trends:

Increasing Adoption of Smart Home Security Systems

The India burglar alarm market is witnessing a significant shift towards the adoption of smart home security systems, driven by the rapid expansion of IoT and growing smartphone penetration. A report highlights that 84% of smartphone users in India check their devices within 15 minutes of waking up, spending 31% of their day on their phones. This surge in smartphone usage, which has risen from an average of 2 hours in 2010 to 4.9 hours in 2023 with 80 daily checks, is accelerating the adoption of connected burglar alarms. Consumers prefer systems that offer remote monitoring and integration with other smart home devices, including cameras, motion sensors, and door locks, ensuring a more comprehensive security solution. Urban areas, where homeowners favor wireless and application-based burglar solutions for better convenience and enhanced security, are witnessing a rising fold of the global wireless and application-based burglar alarms market. Additionally, the increasing availability of affordable smart security solutions, along with the availability of high-speed Internet, is fueling this trend. As a result, manufacturers are focusing their efforts on developing advanced, user-friendly, and energy-efficient burglar alarm systems to fulfill this growing need.

To get more information on this market, Request Sample

Rising Awareness of Home Security in Tier 2 and Tier 3 Cities

Another notable trend creating a positive India burglar alarm market outlook is the growing awareness of home security in tier 2 and tier 3 cities. As disposable incomes increase and urbanization spreads, residents in these regions are becoming more conscious of the need for robust security measures. The rise in property crimes and burglaries has further fueled the demand for burglar alarms in smaller cities and towns. Affordable and easy-to-install alarm systems are gaining popularity among middle-class households as they provide a cost-effective way to safeguard homes. According to Delhi Police data, the national capital witnessed a 25.2% increase in burglaries and a 23% increase in dacoities in the year 2024 as compared to the year 2023, with a total of 12,698 incidents, including property crime (residential thefts, etc.). This disturbing trend highlights the urgent need for improved security solutions, which in turn drives the India burglar alarm market growth. With the community encouraging a stronger law enforcement presence, the rise in property crimes emphasizes the importance of innovative security technology to defend homes and businesses. In addition, government initiatives focused on smart cities and the improvement of digital infrastructure are contributing to the growth of the market. Companies are concentrating on these emerging economies by presenting them with very affordable products and expanding their distribution channel, thus allowing burglar alarms to be available to a wider population. This trend is expected to drive the continuous growth of the market in India.

India Burglar Alarm Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on systems and hardware, and end user.

Systems and Hardware Insights:

- Remote Terminal Unit

- Alarm Sensors

- Central Monitoring Receiver

The report has provided a detailed breakup and analysis of the market based on the systems and hardware. This includes remote terminal unit, alarm sensors, and central monitoring receiver.

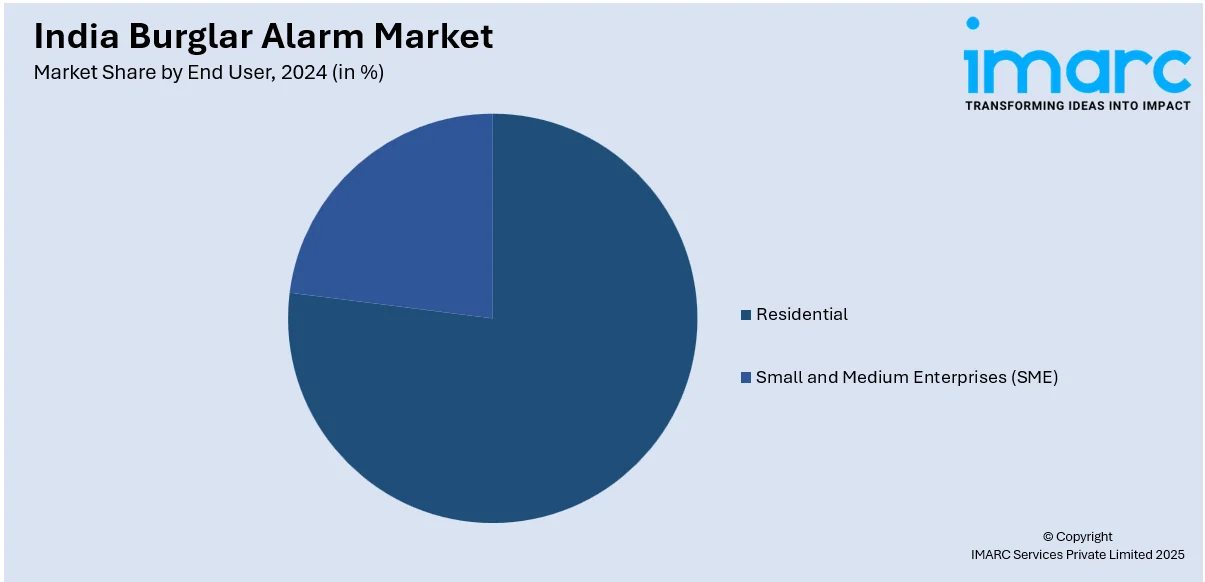

End User Insights:

- Residential

- Small and Medium Enterprises (SME)

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and small and medium enterprises (SME).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Burglar Alarm Market News:

- December 09, 2024: Godrej unveiled the Advantis IoT9 smart lock in India at a price of ₹67,900 (approximately USD 777.73). With nine different access methods, including PINs and fingerprints, as well as RFID cards and voice commands, this smart lock provides inspiring clarity for your home security. This smart lock is capable of being integrated with burglar alarm systems, video door phones, and smart assistants such as Alexa and Google Assistant, indicating India’s growing demand for nuanced security solutions under its smart home umbrella. Surgical two-factor and spy codes, the latest IoT9 model, are designed to alleviate the anxious pattern of increasing burglaries and property crime, which has resulted in developments in the market.

India Burglar Alarm Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems and Hardwares Covered | Remote Terminal Unit, Alarm Sensors, Central Monitoring Receiver |

| End Users Covered | Residential, Small and Medium Enterprises (SME) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India burglar alarm market performed so far and how will it perform in the coming years?

- What is the breakup of the India burglar alarm market on the basis of systems and hardware?

- What is the breakup of the India burglar alarm market on the basis of end user?

- What is the breakup of the India burglar alarm market on the basis of region?

- What are the various stages in the value chain of the India burglar alarm market?

- What are the key driving factors and challenges in the India burglar alarm market?

- What is the structure of the India burglar alarm market and who are the key players?

- What is the degree of competition in the India burglar alarm market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India burglar alarm market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India burglar alarm market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India burglar alarm industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)