India Canned Food Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, and Region, 2025-2033

India Canned Food Market Overview:

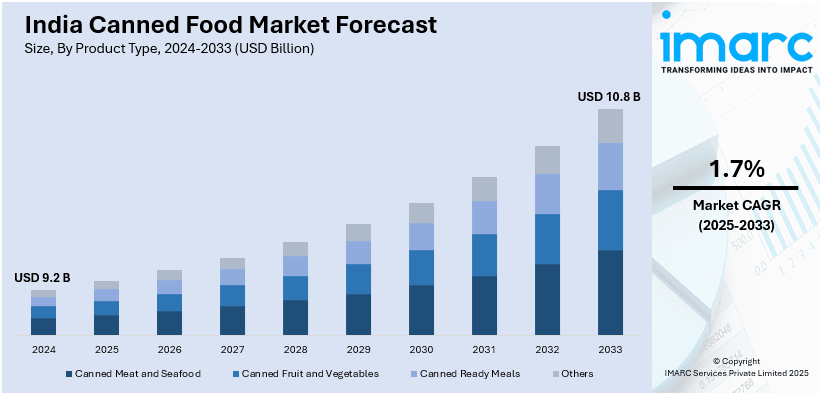

The India canned food market size reached USD 9.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.8 Billion by 2033, exhibiting a growth rate (CAGR) of 1.7% during 2025-2033. The market share is prompted by urbanization, hectic lifestyle, and higher disposable incomes. The need for convenience, greater shelf life, and instant cooking, along with advances in packaging and distribution, also stimulate the India canned food market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.2 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Market Growth Rate 2025-2033 | 1.7% |

India Canned Food Market Trends:

Increasing Popularity of Health-Conscious Canned Food

India canned food market outlook is experiencing a movement toward health-oriented canned foods as more consumers are becoming health-aware about the nutritional quality of what they eat. The EY Future Consumer Index states that nearly 94% of Indians are concerned about the well-being of their families, higher than the global average of 82%. Therefore, individuals are moving toward canned foods that provide convenience without losing health benefits. This consists of items such as low-sodium vegetables, bean-based proteins, and fruits with no added preservatives. Based on business publications, with the number of health-conscious consumers expected to rise from 108 million in 2020 to 176 million in 2026, the desire for healthy alternatives to food is an unprecedented shift in consumption behavior, instead of being a passing trend. With increasing health issues, particularly in urban centers, consumers are gravitating toward products that promote healthy living, including organic, gluten-free, and non-GMO canned food. The plant-based and vegan diets trend is also affecting canned food producers to increase their lines to meet this demand. These health-aware trends are supplemented by packaging innovations, including BPA-free cans and green materials, to make the product safe and sustainable. Increasing demand for healthier and convenient products in urban and semi-urban areas is transforming India's canned food market.

To get more information on this market, Request Sample

Rising Demand for Ready-to-Eat and Convenience Canned Foods

The increasing demand for ready-to-eat (RTE) and convenience canned foods is a major trend driving the growth of India’s canned food market. As lifestyles become busier, especially in urban areas, consumers are seeking quick, easy-to-prepare meal solutions. According to the IMARC Group, the India convenience food market size reached US$ 887.9 Million in 2023 and is further expected to reach US$ 3,498.9 Million by 2032. Canned vegetables and fruits, soups, curries, and snacks provide convenience, longer shelf life, and lesser preparation time and are thus a preferred choice of working professionals, students, and busy families. The increasing population of nuclear families in which both the partners are employed is also contributing to the demand for ready-to-eat canned foods. These products spare time while also minimizing cooking requirements, fitting the contemporary consumer's lifestyle of speed. Companies are emphasizing providing diverse flavors, textures, and cuisines to meet the various consumer needs so that the convenience aspect does not be at the expense of taste.

India Canned Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, type, and distribution channel.

Product Type Insights:

- Canned Meat and Seafood

- Canned Fruit and Vegetables

- Canned Ready Meals

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes canned meat and seafood, canned fruit and vegetables, canned ready meals, and others.

Type Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the type. This includes organic and conventional.

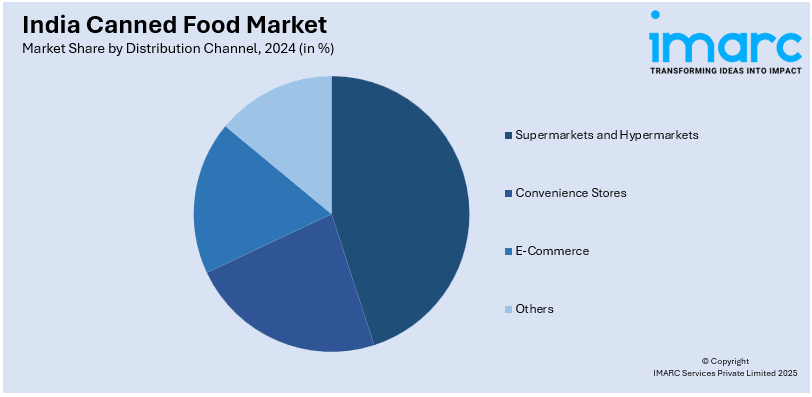

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- E-Commerce

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, e-commerce, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Canned Food Market News:

- In February 2025, Agro Tech Foods Limited finalized the purchase of Del Monte Foods Private Limited (DMFPL), a canned food maker, representing a key achievement in its growth strategy.

India Canned Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Canned Meat and Seafood, Canned Fruit and Vegetables, Canned Ready Meals, Others |

| Types Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, E-Commerce, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India canned food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India canned food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India canned food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The canned food market in India was valued at USD 9.2 Billion in 2024.

The India canned food market is projected to exhibit a CAGR of 1.7% during 2025-2033, reaching a value of USD 10.8 Billion by 2033.

The market is driven by shifting diet patterns, expanding urbanization, and the demand for ready-to-eat, convenient foods. Dual-income families and hectic lifestyles boost demand. Expansion of modern retail enhanced cold-chain logistics, and expanding awareness of food safety enable growth. Increased product innovation in seafood, fruits, vegetables, and meat drives consumer adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)