India Cargo Handling Equipment Market Size, Share, Trends and Forecast by Equipment Type, Propulsion Type, Application, and Region, 2025-2033

India Cargo Handling Equipment Market Overview:

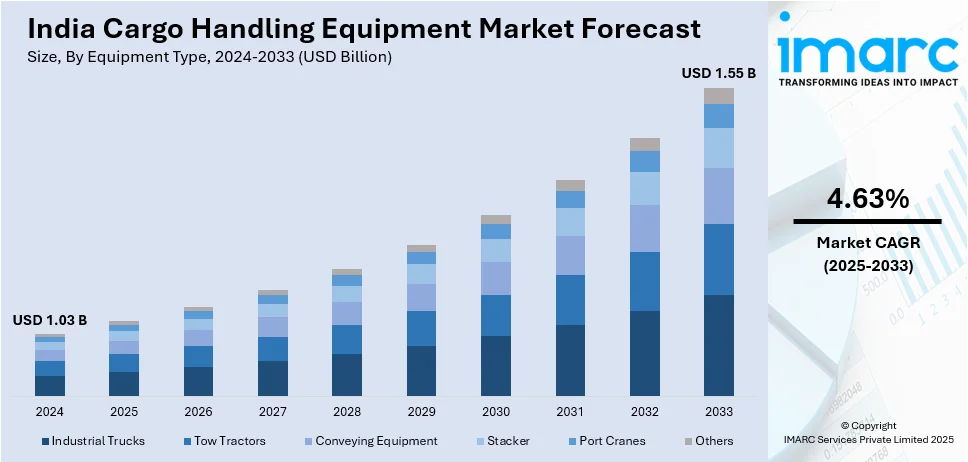

The India cargo handling equipment market size reached USD 1.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.55 Billion by 2033, exhibiting a growth rate (CAGR) of 4.63% during 2025-2033. The rising trade volumes, expanding port infrastructure, government initiatives, increasing automation in logistics, growing e-commerce, and stricter emission regulations promoting electric and hybrid equipment adoption for improved efficiency and sustainability are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.03 Billion |

| Market Forecast in 2033 | USD 1.55 Billion |

| Market Growth Rate 2025-2033 | 4.63% |

India Cargo Handling Equipment Market Trends:

Expansion of Port Infrastructure and Maritime Capacity

India is significantly enhancing its marine capabilities by expanding cargo handling capacity at major ports. The emphasis is on updating infrastructure, including new freight handling technology, and increasing efficiency. Shipbuilding and repair centers are being built in many states to accommodate increased trade volumes and minimize reliance on imports. Furthermore, developments in alternative energy, particularly hydrogen production, show a trend toward more sustainable port operations. These measures are anticipated to increase employment while improving logistical efficiency. The concentration on Greenfield projects demonstrates a commitment to long-term marine development, drawing both local and foreign investment. This development is consistent with wider economic objectives, strengthening India's place in global shipping and trade networks while assuring future-ready port operations. For example, in September 2024, India announced its aims to double container handling capacity at government-run ports to 40 Million TEUs in five years, generating 2 Million jobs. The proposal includes the establishment of shipbuilding and repair centers in Gujarat, Maharashtra, Kerala, Andhra Pradesh, and Odisha, which would be supported by a new Greenfield Shipyard Building Scheme. Additionally, hydrogen industrial centers were suggested, which would draw major investment.

To get more information on this market, Request Sample

Advancements in Cargo Handling and Port Efficiency

Ports are increasingly using automation and digital integration to improve cargo transit efficiency. The use of modern handling technologies, such as automated equipment and enhanced logistical infrastructure, is increasing throughput and decreasing operating delays. Improved digital connectivity simplifies freight tracking and processing, resulting in speedier turnaround times. These initiatives are consistent with larger efforts to upgrade port operations and support increasing trade volumes. As global shipping demand rises, there is a greater emphasis on technology-driven solutions that optimize resource usage and reduce congestion. Investing in smart port infrastructure promotes sustainability by decreasing manual intervention and energy use. These initiatives are part of a larger drive for efficiency, competitiveness, and seamless cargo handling in India's developing marine sector. For instance, in August 2024, Adani Krishnapatnam Port implemented an improved cargo handling system to increase efficiency and throughput. The update comprises automated equipment, better logistical infrastructure, and digital integration to accelerate cargo transit. This project promotes India's expanding trade volumes and is consistent with contemporary port development objectives.

India Cargo Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on equipment type, propulsion type, and application.

Equipment Type Insights:

- Industrial Trucks

- Tow Tractors

- Conveying Equipment

- Stacker

- Port Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes industrial trucks, tow tractors, conveying equipment, stacker, port cranes, and others.

Propulsion Type Insights:

- IC Engine

- Electric

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes IC engine and electric.

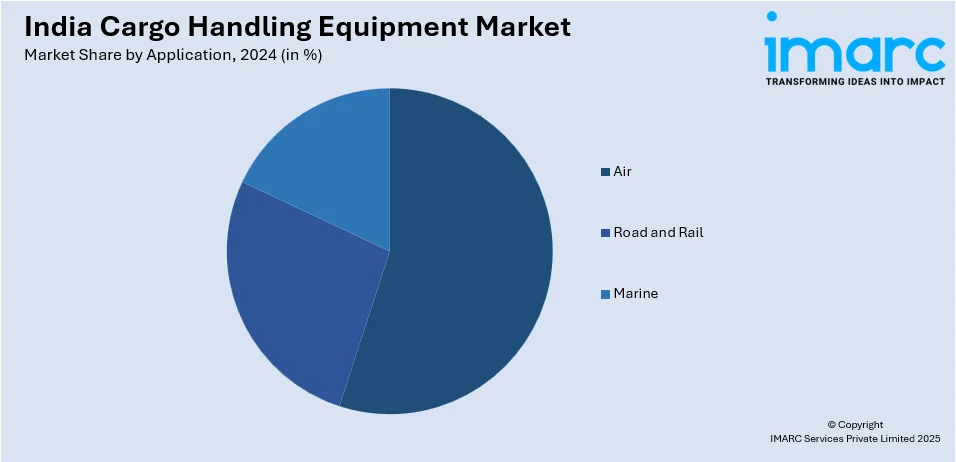

Application Insights:

- Air

- Road and Rail

- Marine

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air, road and rail, and marine.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cargo Handling Equipment Market News:

- In February 2025, Allcargo Gati Limited upgraded its on-premises ERP system to Oracle Cloud Infrastructure, resulting in 20% improved system performance and operational efficiency. This modernization benefits India's logistics business by improving operations and reducing latency. The relocation enables Allcargo Gati to combine technology such as artificial intelligence and data analytics, bolstering its logistics leadership.

- In January 2025, the Ministry of Ports, Shipping & Waterways unveiled an INR 57,000 Crore investment to expand Kandla Port capacity. This comprises an INR 30,000 Crore major shipbuilding plant capable of producing 32 new ships and repairing 50 per year, and an INR 27,000 Crore cargo port adding 135 MTPA capacity with advanced cargo handling technology. These efforts seek to strengthen India's shipbuilding skills and increase freight handling efficiency.

India Cargo Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Industrial Trucks, Tow Tractors, Conveying Equipment, Stacker, Port Cranes, Others |

| Propulsion Types Covered | IC Engine, Electric |

| Applications Covered | Air, Road and Rail, Marine |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cargo handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India cargo handling equipment market on the basis of equipment type?

- What is the breakup of the India cargo handling equipment market on the basis of propulsion type?

- What is the breakup of the India cargo handling equipment market on the basis of application?

- What are the various stages in the value chain of the India cargo handling equipment market?

- What are the key driving factors and challenges in the India cargo handling equipment market?

- What is the structure of the India cargo handling equipment market and who are the key players?

- What is the degree of competition in the India cargo handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cargo handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cargo handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cargo handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)