India Car Wash Service Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

India Car Wash Service Market Overview:

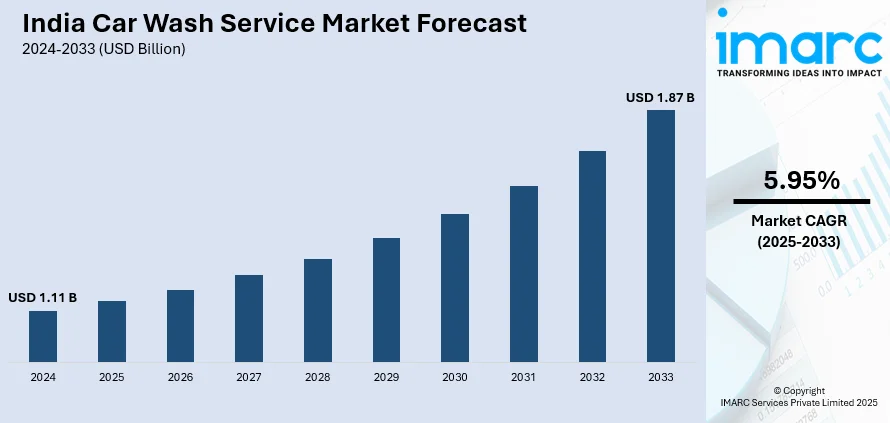

The India car wash service market size reached USD 1.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.87 Billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The market is driven by rising urbanization, increasing vehicle ownership, time-constrained lifestyles, the emergence of tech-enabled service startups, growing awareness of water conservation, evolving consumer preferences for convenience and hygiene, and promotional initiatives by automakers that enhance demand for professional, eco-friendly, and accessible car cleaning solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.11 Billion |

| Market Forecast in 2033 | USD 1.87 Billion |

| Market Growth Rate 2025-2033 | 5.95% |

India Car Wash Service Market Trends:

Rapid Urbanization and Rising Car Ownership

One of the key drivers of India's car wash service market is the fast rate of urbanization coupled with increased personal vehicle ownership rates. As per reports, by 2030, more than 40% of India’s population are expected to live in urban areas. India witnessed a massive demographic transformation in the last ten years with millions shifting from rural to urban areas. As urban centers grow and evolve, so does the burgeoning middle class, which an increasing number of consumers looking to own personal vehicles. This expanding car population in urban areas—especially in metropolitan cities such as Mumbai, Delhi, Bengaluru, and Hyderabad—is propelling the demand for car wash and maintenance services. Urban routines tend to leave people with very little time for regular vehicle maintenance, and, therefore, they seek professional car wash services. In addition to this, the growing popularity of high-rise apartments and gated communities, where water consumption and car washing area are usually limited or regulated, renders doorstep or automated car wash services an attractive option.

To get more information on this market, Request Sample

Emergence of Organized and Technology-Enabled Car Wash Startups

The emergence of organized, technology-based startups that are replacing conventional car cleaning processes with new-age service models and online platforms is acting as another significant growth-inducing factor. In contrast to previous disorganized and unstructured car washing systems usually operated by independent cleaners with no regular schedule or standardization, new-generation startups have brought in organized, scalable, and convenient options. These businesses are making use of technology to provide app-based bookings, subscription services, GPS-based tracking, digital payment, and feedback mechanisms. All these technologies make not only user experience better but also ensure building trust with openness, quality service, and efficient service delivery on time. Brands such as GoMechanic, MyTVS, Urban Company, etc., are establishing standards with skilled training, brand-identified vehicles, or AI-based scheduling systems. Additionally, such platforms serve a wider category of consumers—particularly millennials and Gen Z, who prefer digital convenience to manual coordination. Such startups are also exploring B2B opportunities by offering fleet cleaning solutions to cab aggregators, logistics companies, and corporate clients.

India Car Wash Service Market Segmentation:

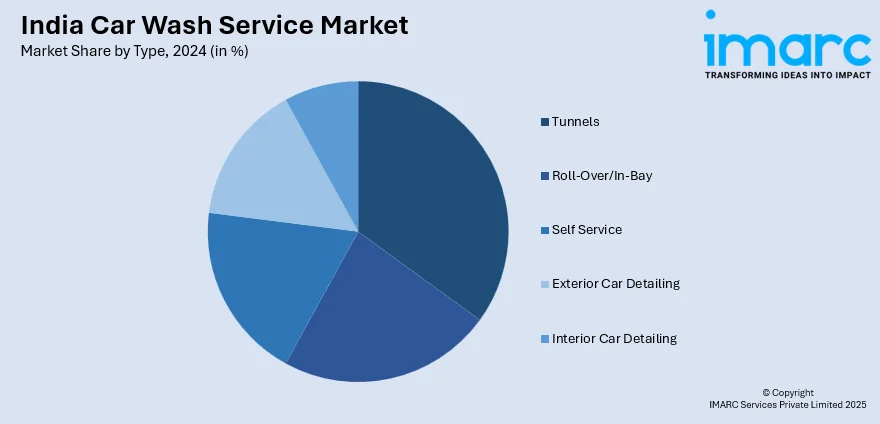

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Tunnels

- Roll-Over/In-Bay

- Self Service

- Exterior Car Detailing

- Interior Car Detailing

The report has provided a detailed breakup and analysis of the market based on the type. This includes tunnels, roll-over/in-bay, self service, exterior car detailing, and interior car detailing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Car Wash Service Market News:

- July 2024: Rocket Car Wash launched a new outlet in Coimbatore, Tamil Nadu, expanding its footprint in the Indian market. The brand showcased its high-end, automated car wash technology and premium service offerings.

- June 2024: Kia India conducted a nationwide service camp from June 27 to July 3, 2024, offering customers a 36-point vehicle check-up, complimentary car wash, and discounts on services and accessories. Such initiatives enhance customer satisfaction and loyalty, encouraging regular vehicle maintenance. This, in turn, drives demand for professional car care services, contributing to the India's car wash service market.

India Car Wash Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tunnels, Roll-Over/In-Bay, Self Service, Exterior Car Detailing, Interior Car Detailing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car wash service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India car wash service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car wash service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car wash service market in India was valued at USD 1.11 Billion in 2024.

The India car wash service market is projected to exhibit a CAGR of 5.95% during 2025-2033, reaching a value of USD 1.87 Billion by 2033.

Key factors driving the India car wash service market include the increasing vehicle ownership, growing awareness about vehicle maintenance, and the demand for eco-friendly and water-efficient washing solutions. Additionally, the convenience of professional services and the expansion of the middle-class population further fuel the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)