India Cell and Gene Therapy Market Size, Share, Trends and Forecast by Therapy Type, Indication, Delivery Mode, End User, and Region, 2025-2033

India Cell and Gene Therapy Market Overview:

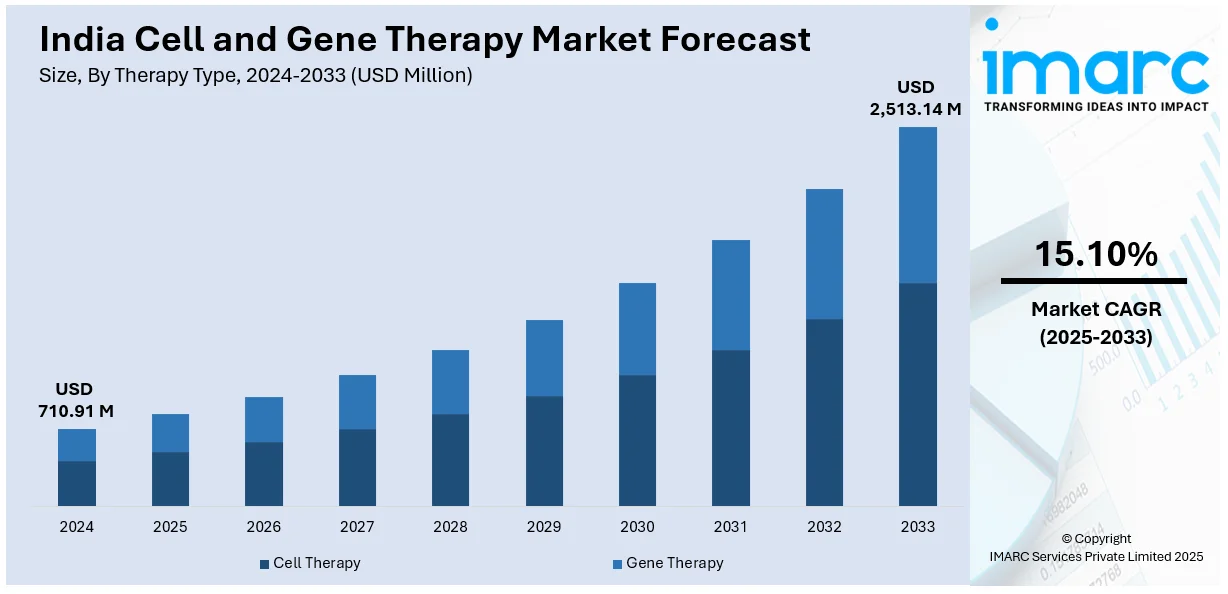

The India cell and gene therapy market size reached USD 710.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,513.14 Million by 2033, exhibiting a growth rate (CAGR) of 15.10% during 2025-2033. Rising prevalence of genetic disorders, growing investments in biotechnology, regulatory support for advanced therapies, increasing clinical trials, demand for personalized medicine, expanding healthcare infrastructure, technological advancements in gene editing, availability of skilled researchers, collaborations between academia and industry, and a surge in stem cell research are key drivers shaping market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 710.91 Million |

| Market Forecast in 2033 | USD 2,513.14 Million |

| Market Growth Rate (2025-2033) | 15.10% |

India Cell and Gene Therapy Market Trends:

Expansion of Domestic Manufacturing and Infrastructure

India is witnessing significant investment in domestic cell and gene therapy manufacturing to reduce dependency on imports. Leading biotechnology firms and pharmaceutical companies are establishing Good Manufacturing Practice (GMP)-compliant facilities to produce vector-based and autologous therapies. Government initiatives are further encouraging indigenous production. This expansion is expected to improve affordability, streamline regulatory approvals, and accelerate market access for innovative therapies. Additionally, contract development and manufacturing organizations (CDMOs) are gaining traction as key players in supporting large-scale production. The establishment of dedicated cell therapy centers and regulatory-backed infrastructure projects positions India as a competitive hub for cell and gene therapy innovation in the Asia-Pacific region. For instance, in April 2024, the Government of India (GoI) launched country’s first homegrown gene therapy for cancer, CAR-T cell therapy, at IIT Bombay. Developed in collaboration with Tata Memorial Hospital and ImmunoACT, it is the world’s most affordable CAR-T therapy. The initiative aligns with ‘Make in India’ and ‘Atmanirbhar Bharat,’ making advanced cancer treatment accessible. The therapy, a major medical breakthrough, leverages academia-industry partnerships, reinforcing India’s role in cutting-edge healthcare innovation and technological self-reliance.

To get more information on this market, Request Sample

Increasing Clinical Trials and Regulatory Advancements

India is emerging as a strategic location for clinical trials in cell and gene therapy, driven by a large patient pool and cost-effective research capabilities. The Central Drugs Standard Control Organization (CDSCO) is implementing structured regulatory pathways, streamlining approval processes for experimental therapies. The introduction of accelerated approvals for orphan diseases and rare genetic disorders is further fueling trial activity. Additionally, collaborations between Indian research institutions and global biotech firms are facilitating multicenter trials, leading to faster clinical validation of therapies. As regulatory frameworks evolve to align with international standards, India’s attractiveness as a research and development hub for advanced therapeutic medicinal products (ATMPs) is increasing, creating an ecosystem conducive to innovation and commercialization. For instance, in February 2024, India approved its first homegrown CAR T-cell therapy, NexCAR19. Developed by ImmunoACT, a spin-off of IIT Bombay, it was tested in 64 patients with lymphoma or leukemia, achieving a 67% response rate. The therapy, licensed for manufacturing in Mumbai, aims to treat 1,200 patients annually. Collaboration with NCI scientists helped refine its development, ensuring accessibility in India’s healthcare system.

India Cell and Gene Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on therapy type, indication, delivery mode, and end user.

Therapy Type Insights:

- Cell Therapy

- Stem Cell

- Pluripotent Stem Cell

- Cancer Stem Cell

- Adult Stem Cell

- Non-Stem Cell

- T-Cell

- Natural Killer Cell

- Others

- Stem Cell

- Gene Therapy

The report has provided a detailed breakup and analysis of the market based on the therapy type. This includes cell therapy (stem cell (pluripotent stem cell, cancer stem cell, and adult stem cell) and non-stem cell (t-cell, natural killer cell, and others)) and gene therapy.

Indication Insights:

-

- Cardiovascular Disease

- Oncology Disorder

- Genetic Disorder

- Infectious Disease

- Neurological Disorder

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes cardiovascular disease, oncology disorder, genetic disorder, infectious disease, neurological disorder, and others.

Delivery Mode Insights:

- In-Vivo

- Ex-Vivo

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes in-vivo and ex-vivo.

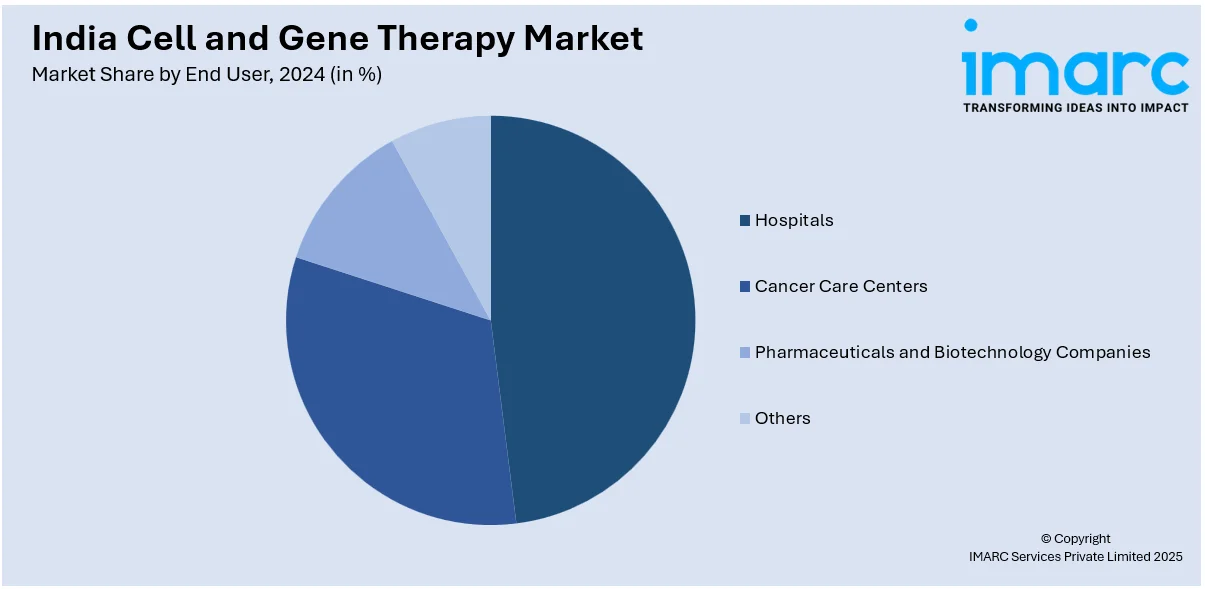

End User Insights:

- Hospitals

- Cancer Care Centers

- Pharmaceuticals and Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, cancer care centers, pharmaceuticals and biotechnology companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cell and Gene Therapy Market News:

- In January 2025, Immuneel Therapeutics launched Qartemi, India's second CAR T-cell therapy for B-cell non-Hodgkin lymphoma (B-NHL). With 120,000 new blood cancer cases and 70,000 deaths annually, this therapy offers a breakthrough alternative to chemotherapy. Immuneel initiated clinical trials in 2022 and has partnered with major hospitals, ensuring accessibility. Licensed from Hospital Clínic de Barcelona, Qartemi meets global standards while being produced in Bangalore at lower costs. The therapy enhances India’s role in advanced cancer treatments.

- In February 2025, Miltenyi Biotec inaugurated India’s first cell and gene therapy Centre of Excellence (CoE) in Hyderabad, spanning 1,800 sqm in Genome Valley. The Miltenyi Innovation and Technology Centre (MITC) will advance biomedical research, offering cutting-edge MACS instruments, therapy development platforms, and training programs. The facility aims to accelerate cell and gene therapy innovations, particularly for cancer treatment, strengthening Telangana’s biotech ecosystem.

- In June 2024, AIIMS researchers announced that they are developing gene therapy for sickle cell disease using CRISPR-Cas9, with expected breakthroughs by January 2025. The therapy targets India's high disease burden, especially among Scheduled Tribes. The Union Tribal Affairs Ministry anticipates promising laboratory results, marking a significant step toward an effective treatment.

India Cell and Gene Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Types Covered |

|

| Indications Covered | Cardiovascular Disease, Oncology Disorder, Genetic Disorder, Infectious Disease, Neurological Disorder, Others |

| Delivery Modes Covered | In-Vivo, Ex-Vivo |

| End Users Covered | Hospitals, Cancer Care Centers, Pharmaceuticals And Biotechnology Companies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cell and gene therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cell and gene therapy market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cell and gene therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cell and gene therapy market in India was valued at USD 710.91 Million in 2024.

The India cell and gene therapy market is projected to exhibit a CAGR of 15.10% during 2025-2033, reaching a value of USD 2,513.14 Million by 2033.

The India cell and gene therapy market is driven by advancements in biotechnology, increasing investment in healthcare innovation, and a rising prevalence of genetic disorders. The growing awareness about personalized medicine, favorable government policies, and improvements in research operations are offering a favorable market outlook. Enhanced healthcare infrastructure and better access to treatment options further support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)