India Cement Admixtures Market Size, Share, Trends and Forecast by Product Type, End-Users, and Region, 2025-2033

India Cement Admixtures Market Overview:

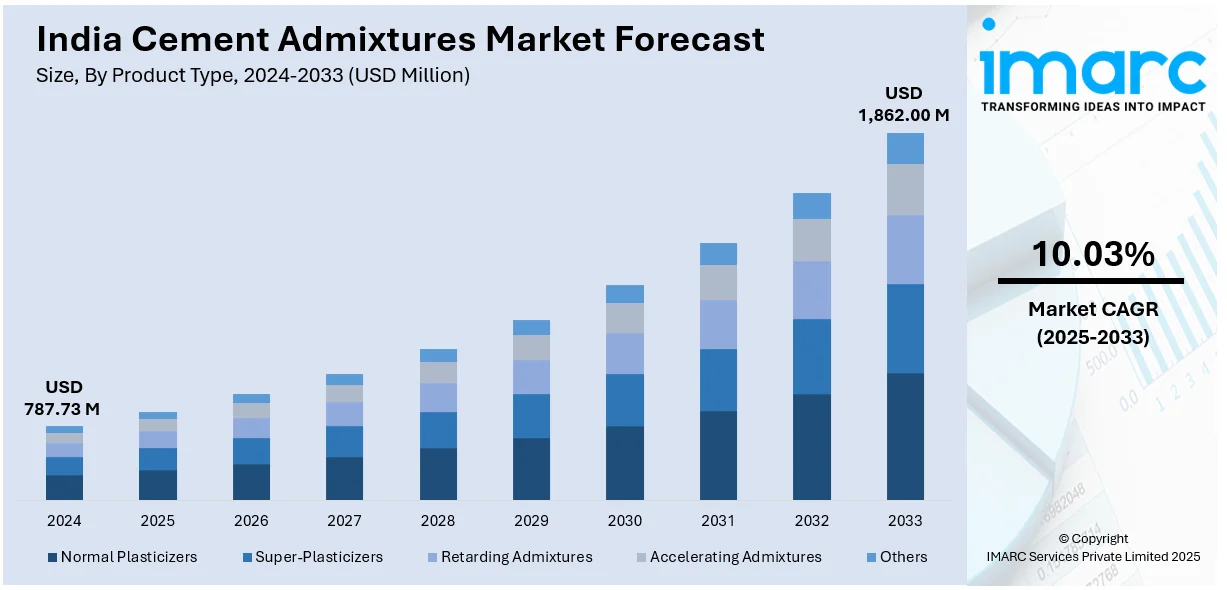

The India cement admixtures market size reached USD 787.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,862.00 Million by 2033, exhibiting a growth rate (CAGR) of 10.03% during 2025-2033. The market is driven by rapid urbanization, infrastructure development, and government initiatives including smart cities and affordable housing. Increasing demand for high-performance, durable concrete and the shift toward eco-friendly, sustainable admixtures further propel India cement admixtures market share. Technological advancements and rising awareness about the benefits of admixtures also contribute to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 787.73 Million |

| Market Forecast in 2033 | USD 1,862.00 Million |

| Market Growth Rate (2025-2033) | 10.03% |

India Cement Admixtures Market Trends:

Growing Demand for High-Performance Concrete Admixtures

The rising demand for high-performance concrete admixtures, driven by the rapid urbanization and infrastructure development across the country, is supporting the India cement admixtures market growth. Notably, on 25th February 2025, the Adani Group announced ₹50,000 Crores (approximately USD 6,097 Million) investment in Assam to develop airports, power transmission systems, roadways, and cement production. The commitment was announced at the recently concluded Advantage Assam 2.0 Summit 2025. The investment complements Assam’s Act East Policy, which aims to enhance connectivity and spur industrialization. It is expected to have a significant impact on India's cement admixtures market, considering the rise in demand for cement in nonresidential and residential large-scale construction projects. Along with this, government’s focus on initiatives, including smart cities, affordable housing, and transportation projects, results in an increasing need for durable and sustainable construction materials. High-performance admixtures, such as superplasticizers and waterproofing agents, enhance the strength, durability, and workability of concrete, making them ideal for large-scale infrastructure projects. Additionally, the rising acceptance of these admixtures is mainly due to the increasing awareness regarding their benefits, such as reduced water requirement and improved resistance to extreme weather conditions. Manufacturers are investing resources in research and development to create innovative solutions that cater to the changing requirements of the construction sector and ensure continued growth in this sector.

To get more information on this market, Request Sample

Shift Toward Eco-Friendly and Sustainable Admixtures

Sustainability is emerging as a key trend in the India cement admixtures market outlook, with a growing emphasis on eco-friendly and green construction practices. A market research report by the IMARC Group indicates that the Indian green cement market size reached USD 1.6 Billion in 2024. It is expected to reach USD 2.8 Billion by 2033, expanding at a compound annual growth rate (CAGR) of 6.11% during 2025-2033. As environmental concerns rise, construction companies are increasingly adopting admixtures that reduce the carbon footprint of concrete production. Several construction products, including fly ash-based admixtures and those derived from industrial by-products, are gaining traction due to their ability to minimize waste and lower energy consumption. This shift is also driven largely by government regulations calling for sustainable construction practices and the use of environmentally friendly building materials. Furthermore, rising acceptance for certifications such as LEED and GRIHA is driving builders to include sustainable additives in their projects. That trend is expected to continue as stakeholders call for environmentally friendly solutions, creating new opportunities for manufacturers to innovate and expand their product portfolios in the Indian market.

India Cement Admixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end-users.

Product Type Insights:

- Normal Plasticizers

- Super-Plasticizers

- Retarding Admixtures

- Accelerating Admixtures

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes normal plasticizers, super-plasticizers, retarding admixtures, accelerating admixtures, and others.

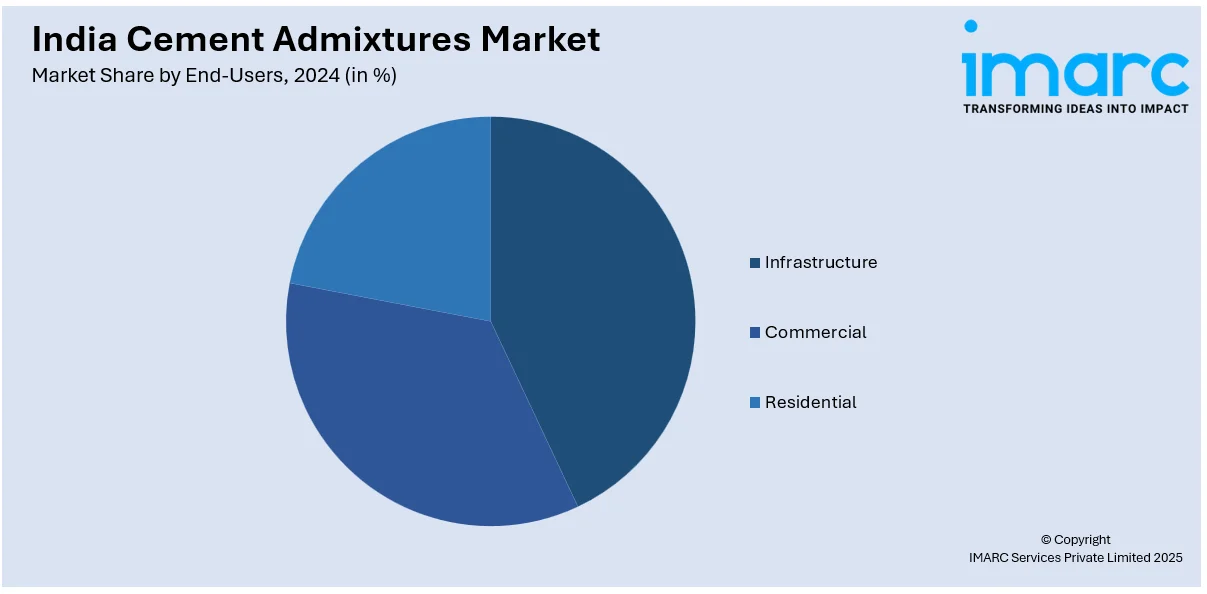

End-Users Insights:

- Infrastructure

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end-users have also been provided in the report. This includes infrastructure, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cement Admixtures Market News:

- November 27, 2024: JSW One Platforms, a B2B e-commerce arm of the JSW Group, has launched a ready-mix concrete solution, JSW One Concrete, in the Mumbai Metropolitan Region, with plans to expand to the top 20 RMC markets by FY 2027. In line with the growing need from the construction industry, the company plans to expand to 20 key RMC markets by FY27 to garner 50% of the RMC market share in India.

- July 23, 2024: Nuvoco Vistas Corp. launched Concrete Uno – Hydrophobic Concrete, a product that has a damp-lock formula to reduce permeability, thereby eliminating the need to put in cost-intensive waterproofing systems. It incorporates a tailored mix design and a specialized admixture blend to inhibit capillary formation, thus significantly reducing permeability compared to conventional concrete. This waterproof formulation strengthens and densifies the structure, extending the lifespan of infrastructure. Available at Nuvoco’s RMX plants across India, this product adds an edge to infra durability while reducing maintenance costs.

India Cement Admixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Normal Plasticizers, Super-Plasticizers, Retarding Admixtures, Accelerating Admixtures, Others |

| End-Users Covered | Infrastructure, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cement admixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the India cement admixtures market on the basis of product type?

- What is the breakup of the India cement admixtures market on the basis of end-users?

- What is the breakup of the India cement admixtures market on the basis of region?

- What are the various stages in the value chain of the India cement admixtures market?

- What are the key driving factors and challenges in the India cement admixtures market?

- What is the structure of the India cement admixtures market and who are the key players?

- What is the degree of competition in the India cement admixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cement admixtures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cement admixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cement admixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)