India Ceramide Market Size, Share, Trends and Forecast by Type, Process, Application, and Region, 2025-2033

India Ceramide Market Size and Share:

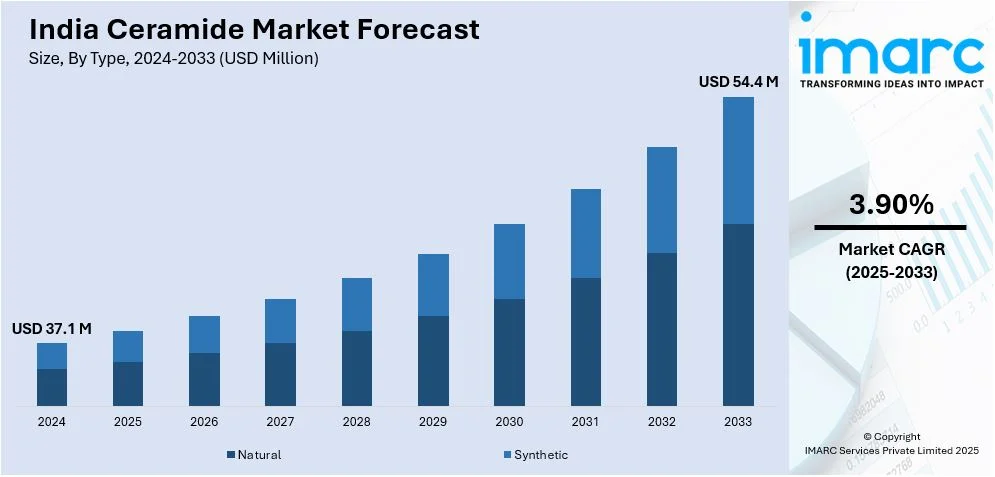

The India ceramide market size reached USD 37.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 54.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The rising consumer awareness of skincare benefits, increasing demand for anti-aging products, growing adoption in pharmaceuticals, expanding personal care and cosmetics industry, advancements in biotechnology, rising disposable incomes, and increasing research and development (R&D) investments are some of the major factors augmenting the India ceramide market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.1 Million |

| Market Forecast in 2033 | USD 54.4 Million |

| Market Growth Rate 2025-2033 | 3.90% |

India Ceramide Market Trends:

Growth of the Cosmetic Industry Driving Ceramide Demand

The expansion of India's cosmetic industry is fueling the demand for ceramide-based skincare products, which is positively influencing India ceramide market outlook. According to IBEF, the market share of the entire cosmetics business is estimated to reach USD 20 Billion, growing at a CAGR of 25% by 2025. This rapid growth is driven by inflating disposable incomes, increasing consumer awareness of skincare benefits, and the influence of global beauty trends. Ceramides, known for their skin-barrier strengthening and anti-aging properties, are becoming a key ingredient in premium skincare formulations as Indian consumers shift towards science-backed, functional skincare. Consumers are becoming more aware of skincare science, moving beyond basic moisturizers and cleansers to targeted solutions that improve skin health. This shift results in the inclusion of ceramides in a wide range of cosmetic products, from face creams and serums to sunscreens and cleansers. Additionally, the Indian market is witnessing a growth in homegrown cosmetic brands that are formulating skincare with dermatological backing, making ceramides more mainstream. Professional skincare lines and high-end cosmetic brands are also introducing ceramide-rich formulations to cater to consumers seeking hydration, anti-aging benefits, and improved skin barrier protection. With greater exposure to international beauty trends, consumers are demanding high-performance skincare, making ceramides a key ingredient in both daily skincare and specialized treatments.

To get more information on this market, Request Sample

Expansion of E-Commerce Boosting Accessibility to Ceramide Products

The rapid growth of e-commerce is transforming the way Indian consumers purchase skincare products, which is significantly contributing to India ceramide market growth. According to IBEF, The e-commerce industry in India is estimated to reach USD 325 Billion by 2030, with the e-retail market expected to exceed USD 160 Billion by 2028. This growth is fueled by the convenience of e-commerce platforms, wider product availability, and the increasing influence of digital marketing and social media, which also strongly influence the sale of skin care products. In addition to this, online marketplaces, brand-exclusive websites, and direct-to-consumer platforms have simplified the process for customers to obtain variety of ceramide-infused products from both domestic and international brands. The ability to compare ingredients, read reviews, and understand product benefits further accelerates the requirement for ceramides as consumers are making more informed choices. Moreover, e-commerce platforms also enable smaller brands specializing in ceramide-based skincare to reach a wider audience, eliminating geographical limitations. In line with this, online sales allow brands to experiment with new formulations and quickly adapt to changing consumer preferences.

India Ceramide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, process, and application.

Type Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and synthetic.

Process Insights:

- Fermentation Ceramides

- Plant Extract Ceramides

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes fermentation ceramides and plant extract ceramides.

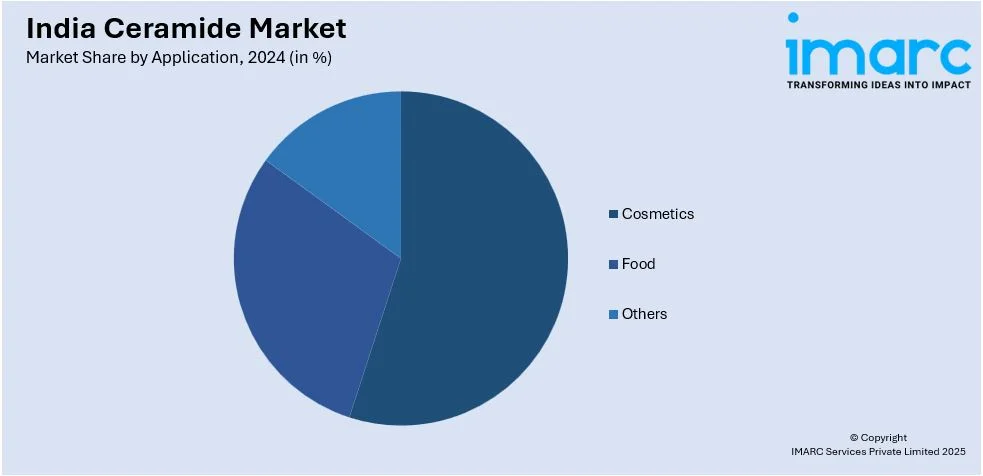

Application Insights:

- Cosmetics

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cosmetics, food, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ceramide Market News:

- On November 7, 2024, Honasa Consumer Limited, headquartered in India, introduced new winter moisturizing products across its different brands. Mamaearth, the company's flagship brand, launched two light moisturizing creams. Dr. Sheth's introduced moisturizing creams with Kesar Kojic Acid and Vitamin C & Ceramide varieties that provide 48-hour hydration, while The Derma Co. introduced a Nia-Ceramide Deep Moisturizing Cream that combines niacinamide and ceramides. The products will be available through Honasa's extensive distribution network, covering over 100,000 FMCG retail locations and e-commerce platforms across India.

- On December 17, 2024, Hyphen, the skincare brand co-founded by actress Kriti Sanon and Pep Brands, expanded its product portfolio by launching the 'Hydrating Essentials' range. This collection includes Ceramide Rich Pillow Cream and Hydrating Ceramide Toner-Essence, both formulated with a combination of natural and science-backed ingredients to deliver intense hydration. The new products are available for purchase on official website and other e-commerce forums.

India Ceramide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Processes Covered | Fermentation Ceramides, Plant Extract Ceramides |

| Applications Covered | Cosmetics, Food, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ceramide market performed so far and how will it perform in the coming years?

- What is the breakup of the India ceramide market on the basis of type?

- What is the breakup of the India ceramide market on the basis of process?

- What is the breakup of the India ceramide market on the basis of application?

- What is the breakup of the India ceramide market on the basis of region?

- What are the various stages in the value chain of the India ceramide market?

- What are the key driving factors and challenges in the India ceramide market?

- What is the structure of the India ceramide market and who are the key players?

- What is the degree of competition in the India ceramide market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ceramide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ceramide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ceramide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)