India Camel Dairy Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type and Region, 2025-2033

India Camel Dairy Market Overview:

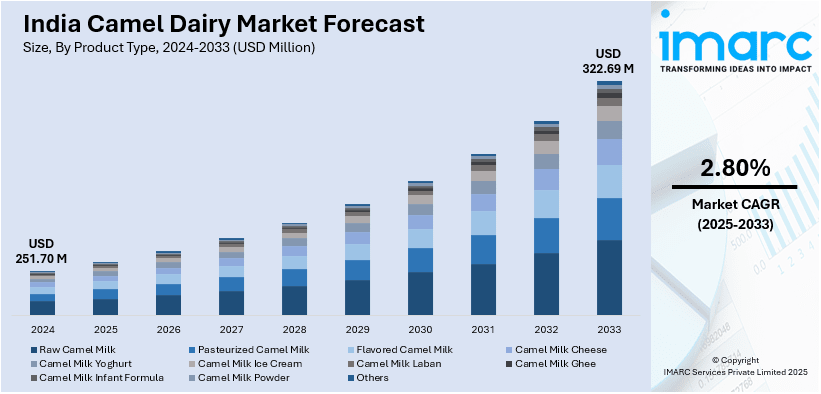

The India camel dairy market size reached USD 251.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 322.69 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The India camel dairy market share is boosted by growing health awareness regarding the nutritional value and therapeutic potential of camel milk. Demand for organic and natural dairy products, urbanization, and popularity of camel milk-based foods in domestic as well as overseas markets also propel the India camel dairy market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 251.70 Million |

| Market Forecast in 2033 | USD 322.69 Million |

| Market Growth Rate 2025-2033 | 2.80% |

India Camel Dairy Market Trends:

Growing Popularity of Camel Milk and Its Derivatives

One of the significant trends influencing the India camel dairy market outlook, is increasing consumer demand for camel milk and its derivatives as a result of its nutritional value. Camel milk contains essential nutrients like vitamins, minerals, and proteins, and is typically regarded as healthier compared to cow's milk. This increased popularity is propelled by the mounting awareness about camel milk's therapeutic nature, such as its ability to enhance immunity and reduce lactose intolerance. With more consumers pursuing healthfulness, they are looking for functional foods, such as camel milk-based foods like yogurt, cheese, ice cream, and camel milk powder. These foods are increasingly found in both city and rural markets. Moreover, camel milk is also attracting interest for its therapeutic potential in the treatment of diseases, which is propelling demand for new products such as camel milk-based beauty and skincare products.

To get more information on this market, Request Sample

Shift Toward Organic and Sustainable Camel Dairy Production

Another trend in the India camel dairy market is the shift toward organic and sustainable camel farming practices. With increasing awareness about environmental and health issues, there is a growing demand for organic and natural dairy products. Camel milk, being positioned as a clean and organic product, is taking advantage of this trend. Several camel dairy farmers are emphasizing sustainable farming, including natural feeding, green farming methods, and low usage of chemicals, to attract environmentally conscious and health-oriented consumers. The trend is also complemented by the increased demand for locally produced and ethically sourced goods, which in turn is promoting the demand for camel milk.

Government policies to aid organic camel farming, particularly in states such as Rajasthan and Gujarat, have also helped in the development of the organic camel dairy industry. The move toward sustainability is likely to fuel innovation and growth in the India camel dairy market in the future. For example, recently, the United Nations announced that 2024 will be the International Year of Camelids. The Department of Animal Husbandry and Dairying (DAHD), part of the Ministry of Fisheries, Animal Husbandry and Dairying, in partnership with the Food and Agriculture Organization of the United Nations (FAO) and ICAR – National Research Center on Camel, held a one-day workshop for stakeholders on ‘Enhancing the Camel Milk Value Chain in India’ in Bikaner, Rajasthan. The event sought to inspire and enable a conversation among various stakeholders to address the challenges that could enhance the sustainable growth of the non-bovine (camel) dairy value chain, including its nutraceutical and therapeutic benefits. The occasion witnessed over 150 participants, including camel breeders from Rajasthan and Gujarat, government representatives, social enterprises, scientists, and academics, as well as delegates from the National Rainfed Area Authority, National Dairy Research Institute-Karnal, Sarhad Dairy-Kutch, Lotus Dairy, and Amul.

India Camel Dairy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Raw Camel Milk

- Pasteurized Camel Milk

- Flavored Camel Milk

- Camel Milk Cheese

- Camel Milk Yoghurt

- Camel Milk Ice Cream

- Camel Milk Laban

- Camel Milk Ghee

- Camel Milk Infant Formula

- Camel Milk Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes raw camel milk, pasteurized camel milk, flavored camel milk, camel milk cheese, camel milk yoghurt, camel milk ice cream, camel milk laban, camel milk ghee, camel milk infant formula, camel milk powder, and others.

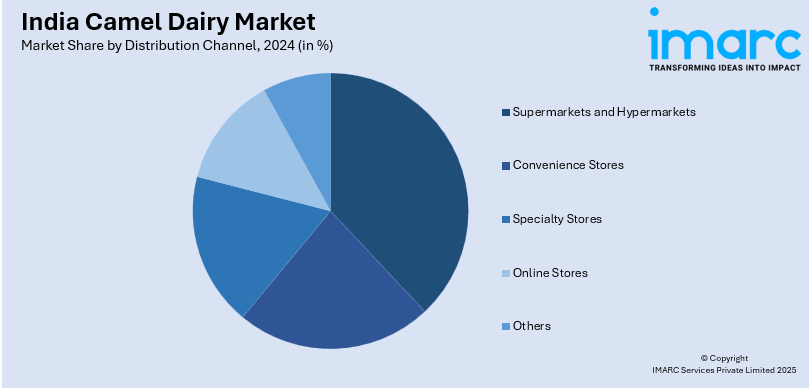

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Packaging Type Insights:

- Cartons

- Bottles

- Cans

- Jars

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes cartons, bottles, cans, jars, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Camel Dairy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Raw Camel Milk, Pasteurized Camel Milk, Flavored Camel Milk, Camel Milk Cheese, Camel Milk Yoghurt, Camel Milk Ice Cream, Camel Milk Laban, Camel Milk Ghee, Camel Milk Formula, Camel Milk Powder, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Packaging Types Covered | Cartons, Bottles, Cans, Jars, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India camel dairy market performed so far and how will it perform in the coming years?

- What is the breakup of the India camel dairy market on the basis of product type?

- What is the breakup of the India camel dairy market on the basis of distribution channel?

- What is the breakup of the India camel dairy market on the basis of packaging type?

- What is the breakup of the India camel dairy market on the basis of region?

- What are the various stages in the value chain of the India camel dairy market?

- What are the key driving factors and challenges in the India camel dairy market?

- What is the structure of the India camel dairy market and who are the key players?

- What is the degree of competition in the India camel dairy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India camel dairy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India camel dairy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India camel dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)