India Ceramic Sanitary Ware Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Ceramic Sanitary Ware Market Overview:

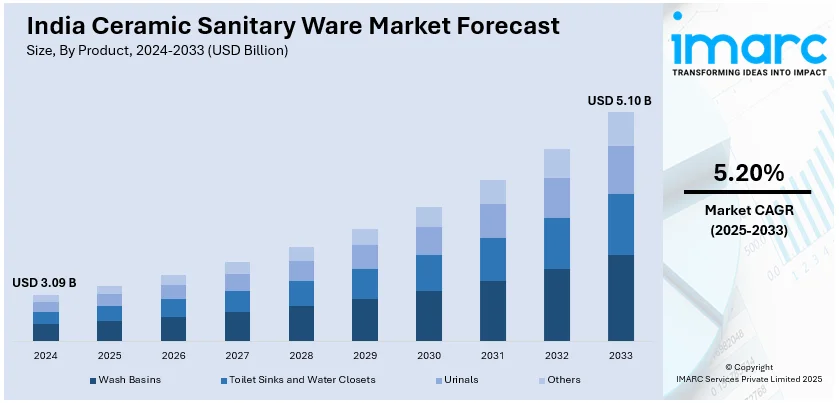

The India ceramic sanitary ware market size reached USD 3.09 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The rapid urbanization, rising disposable incomes, increasing residential and commercial construction, government initiatives promoting sanitation, growing consumer preference for premium bathroom solutions, advancements in manufacturing technology, and the expanding influence of organized retail and e-commerce platforms are some of the major factors positively impacting the India ceramic sanitary ware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.09 Billion |

| Market Forecast in 2033 | USD 5.10 Billion |

| Market Growth Rate (2025-2033) | 5.20% |

India Ceramic Sanitary Ware Market Trends:

Rising Urbanization and Real Estate Development

The increasing urbanization in India is positively influencing the India ceramic sanitary ware market outlook. Modern bathrooms are becoming a crucial component of home design due to the growing middle class and developing cities. According to the World Bank Group, by 2036, there will be 600 million people living in towns and cities, making approximately 40% of the total population in India, compared to 31% in 2011, and more than 70% of GDP will come from metropolitan areas. As people migrate to urban areas, expectations for high-quality living spaces increase, driving the need for stylish, durable, and efficient sanitary ware. Developers and builders are incorporating contemporary bathroom fittings to enhance property value and appeal to buyers looking for comfort and aesthetics. The hospitality and commercial sectors are also investing in high-end sanitary ware to offer premium experiences in hotels, offices, and malls. Additionally, high-rise apartments and gated communities are now focusing on advanced plumbing and space-efficient designs, leading to higher demand for compact and functional ceramic fixtures. Homeowners are prioritizing hygiene, easy maintenance, and visual appeal, pushing manufacturers to innovate with sleek and modern designs. The integration of luxury elements into sanitary ware, such as designer basins and wall-mounted toilets, has further strengthened this market shift.

To get more information on this market, Request Sample

Technological Advancements and Product Innovation

Sanitary ware is evolving with smart features that enhance hygiene, efficiency, and convenience. The advances in sanitary ware, such as touchless flushing systems, sensor-operated faucets, and self-cleaning toilets, are becoming increasingly popular, especially in high-end residences and commercial spaces. Consumers are also seeking anti-bacterial ceramic coatings that reduce stains and bacteria buildup, making maintenance easier. Water-saving technology is another major focus, with low-flow faucets and dual-flush systems that can save water without compromising functionality. Manufacturers are also introducing color variations beyond traditional white, with matte and pastel shades gaining popularity for modern interiors. Continual innovations are enhancing product consistency and quality, which is facilitating India ceramic sanitaryware market growth. On December 11, 2024, Duravit India, a growing subsidiary of Duravit AG. Duravit, in collaboration with designer Philippe Starck, introduced the SensoWash® Starck f, a new generation of shower toilets available in two models: SensoWash® Starck f Plus and SensoWash® Starck f Lite. These models feature minimalist designs with integrated technology, including a flat seat measuring 40 mm in height, and are operable via remote control or a dedicated app. Enhanced functionalities encompass automatic cover opening, customizable seat heating, adjustable shower flow, a controllable hot air dryer, and advanced hygiene features. These advancements collectively reflect the industry’s move towards smarter, more efficient, and visually appealing sanitary ware.

India Ceramic Sanitary Ware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Wash Basins

- Toilet Sinks and Water Closets

- Urinals

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wash basins, toilet sinks and water closets, urinals, and others.

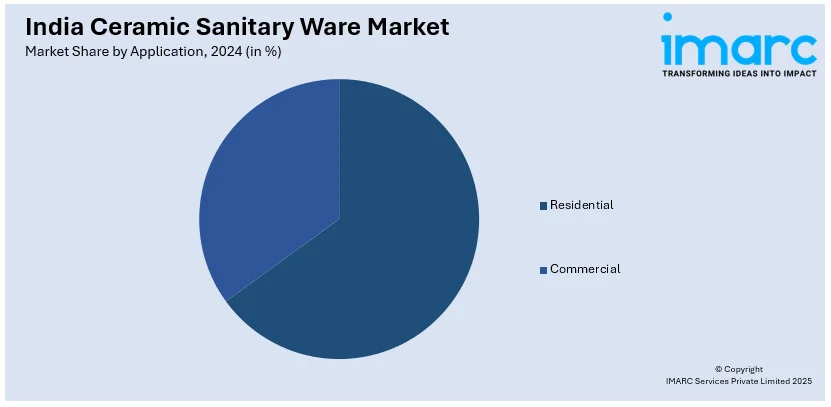

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ceramic Sanitary Ware Market News:

- On October 5, 2023, Hansgrohe expanded its product offerings in India by introducing a comprehensive range of sanitary ceramics, including the EluPura toilet series and the Xelu, Xevolos, and Xuniva washbasin collections. The EluPura toilets feature eco-friendly designs with a water consumption rate of 4.5 liters per flush and incorporate HygieneEffect glaze to inhibit bacterial growth. The washbasin collections are crafted from durable, sanitary ceramics, blending aesthetics with functionality to provide a luxurious bathroom experience.

- On April 10, 2024, DLT successfully ignited the second sanitary ware tunnel kiln for Kerovit Global, a subsidiary of Kajaria Ceramic, in Morbi, Gujarat, India. This kiln is designed to produce 2,288 high-end sanitary ware pieces daily, catering to both domestic and international markets. The project signifies Kajaria Ceramic's strategic expansion in the ceramic industry, enhancing its production capacity in the high-end sanitary ware sector.

India Ceramic Sanitary Ware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wash Basins, Toilet Sinks and Water Closets, Urinals, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ceramic sanitary ware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ceramic sanitary ware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ceramic sanitary ware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceramic sanitary ware market in India was valued at USD 3.09 Billion in 2024.

The India ceramic sanitary ware market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 5.10 Billion by 2033.

The market is driven by rapid urbanization, rising disposable incomes, and increasing residential and commercial construction. Government sanitation initiatives, product innovations, and the expanding influence of e-commerce and organized retail are also contributing significantly to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)