India Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Market Overview:

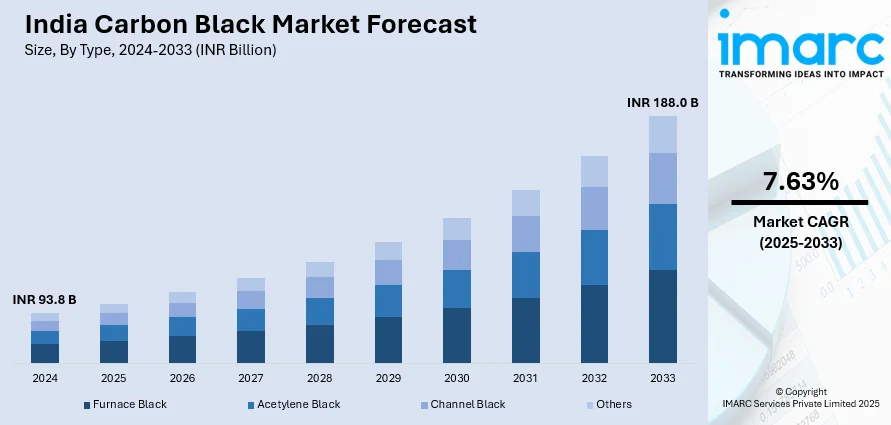

The India carbon black market size reached INR 93.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 188.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.63% during 2025-2033. The rapid expansion of the automobile industry, an enhanced focus on infrastructure development, and considerable growth in the manufacturing sector in India represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 93.8 Billion |

|

Market Forecast in 2033

|

INR 188.0 Billion |

| Market Growth Rate 2025-2033 | 7.63% |

The Rapid Expansion of the Automotive Industry is Augmenting the Market Growth

The carbon black market has been experiencing continuous growth. The rapid expansion of the automotive industry currently represents one of the primary drivers resulting in the increasing sales of disposable carbon black. Carbon black is an essential component in the manufacturing of parts used in automobiles such as tires, belts, hoses, thereby making it a vital ingredient in the automotive supply chain. The transition towards electric vehicles (EVs) is propelling the demand for carbon black for the manufacturing of specialized carbon black-based tires and rubber components. Additionally, various factors such as inflating disposable income levels, rapid urbanization, and improved infrastructure are resulting in the growing demand for automobiles, which in turn is stimulating the market growth.

To get more information on this market, Request Sample

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is consolidated with a few top players operating in the industry. The volume of new entrants is medium in the carbon black industry due to the scope for innovations, high brand loyalty, high fixed cost, high market concentration, and difficult to access capital.

What is Carbon Black?

Carbon black refers to a form of amorphous carbon typically consisting of fine particles of elemental carbon, with particle sizes ranging from 8 to 500 nanometers, and is produced by the incomplete combustion of hydrocarbon fuels. It is characterized by a large surface area per unit mass for excellent adsorption properties, black pigmentation, chemical stability, durability, resistance to degradation, and excellent electrical conductivity. Carbon black offers reinforcement to materials and enhances their mechanical properties including strength and stiffness as well as provides UV protection by absorbing and dissipating UV radiation. Carbon black integrates with the rubber matrix in rubber compounds to form a reinforcing network and disperses within materials for pigmentation, thereby providing an intense and stable black coloration by absorbing and scattering light. In addition to this, its adsorption properties enable effective removal of impurities and contaminants from air and water.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a severe problem for the carbon black industry and imposed unprecedented challenges on India. The Indian government implemented a nationwide lockdown that resulted in significant repercussions throughout its economy, resulting in a sharp decline for carbon black and related products. The supply chain and distribution faced major halts, leading to major players shutting down manufacturing units or operating at minimal capacity utilization. This resulted in reduced production and sales and the decline of related sectors, such as the automobile and tire sectors. However, the gradual reduction in COVID-19 cases and subsequent upliftment of travel restrictions led to recovery in the auto and tire industries, which subsequently presented improved prospects for carbon black demand. As a result, the carbon black market faced positive growth opportunities and is expected to grow steadily.

India Carbon Black Market Trends:

The market in India is primarily driven by an enhanced focus on infrastructure development, such as road construction, bridges, and buildings. This can be attributed to the rapid urbanization, along with the growing population levels in the country. In addition to this, the augmenting product demand in the production of rubber as a filler in tires on account of the exceptional physical characteristics offered by carbon black, including reduced thermal stress and enhanced strength and longevity, is influencing the growth of the market across the country. In line with this, considerable growth in the manufacturing sector in India, particularly in plastics and textile industries, is propelling the demand for carbon black across numerous industrial applications. Moreover, the escalating demand for specialty carbon black, including conductive carbon black and high-performance carbon black in the electrical and electronics industries, is also acting as a significant growth-inducing factor for the market. Apart from this, favorable initiatives undertaken by the Indian government to support industrial growth and attract investments is creating a positive outlook for the market. Some of the other factors contributing to the market include the growing export opportunities, rapid industrialization, the rising sales of automobiles, the advent of renewable carbon black products manufactured using industrial-grade plant-based oils, and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India carbon black market, along with forecasts at the regional level from 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the India carbon black market based on the type. This includes furnace black, acetylene black, channel black, and others. According to the report, furnace black represented the largest segment due to the rising demand for construction and infrastructure development requiring raw materials with high reinforcing and strengthening properties. In addition to this, the growing consumption of various rubber goods, including tires, hoses, belts, and seals, among the masses is propelling the market growth in this segment.

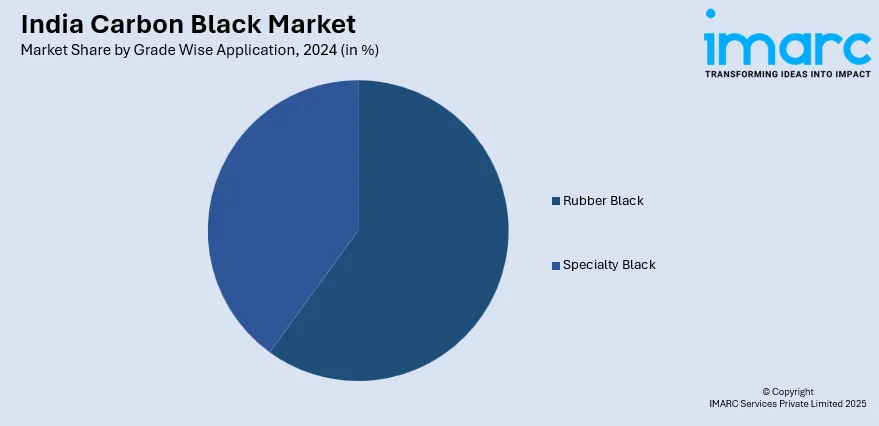

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

A detailed breakup and analysis of the India carbon black market based on the grade wise application has also been provided in the report. This includes rubber black (tire treads, inner liners and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink & toners, paint & coatings, wires & cables, and others). According to the report, rubber black accounted for the largest market share on account of considerable growth in the automotive industry. In addition to this, the rising demand for vehicle tires in replacement cycles is resulting in a consistent demand for rubber black.

Regional Insights:

- South India

- West and Central India

- North India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, West and Central India, North India, and East India. According to the report, South India was the largest market for carbon black. Some of the factors driving the India carbon black market in South India included enhanced focus on infrastructure development, rapid urbanization along with the growing population levels. Apart from this, considerable growth in the manufacturing sector, the escalating demand for specialty carbon black, and flourishing electrical and electronics industries in the region has also impacted the market positively. In line with this, numerous favorable initiatives undertaken by the Indian government to support industrial growth in this region, rapid industrialization, and the rising sales of automobiles are further contributing to the growth of the market.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India carbon black market. Some of the companies covered in the report include:

- Phillips Carbon Black Limited (PCBL)

- Birla Carbon India Pvt. Ltd.

- Balkrishna Industries Limited (BKT)

- Himadri Specialty Chemical Ltd.

- Continental Carbon India Private Limited

- Ralson Shine Carbon Ltd.

- Epsilon Carbon Private Limited

- Cabot Corporation

- Selective Minerals and Color Industries Pvt. Ltd.

Please note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | South India, West and Central India, North India, East India |

| Companies Covered | Phillips Carbon Black Limited (PCBL), Birla Carbon India Pvt. Ltd., Balkrishna Industries Limited (BKT), Himadri Specialty Chemical Ltd., Continental Carbon India Private Limited, Ralson Shine Carbon Ltd., Epsilon Carbon Private Limited, Cabot Corporation, Selective Minerals and Color Industries Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India carbon black market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India carbon black market?

- What is the impact of each driver, restraint, and opportunity on the India carbon black market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the India carbon black market?

- What is the breakup of the market based on the grade wise application?

- Which is the most attractive grade wise application in the India carbon black market?

- What is the competitive structure of the India carbon black market?

- Who are the key players/companies in the India carbon black market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carbon black market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India carbon black market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)