India Business Travel Market Size, Share, Trends and Forecast by Type, Purpose Type, Expenditure, Age Group, Service Type, Travel Type, End User, and Region 2026-2034

India Business Travel Market Summary:

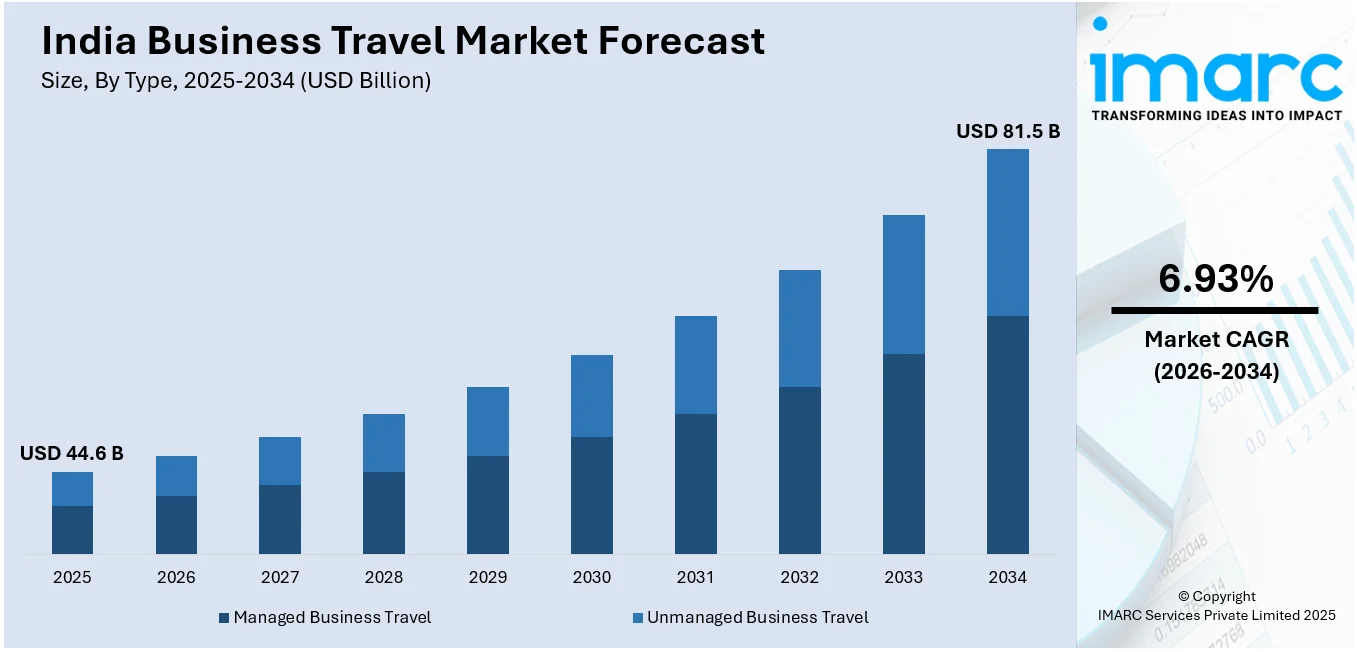

The India business travel market size was valued at USD 44.61 Billion in 2025 and is projected to reach USD 81.54 Billion by 2034, growing at a compound annual growth rate of 6.93% from 2026-2034.

The India business travel market is experiencing robust growth driven by expanding corporate activities, rising economic prosperity, and increasing demand for face-to-face business interactions. The growing investments in aviation infrastructure, the proliferation of digital booking platforms, and strengthening international trade relationships are positively influencing the market. Additionally, the convergence of domestic corporate travel demand, the expanding meetings, incentives, conferences, and exhibitions sector, and evolving traveler preferences toward seamless travel experiences are reshaping the competitive landscape, creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Type: Managed business travel dominates the market with a share of 63% in 2025, driven by corporate demand for centralized travel management, policy compliance, cost optimization, and streamlined booking processes across large enterprises and multinational organizations operating throughout India.

- By Purpose Type: Internal meetings lead the market with a share of 32% in 2025, owing to the growing emphasis on team collaboration, strategic planning sessions, training programs, and cross-functional coordination activities across expanding corporate operations nationwide.

- By Expenditure: Travel fare represents the largest segment with a market share of 40% in 2025. This dominance is because of rising airfare costs, increasing frequency of domestic and international business flights, and enhanced connectivity options across aviation networks.

- By Age Group: Travelers below 40 years dominate the market with a share of 59% in 2025, reflecting the young demographic composition of India's corporate workforce and the increasing participation of millennials in business travel activities.

- By Service Type: Food and lodging lead the market with a share of 40% in 2025, underscoring the critical importance of accommodation and dining services in comprehensive business travel arrangements and expense management.

- By Travel Type: Group travel represents the largest segment with a market share of 55% in 2025, supported by the increasing corporate team activities, incentive programs, trade delegations, and collective attendance at conferences and exhibitions.

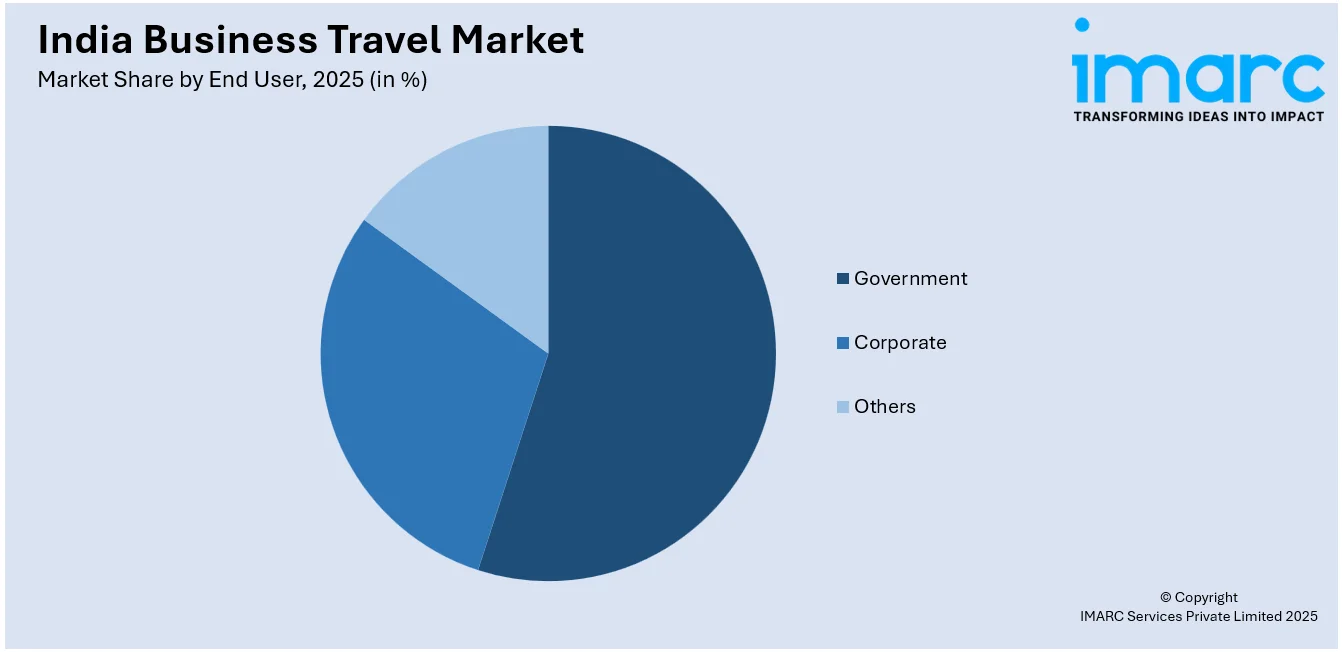

- By End User: Corporate dominates the market with a share of 71% in 2025, influenced by the substantial business travel expenditure by private enterprises across information technology, manufacturing, financial services, and consulting sectors.

- By Region: North India leads the market with a share of 28% in 2025, driven by the concentration of corporate headquarters in Delhi-NCR, presence of major business hubs, superior aviation connectivity, and extensive government institutional activities.

- Key Players: The India business travel market exhibits moderate competitive intensity, with travel management companies competing alongside online travel agencies and hospitality providers across diverse corporate travel segments and service categories.

To get more information on this market Request Sample

The India business travel market is advancing as corporations, government institutions, and business travelers embrace efficient mobility solutions and comprehensive travel management services. According to the Global Business Travel Association, India's business travel spending reached an estimated USD 38.3 billion in 2024, making it the eighth largest market globally for corporate travel expenditure. This growth is supported by improvements in aviation infrastructure, the expansion of hotel inventory, and the rise of the meetings, incentives, conferences, and exhibitions (MICE) sector. Additionally, the increasing volume of international trade and cross-border business activities further drives the demand for business travel services. As global trade relationships deepen and more organizations expand their reach, the need for seamless, integrated travel solutions becomes even more pronounced. This trend highlights the growing importance of business travel as a key component of India’s economic development, driving further investment in infrastructure and services to support the sector’s expansion.

India Business Travel Market Trends:

Growth in Startups and Entrepreneurship

With more entrepreneurs launching new ventures, there is a rise in the need for them to travel for networking, funding opportunities, and business partnerships. This trend is particularly prominent in sectors like technology, finance, and e-commerce. India has solidly positioned itself as the third-largest startup ecosystem globally, having issued more than 1.57 lakh certificates by the Department for Promotion of Industry and Internal Trade (DPIIT) to recognize startups as of December 31, 2024. As new businesses scale up and venture into new markets, the need for business travel becomes more pronounced, further catalyzing the demand for travel-related services that cater to the growing entrepreneurial ecosystem.

Shift Towards Corporate Travel Management Services

Companies are increasingly outsourcing their travel needs to specialized agencies and service providers to ensure cost-effective and efficient travel solutions. These services provide personalized travel plans, manage bookings, and ensure adherence to company policies, making it easier for businesses to handle their travel arrangements. As more companies recognize the advantages of leveraging corporate travel management services, the demand for business travel solutions continues to increase, further contributing to the market growth. In line with this trend, in 2025, Pune-based Techspian launched CBT Suite, an AI-powered platform for Travel Management Companies (TMCs). With a $3 million investment, this platform addressed key challenges in corporate travel management, including financial reconciliation, fraud detection, and policy enforcement.

Enhanced Connectivity and Premiumization of Low-Cost Carriers

The Indian business travel market growth is driven by the strategic shift by domestic airlines toward premiumization and specialized corporate services. As the demand for efficiency on high-traffic corridors increases, carriers are evolving beyond budget models to offer premium, productivity-focused experiences. A prime example of this trend is IndiGo’s 2026 initiative to launch a tailor-made business travel product specifically designed for India’s busiest routes. By introducing offerings that cater to the evolving needs of corporate flyers, such as enhanced comfort and streamlined scheduling, airlines are capturing a larger share of the professional segment and bolstering the market growth.

Market Outlook 2026-2034:

The India business travel market demonstrates robust growth potential throughout the forecast period, underpinned by strengthening economic fundamentals and expanding corporate activities. The market generated a revenue of USD 44.61 Billion in 2025 and is projected to reach a revenue of USD 81.54 Billion by 2034, growing at a compound annual growth rate of 6.93% from 2026-2034. The sustained revenue growth reflects steady market maturation as corporate travel volumes increase, infrastructure connectivity improves, and comprehensive travel management adoption accelerates across diverse enterprise segments and geographic regions throughout India.

India Business Travel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Managed Business Travel |

63% |

|

Purpose Type |

Internal Meetings |

32% |

|

Expenditure |

Travel Fare |

40% |

|

Age Group |

Travelers Below 40 Years |

59% |

|

Service Type |

Food and Lodging |

40% |

|

Travel Type |

Group Travel |

55% |

|

End User |

Corporate |

71% |

|

Region |

North India |

28% |

Type Insights:

- Managed Business Travel

- Unmanaged Business Travel

Managed business travel leads with a market share of 63% of the total India business travel market in 2025.

Managed business travel covers corporate trips planned and monitored through dedicated travel management firms and integrated booking tools that align travel activity with organizational policies. Its strong market position stems from enterprises seeking predictable budgeting, streamlined approvals, and consistent travel standards. Centralized programs offer greater transparency into travel spending, enhance employee travel experiences, and reduce operational complexity. Companies also benefit from coordinated itineraries, centralized vendor coordination, and improved oversight of employee movement, making managed travel a preferred approach for organizations with frequent or geographically dispersed travel needs.

The dominance of the managed travel segment is driven by substantial efficiency gains and cost optimization achieved through centralized management. By transitioning from fragmented processes to unified platforms, organizations significantly reduce administrative burdens while enhancing policy compliance. For instance, the 2024 launch of Tumodo’s B2B platform in Bengaluru exemplifies this shift, as the company leverages AI-driven solutions to target a 5% market share by 2027. Such technological integration allows enterprises to negotiate preferred rates and consolidate data for strategic analysis, ultimately fostering a more resilient and scalable corporate travel ecosystem in India.

Purpose Type Insights:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

Internal meetings dominate with a market share of 32% of the total India business travel market in 2025.

Internal meetings involve corporate travel undertaken for leadership reviews, project planning, training programs, and coordination among teams operating from different offices and regions. This segment holds strong relevance as organizations recognize the effectiveness of in-person discussions for complex decision-making, alignment on strategic priorities, and relationship building. Face-to-face interactions allow teams to resolve issues faster, encourage open dialogue, and strengthen trust among stakeholders. As enterprises scale operations across cities and regions, internal travel remains a vital tool for ensuring operational coherence and consistent execution of organizational objectives.

The growth of internal meeting travel is supported by the widening geographic footprint of Indian companies and increasing cross-functional collaboration requirements. Hybrid and flexible work arrangements are reinforcing the need for periodic physical gatherings to maintain organizational culture and employee engagement. In-person meetings play a key role in mentorship, onboarding, and leadership development, while also enabling collaborative problem-solving and innovation. These interactions help bridge gaps created by remote work, ensuring teams remain connected, aligned, and productive despite physical separation.

Expenditure Insights:

- Travel Fare

- Lodging

- Dining

- Others

Travel fare exhibits a clear dominance with a 40% share of the total India business travel market in 2025.

Travel fare expenditure includes costs related to air tickets, rail services, and ground transportation incurred for official business travel. This segment holds a leading share as employee mobility remains essential for client meetings, project execution, and internal coordination. According to the India Brand Equity Foundation (IBEF), India targets expanding the number of operational airports to 220 by 2025, significantly improving regional and international connectivity. Despite better infrastructure and route availability, travel fares continue to account for the largest portion of corporate travel spending due to volume and frequency.

The segment is further supported by the growing intensity of domestic and international business travel, with enterprises favoring faster transit options to reduce productivity loss. Organizations increasingly rely on structured cost management strategies, including advance ticket purchases, preferred airline partnerships, and centralized booking platforms. These measures help stabilize fare expenses amid fluctuating prices while ensuring timely travel. As businesses expand geographically and operational timelines tighten, maintaining efficient and cost-controlled travel fare expenditure remains a strategic priority.

Age Group Insights:

- Travelers Below 40 Years

- Travelers Above 40 Years

Travelers below 40 years lead with a market share of 59% of the total India business travel market in 2025.

This demographic segment consists primarily of young professionals and millennials who form a significant share of India’s organized corporate workforce. Their roles often require frequent business travel for client interactions, project coordination, training sessions, and career advancement opportunities. As companies expand across regions and industries, this age group increasingly represents the most mobile segment of employees. Their higher willingness to travel, adaptability to dynamic work environments, and focus on professional growth contribute to sustained demand for structured and efficient corporate travel solutions.

Young business travelers exhibit clear preferences for technology-driven travel experiences that simplify planning and execution. Digital booking platforms, mobile applications, and real-time travel updates are widely adopted to improve convenience and transparency. This segment values seamless itineraries, flexible scheduling, and integrated expense management tools that reduce administrative effort. Their expectations are also shaping service innovation, encouraging providers to offer personalized options, faster approvals, and end-to-end digital integration aligned with modern workplace practices.

Service Type Insights:

- Transportation

- Food and Lodging

- Recreational Activities

- Others

Food and lodging dominate with a market share of 40% of the total India business travel market in 2025.

Food and lodging include hotel stays, serviced accommodations, and business-related meals that support employees during official travel. This segment holds a dominant position due to the unavoidable need for comfortable lodging and reliable dining arrangements during work trips. Corporations consistently allocate a significant share of travel budgets to ensure employee well-being, productivity, and safety. As business travel spans multiple days and locations, dependable accommodation and meal services remain central to complete travel planning, making this segment a core component of managed business travel expenditure.

Segment growth is reinforced by the rising inclination toward premium and mid-scale hotels among corporate travelers. Expanding hotel capacity across major commercial hubs and emerging business cities is improving availability and choice. Hospitality providers are tailoring offerings with business-focused amenities, including high-speed internet, conference spaces, co-working lounges, and flexible check-in policies. These enhancements align with corporate expectations for efficiency and comfort, supporting longer stays and higher service adoption among frequent business travelers.

Travel Type Insights:

- Group Travel

- Solo Travel

Group travel exhibits a clear dominance with a 55% share of the total India business travel market in 2025.

Group travel refers to organized travel arrangements for teams, departments, or corporate delegations participating in meetings, conferences, exhibitions, and incentive programs. This segment holds a notable share as businesses increasingly rely on collective travel to achieve shared goals, strengthen collaboration, and represent organizations at industry platforms. Coordinated group movement simplifies logistics, ensures schedule alignment, and supports unified participation in strategic events. As companies expand their external engagements and internal coordination efforts, demand for structured group travel solutions continues to rise steadily.

The segment is further supported by the growing corporate focus on team-building initiatives and employee reward programs. Participation in trade fairs, training workshops, and global conferences often involves multiple employees traveling together. Organizations are leveraging group bookings to secure cost efficiencies across flights, accommodations, and ground transport while maintaining standardized service quality. Centralized planning also improves compliance with travel policies and enhances oversight, making group travel an efficient and scalable option for corporate mobility management.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Corporate

- Others

Corporate leads with a market share of 71% of the total India business travel market in 2025.

Corporate refers to journeys undertaken by private sector enterprises to support client engagements, sales activities, operational coordination, and employee training across domestic and international locations. This segment accounts for a significant share of overall business travel spending, driven by high travel intensity in sectors, such as information technology, financial services, manufacturing, and consulting. Companies operating across multiple cities and countries rely on frequent travel to manage distributed teams, serve global clients, and ensure consistent execution of business strategies across diverse markets.

The dominance of the segment is reinforced by the expansion of multinational operations and deeper cross-border commercial relationships. As supply chains, partnerships, and customer bases become more globalized, organizations increasingly prioritize in-person meetings for negotiations, project reviews, and strategic planning. Face-to-face interactions remain critical for building trust, managing complex engagements, and accelerating decision-making. Many enterprises now view business travel as a strategic investment that supports revenue generation, strengthens partnerships, and sustains long-term competitive positioning.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 28% of the total India business travel market in 2025.

North India represents the largest segment, driven by the dense concentration of corporate headquarters, multinational offices, government ministries, and policy institutions clustered in Delhi-NCR and nearby cities. The region benefits from strong air, rail, and road connectivity, anchored by Indira Gandhi International Airport and a well-developed network of business hotels, convention centers, and corporate parks. Proximity to central government bodies also fuels frequent official travel, regulatory meetings, and industry consultations, reinforcing sustained demand for organized business travel services across sectors.

The dominance of the region is set to strengthen further with the upcoming Noida International Airport at Jewar, scheduled for launch in 2025. The new greenfield airport is expected to ease congestion at Delhi IGI while expanding passenger and cargo handling capacity for the wider NCR. Enhanced domestic and international connectivity will support corporate mobility, trade exhibitions, and logistics-driven travel. Improved access to emerging business corridors in Uttar Pradesh and Haryana will further position North India as a preferred destination for corporate travel activity.

Market Dynamics:

Growth Drivers:

Why is the India Business Travel Market Growing?

Expanding Aviation Infrastructure and Connectivity

India's ambitious aviation infrastructure development is fundamentally reshaping the business travel landscape by enhancing connectivity across domestic and international destinations. The government's strategic investment program encompasses construction of new airports, expansion of existing facilities, and modernization of air navigation systems to accommodate the growing passenger volumes. In 2026, the Union Civil Aviation Minister announced plans for India to add 50 new airports over the next five years, taking the total to nearly 350 airports by 2047. The expansion supports rising air travel demand and aligns with the Viksit Bharat 2047 vision. These infrastructure investments are reducing travel times, expanding route options, and improving accessibility to tier-two and tier-three cities, enabling corporations to efficiently connect with business partners and expand operations across previously underserved regions.

Global Events and Conferences

India’s growing reputation as a premier destination for high-profile international trade summits and sector-specific conferences is a vital factor influencing the business travel market. These professional forums facilitate critical networking and strategic knowledge exchange, encouraging organizations to invest heavily in corporate mobility. Demonstrating this momentum, OTM 2026 is scheduled to host over 2,200 exhibitors from more than 60 countries in Mumbai, underscoring the nation's pivotal role in the global outbound tourism landscape. As a result, the rise in international delegates and domestic professionals attending such large-scale exhibitions necessitates sophisticated travel services, thereby contributing to the growth of the specialized corporate travel sector.

Digital Automation and Integrated Expense Management

A critical factor propelling the growth of the India business travel market is the shift toward digital automation and integrated expense management. Modern enterprises are moving away from fragmented, manual booking processes in favor of unified platforms that offer real-time oversight and financial transparency. A prominent example is the 2024 launch of EMT Desk by EaseMyTrip, a comprehensive B2B platform designed to streamline corporate operations. By providing travel managers with automated expense tracking, policy compliance tools, and exclusive discounts, such platforms reduce administrative overhead and optimize corporate budgets. This technological evolution enables businesses to manage high-volume travel more efficiently, strengthening the overall growth of the sector.

Market Restraints:

What Challenges the India Business Travel Market is Facing?

Cost Pressures and Budget Constraints

Rising travel costs, including airfares, accommodation rates, and ancillary expenses, are creating budgetary pressures for organizations seeking to optimize their travel expenditure. Economic uncertainties and corporate cost-cutting initiatives are prompting enterprises to scrutinize travel spending more closely, potentially limiting business travel volumes and encouraging substitution with virtual communication alternatives where feasible.

Infrastructure Gaps in Tier-Two and Tier-Three Cities

Inadequate transportation infrastructure and limited hospitality options in smaller cities create challenges for business travelers seeking to access emerging markets and regional business centers. Connectivity constraints, including limited direct flight options and inconsistent ground transportation services, increase travel times and reduce the efficiency of business trips to developing commercial areas.

Complex Regulatory and Tax Structures

Intricate tax regulations, layered goods and services tax rules on travel bookings, and differing state-level compliance norms complicate the management of corporate travel in India. Companies must track multiple tax rates, input credit eligibility, and documentation standards across jurisdictions. These administrative demands raise compliance risk, slow reimbursement cycles, and inflate effective travel costs, particularly for firms with frequent multi-state travel and decentralized booking practices nationwide.

Competitive Landscape:

The India business travel market exhibits dynamic competitive intensity characterized by the presence of travel management companies, online travel agencies, and hospitality service providers operating across diverse corporate travel segments. Market participants are differentiating through technology-enabled platforms, comprehensive service portfolios, and strategic partnerships that enhance value propositions for corporate clients. Competition is increasingly shaped by digital capabilities, client experience innovations, and the ability to deliver cost optimization while ensuring traveler satisfaction. The competitive landscape is evolving as players invest in AI, data analytics, and mobile solutions to capture the growing demand from both large enterprises and small and medium businesses. Strategic collaborations between airlines, hotels, and travel management platforms are creating integrated service ecosystems that address the complete spectrum of business travel requirements.

Recent Developments:

- December 2025: The GBTA India Summit set a new benchmark for business travel in India, bringing together over 250 industry leaders. Held in Gurugram, the event focused on the evolving landscape of corporate travel, emphasizing technology, mobility, and the growing importance of India in global travel trends.

- July 2025: OYO partnered with Yatra to expand its business travel offerings, particularly targeting emerging metros in India. This collaboration brought over 500 OYO hotels onto Yatra’s platform, catering to the increasing demand for business travel accommodation. The partnership aimed to provide quality, flexible stay options for corporate clients.

India Business Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Managed Business Travel, Unmanaged Business Travel |

| Purpose Types Covered | Marketing, Internal Meetings, Trade Shows, Product Launch, Others |

| Expenditures Covered | Travel Fare, Lodging, Dining, Others |

| Age Groups Covered | Travelers Below 40 Years ,Travelers Above 40 Years |

| Service Types Covered | Transportation, Food and Lodging, Recreational Activities, Others |

| Travel Types Covered | Group Travel, Solo Travel |

| End Users Covered | Government, Corporate, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India business travel market size was valued at USD 44.61 Billion in 2025.

The India business travel market is expected to grow at a compound annual growth rate of 6.93% from 2026-2034 to reach USD 81.54 Billion by 2034.

Managed business travel, holding the largest revenue share of 63%, dominates the India business travel market, driven by corporate demand for centralized travel management, policy compliance, cost optimization, and streamlined booking processes across enterprises.

Key factors driving the India business travel market include the rapid growth of the startup ecosystem, increasing entrepreneurial activity, and rising demand for networking and funding travel. As of December 31, 2024, over 1.57 lakh startups were recognized, strengthening sustained demand for corporate travel services.

Major challenges include cost pressures and corporate budget constraints, infrastructure gaps in tier-two and tier-three cities, complex regulatory and tax structures, economic uncertainties affecting travel expenditure decisions, and competition from virtual meeting technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)