India Cellulose Fibers Market Size, Share, Trends and Forecast by Fiber Type, Application, and Region, 2026-2034

India Cellulose Fibers Market Overview:

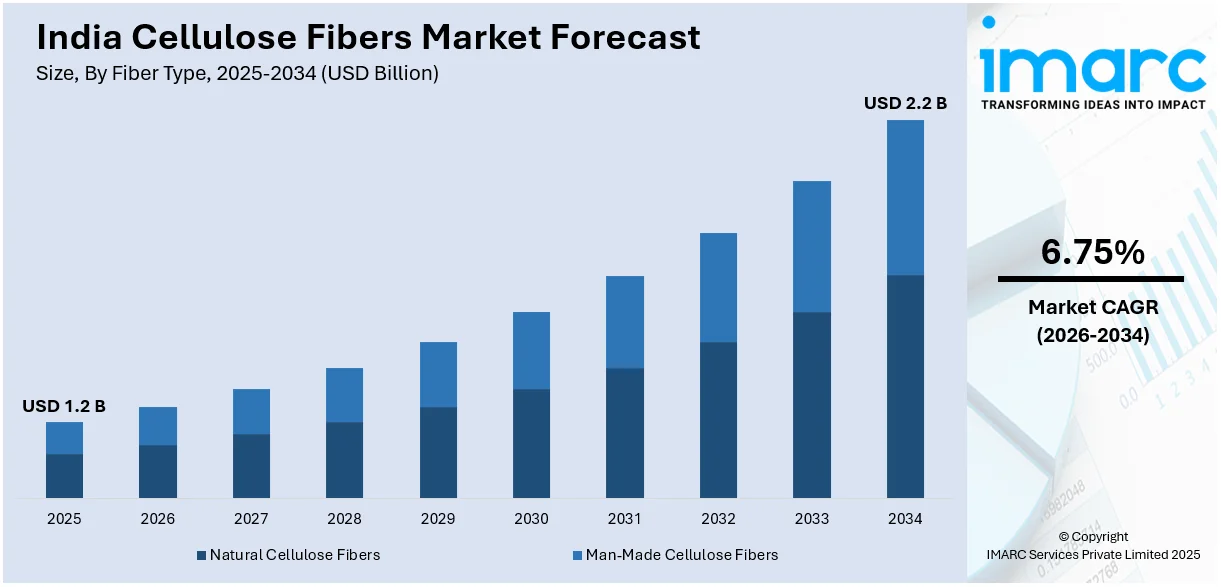

The India cellulose fibers market size reached USD 1.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034. The market is driven by rising demand for sustainable textiles, government initiatives promoting eco-friendly fiber production, substantial investments in recycling technologies, and the growing adoption of cellulose-based fibers in apparel and industrial applications, supported by consumer preference for biodegradable materials and stricter environmental regulations in the textile sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.2 Billion |

| Market Growth Rate 2026-2034 | 6.75% |

India Cellulose Fibers Market Trends:

Rising Demand from the Textile Industry

The Indian textile industry has been a major consumer of cellulose fibers, specifically because of their versatility and comfort. Cellulose fibers from natural sources like wood pulp and cotton linters are widely utilized in the production of fabrics, such as rayon, viscose, and modal. These types of fabrics are well known for their softness, breathability, and biodegradability, which is why they are very much in demand in domestic and foreign markets. India's textile industry has seen tremendous improvement over the last few years. As per the Annual Survey of Industries (ASI) for 2021-22, industrial production upsurged by over 35% compared to the earlier year, reflecting a strong growth in manufacturing activities, including textiles. This strengthening of production aligns with the higher consumption of raw materials such as cellulose fibers. In addition, the government's goal of reaching USD 100 Billion in textile and apparel exports by 2029-30 reflects the industry's path. The man-made fiber textiles industry is likely to account for approximately USD 12 Billion towards this goal, pointing toward the escalating demand for fibers like viscose and rayon. The performance of cellulose and its chemical derivatives as exports also showcases this trend. India exported cellulose and chemical derivatives worth USD 114.92 Million in 2021, up by more than 31% from 2020. The USA was the largest market for these exports, showing robust demand from overseas markets.

To get more information on this market Request Sample

Emphasis on Sustainable and Eco-Friendly Materials

As the world focuses on sustainability, there is a boosting demand for green materials across industries. Cellulose fibers, being renewable and biodegradable, fit the bill perfectly when it comes to this sustainability culture. This has resulted in their increased use in industries like textiles, packaging, and personal care products. The efforts of the Indian government to encourage sustainable practices have also contributed to this trend. Technical textiles, covering products containing cellulose fibers, have been a focus area for expansion. During the financial year 2021-22, India's technical textiles market value was USD 22.5 Billion, of which exports crossed USD 2.85 Billion. Technical textiles penetration in India was 10-12% during the said period, reflecting tremendous scope for expansion. The government's emphasis on research and development, innovation, and a strong policy framework has provided a positive climate for the use of sustainable materials such as cellulose fibers. The thrust towards minimizing carbon footprints and encouraging biodegradable products has prompted manufacturers to include cellulose fibers in their product offerings to meet the changing consumer demand for green products. Additionally, the global trend towards the minimization of plastic use has created new opportunities for cellulose fibers in packaging and other non-textile industries. This change is consistent with India's push towards environmental sustainability and offers chances for the cellulose fibers market to diversify and grow.

India Cellulose Fibers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on fiber type, and application.

Fiber Type Insights:

- Natural Cellulose Fibers

- Cotton Fibers

- Jute Fibers

- Wood Fibers

- Others

- Man-Made Cellulose Fibers

- Viscose Fibers

- Lyocell Fibers

- Modal Fibers

- Others

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes natural cellulose fibers (cotton fibers, jute fibers, wood fibers, and others) and man-made cellulose fibers (viscose fibers, lyocell fibers, modal fibers, and others).

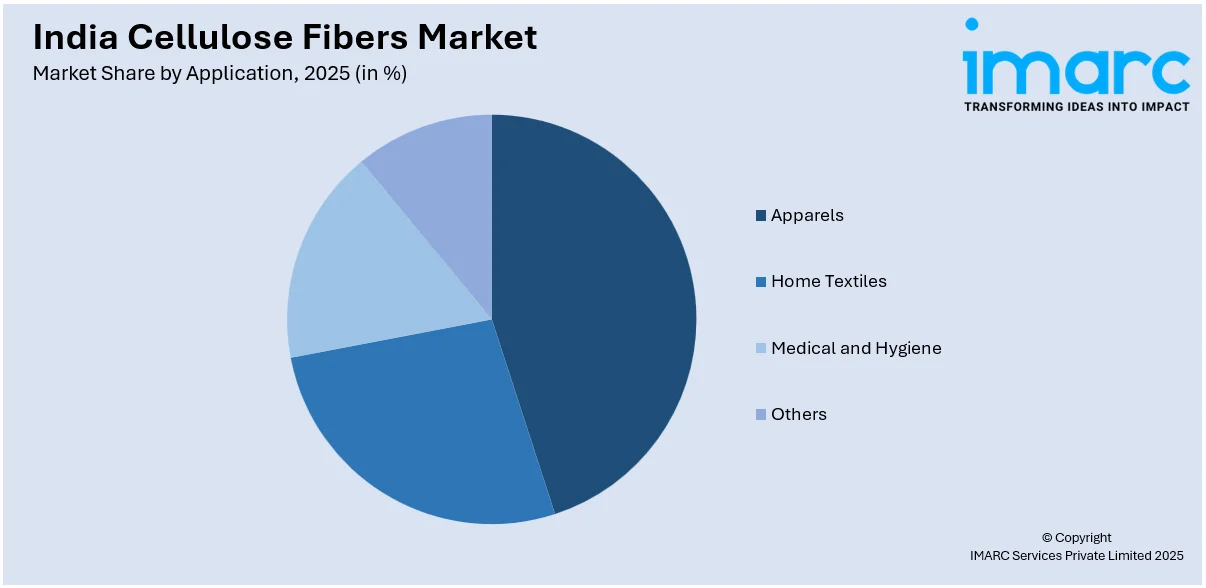

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Apparels

- Home Textiles

- Medical and Hygiene

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes apparels, home textiles, medical and hygiene, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cellulose Fibers Market News:

- October 2024: Birla Cellulose entered into a partnership with Circ to accelerate textile recycling by buying as much as 5,000 tons of recycled pulp from Circ each year for use in producing lyocell fiber. The partnership bolsters India's cellulose fiber industry by ensuring sustainable raw material sourcing and lowering reliance on virgin fibers. The move is in line with India's efforts towards practicing circular economy, with demand for sustainable cellulose fibers escalating.

- September 2024: Global non-profit Canopy has recognized a major opportunity for India to dominate the alternative fiber market by converting agricultural and textile waste into low-carbon materials, cutting emissions, and generating green jobs. The effort will cost USD 13-15 billion to develop the required processing capacity, making India a global leader in sustainable materials. The investment is likely to spur significant elevation in India's cellulose fibers market by expanding production capacity and encouraging sustainable practices.

India Cellulose Fibers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered |

|

| Applications Covered | Apparels, Home Textiles, Medical and Hygiene, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cellulose fibers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cellulose fibers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cellulose fibers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cellulose fibers market in India was valued at USD 1.2 Billion in 2025.

The India cellulose fibers market is projected to exhibit a CAGR of 6.75% during 2026-2034, reaching a value of USD 2.2 Billion by 2034.

The market is driven by rising demand for sustainable textiles, government initiatives promoting eco-friendly fiber production, substantial investments in recycling technologies, growing adoption of cellulose-based fibers in apparel and industrial applications, consumer preference for biodegradable materials, and stricter environmental regulations in the textile sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)